Do you need some help in preparing for your upcoming Class 12 Accountancy exam? We’ve compiled a list of MCQ questions on Accounting for Not for Profit Organisation Class 12 MCQs Questions with Answers to get you started with the subject. You can download NCERT MCQ Questions for Chapter 1 Accounting for Not for Profit Organisation with Answers Pdf free download, and learn how smart students prepare well ahead MCQ Questions for Class 12 Accountancy with Answers.

Accounting for Not for Profit Organisation Class 12 MCQs Questions with Answers

I. State which of the following is correct.

Question 1.

Receipts and Payments A/c is the summary of a:

(a) Cash Book

(b) Sales Book

(c) Purchases Book

(d) Journal

Answer

Answer: (a) Cash Book

Question 2.

Subscriptions received in advance during the accounting year is:

(a) An Income

(b) An Expense

(c) An Asset

(d) A Liability

Answer

Answer: (d) A Liability

Question 3.

Income and Expenditure A/c is of the nature of:

(a) Trial Balance

(b) Deficit A/c

(c) P & L A/c

(d) Balance Sheet

Answer

Answer: (c) P & L A/c

Question 4.

Cash received by converting an asset into cash is reflected in:

(a) Conversion A/c

(b) Receipts and Payments A/c

(c) Contract A/c

(d) Suspense A/c

Answer

Answer: (b) Receipts and Payments A/c

Question 5.

If the credit side of Receipts and Payments A/c exceeds the debit side, the balance represents:

(a) Bank charges

(b) Commission

(c) Bank overdraft

(d) Interest

Answer

Answer: (c) Bank overdraft

Question 6.

No cash transaction will be excluded from:

(a) Balance Sheet

(b) Profit & Loss A/c

(c) Receipts and Payments

(d) Income and Expenditure A/c

Answer

Answer: (c) Receipts and Payments

Question 7.

In Receipts and Payments A/c, cash in hand or at the bank is put on:

(a) Credit side

(b) Left-hand side

(c) Right-hand side

(d) None of these

Answer

Answer: (b) Left-hand side

Question 8.

The task of preparing Income and Expenditure A/c and the Balance Sheet commences after the preparation of the:

(a) Trial Balance

(b) Profit and loss A/c

(c) Trading A/c

(d) Cash A/c

Answer

Answer: (d) Cash A/c

Question 9.

In Income and Expenditure A/c all revenue expenses are entered on:

(a) Assets side

(b) Left-hand side

(c) Liabilities side

(d) Right-hand side

Answer

Answer: (b) Left-hand side

Question 10.

In the Income and Expenditure Account all revenue receipts are entered on:

(a) Assets side

(b) Left-hand side

(c) Right-hand side

(d) Liabilities side

Answer

Answer: (c) Right-hand side

II. Fill in the blanks with the correct word.

Question 11.

Excess of incomes over expenditure is known as _________

Answer

Answer: Surplus

Question 12.

The difference in the balance sheet at the beginning of the year is known as _________

Answer

Answer: Capital fund

Question 13.

Entrance fee should be taken as ________ receipt.

Answer

Answer: Revenue

Question 14.

The main source of income for a not for profit is ____________

Answer

Answer: Subscription

Question 15.

Financial statements in case of NPO consists of receipts & payments account, _______, and balance sheet.

Answer

Answer: Income and Expenditure account

Question 16.

Receipts and payments account is prepared on _________ basis whereas cash book is prepared on the _______ basis.

Answer

Answer: Yearly, daily

Question 17.

Income and expenditure account is prepared on the basis of _______ incomes and _________ expenditures.

Answer

Answer: Revenue, revenue

Question 18.

Legacy is a ______ receipt.

Answer

Answer: Capital

III. State whether the following statements are True or False:

Question 19.

Not-for-profit organisations are organisations that serve not only their members but also the general public.

Answer

Answer: True

Question 20.

Not for profit organisations do not enjoy separate legal entity.

Answer

Answer: False

Question 21.

Profit earned by a, not for profit organisation is known as surplus.

Answer

Answer: True

Question 22.

General donations are capital in nature whereas specific donations are capital in nature.

Answer

Answer: False

Question 23.

Receipts and payments account records capital receipts and capital payments only.

Answer

Answer: False

Question 24.

Income & expenditure account is prepared on the same principles as we prepare profit and loss account.

Answer

Answer: True

Question 25.

Specific funds are shown on the liabilities side whereas expenses on specific funds are shown on the assets side.

Answer

Answer: False

Question 26.

Cashbook and receipts & payments account is prepared on the basis of cash basis of accounting.

Answer

Answer: True

IV. One word Questions.

Question 27.

How are specific donations treated while preparing final accounts of a ‘Not-For-Profit Organisation’?

Answer

Answer: Specific donation is treated as capital receipt & it is shown on the liabilities side of the Balance Sheet.

Question 28.

State the basis of accounting of preparing ‘Income and Expenditure Account’ of a ‘Not-For-Profit

Organisation.

Answer

Answer: Accrual basis.

Question 29.

Differentiate between ‘Receipts and Payments Account’ and ‘Income and Expenditure Account’ on the basis of ‘Period’.

Answer

Answer:

| Basic | Receipts & Payments A/c | Income & Expenditure A/c |

| Period | May relate to preceding and succeeding periods | Relate to the current period |

Question 30.

What is meant by ‘Life membership fees’?

Answer

Answer: Membership fee paid in lump stun to become a life member of a not-for-profit organisation.

Question 31.

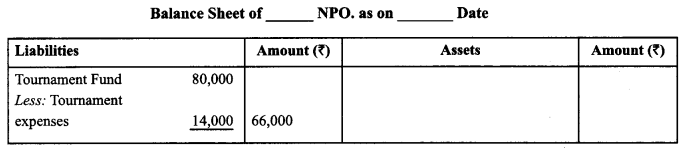

How are the following items presented in the financial statements of a Not-for-Profit organisation:

(a) Tournament Fund – 80,000

(b) Tournament expenses – 14,000

Answer

Answer:

Question 32.

How are general donations treated while preparing financial statements of a not-for-profit organisation?

Answer

Answer: General donations are treated as revenue receipts

Or

How are general donations treated while preparing financial statements of a not-for-profit organisation?

Answer

Answer: Life membership fee is the membership fee paid by some members as a lump sum amount instead of a periodic subscription

Question 33.

State the basis of accounting on which ‘Receipt and Payment Account’ is prepared in case of Not-for Profit Organisation.

Answer

Answer: Cash basis of accounting

Question 34.

Where will you show the ‘Subscription received in advance’ during the current year in the Balance Sheet of a Not-For-Profit Organisation?

Answer

Answer: Liability side of current year’s balance sheet

Question 35.

A not-for-profit organisation sold its old furniture. State whether it will be treated as revenue receipt or capital receipt.

Answer

Answer: Revenue

Question 36.

Mention a fund who are specific in nature.

Answer

Answer: Sports fund

Question 37.

Income and Expenditure Account of a not-for-profit organisation has shown credit balance of ₹ 1,20,000 during 2012-13. When will you show it?

Answer

Answer: It will be added in the capital fund on the liability side

Question 38.

Do not for profit organisation maintain proper system of accounts?

Answer

Answer: No

Question 39.

Name any one account prepared by not for profit organisations.

Answer

Answer: Receipts and Payment Account, Income and Expenditure Account and Balance Sheet

Question 40.

Give one example of not for profit organisations.

Answer

Answer: Charitable dispensaries, schools, educational institutions, trusts, societies etc

Question 41.

State one source of not for profit organisations.

Answer

Answer: Subscriptions, donations, legacies, government grant etc

Question 42.

State the receipts relating to non-recurring in nature.

Answer

Answer: Capital receipts

Question 43.

State the payments relating to non-recurring in nature.

Answer

Answer: The payments can be classified into capital payment and revenue payment

Question 44.

Give an example of revenue receipt.

Answer

Answer: Subscription

Question 45.

Give an example of capital receipt.

Answer

Answer: Government grant

Question 46.

Give an example of capital payments.

Answer

Answer: Purchase of assets

Question 47.

What name is used for the cash book in case of not for profit organisations?

Answer

Answer: Receipts and Payments Account

Question 48.

Which side the revenue receipts are transferred in the income and enpenditure account?

Answer

Answer: Credit side

Question 49.

When the capital receipts are shown?

Answer

Answer: Liabilities side

Question 50.

Where the capital payments are shown?

Answer

Answer: Assets side

Question 51.

In which account the funds are transferred in case of not for profit organisation?

Answer

Answer: Capital Fund

Question 52.

What is the major source of income for not for profit organisations?

Answer

Answer: Subscription

Question 53.

What name is used for profit in case of not for profit organisations?

Answer

Answer: Surplus

Question 54.

What name is used for loss in case of not for profit organisations?

Answer

Answer: Deficit

Question 55.

Is the surplus or deficit in case of not for profit organisations distributed among members?

Answer

Answer: No

Question 56.

What type of rec eipts are recorded in the income and expenditure account?

Answer

Answer: Revenue Receipts

Question 57.

What type of payments are recorded in the income and expenditure account?

Answer

Answer: Revenue Payments

Question 58.

Which system of accountancy is followed to prepare receipts and payments account?

Answer

Answer: Cash system of accounting

Question 59.

Which system of account is followed to prepare income and expenditure account.

Answer

Answer: Accrual system of accounting

We hope you found this CBSE Class 12 Accountancy Accounting for Not for Profit Organisation MCQs Multiple Choice Questions with Answers helpful. If you have any questions about NCERT MCQ Questions for Class 12 Accountancy Chapter 1 Accounting for Not for Profit Organisation with Answers Pdf free download, please share them in the comment box below and we will get back to you at the earliest possible time.

Accountancy MCQ Class 12 Part 1 and Accounts MCQ Class 12 Part 2

- Accounting for Not for Profit Organisation Class 12 MCQ

- Accounting for Partnership: Basic Concepts Class 12 MCQ

- Reconstitution of Partnership Firm: Admission of a Partner Class 12 MCQ

- Reconstitution of Partnership Firm: Retirement / Death of a Partner Class 12 MCQ

- Dissolution of a Partnership Firm Class 12 MCQ

- Accounting for Share Capital Class 12 MCQ

- Issue and Redemption of Debentures Class 12 MCQ

- Financial Statements of a Company Class 12 MCQ

- Analysis of Financial Statements Class 12 MCQ

- Accounting Ratios Class 12 MCQ

- Cash Flow Statement Class 12 MCQ