Do you need some help in preparing for your upcoming Class 12 Accountancy exam? We’ve compiled a list of MCQ questions on Reconstitution of Partnership Firm: Admission of a Partner Class 12 MCQs Questions with Answers to get you started with the subject. You can download NCERT MCQ Questions for Chapter 3 Reconstitution of Partnership Firm: Admission of a Partner with Answers Pdf free download, and learn how smart students prepare well ahead MCQ Questions for Class 12 Accountancy with Answers.

Reconstitution of Partnership Firm: Admission of a Partner Class 12 MCQs Questions with Answers

I. State which of the following is correct:

Question 1.

A and B are partners in a firm having a capital of ₹ 54,000 and ₹ 36,000 respectively. They admitted C for 1/3rd share in the profits C brought proportionate amount of capital. The Capital brought in by C would be:

(a) ₹ 90,000

(b) ₹ 45,000

(c) ₹ 5,400

(d) ₹ 36,00

Answer

Answer: (b) ₹ 45,000

Question 2.

Any change in the relationship of existing partners which results at an end of the existing agreement and enforces making of a new agreement is called

(a) Revaluation of partnership

(b) Reconstitution of partnership

(c) Realisation of partnership

(d) None of the above

Answer

Answer: (b) Reconstitution of partnership

Question 3.

When the new partner brings cash for goodwill, the amount is credited to:

(a) Realisation Account

(b) Cash Account

(c) Premium for Goodwill Account

(d) Revaluation Account

Answer

Answer: (c) Premium for Goodwill Account

Question 4.

Goodwill is an _______ Assets.

(a) fixed

(b) intangible

(c) current

(d) fictitious

Answer

Answer: (b) intangible

Question 5.

Value of reputation of the firm is:

(a) Royalty

(b) Assets

(c) Goodwill

(d) Patents

Answer

Answer: (c) Goodwill

Question 6.

________ profit is excess of actual profits over normal profits.

(a) Net

(b) Average

(c) Super

(d) Appropriated

Answer

Answer: (c) Super

Question 7.

Sacrifice Ratio = _______

(a) New Ratio – Old Ratio

(b) Old Ratio – New Ratio

(c) New Ratio + Old Ratio

(d) Old Ratio + New Ratio

Answer

Answer: (b) Old Ratio – New Ratio

Question 8.

Gaining Ratio = ________

(a) New Ratio – Old Ratio

(b) Old Ratio – New Ratio

(c) New Ratio + Old Ratio

(d) Old Ratio + New Ratio

Answer

Answer: (a) New Ratio – Old Ratio

Question 9.

Share of old Partners will ________ if new partner admit in the firm.

(a) increase

(b) decrease

(c) remains same

(d) not changed

Answer

Answer: (b) decrease

Question 10.

Unrecorded liabilities will be ______ in Revaluation Account.

(a) debited

(b) credited

(c) not shown

(d) shown

Answer

Answer: (a) debited

Question 11.

Unrecorded Assets will be _______ in Revaluation Account.

(a) debited

(b) credited

(c) not shown

(d) shown

Answer

Answer: (b) credited

Question 12.

New Partner can be admitted in the firm with the consent of ________ old partners.

(a) anyone

(b) all

(c) 3/4

(d) 1/2

Answer

Answer: (b) all

Question 13.

Old Partnership will dissolve if

(a) profit sharing ratio changes

(b) new partner admits

(c) any partner retires

(d) all of these

Answer

Answer: (d) all of these

Question 14.

If new partner brings goodwill in cash then ________ Account will be debited.

(a) cash

(b) premium for goodwill

(c) goodwill

(d) capital

Answer

Answer: (a) cash

Question 15.

If new partner brings goodwill in cash then Account will be credited.

(a) cash

(b) premium for goodwill

(c) goodwill

(d) capital

Answer

Answer: (b) premium for goodwill

Question 16.

Profit or loss represented by Revaluation Account will be transferred to capital accounts of ______ partners.

(a) all

(b) new

(c) old

(d) remaining

Answer

Answer: (c) old

Question 17.

Goodwill brought in cash by new partners will be transferred in old partners capital account in _______ Ratio.

(a) new

(b) old

(c) sacrificing

(d) gaining

Answer

Answer: (c) sacrificing

Question 18.

Amount of old goodwill already appearing in the books will be written off:

(a) in old ratio

(b) in new ratio

(c) in sacrifice ratio

(d) in gaining ratio

Answer

Answer: (a) in old ratio

Question 19.

An increase in the value of an assets will be recorded in the _______ side of revaluation account.

(a) debit

(b) credit

(c) either debit or credit

(d) debit and credit both

Answer

Answer: (b) credit

Question 20.

An increase in the value of a liability will be recorded on the ________ side of revaluation account.

(a) debit

(b) credit

(c) either debit or credit

(d) debit and credit both

Answer

Answer: (a) debit

Question 21.

A decrease in the value of a liability will be recorded on the ________ side of revaluation account.

(a) debit

(b) either debit or credit

(c) credit

(d) debit and credit both

Answer

Answer: (c) credit

Question 22.

An increase in the value of a liability will be recorded on the ________ side of revaluation account.

(a) debit

(b) either debit or credit

(c) credit

(d) debit and credit both

Answer

Answer: (a) debit

Question 23.

At the time of admission of a partner, new ratio will be calculated by:

(a) Old Ratio – New Ratio

(b) New Ratio – Old Ratio

(c) Old Ratio – Sacrifice Ratio

(d) Old Ratio + Sacrifice Ratio

Answer

Answer: (c) Old Ratio – Sacrifice Ratio

II. Fill in the blanks with correct word.

Question 24.

Old Ratio – New Ratio = _________

Answer

Answer: Sacrifice Ratio

Question 25.

New Ratio – Old Ratio = __________

Answer

Answer: Gaining Ratio

Question 26.

Old Ratio – Sacrifice Ratio = __________

Answer

Answer: New Ratio

Question 27.

Old Ratio + Gaining Ratio = __________

Answer

Answer: New Ratio

Question 28.

A new Partner can be admitted in partnership firm with the ________ of all partners.

Answer

Answer: Consent

Question 29.

Old Partnership will dissolve if profit share ratio is _________

Answer

Answer: Changed

Question 30.

Amount of goodwill paid by new partner will be shared by old partners in _______ ratio.

Answer

Answer: Sacrifice

Question 31.

Amount of goodwill already shown in the balance sheet will be written off in ________ ratio.

Answer

Answer: Old

Question 32.

Old partners sacrifice their shares in favour of new partner in ______ ratio.

Answer

Answer: Sacrifice

Question 33.

If business is located at the central place of city then value of goodwill will be ________

Answer

Answer: High

Question 34.

Old businesses have _________ goodwill in comparison to newly established business.

Answer

Answer: More

Question 35.

If average profit method is adopted for valuation of goodwill then ________ profits are used for this propose.

Answer

Answer: Average

Question 36.

If super profit method is adopted for valuation of goodwill then _______ profits are used for this purpose.

Answer

Answer: Super

Question 37.

Super profits are the excess of actual profits over __________ profits.

Answer

Answer: Normal

Question 38.

Normal profits are those profits which are earned by __________ organisations of the industry.

Answer

Answer: Other

III. State whether the following statements are True or False.

Question 39.

Amount of goodwill may be given personally to the old Partners by new partner.

Answer

Answer: True

Question 40.

It is compulsory to pay goodwill in cash by new partner to the old partners.

Answer

Answer: False

Question 41.

It is compulsory to revalue assets and liabilities at the time of reconstitution of partnership in a firm.

Answer

Answer: True

Question 42.

Resulted profit or Loss out of Revaluation Account is shared by all partners including new partner.

Answer

Answer: False

Question 43.

A minor could be the partner of a partnership firm.

Answer

Answer: True

Question 44.

Premium method of goodwill is followed when new partner brings goodwill in cash.

Answer

Answer: True

Question 45.

Goodwill account appearing in the balance sheet of old firm need not to be written off at the time of admission of a partner.

Answer

Answer: False

Question 46.

Revaluation Account is a Real Account.

Answer

Answer: False

Question 47.

Capital Accounts are nominal Account.

Answer

Answer: False

Question 48.

After the admission of a new partner, it is compulsory that old ratio gets changed.

Answer

Answer: True

IV. One word Questions.

Question 49.

What is meant by ‘Issued Capital’?

Answer

Answer: Issued capital means such capital as the company issues from time to time for subscription-section 2(50) of the companies Act 2013.

Question 50.

What is meant by ‘Employees Stock Option Plan’?

Answer

Answer: ESOP means option granted by the company to its employees & employee directors to subscribe the share at a price that is lower than the market price i.e., fair value. It is an option granted by the company but it is not an obligation on the employee to subscribe it.

Question 51.

A and B were partners in a firm sharing profits in the ratio of 3 : 2. C and D were admitted as new partners. A sacrificed \(\frac{1}{4}\)th of his share in favour of C and B sacrificed 50% of his share in favour of D. Calculate the new profit sharing ratio of A, B, C and D.

Answer

Answer: Old ratio = 3 : 2

A’s Sacrifice (in favour of C) = 1/4 × 3/5 = 3/20

B’s Sacrifice (in favour of D) = 1/2 × 2/5 = 2/10

A’s New Share = 3/5 – 3/20 = 9/20

B’s New Share = 2/5 – 2/10 = 2/10

Question 52.

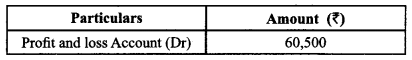

Ankit, Unnati and Aryan are partners sharing profits in the ratio of 5 : 3 : 2. They decided to share future profits in the ratio of 2 : 3 : 5 with effect from 1st April, 2018. They had the following balance in their balance sheet, passing necessary Journal Entry:

Answer

Answer:

Journal

Question 53.

A and B are partners in a firm. They admit C as a partner with 1/5th share in the profits of the firm. C brings ₹ 4,00,000 as his share of capital. Calculate the value of C’s share of Goodwill on the basis of his capital, given that the combined capital of A and B after all adjustments is ₹ 10,00,000.

Answer

Answer: Total Capital as per C’s Share = (4,00,000 × (5/1)) = ₹ 20,00,000

Less Actual capital of A, B, C = (10,00,000 + 4,00,000) = ₹ 14,00,000

Value of firm’s Goodwill = ₹ 6,00,000

C’s share of Goodwill = 6,00,000 × (1/5) = ₹ 1,20,000

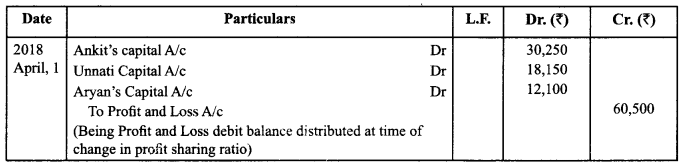

Question 54.

A and B are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 1st April, 2019 they decided to admit C their new ratio is decided to be equal. Pass the necessary journal entry to distribute Investment Fluctuation Reserve of ₹ 60,000 at the time of C’s admission, when Investment appear in the books at ₹ 2,10,000 and its market value is ₹ 1,90,000.

Answer

Answer:

Journal

Question 55.

A and B are in partnership sharing profits and losses in the ratio of 3 : 2. They admit C into partnership with 1/5th share which he acquires equally from A and B. Accountant has calculated new profit sharing ratio as 5 : 3 : 2. Is accountant correct?

Answer

Answer: C’s Share acquired from A and B each = \(\frac{1}{5} \times \frac{1}{2}=\frac{1}{10}\)

A’s Share = \(\frac{3}{5}-\frac{1}{10}=\frac{5}{10}\)

B’s Share = \(\frac{2}{5}-\frac{1}{10}=\frac{3}{10}\)

New Profit Sharing ratio of A : B : C is 5 : 3 : 2

Yes, new profit sharing ratio is 5 : 3 : 2

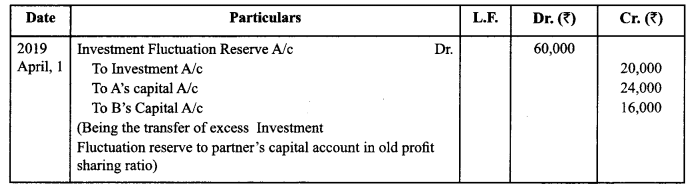

Question 56.

A, B and C were partners sharing profits in the ratio of 5 : 4 : 3. They decided to change their profit sharing ratio to 2 : 2 : 1 w.e.f. 1st April, 2019. On that date, there was a balance of ₹ 3,00,000 in General Reserve and a debit balance of ₹ 4,80,000 in the Profit and Loss Account.

Pass necessary journal entries for the above on account of change in the profit sharing ratio.

Answer

Answer:

Journal

Question 57.

At the time of admission of a partner, who decides the share of profit of the new partner out of the firm’s profit?

Answer

Answer: It is decided mutually between the old partners and the new partner.

Question 58.

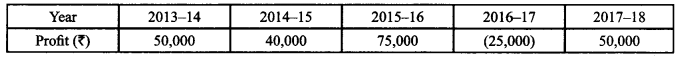

Hari and Krishan were partners sharing profits and losses in the ratio of 2 : 1. They admitted Shyam as a partner for 1/5th share in the profit. For this purpose, the Goodwill of the firm was to be valued on the basis of three years’ purchase of last five years average profits. The profits for the last five years were:

Calculate the Goodwill of the firm after adjusting the following:

The profit of 2014-15 was calculated after charging ₹ 10,000 for abnormal loss of goods by fire.

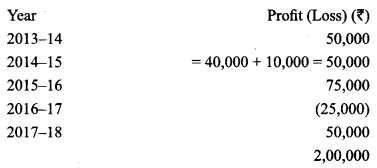

Answer

Answer:

Average profits = ₹ 2,00,000/5 = ₹ 40,000

Goodwill = Average Profits × Number of years purchase

= ₹ 40,000 × 3

= ₹ 1,20,000

Question 59.

Amit and Beena were partners in the firm sharing profits and losses in the ratio of 3 : 1. Chaman was admitted as a new partner for 1/6th share in the profits. Chaman acquired 2/5th of his share from Amit. How many shares did Chaman acquire from Beena?

Answer

Answer: Chaman acquired 1/6 – (1/6 × 2/5) = 3/30 from Beena.

Question 60.

Ritesh and Hitesh are childhood friends. Ritesh is a consultant whereas Hitesh is an architect. They contributed an equal amount and purchased a building for ₹ 2 crores. After 10 years they sold it for ₹ 3 crores and shared the profit equally. Are they doing the business in the partnership?

Answer

Answer: No

Question 61.

Pawan and Jayshree are partners. Bindu is admitted for 1/4th share. State the ratio in which Pawan and Jayshree will sacrifice their share in favour of Bindu?

Answer

Answer: Old ratio i.e. 1 : 1

Question 62.

X and Y are partners. Y wants to admit his son K into the business. Can K become the partner of the firm?

Answer

Answer: Yes, if X agrees to it otherwise not

Question 63.

Name any one factor responsible which affect the value of goodwill.

Answer

Answer: Location of a business

Question 64.

Vishal & Co. is involved in developing computer software which is a high value added product and Tiny & Co. is involved in manufacturing sugar which is a low value item. If capital employed of both the firms is same, value of goodwill of which firm will be higher?

Answer

Answer: Vishal & Co.

Question 65.

State a reason for the preparation of ‘Revaluation Account’ at time of admission of a partner.

Answer

Answer: To record the effect of revaluation of assets and liabilities.

Question 66.

In which ratio is the profit or loss due to revaluation of assets and liabilities transferred to capital accounts?

Answer

Answer: Old Ratio of existing partners

Question 67.

Change in Profit Sharing Ratio amounts to dissolution of partnership or partnership firm?

Answer

Answer: Dissolution of partnership

Question 68.

State one occasion on which a firm can be reconstituted.

Answer

Answer: Change of profit sharing ratio among the existing partners

Question 69.

What is the formula of calculating sacrificing ratio?

Answer

Answer: Sacrificing Ratio = Old Ratio – New Ratio

Question 70.

By which name the profit sharing ratio in which all partners, including the new partner, will share fixture profits?

Answer

Answer: New profit sharing ratio

Question 71.

If the new partner acquires his share in profits from all the old partners in their old profit sharing ratio, by which ratio will the old partners sacrifice their profit sharing ratio?

Answer

Answer: Old profit sharing ratio

Question 72.

Name the accounting standard, issued by the Institute of Chartered Accountants of India, which deals with treatment goodwill.

Answer

Answer: AS26

Question 73.

When the new partner brings amount of premium for goodwill, by which ratio is this amount credited to old partners’ Capital Accounts?

Answer

Answer: Sacrificing ratio

Question 74.

What is the formula for calculating inferred goodwill?

Answer

Answer: Net worth of business on the basis of new partner’s capital minus net worth of business in new firm

We hope you found this CBSE Class 12 Accountancy Reconstitution of Partnership Firm: Admission of a Partner MCQs Multiple Choice Questions with Answers helpful. If you have any questions about NCERT MCQ Questions for Class 12 Accountancy Chapter 3 Reconstitution of Partnership Firm: Admission of a Partner with Answers Pdf free download, please share them in the comment box below and we will get back to you at the earliest possible time.

Accountancy MCQ Class 12 Part 1 and Accounts MCQ Class 12 Part 2

- Accounting for Not for Profit Organisation Class 12 MCQ

- Accounting for Partnership: Basic Concepts Class 12 MCQ

- Reconstitution of Partnership Firm: Admission of a Partner Class 12 MCQ

- Reconstitution of Partnership Firm: Retirement / Death of a Partner Class 12 MCQ

- Dissolution of a Partnership Firm Class 12 MCQ

- Accounting for Share Capital Class 12 MCQ

- Issue and Redemption of Debentures Class 12 MCQ

- Financial Statements of a Company Class 12 MCQ

- Analysis of Financial Statements Class 12 MCQ

- Accounting Ratios Class 12 MCQ

- Cash Flow Statement Class 12 MCQ