Do you need some help in preparing for your upcoming Class 12 Accountancy exam? We’ve compiled a list of MCQ questions on Dissolution of a Partnership Firm Class 12 MCQs Questions with Answers to get you started with the subject. You can download NCERT MCQ Questions for Chapter 5 Dissolution of a Partnership Firm with Answers Pdf free download, and learn how smart students prepare well ahead MCQ Questions for Class 12 Accountancy with Answers.

Dissolution of a Partnership Firm Class 12 MCQs Questions with Answers

State which of the following is correct:

Question 1.

Revaluation account and reaLisation account are _______ accounts.

(a) same

(b) opposite

(c) different

(d) real

Answer

Answer: (c) different

Question 2.

Realisation account is a ________ account

(a) real

(b) personal

(c) nominal

(d) cash.

Answer

Answer: (c) nominal

Question 3.

At the time of dissolution of a partnership firm ___________ account is prepared.

(a) revaluation

(b) realisation

(c) profit & loss

(d) trading

Answer

Answer: (b) realisation

Question 4.

At the time of dissolution of a partnership firm, all assets (except fictitious) are transferred to _______ account.

(a) realisation

(b) revaluation

(c) capital

(d) loan.

Answer

Answer: (a) realisation

Question 5.

At the time of dissolution, partner’s loan account is closed by _______.

(a) transferring in realisation

(b) payment

(c) abolished

(d) none of these.

Answer

Answer: (b) payment

Question 6.

At the time of dissolution of partnership firm, balance of cash and bank will be transferred to _____ account.

(a) realisation

(b) revaluation

(c) bank

(d) capital

Answer

Answer: (c) bank

Question 7.

At the time of dissolution of partnership firm _______ account is prepared.

(a) realisation

(b) partners capital

(c) bank

(d) All of these

Answer

Answer: (d) All of these

Question 8.

After the dissolution of firm, business of the firm will automatically ______.

(a) continued

(b) closed

(c) extended

(d) None of these

Answer

Answer: (b) closed

Question 9.

Realisation account can be prepared _______ in the life of firm.

(a) many

(b) once

(c) two

(d) three

Answer

Answer: (b) once

Question 10.

Revaluation account can be prepared ______ time(s) in the firm.

(a) many

(b) one

(c) two

(d) three

Answer

Answer: (a) many

Question 11.

Unrecorded assets taken over any creditor will ______.

(a) be debited to realisation account

(b) be debited and credited both to realisation account

(c) be credited to realisation account

(d) not be recorded anywhere.

Answer

Answer: (d) not be recorded anywhere.

Question 12.

Unrecorded liability will be ________ to realisation account when paid.

(a) debited

(b) debited and credited both

(c) credited

(d) paid

Answer

Answer: (a) debited

Question 13.

Goodwill already appearing in the balance sheet of the firm will be transferred on the ________ side of account.

(a) debit, capital

(b) debit, realisation

(c) debit, bank

(d) credit, bank

Answer

Answer: (b) debit, realisation

Question 14.

When a partner agrees to receive the sum due to him in lump sum, ______ account is debited.

(a) realisation

(b) concerned partners’ capital

(c) bank

(d) none of the above

Answer

Answer: (b) concerned partners’ capital

Question 15.

At the time of dissolution of a firm, all assets and liabilities will be transferred to realisation account at ______ values.

(a) book

(b) market

(c) cost

(d) realised.

Answer

Answer: (a) book

Question 16.

At the time of dissolution of firm, goodwill account is closed by transferring it to ________ account.

(a) realisation

(b) partners loan

(c) partners capital

(d) bank

Answer

Answer: (a) realisation

Question 17.

On dissolution, balance of partner’s capital account will be transferred to _____ account.

(a) realisation

(b) revaluation

(c) bank

(d) loan.

Answer

Answer: (c) bank

Question 18.

After settlement of dissolving firm, bank account may have _____ balance.

(a) debit

(b) credit

(c) overdraft

(d) nil.

Answer

Answer: (d) nil.

Question 19.

On dissolution of a partnership firm, over draft will be transferred to _______.

(a) bankA/c

(b) cashA/c

(c) realisation A/c

(d) either realisation account or bank account

Answer

Answer: (d) either realisation account or bank account

Question 20.

Realisation expenses are debited to ________.

(a) bankA/c

(b) realisation A/c

(c) revaluation A/c

(d) partners’ capital A/c

Answer

Answer: (b) realisation A/c

Question 21.

Accumulated profits are transferred to credit of _______.

(a) revaluation A/c

(b) partners’capital A;c

(c) realisation Ac

(d) bankA/c

Answer

Answer: (b) partners’capital A;c

Question 22.

Accumulated losses and reserves are transferred to debit of ________ A/c.

(a) revaluation

(b) partners’capital A/c

(c) realisation

(d) bank

Answer

Answer: (b) partners’capital A;c

Question 23.

Anu, Bina and Charan are partners. The firm had given a loan of ₹ 20,000 to Bina. They decided to dissolve the firm. In the event of dissolution, the loan will be settled by

(a) transferring it to debit side of Realisation account.

(b) transferring it to credit side of Realisation account.

(c) transferring it to debit side of Bina’s capital account.

(d) Bina paying Anu and Charan privately.

Answer

Answer: (c) transferring it to debit side of Bina’s capital account.

Fill in the blanks with correct word:

Question 24.

When a liability is discharged by a partner, at the time of dissolution, Capital Account is credited because ______.

Answer

Answer: the claim of the partner against the firm is increased by the amount of liability assumed.

Question 25.

After dissolution of firm business of the firm is _________.

Answer

Answer: Closed

Question 26.

At the time of dissolution of firm assets are _______ and liabilities are ________.

Answer

Answer: sold, paid off

Question 27.

If firm is dissolved then economic relationship between the partners comes to an ________.

Answer

Answer: end

Question 28.

If firm is dissolved the books of accounts are ______.

Answer

Answer: Closed

Question 29.

If firm is dissolved then ________ automatically will dissolved.

Answer

Answer: partnership

Question 30.

At the time of dissolution of firm, first of all ______ are settled.

Answer

Answer: losses

Question 31.

Personal _______ are paid by the partner through assets, at the time of dissolution.

Answer

Answer: debts, personal

Question 32.

_______ debt are paid by the firm through firm’s at the time of dissolution.

Answer

Answer: Firm’s, assets

Question 33.

Realisation expenses are paid by the _________ at the time of dissolution of firm.

Answer

Answer: firm

Question 34.

If any partner takes any asset, then such partner’s capital account will be

Answer

Answer: debited

Question 35.

If any partner takes the responsibility to pay any loan, then such partner’s capital account will be ________.

Answer

Answer: Credited

Question 36.

If any partner pays the realisation expenses on behalf of firm, then such partner’s capital account will be _______.

Answer

Answer: Credited

Question 37.

At the time of dissolution, partner’s current account balance will be transferred to _______ account.

Answer

Answer: Partner’s Capital

Question 38.

At the time of dissolution, Partner’s capital account balance will be transferred to _______ account.

Answer

Answer: Bank

Question 39.

Partner’s loan will ________ be recorded in realisation account.

Answer

Answer: not

Question 40.

No entry is required when any ________ accepts fixed assets in lieu of his balance (due).

Answer

Answer: Creditor

Question 41.

Partner’s loan on the assets side is transferred on the ______ side of account.

Answer

Answer: debit, capital

Question 42.

Loan due to outsider is paid _____ (after/before) the loan payable to any partner is paid.

Answer

Answer: Before

Question 43.

Provision for doubtful debts is transferred on the credit side of _______ account.

Answer

Answer: realisation

Question 44.

Under partnership at ____, any partner may ask for the dissolution of the firm.

Answer

Answer: will

State whether the following statements are true or false:

Question 45.

At the time of dissolution of firm revaluation account is prepared.

Answer

Answer: False

Question 46.

At the time of dissolution of partnership firm, realisation account is prepared.

Answer

Answer: True

Question 47.

Revaluation Account and Realisation Account both are prepared for same purpose.

Answer

Answer: False

Question 48.

Realisation Account is a nominal Account.

Answer

Answer: True

Question 49.

After dissolution of partnership firm, books of accounts are closed.

Answer

Answer: True

Question 50.

Realisation Account is prepared once in the life of a partnership firm.

Answer

Answer: True

Question 51.

At the time of dissolution, first of all firms’ debt are paid out of partners’ personal assets.

Answer

Answer: False

Question 52.

At the time of firm’s dissolution, partners’ loan is settled before outside liabilities.

Answer

Answer: False

Question 53.

At the time of firm’s dissolution, partners’ loan is settled before partner’s capital.

Answer

Answer: True

Question 54.

At the time of firm’s dissolution, after settling all the accounts, Bank / Cash Account automaticallyclosed. After dissolution of firm, business of firm may be continue.

Answer

Answer: True

Question 55.

After dissolution of firm. business of firm may be continue.

Answer

Answer: False

Question 56.

Firm can be dissolved by the Court.

Answer

Answer: True

Question 57.

Firm can be dissolved by notice if partnership at will.

Answer

Answer: True

Question 58.

A firm can be dissolved with the consent of all the partners.

Answer

Answer: True

Question 59.

At the time dissolution of firm balance of bank will be transferred to Realisation Account.

Answer

Answer: False

One word Questions:

Question 60.

Differentiate between Dissolution of Partnership and Dissolution of a Partnership Firm on the basis of ‘Court’s Intervention’

Answer

Answer:

| Base | Dissolution of Partnership | Dissolution of Firm |

| Court’s Intervention | Court does not intervene because partnership is dissolved by mutual agreement. | A firm can be dissolved by court’s order. |

Question 61.

State any two situations when a partnership firm can be compulsorily dissolved. (CBSE Delhi 2019)

Answer

Answer: A firm is compulsorily dissolved in the following cases: (Any two)

(i) When all the partners or all but one partner become insolvent.

(ii) When the business of the firm becomes illegal.

Question 62.

Distinguish between ‘Reconstitution of Partnership’ and ‘Dissolution of Partnership Firm’ on the basis of ‘Closure of books’.

Answer

Answer:

| Basics | Reconstitution of Partnership | Dissolution of Partnership Firm |

| Closure of Books | Does not require because the business is not terminated. | The books of the accounts are closed. |

Question 63.

State the basis of calculating the amount of profit payable to the legal representative of a deceased partner in the year of death. (CBSE Outside Delhi 2019)

Answer

Answer:

Profit may be estimated

(a) On the basis of Last year’s profit/Average profits of last given no. of years

(b) On the basis of Tumover/Sales.

Question 64.

State any two grounds on the basis of which court may order for the dissolution of partnership firm. (CBSE Outside Delhi 2019)

Answer

Answer:

At the suit of a partner, the court may order a partnership firm to be dissolved on any of the following grounds:

(a) when a partner becomes insane;

(b) when a partner becomes permanently incapable of performing his duties as a partner.

Question 65.

State any two situations when a partnership firm can be compulsorily dissolved. (CBSE Outside Delhi 2019)

Answer

Answer:

A firm is compulsorily dissolved in the following-cases:

(i) When all the partners or all but one partner become insolvent.

(ii) When the business of the firm becomes illegal.

Question 66.

State any two contingencies that may result into dissolution of a partnership firm.(CBSE Outside Delhi 2019)

Answer

Answer:

Contingencies that may result into dissolution of a partnership firm: .

(i) If the firm is constituted for a fixed term, on the expiry of that term

(ii) If constituted to carry out one or more ventures, on the completion of the venture.

Question 67.

State the order of payment of the following, in case of dissolution of partnership firm.

(i) to each partner proportionately what is due to him/her from the firm for advances as distinguished from capital (i.e. partner’ loan);

(ii) to each partner proportionately what is due to him on account of capital; and

(iii) for the debts of the firm to the third parties; (CBSE Sample Paper 2019-20)

Answer

Answer:

(iii) for the debts of the firm to the third parties;

(i) to each partner proportionately what is due to him/her from the firm for advances as distinguished from capital (i.e. partner’ loan);

(ii) to each partner proportionately what is due to him on account of capital

Question 68.

A and B are partners in a firm sharing profits in the ratio of 3 : 2 Mrs. B has given a loan of ₹ 40,000 to the firm and A has also given a loan of ₹ 80,000 to the firm. The firm was dissolved and its assets realised ₹ 60,000.

State the order of payment of Mrs. B’s loan and A’s loan assuming that there was no other third party liability – of the firm.

Answer

Answer:

Order of payment:

First, the third party loan i.e. Mrs. B’s loan will be paid.

The Partner’s loan i.e. A’s loan will be paid.

Question 69.

A, B and C are partners in a firm. On April 1, 2013, A and B were declared insolvent by a court. Will the partnership firm be treated as dissolved?

Answer

Answer: Yes.

Question 70.

Mohan and Kanwar are partners in a firm. Their firm was dissolved on 1.1.2013. Mohan was assigned the work of dissolution. For this work, Mohan was paid ₹ 500. Mohan paid dissolution expenses of ₹ 400 from his own pocket. Will any Journal Entry be passed for ₹ 400 paid by Mohan?

Answer

Answer: No.

Ans.

Question 71.

A firm has investments fluctuation fund of? 10,000. It does not have investments on its Balance Sheet at the time of its dissolution. In which account(s), amount of investments fluctuation fund be transferred?

Answer

Answer: In Partners’ Capital Accounts.

Question 72.

Why is cash balance not transferred to Realisation Account on dissolution of a partnership firm?

Answer

Answer: Cash is a liquid asset.

Question 73.

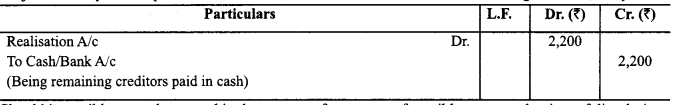

A firm was dissolved on April 1, 2013. Assets side of its Balance Sheet has furniture of ₹ 2,500 whereas on the liabilities side, creditors appeared for ₹ 4,000.-Half of the creditors took half of the furniture at 10% discount and remaining creditors were paid at 10% premium. What journal entries are required?

Answer

Answer:

No journal entry will be passed for the first half of the creditors but for the remaining creditors, entry will be:

Question 74.

Should intangible assets be treated in the manner of treatment of tangible assets at the time of dissolution of partnership firm?

Answer

Answer: Yes.

Question 75.

In case of dissolution of a firm which liabilities are to be paid first? (CBSE 2011 Compartment Delhi)

Answer

Answer: Debts of third parties.

Question 76.

In case of dissolution of a firm, which item on the liabilities side is to be paid last? (CBSE 2011 Compartment Delhi)

Answer

Answer: Partners’ capital.

Question 77.

A firm has furniture of ₹ 6,000 which was taken over by a creditor of ₹ 5,000 in full settlement of his claim. Mention whether any journal entry will be passed for this. If yes, pass the journal entry.

Answer

Answer: No, journal entry will be passed.

Question 78.

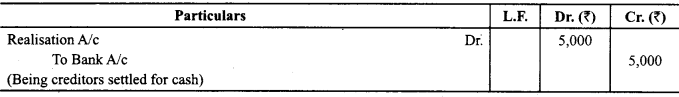

Creditors of ₹ 50,000 took over stock at agreed value of ₹ 45,000 and balance Was paid to him. Pass the journal entry for this transaction.

Answer

Answer: The Journal entry will be:

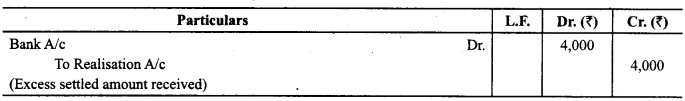

Question 79.

Drawers of bills payable ₹ 25,000 took over furniture at agreed value of ₹ 29,000 and paid the excess value. Pass journal entry for this transaction.

Answer

Answer: The Journal entry will be:

Ans.

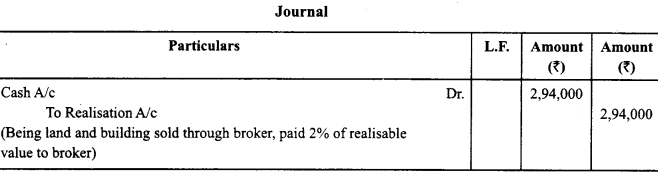

Question 80.

Land and Building (book value) ₹ 1,60,000 sold for ₹ 3,00,000 through a broker who charged 2% commission on the deal. Journalise the transaction, at the time of dissolution of the firm. (CBSE Sample Paper 2018-19)

Answer

Answer:

Question 81.

State any one occasion for the dissolution of the firm on court’s orders when a partner becomes. (Compt. Delhi 2017)

Answer

Answer: Partner becomes permanently incapable of performing his duties as a partner.

Question 82.

Name the asset that is not transferred to the debit side of Realisation account, but brings certain amount of cash against its disposal at the time of dissolution of the firm. (CBSE Delhi 2014)

Answer

Answer: Unrecorded assets

Question 83.

Ram and Shyam formed partnership at will. Ram gave a notice on January 1, 2013 to dissolve the firm. Can partnership firm be dissolved even without consent of Shyam? Give reason.

Answer

Answer: Yes.

We hope you found this CBSE Class 12 Accountancy Dissolution of a Partnership Firm MCQs Multiple Choice Questions with Answers helpful. If you have any questions about NCERT MCQ Questions for Class 12 Accountancy Chapter 5 Dissolution of a Partnership Firm with Answers Pdf free download, please share them in the comment box below and we will get back to you at the earliest possible time.

Accountancy MCQ Class 12 Part 1 and Accounts MCQ Class 12 Part 2

- Accounting for Not for Profit Organisation Class 12 MCQ

- Accounting for Partnership: Basic Concepts Class 12 MCQ

- Reconstitution of Partnership Firm: Admission of a Partner Class 12 MCQ

- Reconstitution of Partnership Firm: Retirement / Death of a Partner Class 12 MCQ

- Dissolution of a Partnership Firm Class 12 MCQ

- Accounting for Share Capital Class 12 MCQ

- Issue and Redemption of Debentures Class 12 MCQ

- Financial Statements of a Company Class 12 MCQ

- Analysis of Financial Statements Class 12 MCQ

- Accounting Ratios Class 12 MCQ

- Cash Flow Statement Class 12 MCQ