TS Grewal Accountancy Class 11 Solutions Chapter 14 Adjustments in Preparation of Financial Statements are part of TS Grewal Accountancy Class 11 Solutions. Here we have given TS Grewal Accountancy Class 11 Solutions Chapter 14 Adjustments in Preparation of Financial Statements.

| Board | CBSE |

| Textbook | NCERT |

| Class | Class 11 |

| Subject | Accountancy |

| Chapter | Chapter 14 |

| Chapter Name | Adjustments in Preparation of Financial Statements |

| Number of Questions Solved | 31 |

| Category | TS Grewal Solutions |

TS Grewal Accountancy Class 11 Solutions Chapter 14 Adjustments in Preparation of Financial Statements

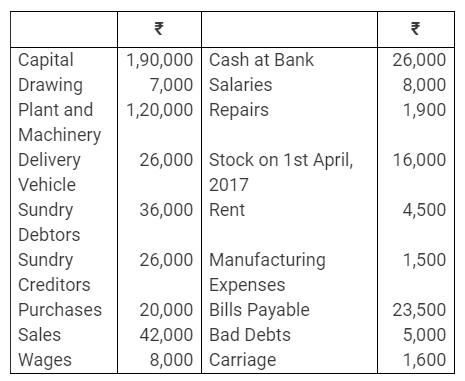

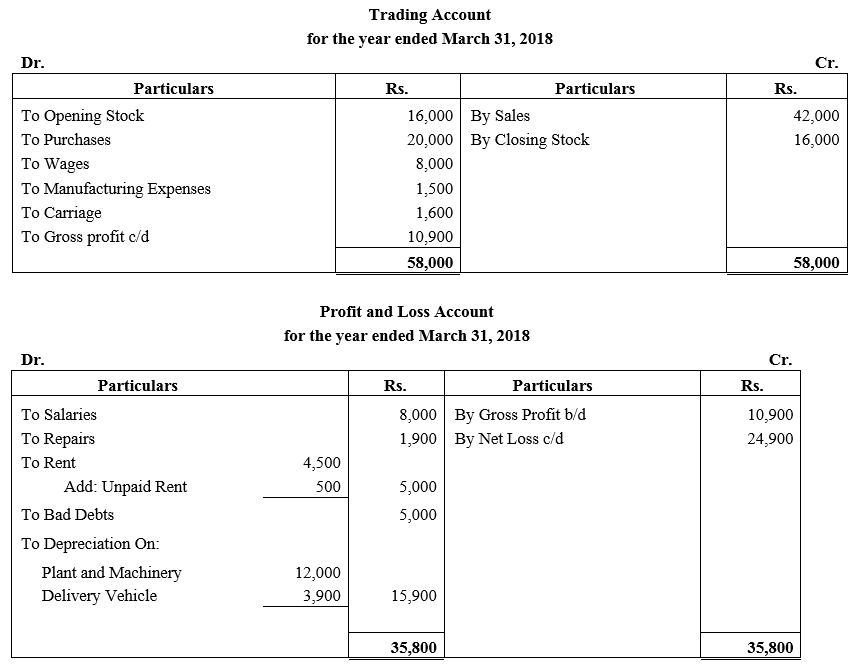

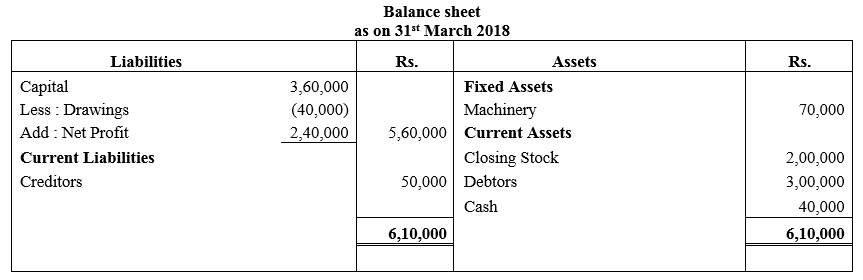

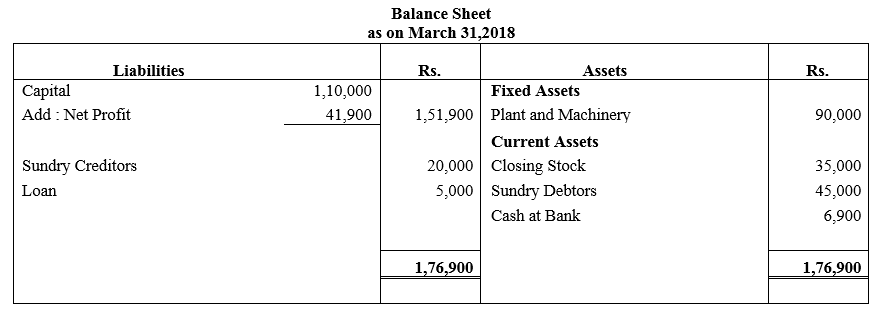

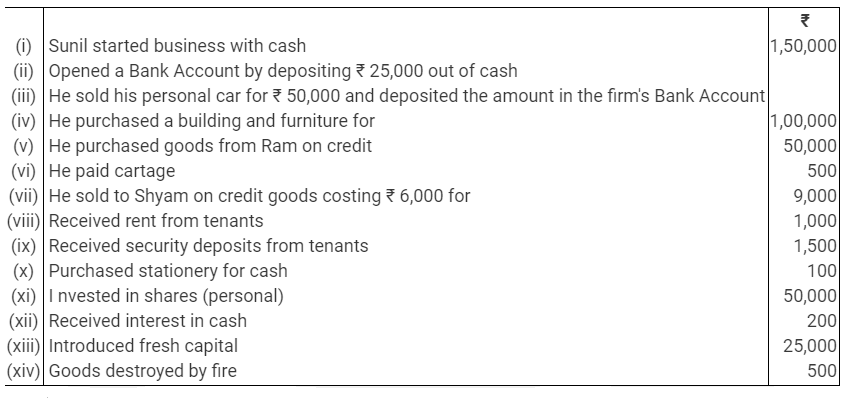

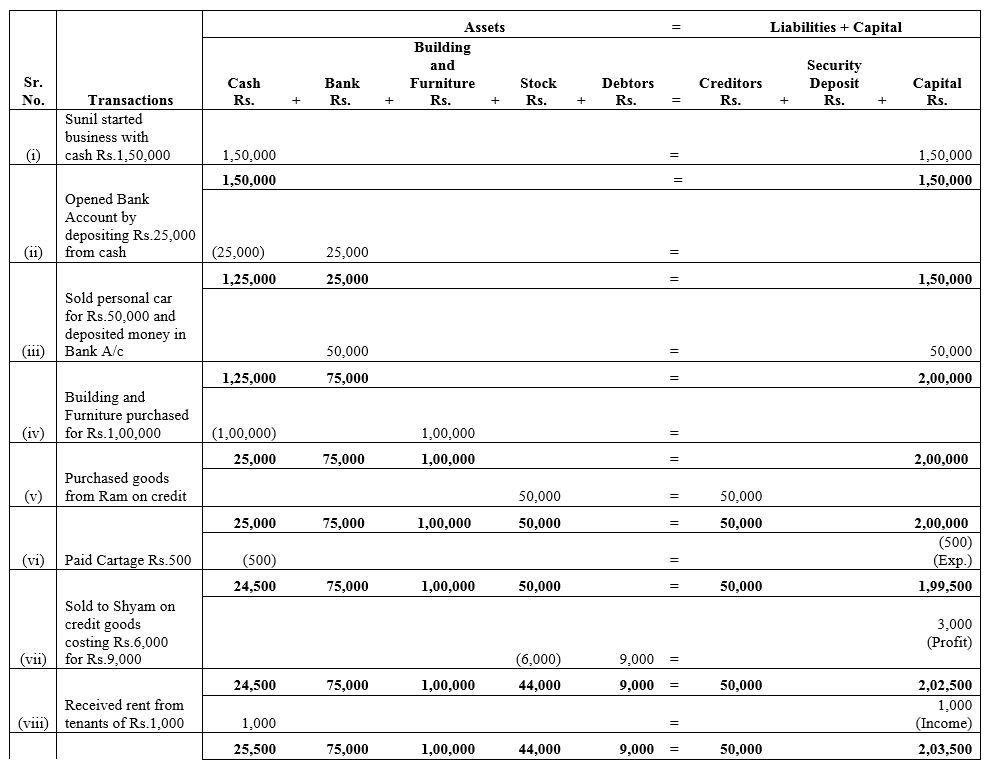

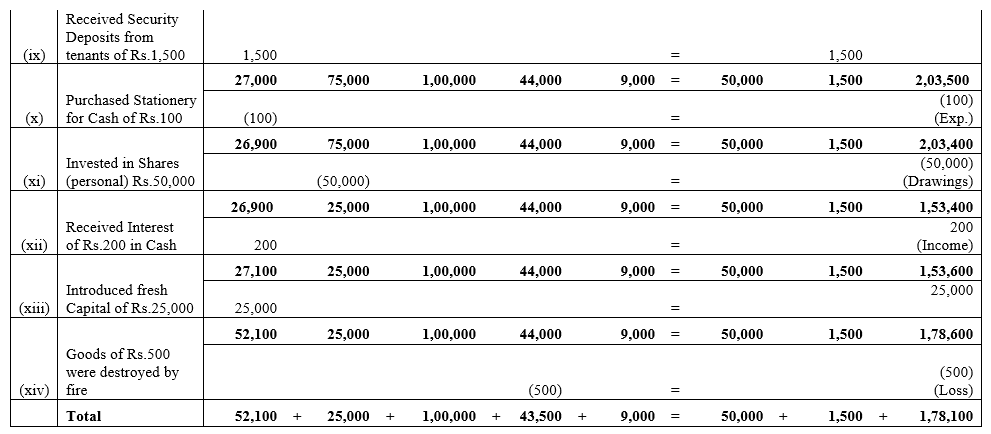

Question 1.

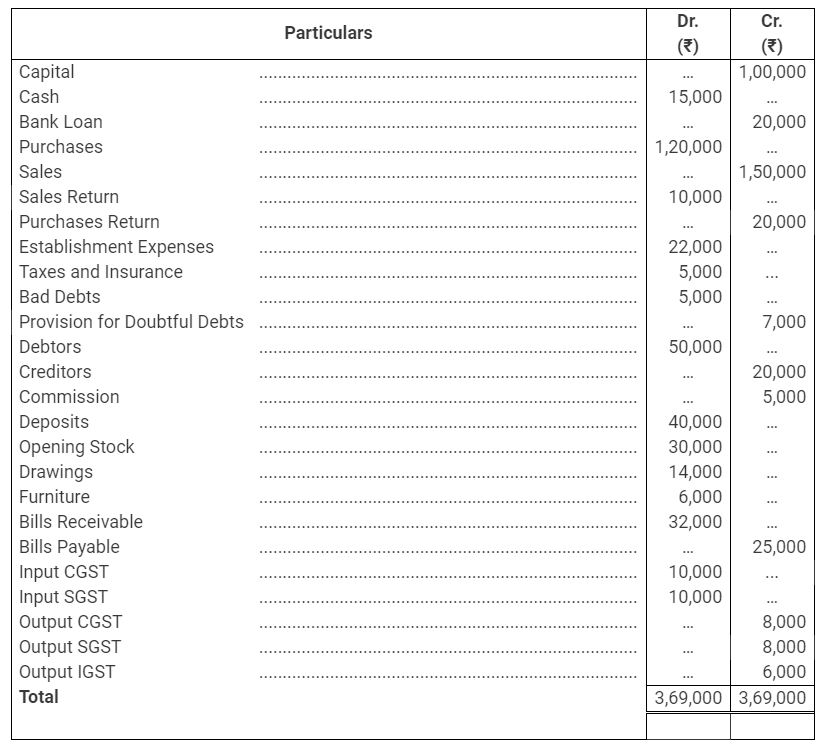

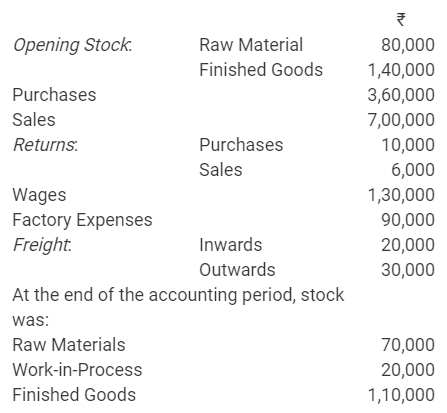

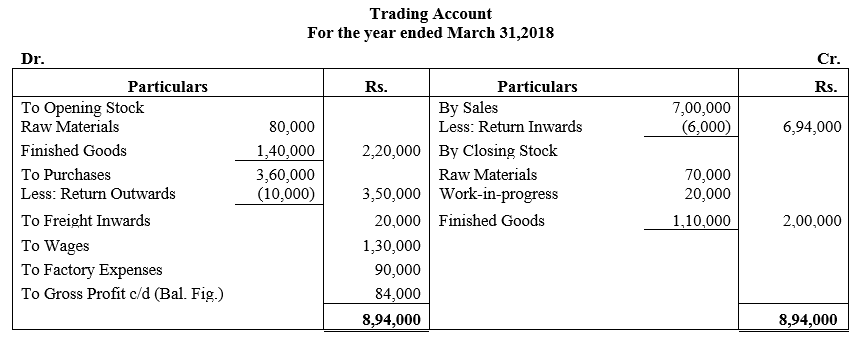

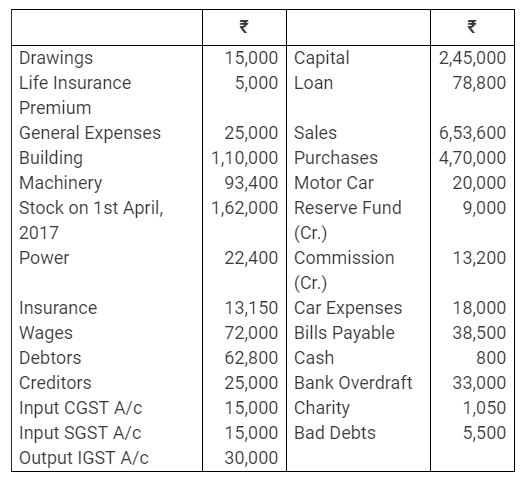

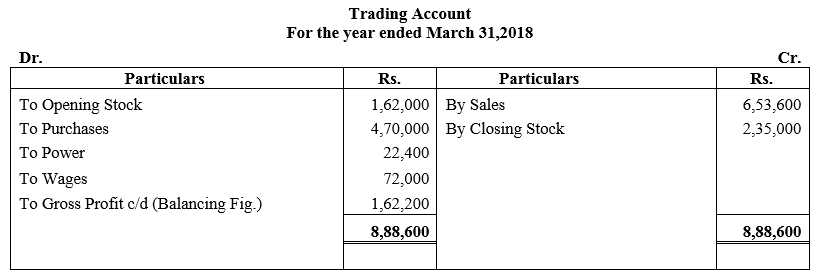

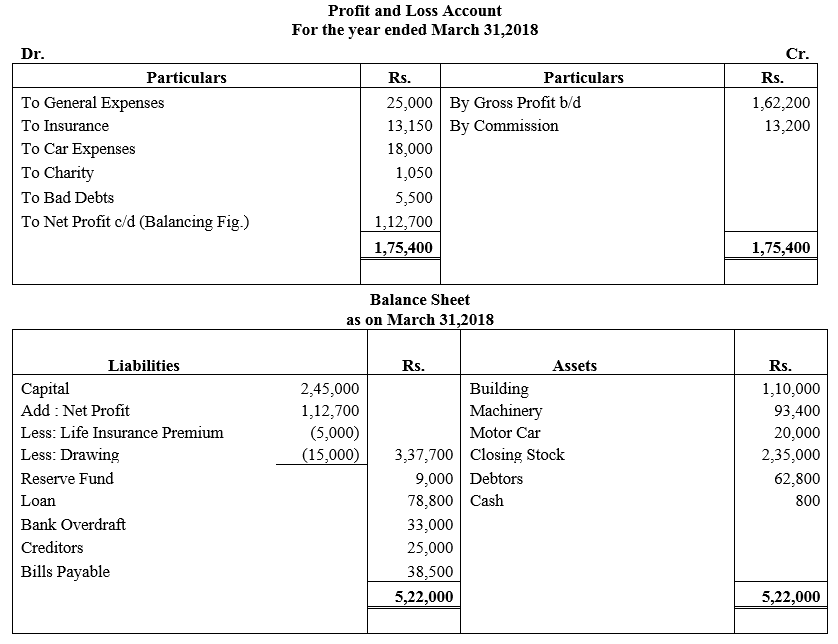

Following are the balances extracted from the books of Manish Gupta on 31st March, 2018:

Prepare Trading and Profit and Loss Account and Balance Sheet as at 31st March, 2018 after following adjustments are made:

(i) Closing Stock was ₹ 16,000.

(ii) Depreciate Plant and Machinery @ 10% and Delivery Vehicle @ 15%.

(iii) Unpaid Rent amounted to ₹ 500.

Solution:

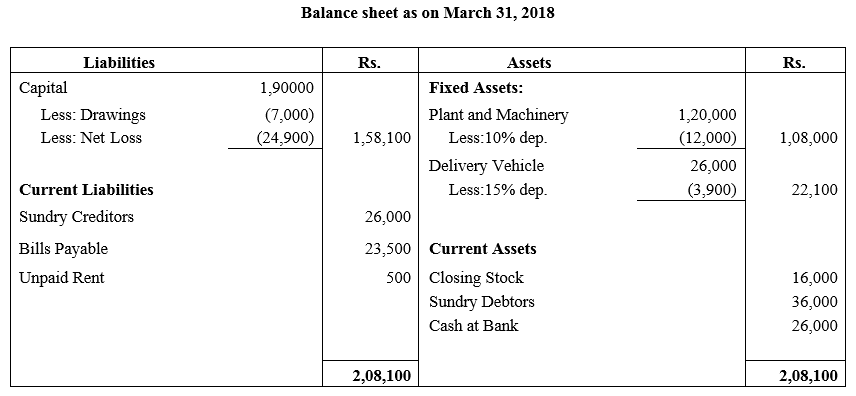

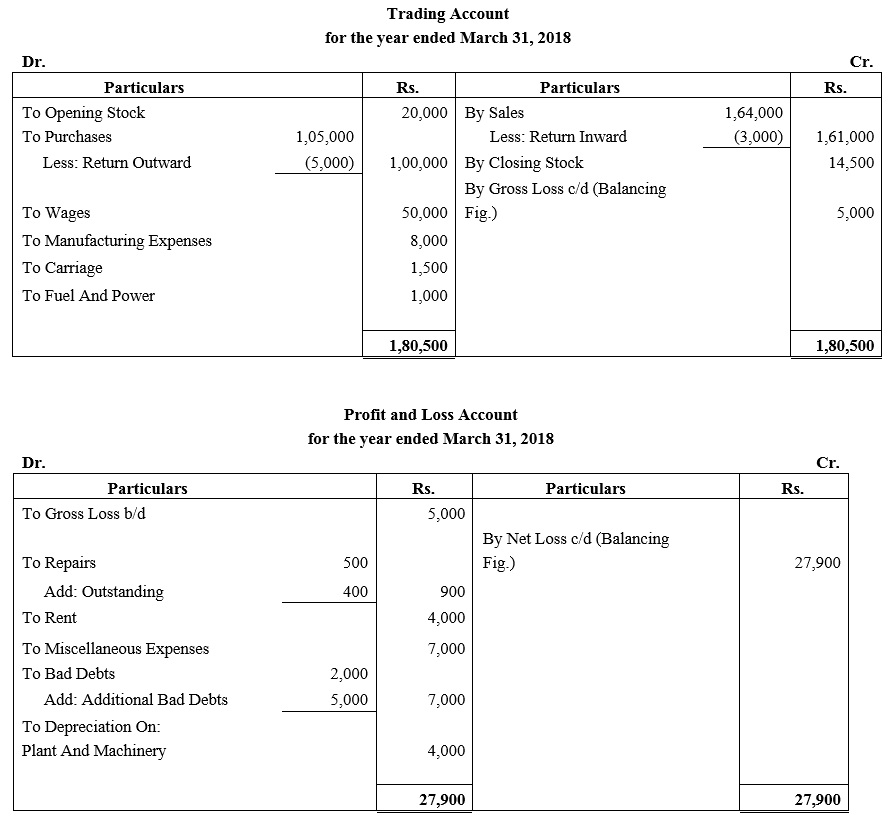

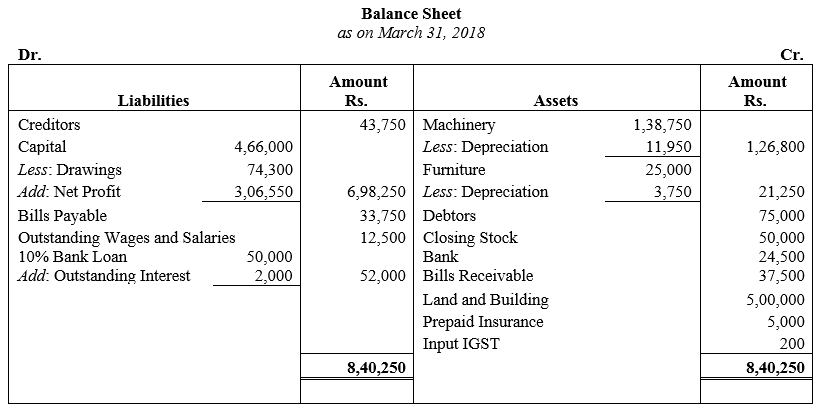

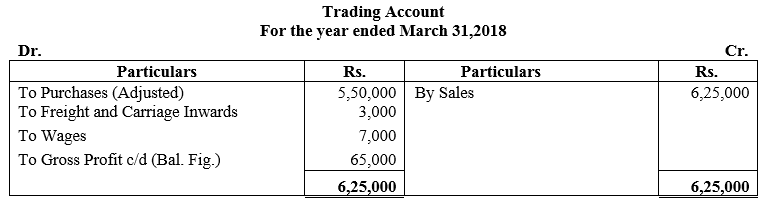

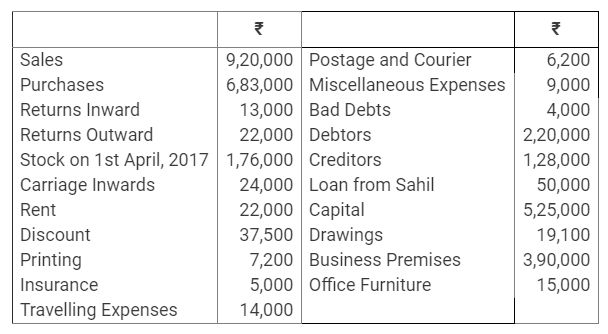

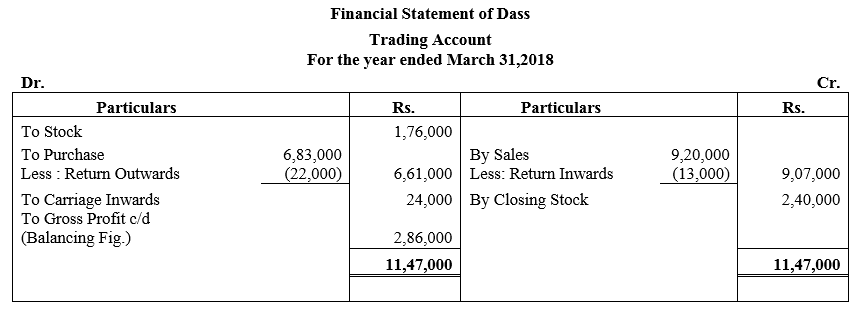

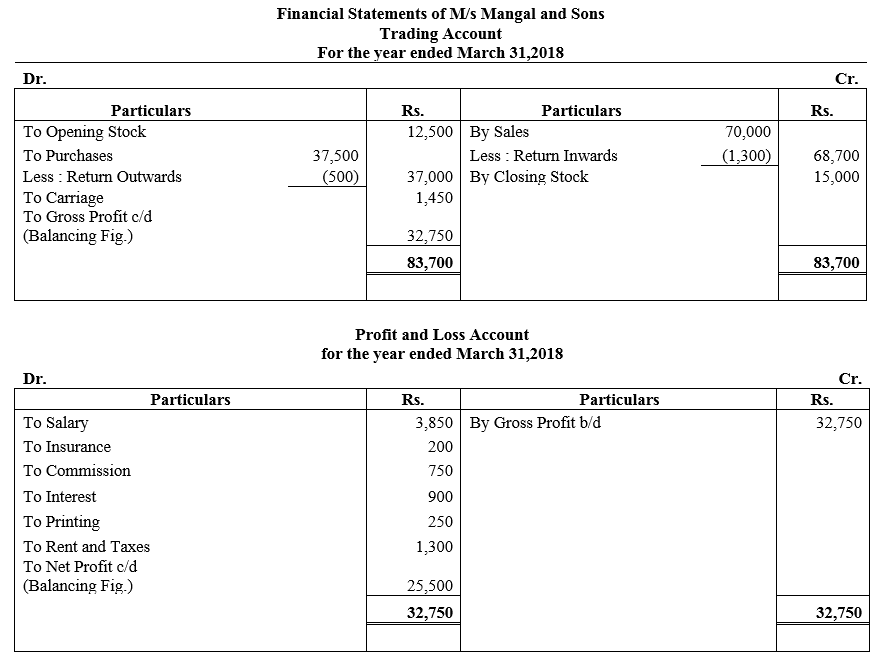

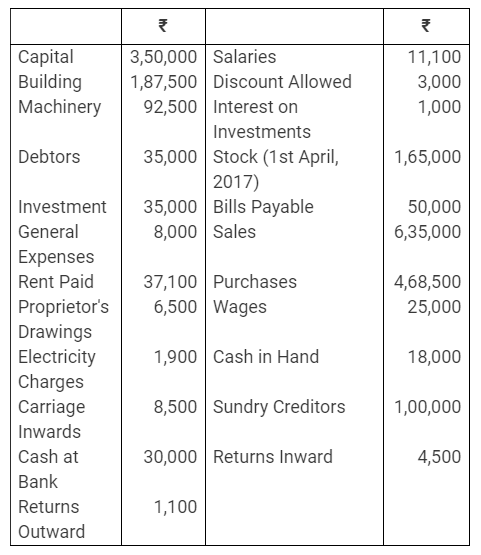

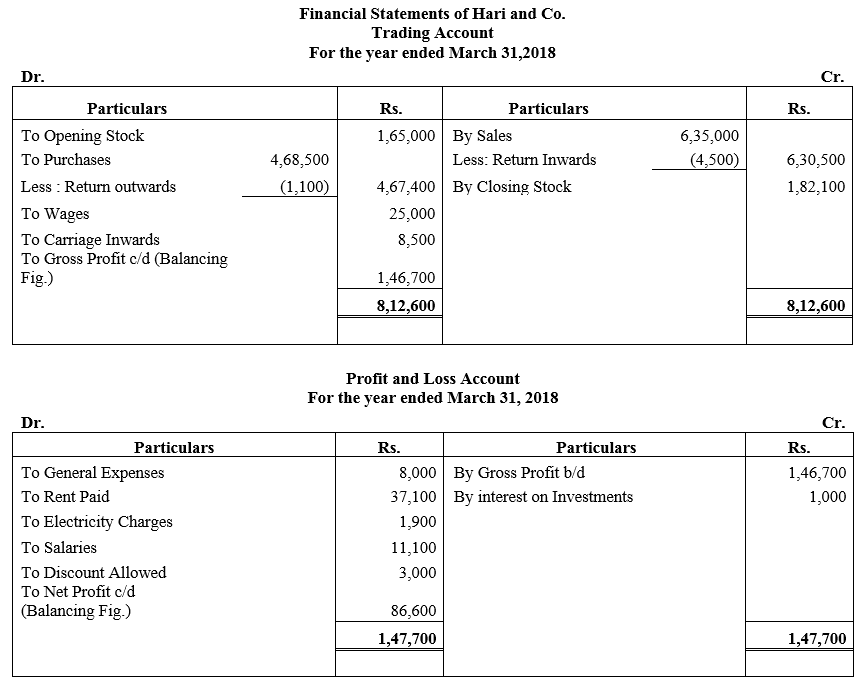

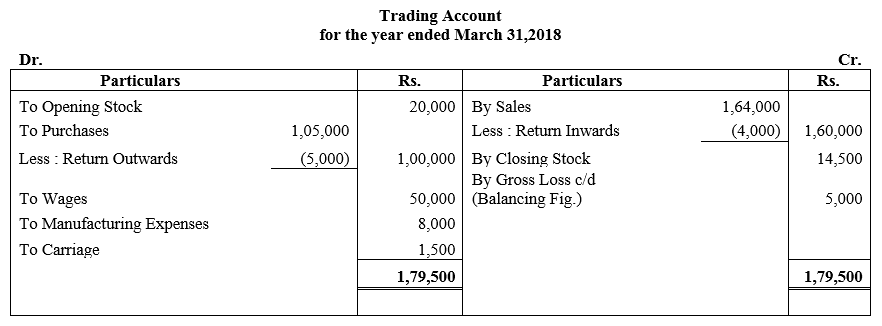

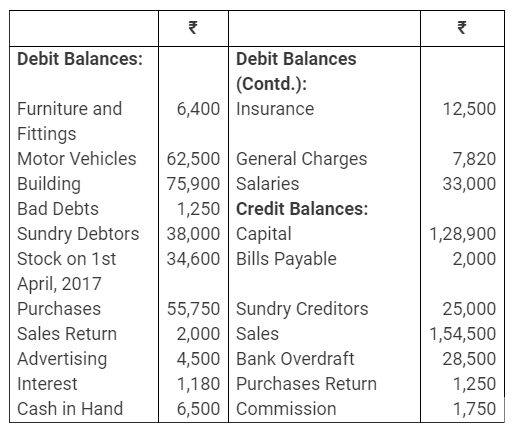

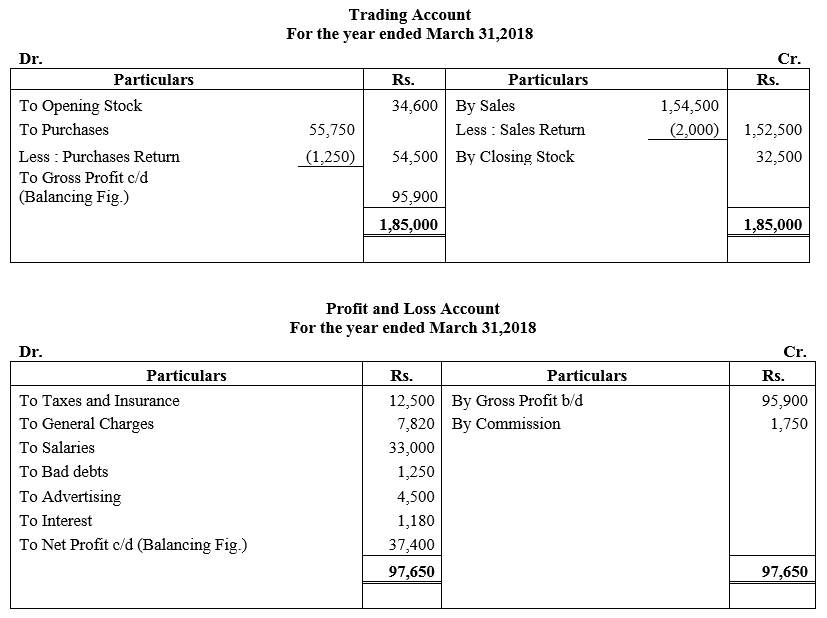

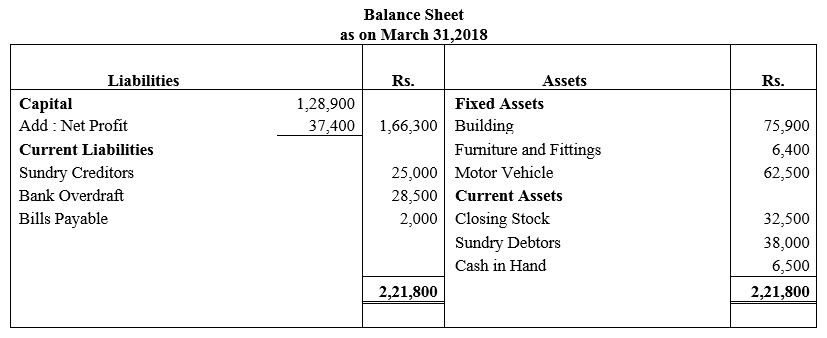

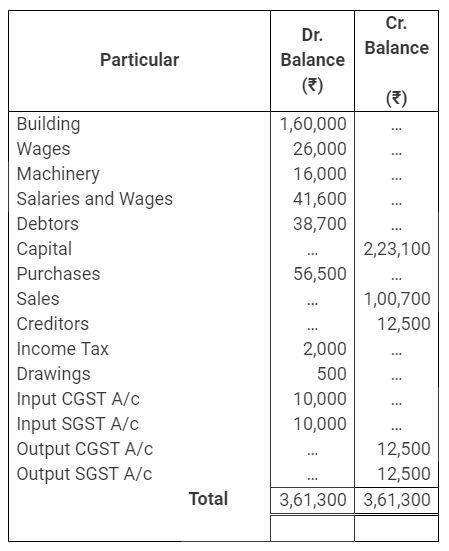

Question 2.

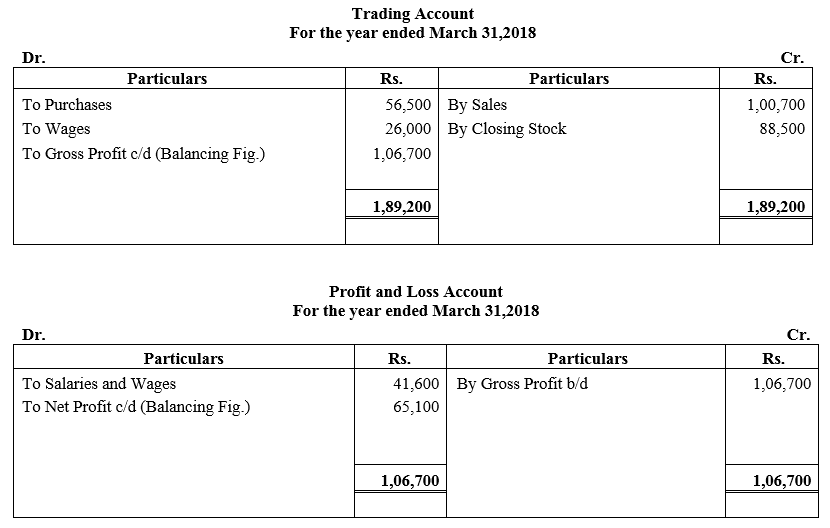

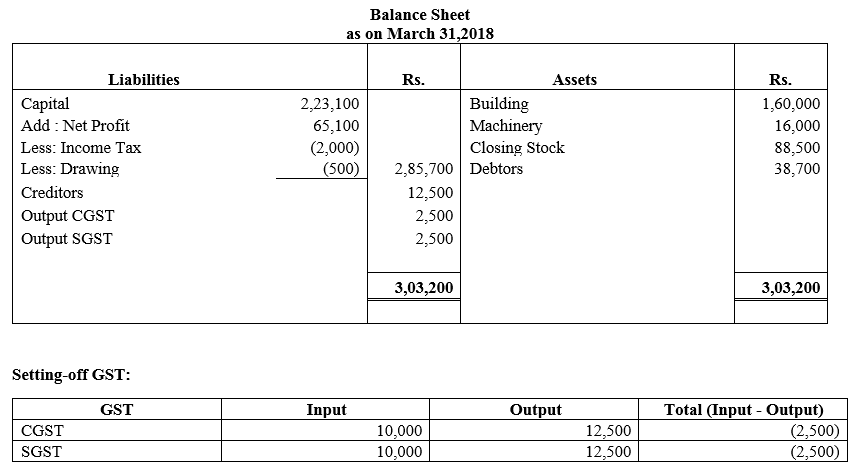

Prepare Trading and Profit and Loss Account and Balance Sheet from the following balances relating to the year ended 31st March, 2018:

Additional Information:

(i) Closing Stock was valued at ₹ 14,500.

(ii) Depreciate Plant and Machinery by ₹ 4,000.

(iii) Write off Bad Debts ₹ 5,000.

(iv) A sum of ₹ 400 is due for repairs.

Solution:

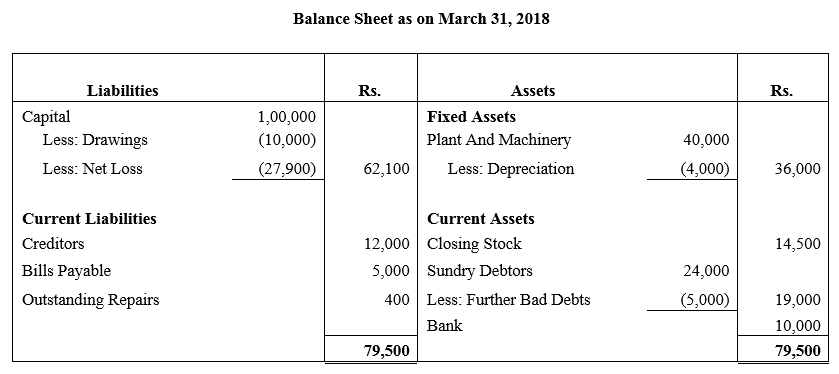

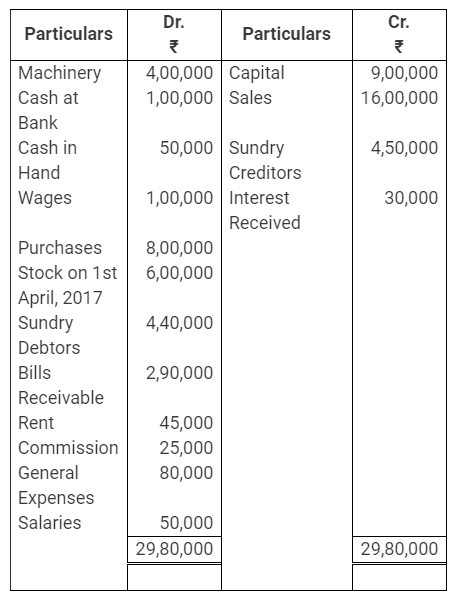

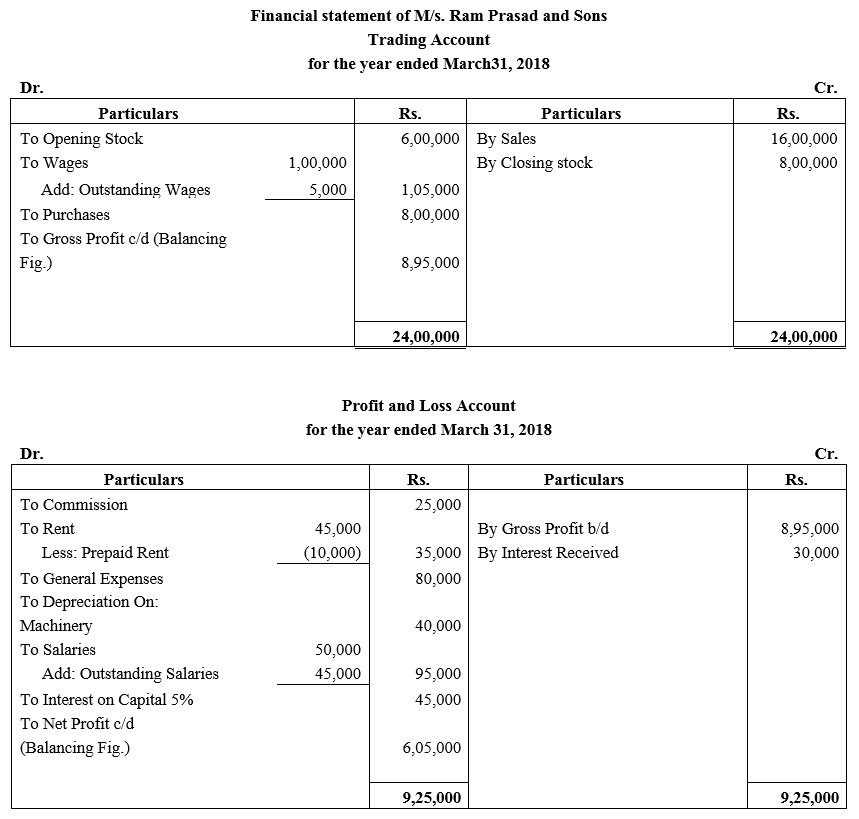

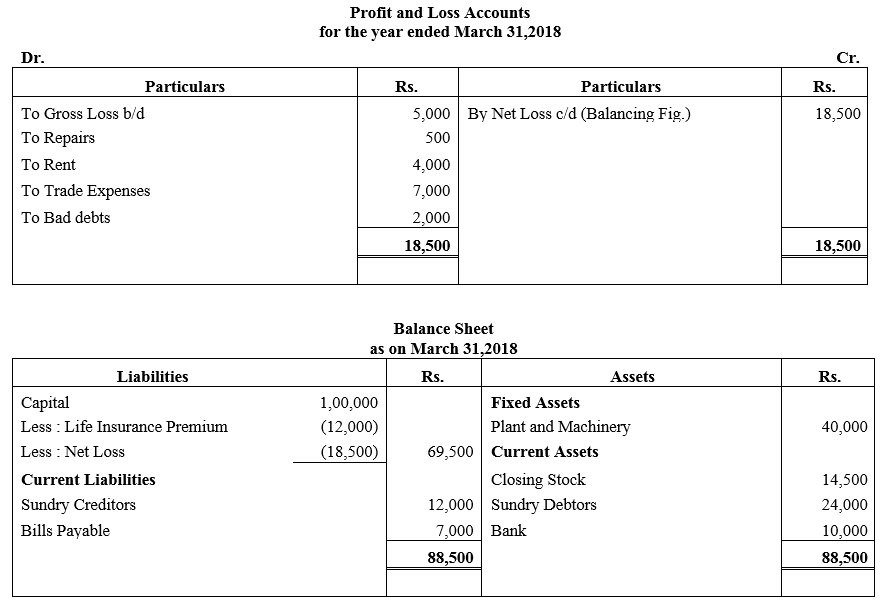

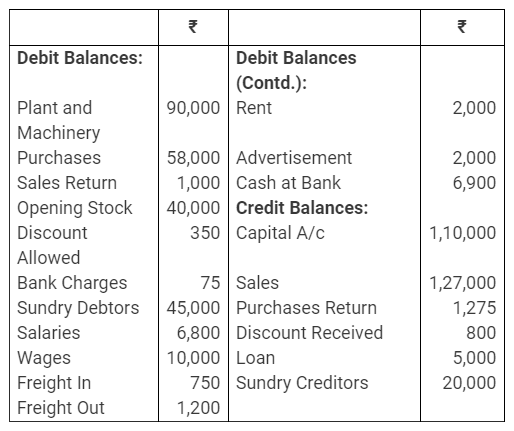

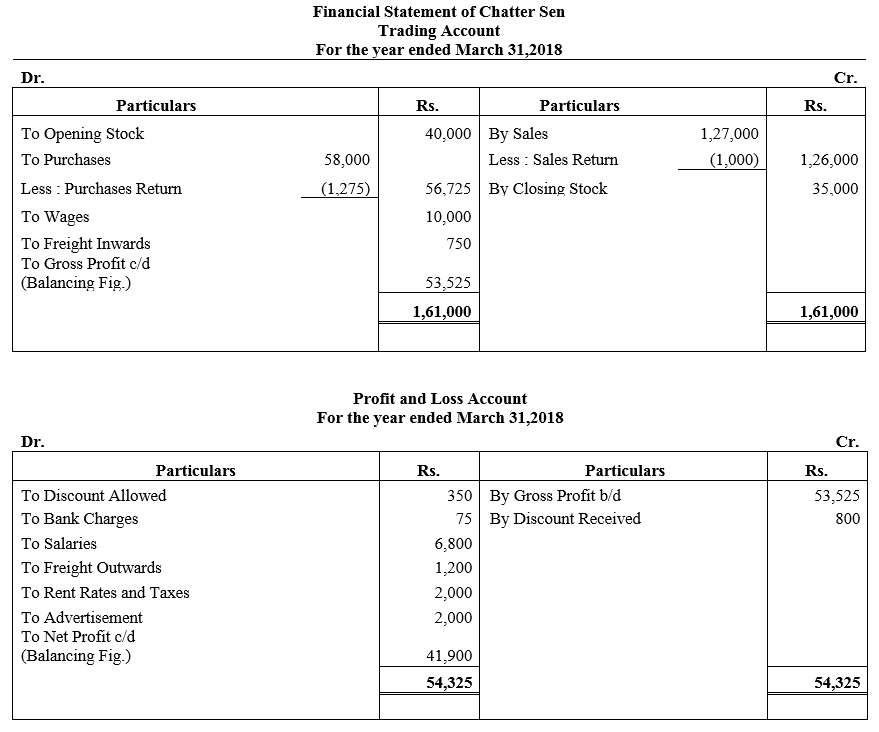

Question 3.

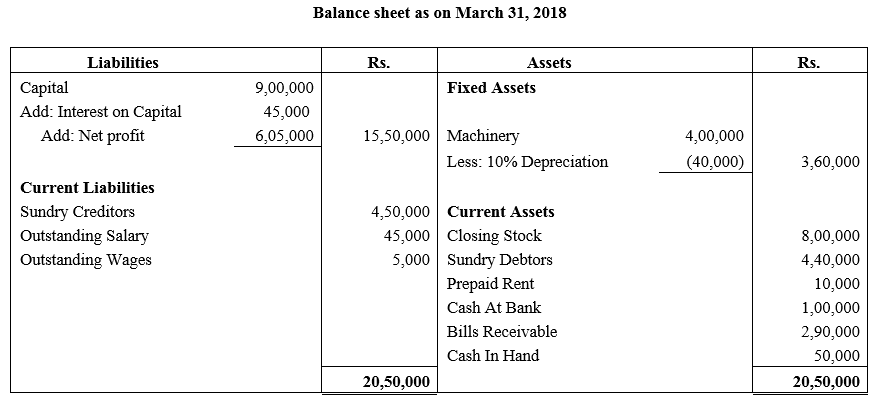

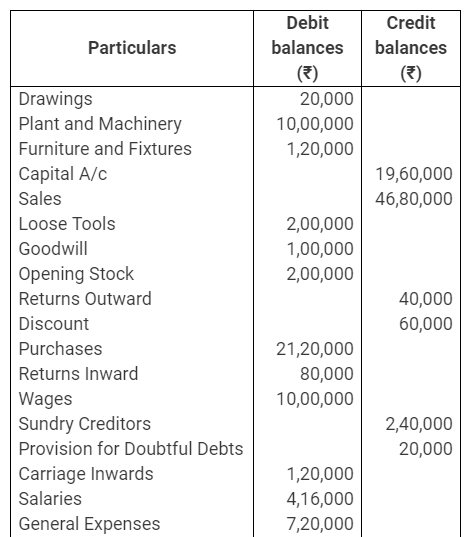

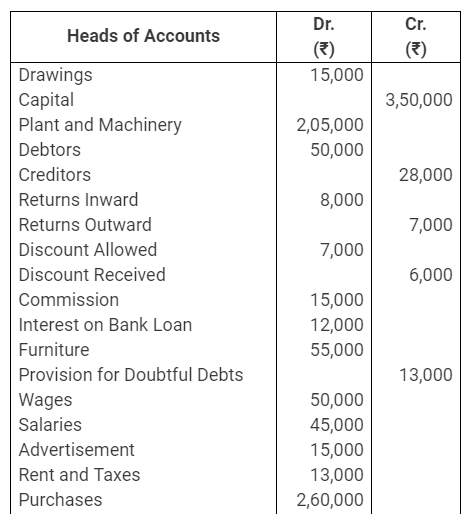

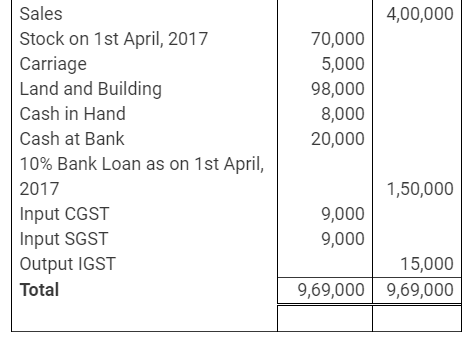

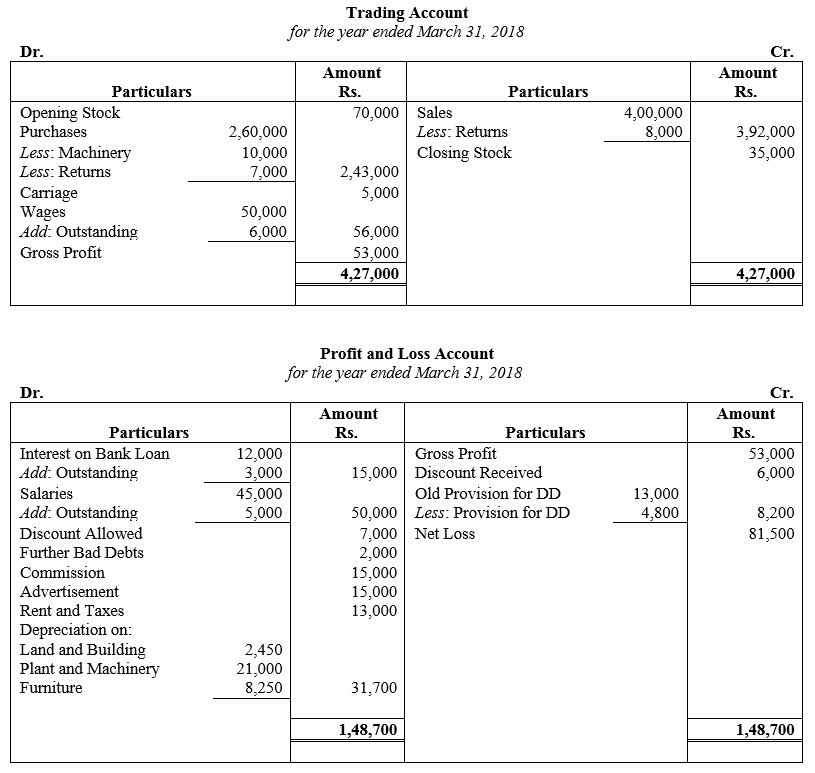

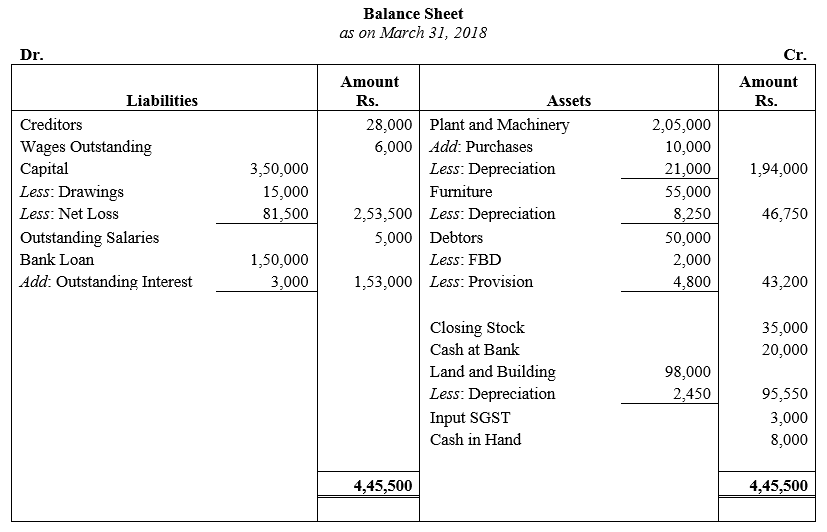

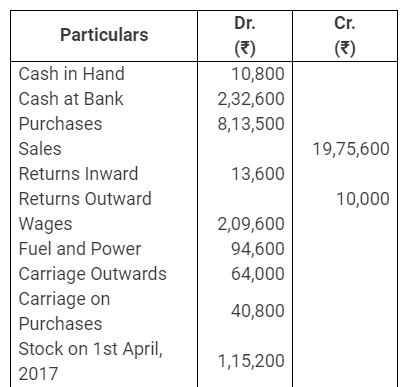

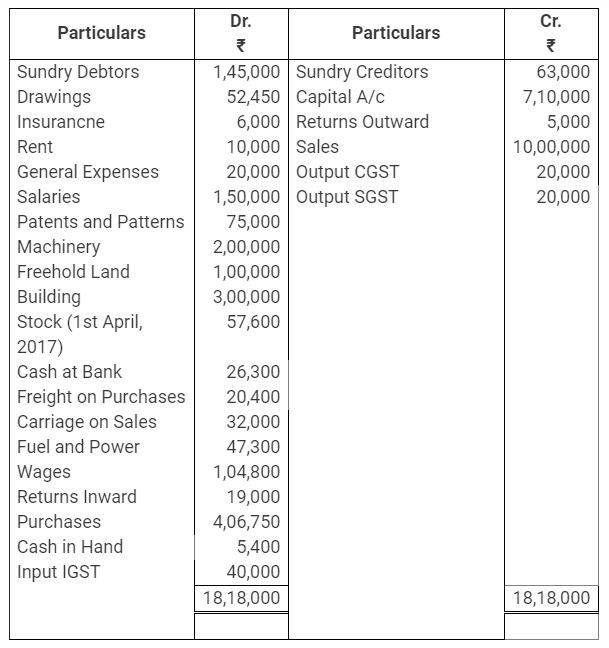

Following Trial Balance has been extracted from the books of M/s. Ram Prasad & Sons on 31st March, 2018:

Additional Information:

(i) Outstanding salaries were ₹ 45,000.

(ii) Depreciate Machinery at 10%.

(iii) Wages outstanding were ₹ 5,000.

(iv) Rent prepaid ₹ 10,000.

(v) Provide for interest on capital 5% per annum.

(vi) Stock on 31st March, 2018 ₹ 8,00,000.

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2018 and Balance Sheet as at that date.

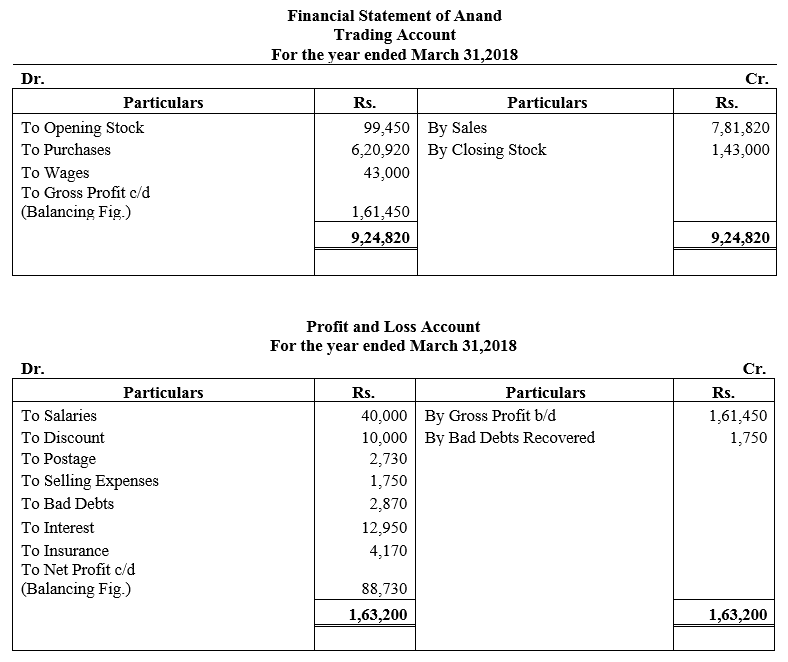

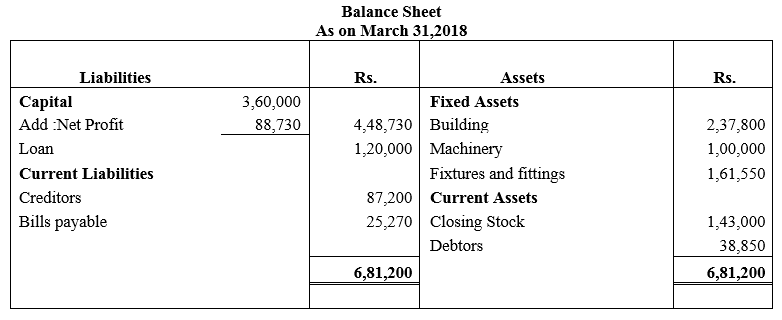

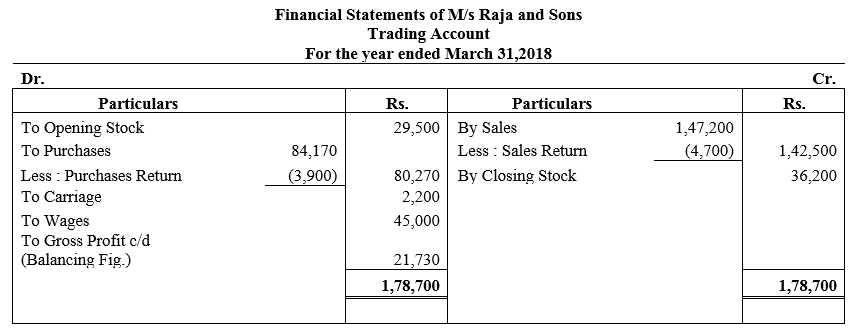

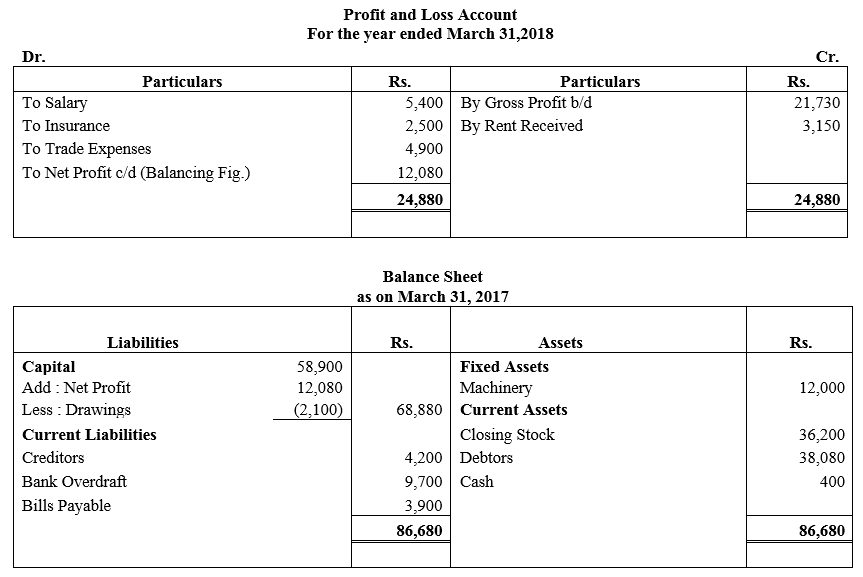

Solution:

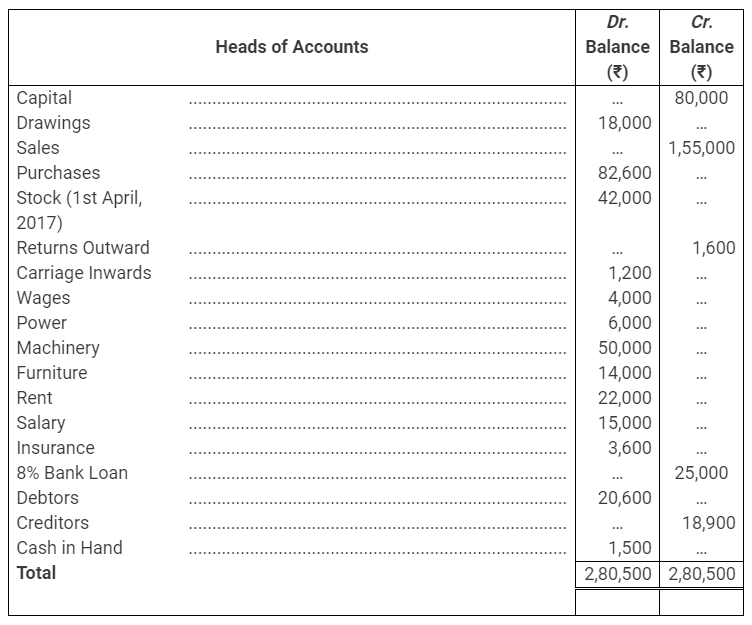

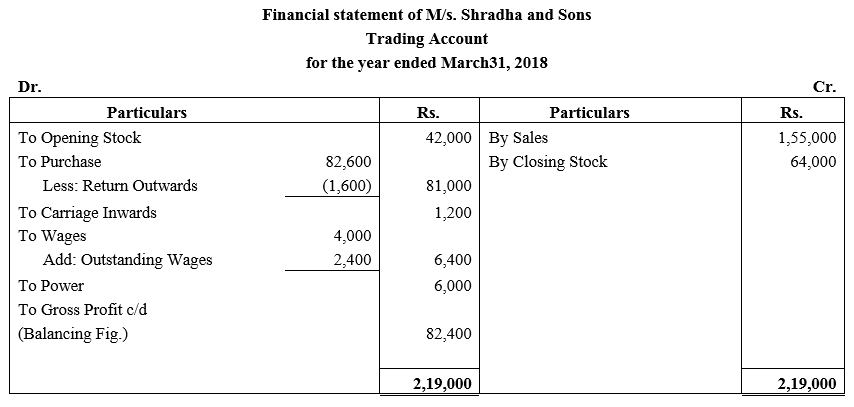

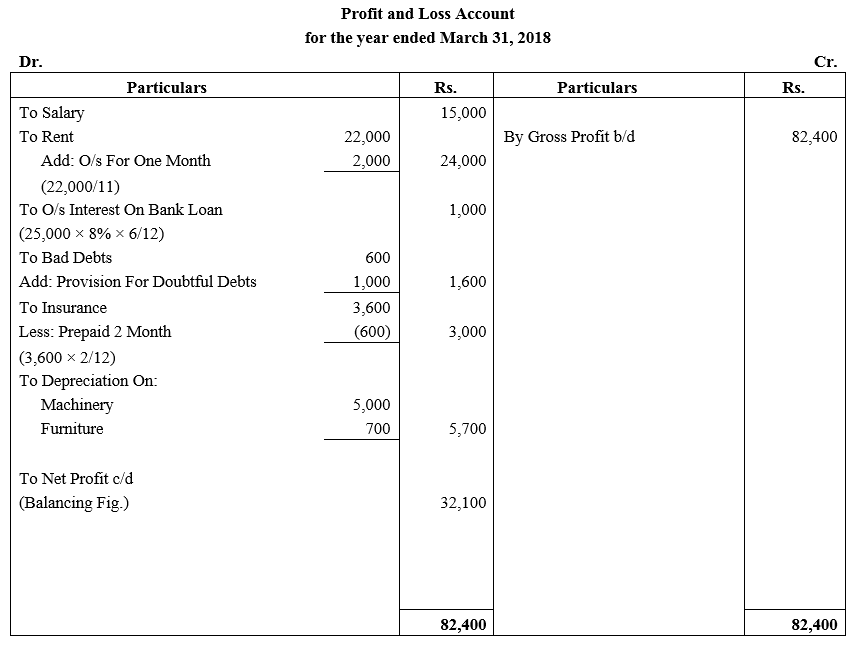

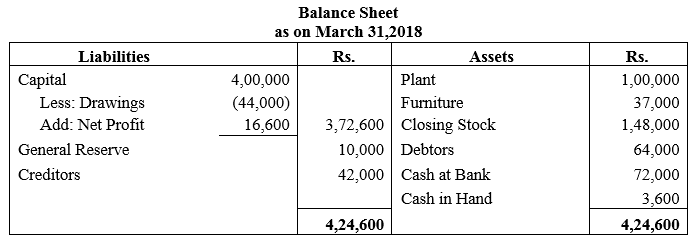

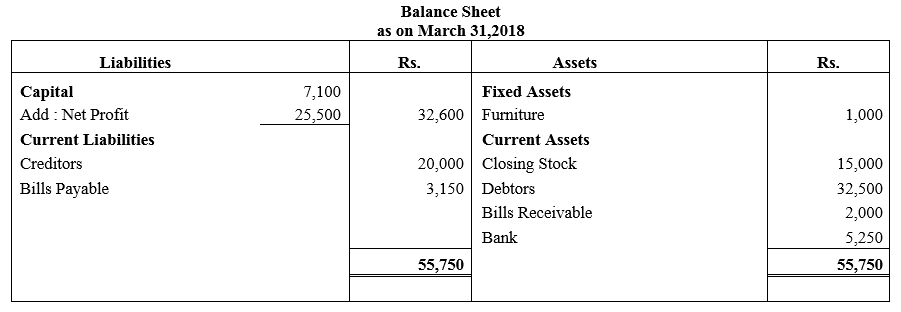

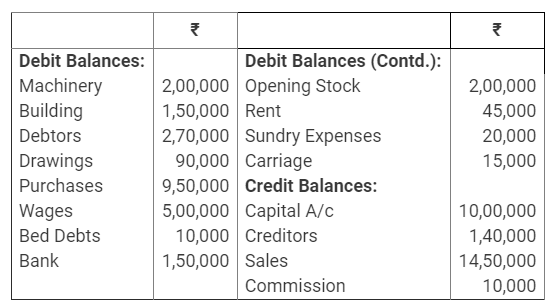

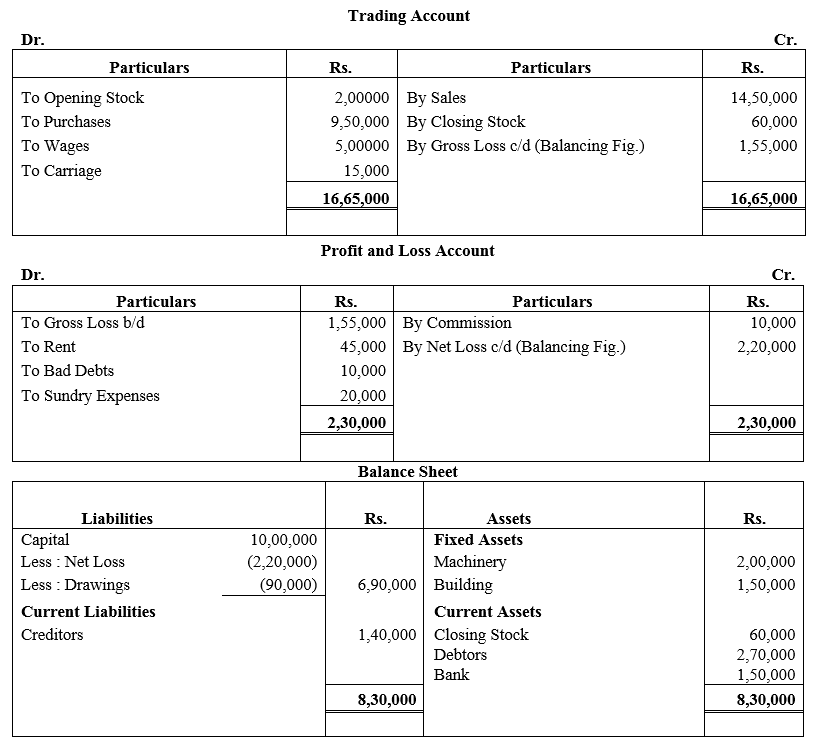

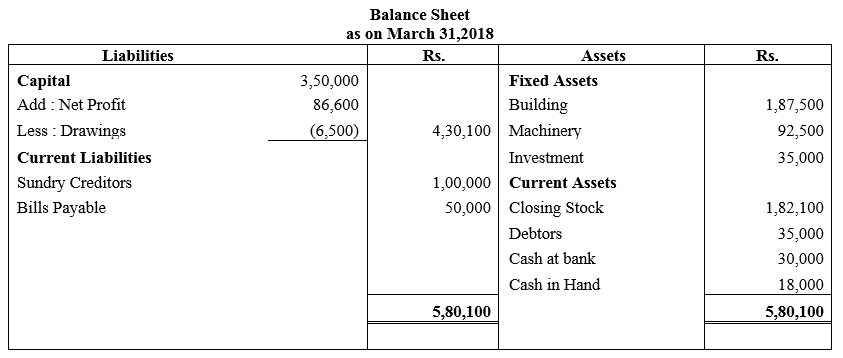

Question 4.

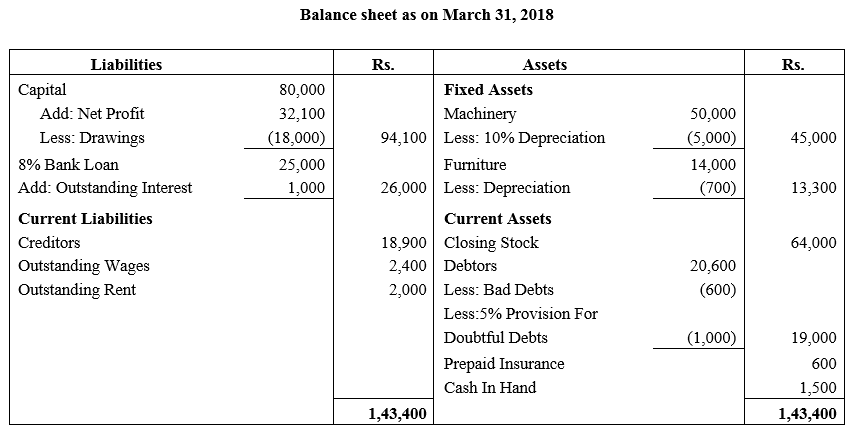

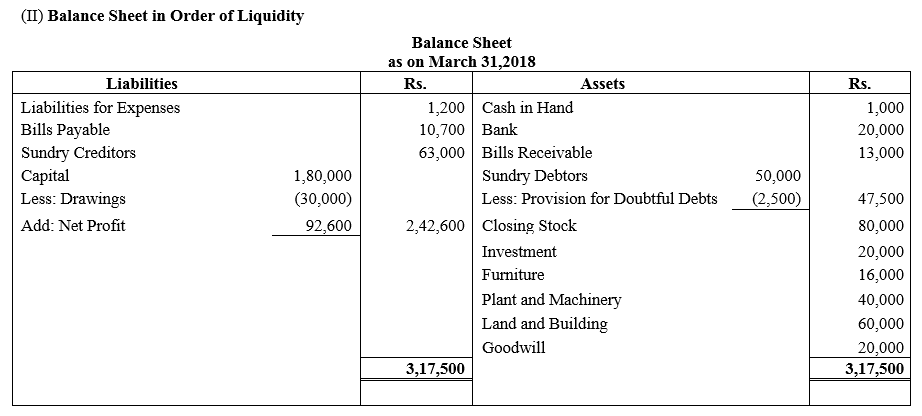

From the following Trial Balance of M/s. Shradha & Sons as on 31st March, 2018, prepare Trading and Profit and Loss Account and Balance Sheet.

Adjustments:

(i) Closing Stock ₹ 64,000.

(ii) Wages outstanding ₹ 2,400.

(iii) Bad Debts ₹ 600.

(iv) Provision for Doubtful Debts to be 5%.

(v) Rent is paid for 11 months.

(vi) Insurance premium is paid per annum, ended 31st May, 2018.

(vii) Loan from the bank was taken on 1st October, 2017.

(viii) Provide Depreciation on machinery @ 10% and on Furniture @ 5%.

Solution:

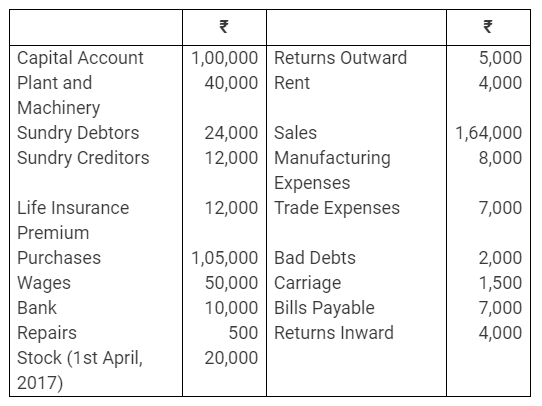

Question 5.

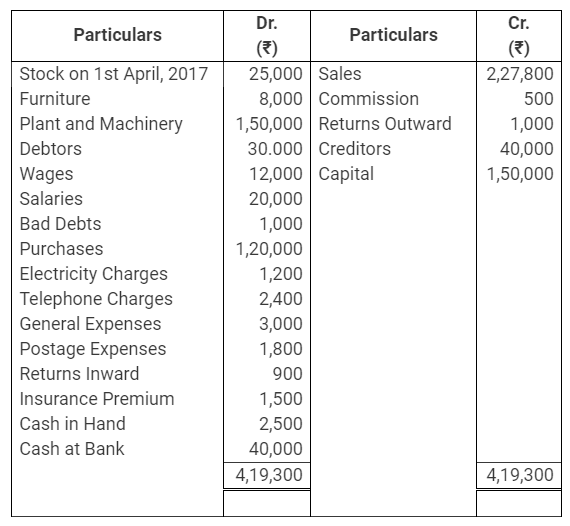

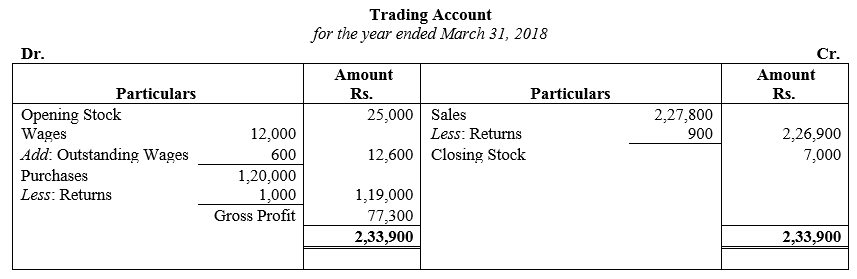

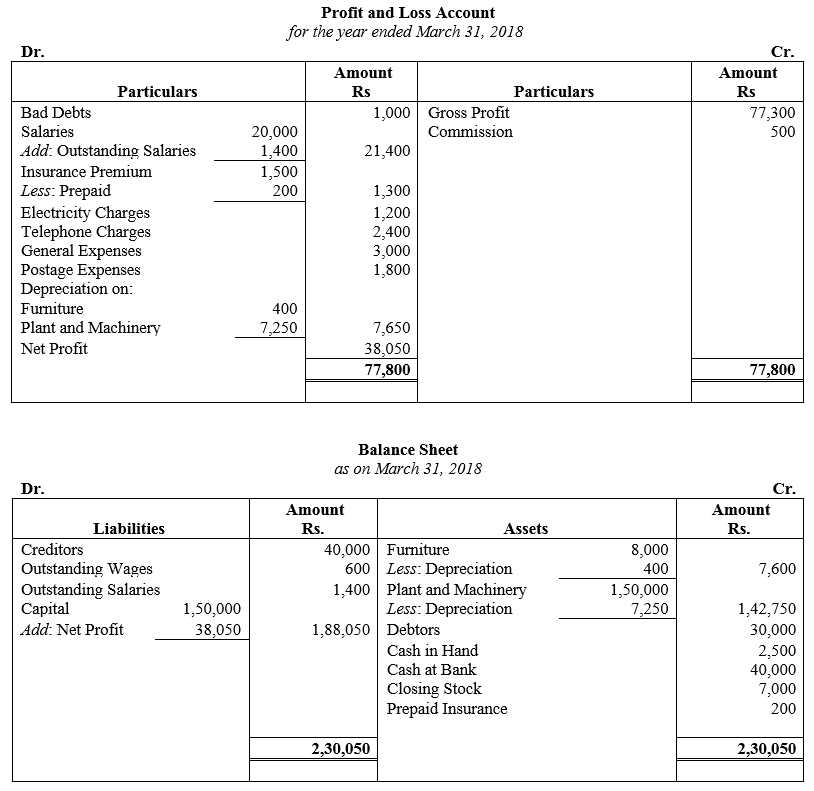

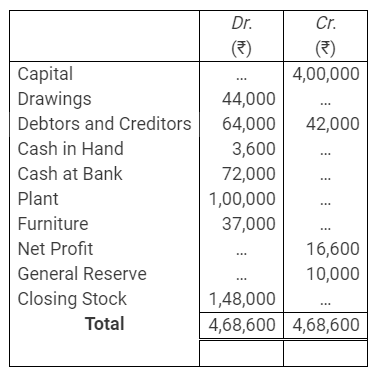

Trial Balance of a business as at 31st March, 2018 is given below:

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2018 and Balance Sheet as at that date after taking into account the following adjustments:

(i) Closing Stock was valued at ₹ 7,000.

(ii) Outstanding liabilities for wages were ₹ 600 and salaries ₹ 1,400.

(iii) Depreciation is to be provided @ 5% p.a. on all fixed assets.

(iv) Included in Plant and Machinery is a machine purchased for ₹ 10,000 on 1st October, 2017.

(v) Insurance premium paid in advance ₹ 200.

Solution:

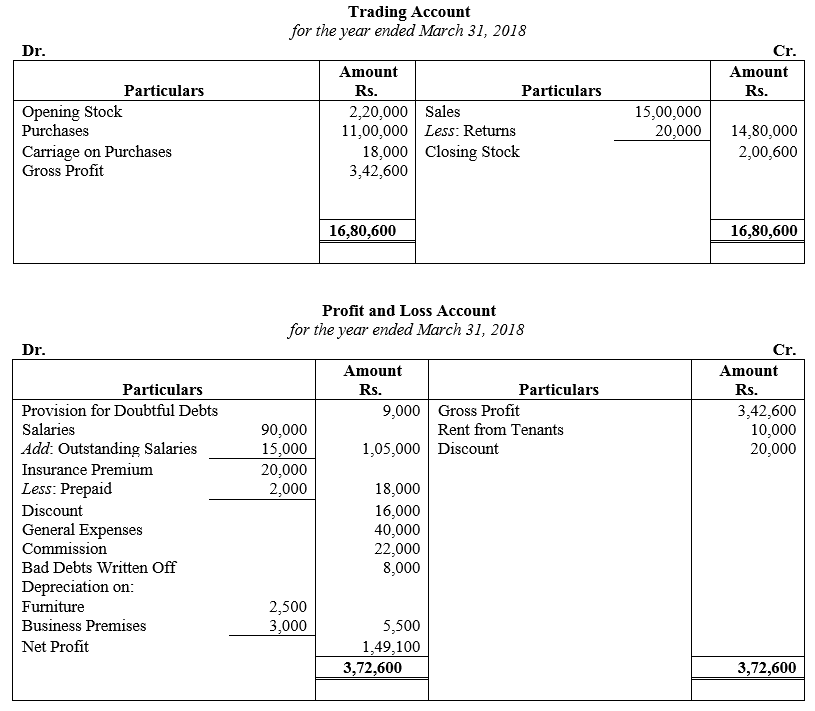

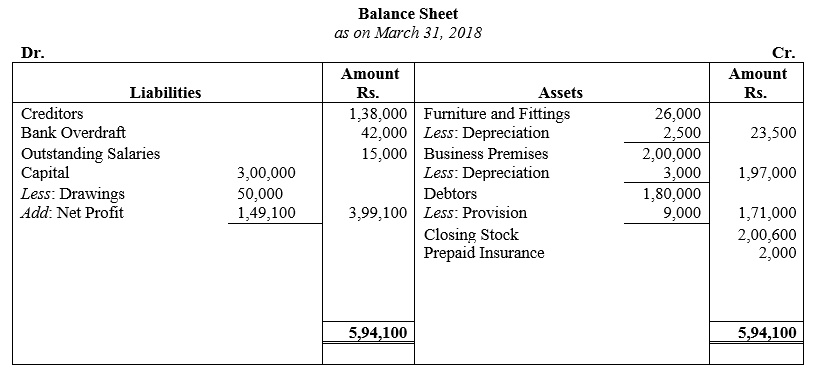

Question 6.

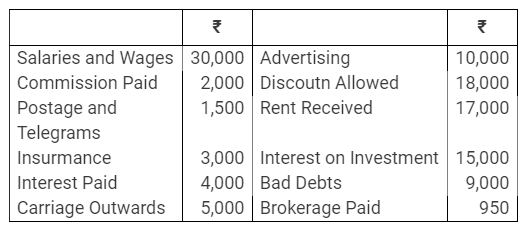

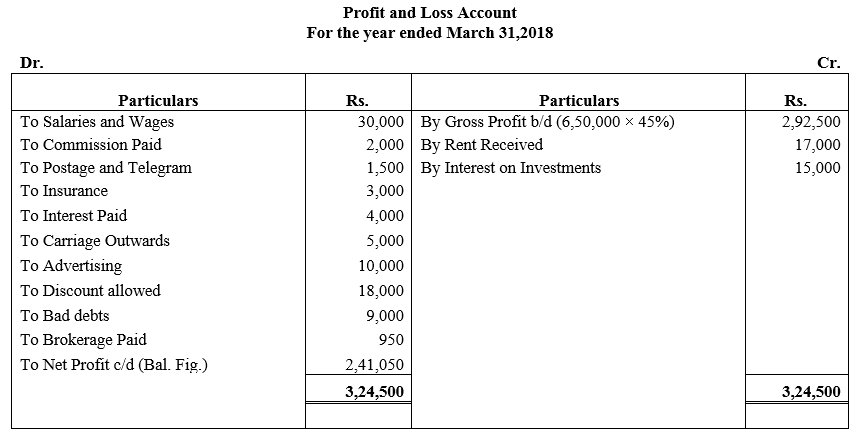

Following are the balances extracted from the books of Narain Lal on 31st March, 2018:

Additional Information:

(i) Closing Stock as on 31st March, 2018 was ₹ 2,00,600.

(ii) Depreciate: Business Premises by ₹ 3,000 and Furniture and Fittings by ₹ 2,500.

(iii) Make a provision of 5% on debtors for doubtful debts.

(iv) Carry forward ₹ 2,000 for unexpired insurance.

(v) Outstanding salary was ₹ 15,000.

Prepare Trading and Profit and Loss Account for the year and Balance Sheet as at that date.

Solution:

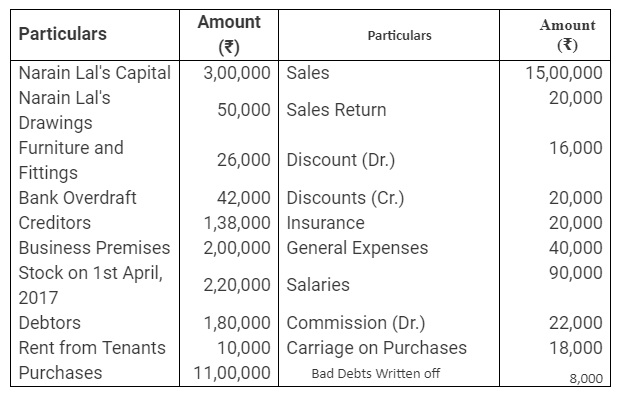

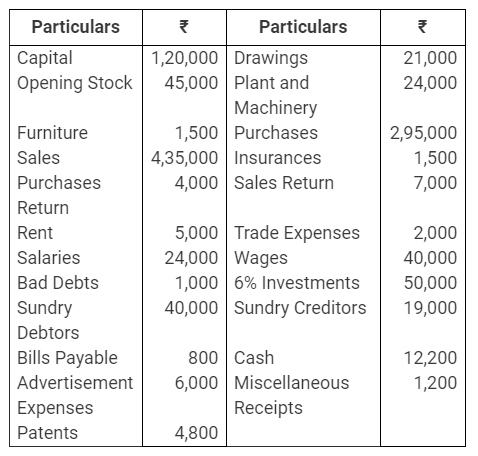

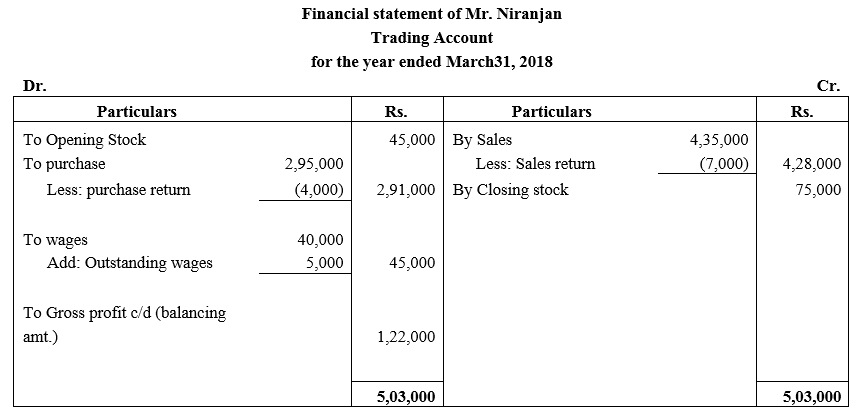

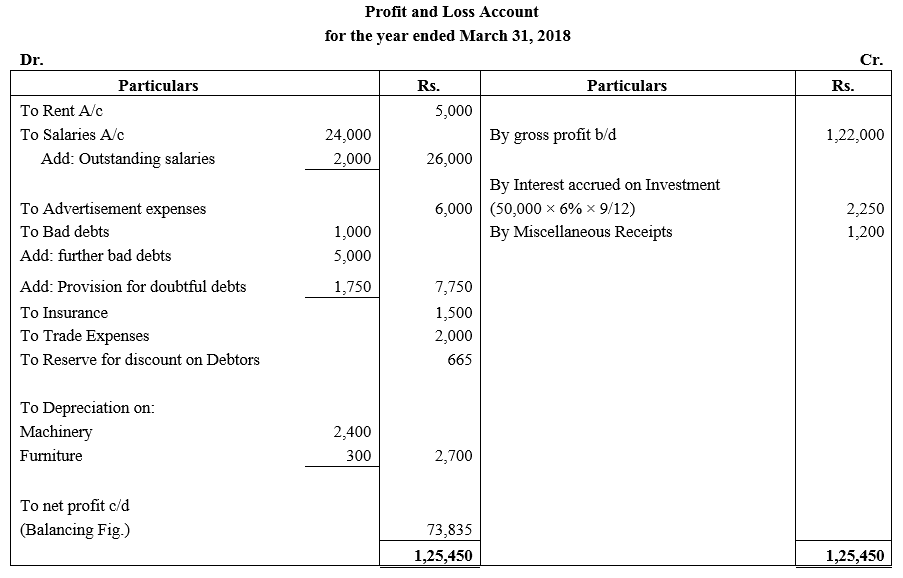

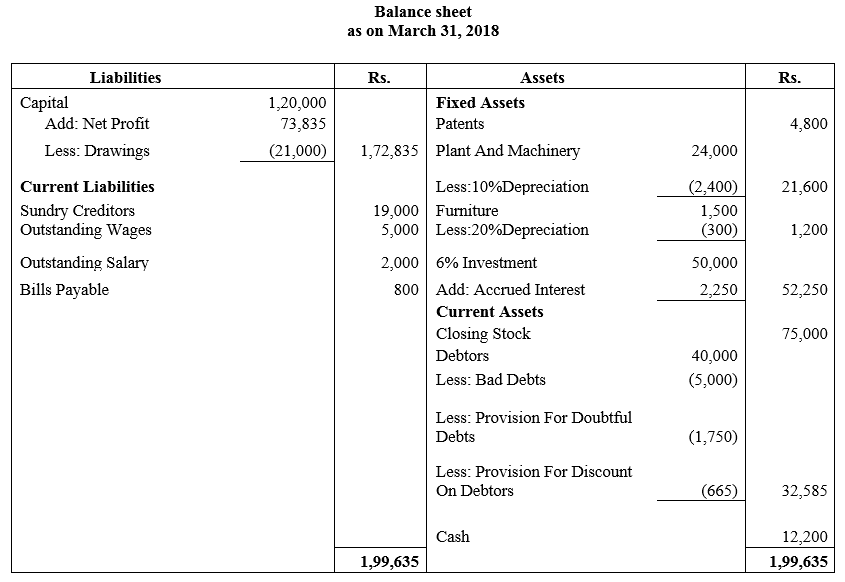

Question 7.

Following balances are taken from the books of Mr. Niranjan. You are required to prepare Trading and Profit and Loss Account and Balance Sheet for the year ended 31st March, 2018:

Adjustments:

(i) Closing Stock ₹ 75,000.

(ii) Depreciate Machinery by 10% and Furniture by 20%.

(iii) Wages ₹ 5,000 and salaries ₹ 2,000 are outstanding.

(iv) Write off ₹ 5,000 as further Bad Debts and create 5% Provision for Doubtful Debts.

(v) Investments were made on 1st July, 2017 and no interest has been received so far.

Solution:

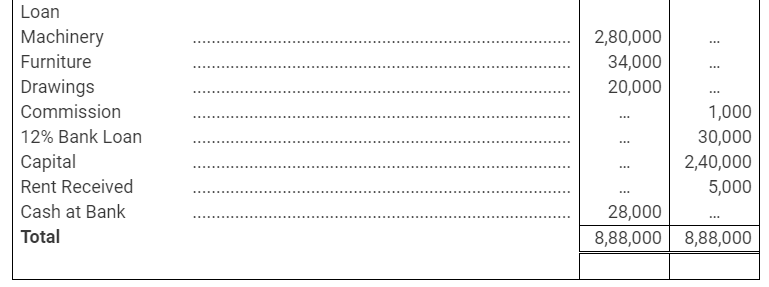

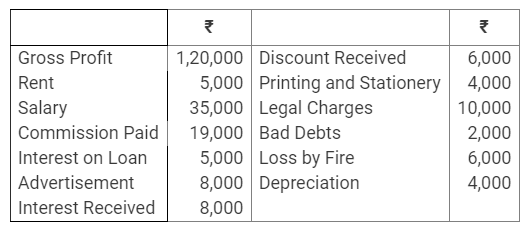

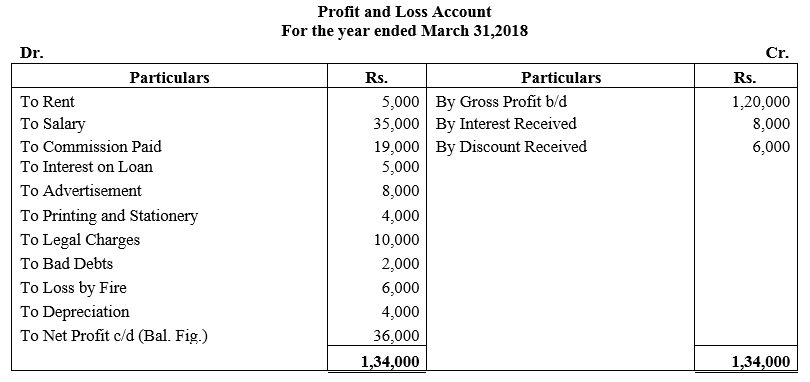

Question 8.

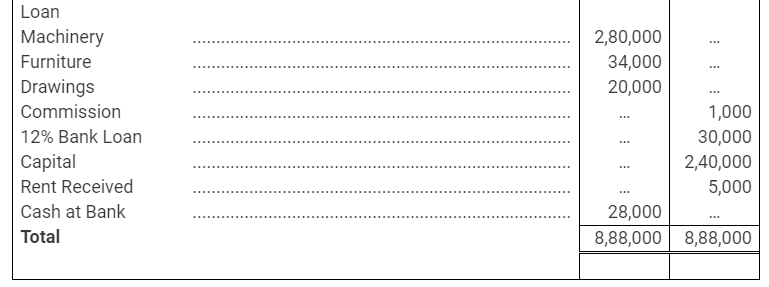

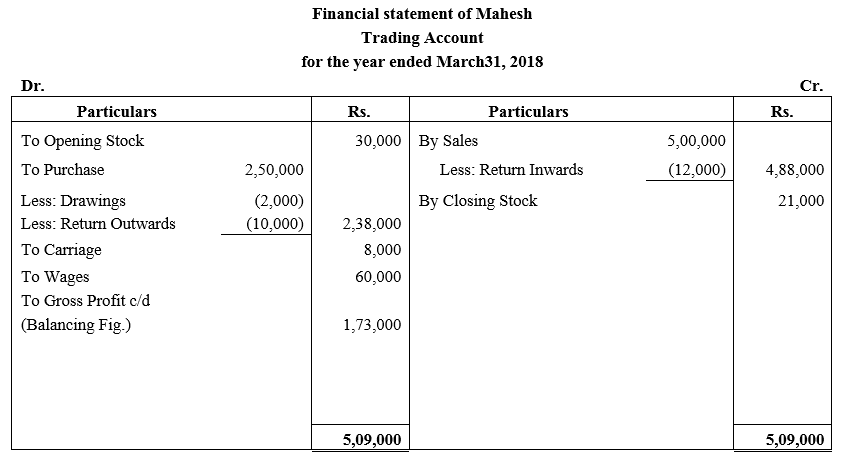

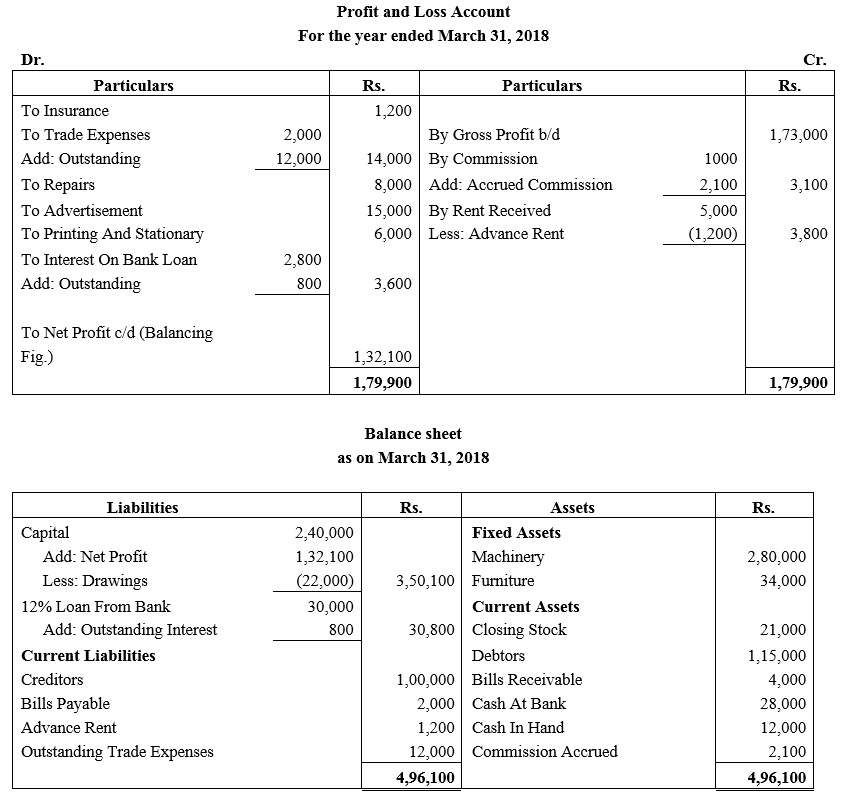

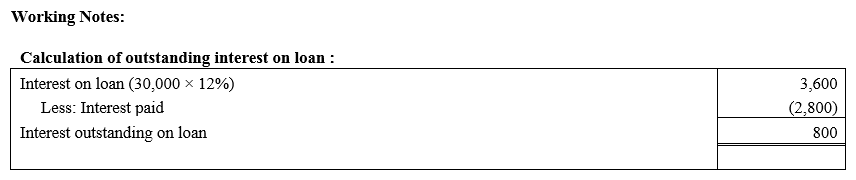

From the following Trial Balance of Mahesh, prepare his Final Accounts for the year ended 31st March, 2018:

Additional Information:

(i) Closing Stock on 31st March, 2018 was ₹ 21,000.

(ii) Rent of ₹ 1,200 has been received in advance.

(iii) Outstanding liability for trade expenses ₹ 12,000.

(iv) Commission earned during the year but not received was ₹ 2,100.

(v) Goods costing ₹ 2,000 were taken by the proprietor for his personal use but no entry has been passed in the books of account.

Solution:

Question 9.

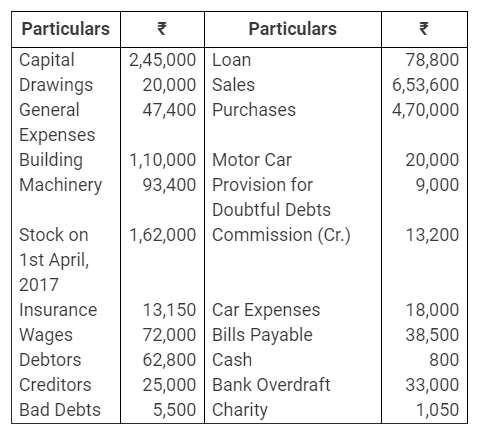

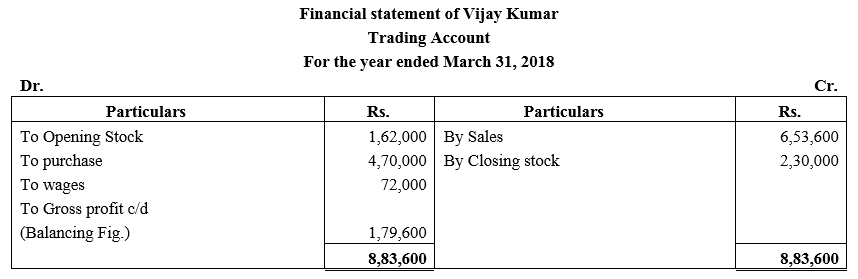

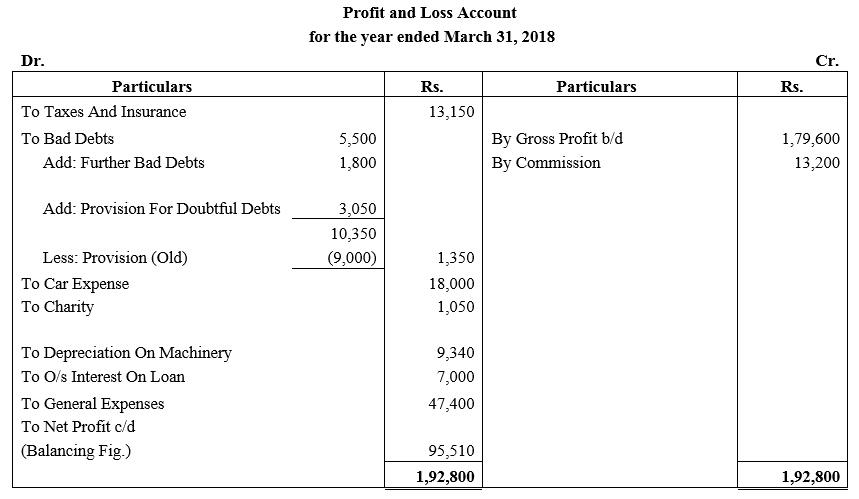

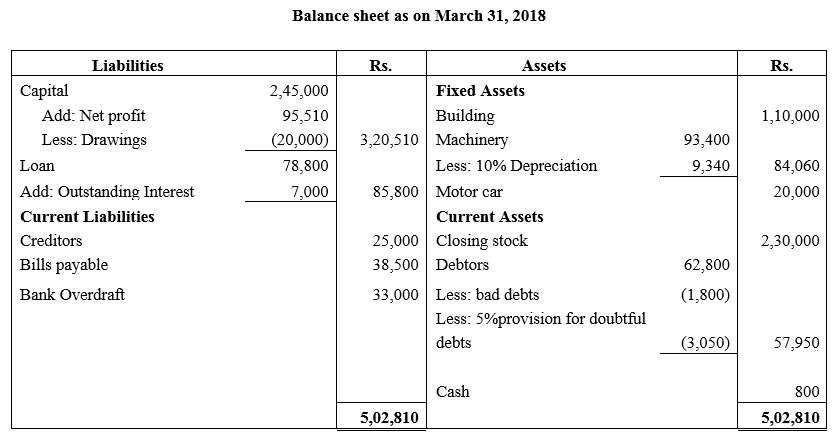

Following balances were extracted from the books of Vijay Kumar on 31st March, 2018:

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2018 and Balance Sheet as at that date after giving effect to the following adjustments:

(a) Stock as on 31st March, 2018 was valued at ₹ 2,30,000.

(b) Write off further ₹ 1,800 as Bad Debts and maintain the Provision for Doubtful Debts at 5%.

(c) Depreciate Machinery at 10%.

(d) Provide ₹ 7,000 as outstanding interest on loan.

Solution:

Question 10.

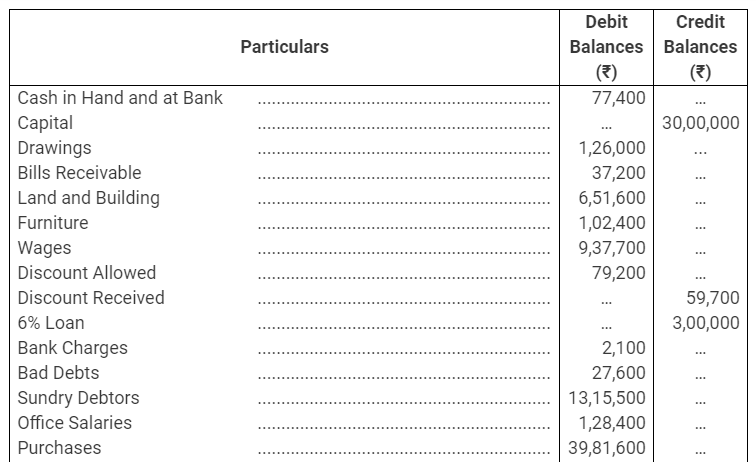

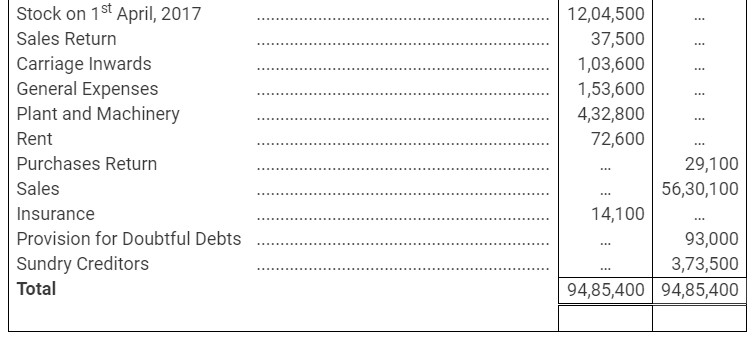

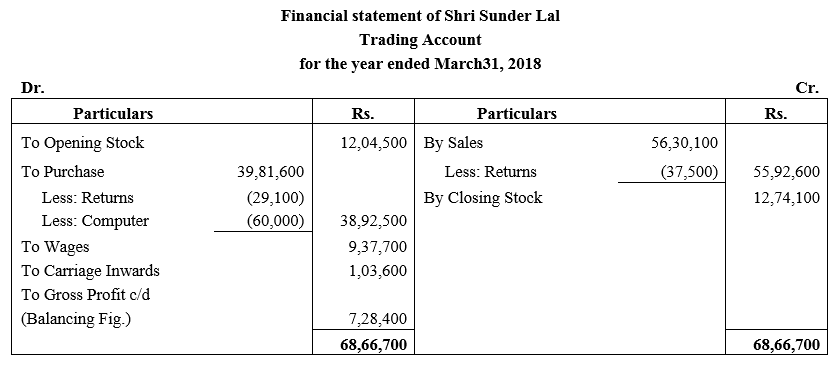

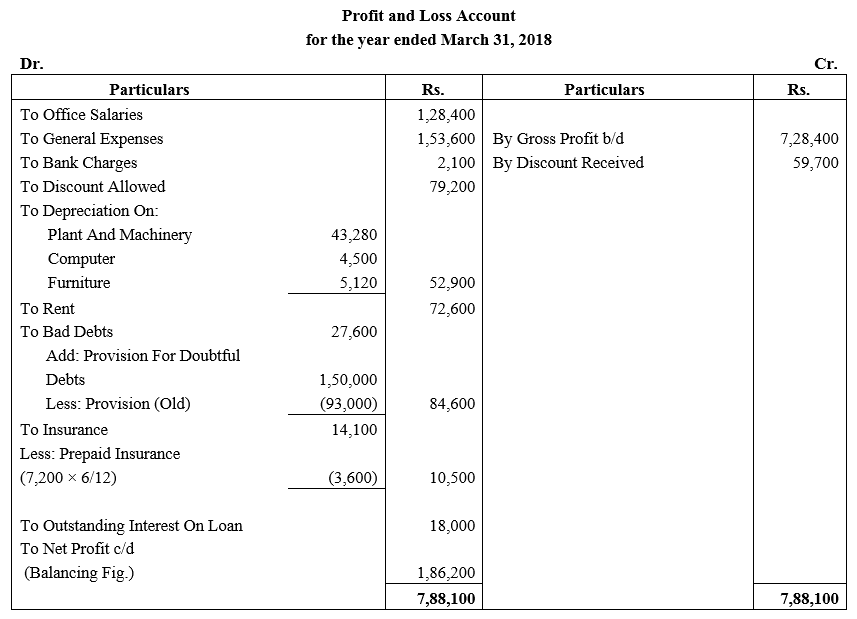

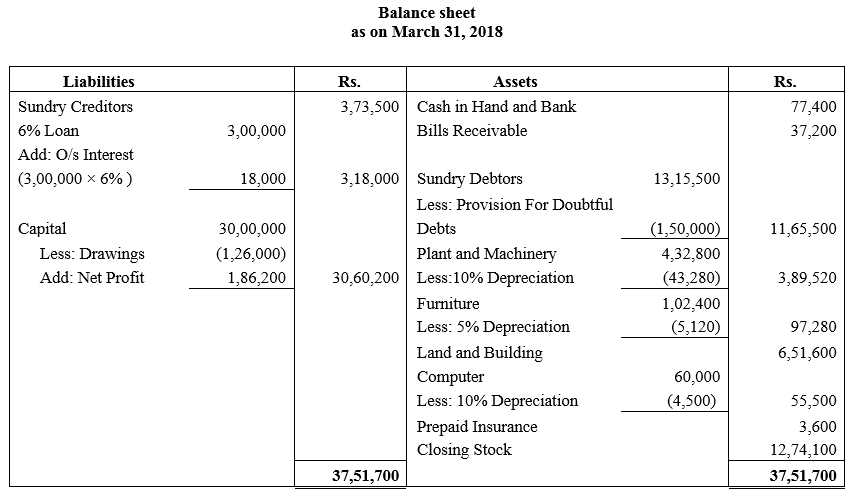

Following Trial Balance has been extracted from the books of Shri Sunder Lal on 31st March, 2018:

Closing Stock on 31st March, 2018 was ₹ 12,74,000. You are required to prepare Trading and Profit and Loss Account for the year ended 31st March, 2018 and Balance Sheet as at that date after making the following adjustments:

(a) Depreciate Plant and Machinery @ 10% and Furniture @ 5%.

(b) Provision for Doubtful Debts to be maintained at ₹ 1,50,000.

(c) Insurance includes annual premium of ₹ 7,200 on a policy which will expire on 30th September, 2018.

(d) Purchases include a computer costing ₹ 60,000 purchased on 1st July, 2017 and is subject to depreciation @ 10% p.a.

Solution:

Working Note:

Calculation of Computer Depreciation

Computer Purchases 1 July 2017 = 60,000

Depreciation = 10%

Computer Depreciation= 60,000 × 10% × 9months = 4,500

Note: As per this Question correct Net Profit is Rs.1,86,200, while, as per the book solution is Net Profit Rs.1,82,600.

Question 11.

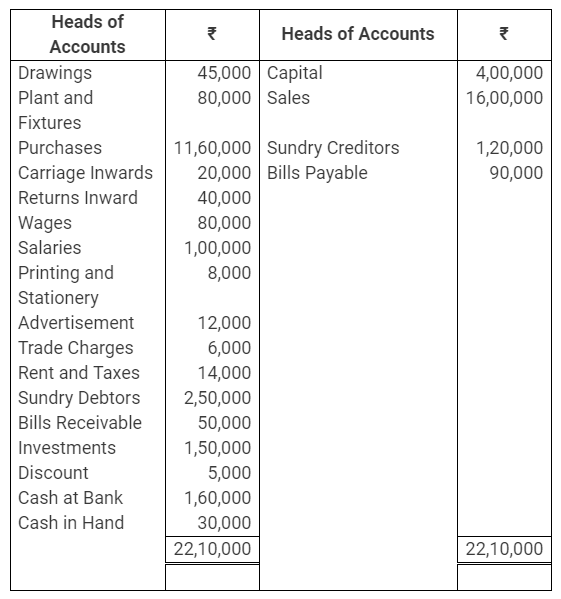

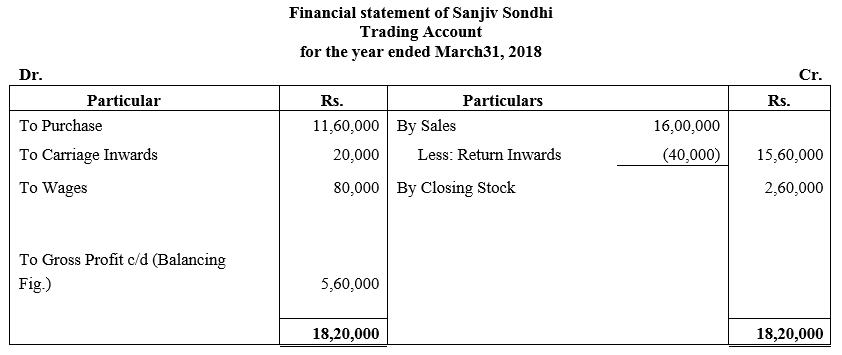

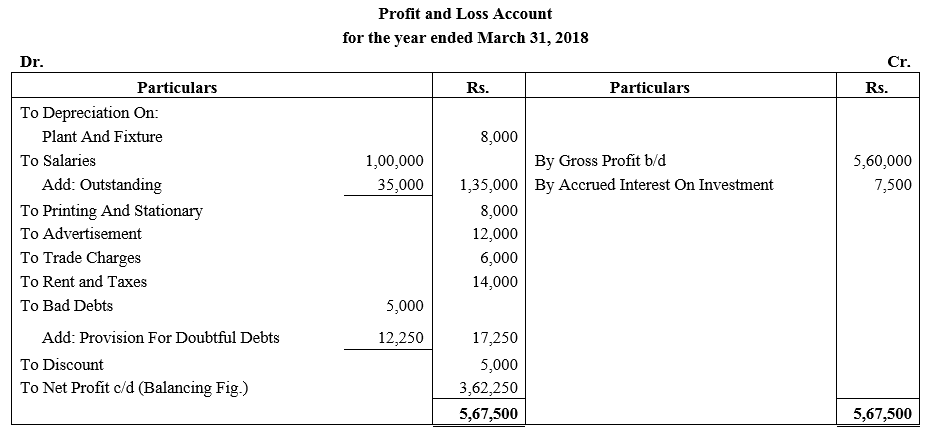

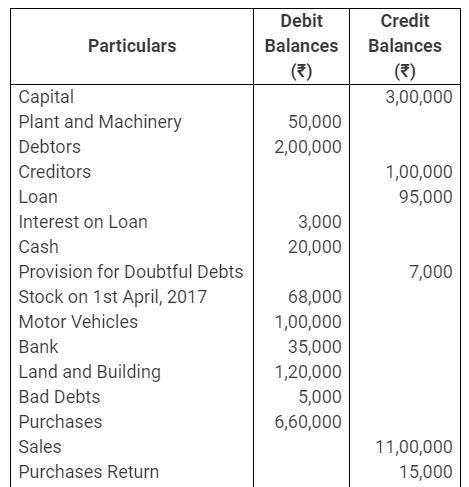

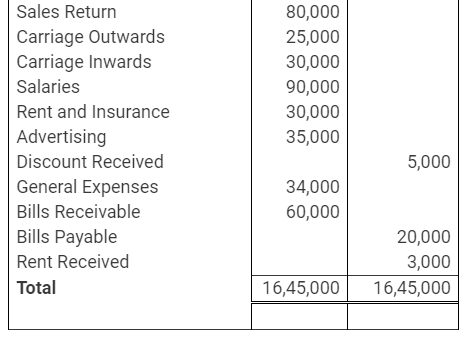

Sanjiv Sondhi started business on 1st April, 2017 with a capital of ₹ 3,00,000. Following Trial Balance was drawn up from his books at t he end of the year:

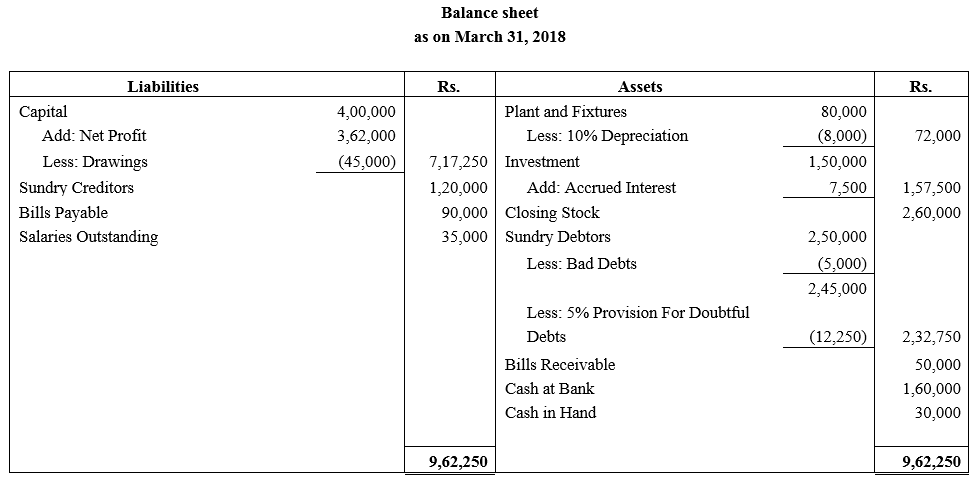

Value of Stock as on 31st March, 2018 was ₹ 2,60,000. You are required to prepare his Trading and Profit and Loss Account for the year ended 31st March 2018 and Balance Sheet as at that date after taking the following facts into account:

(a) Plant and Fixtures are to be depreciated by 10%.

(b) Salaries outstanding on 31st March, 2018 amounted to ₹ 35,000.

(c) Accrued Interest on investment amounted to ₹ 7,500.

(d) ₹ 5,000 are Bad Debts and a Provision for Doubtful Debts is to be created at 5% of the balance of debtors.

Solution:

Question 12.

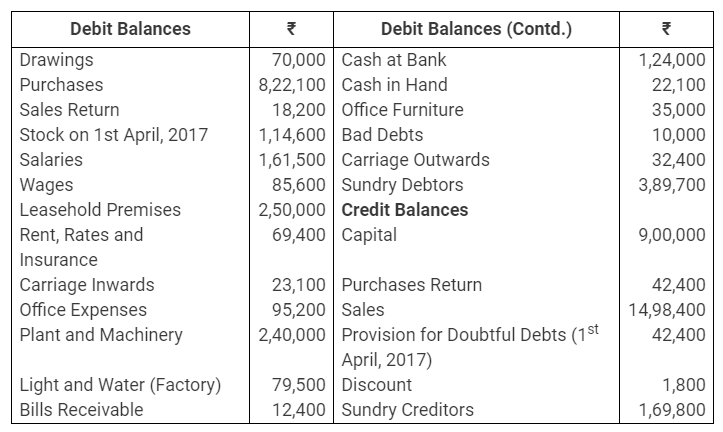

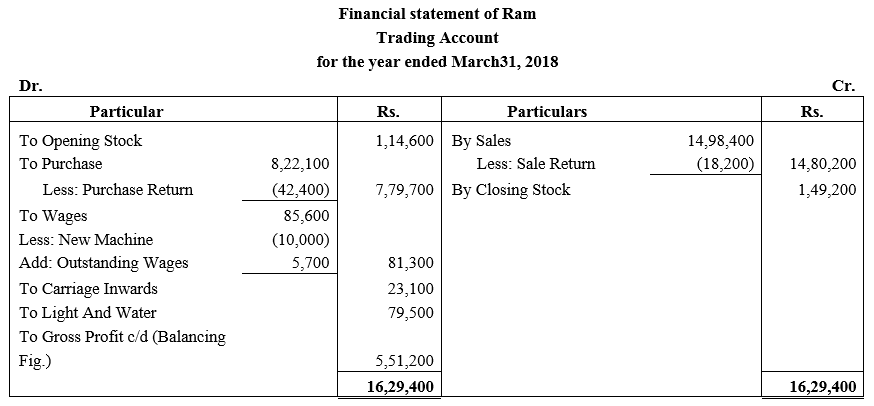

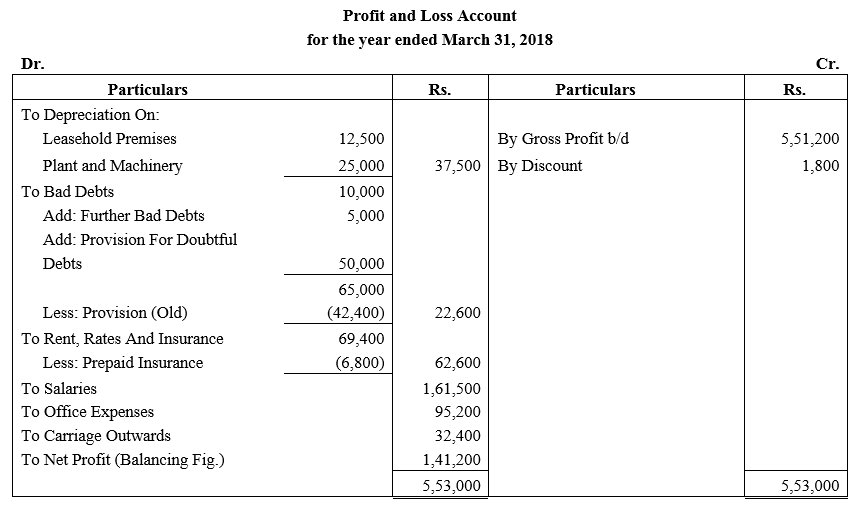

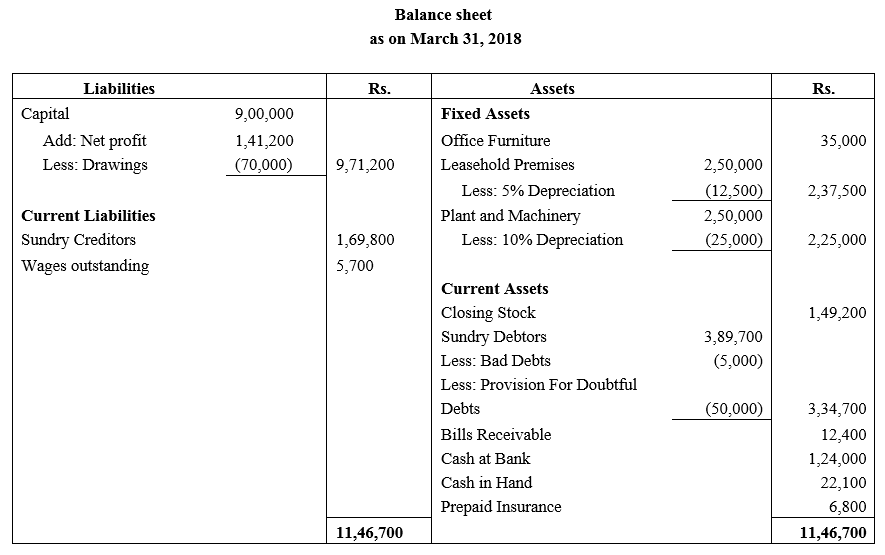

Following Trial Balance were extracted from the books of Ram as on 31st March, 2018:

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2018 and Balance Sheet as at that date after taking into account the following:

(a) Depreciation is to be written off as follows: Leasehold premises 5%. Plant and Machinery 10%.

(b) Write off ₹ 5,000 as further Bad Debts and make a Provision for Doubtful Debts equal to ₹ 5,000.

(c) Wages amounted to ₹ 5,700 have become due but have not been paid.

(d) Wages include ₹ 10,000 incurred on installation of new machine. Machine was installed on 1st April, 2017.

(e) The value of stock on 31st March, 2018 was ₹ 1,49,200.

(f) Unexpired premium amount to ₹ 6,800 is to be carried forward to the next year.

Solution:

Note: Wages installation of machinery increases the value of machinery and reduces the value of wages.

Question 13.

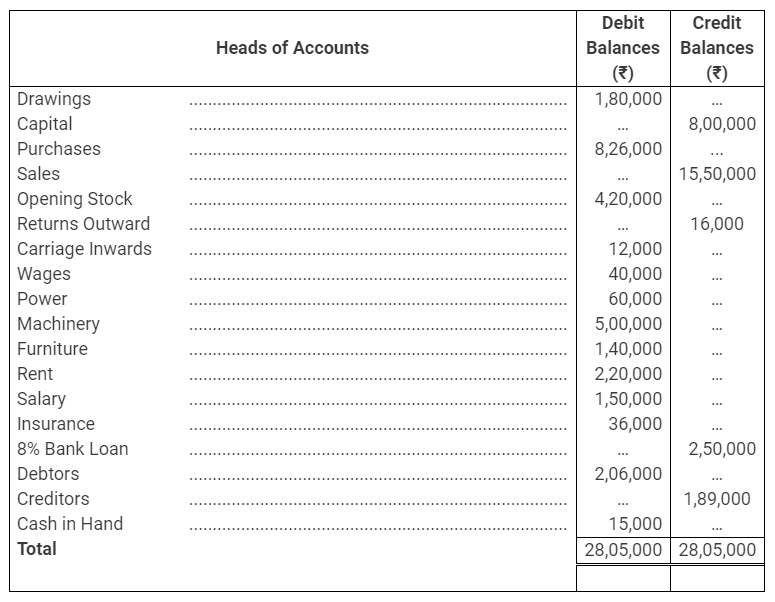

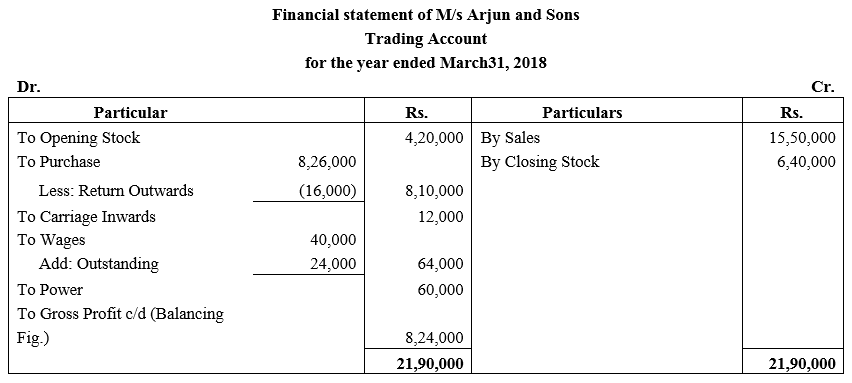

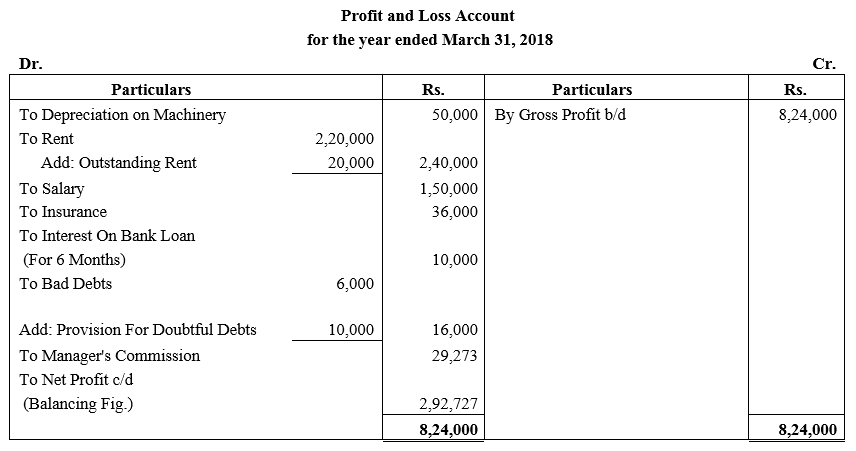

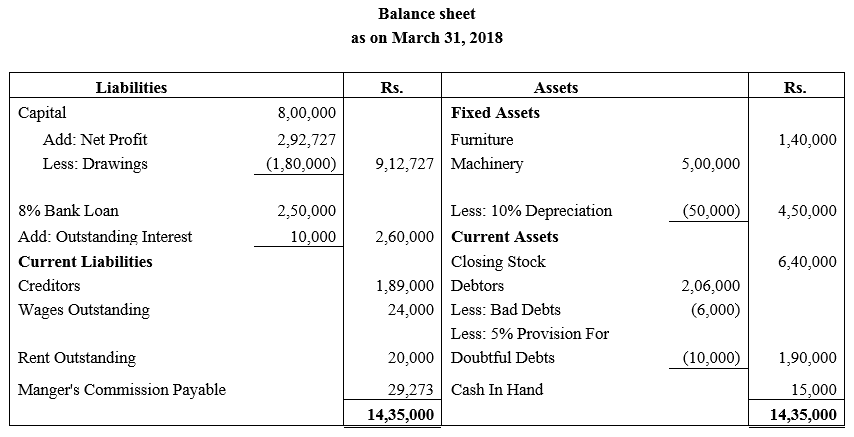

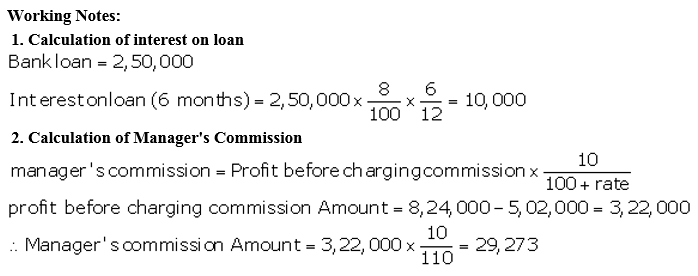

From the following Trial Balance of M/s Arjun and Sons as on 31st March, 2018, prepare Trading and Profit and Loss Account and Balance Sheet:

Adjustments:

(i) Closing Stock ₹ 6,40,000.

(ii) Wages Outstanding ₹ 24,000.

(iii) Bad Debts ₹ 6,000 and Provision for Bad and Doubtful Debts to 5% on Debtors.

(iv) Rent is paid for 11 months.

(v) Loan from bank was taken on 1st October, 2017.

(vi) Provide Depreciation on Machinery @ 10% p.a.

(vii) Provide Manager’s Commission at 10% on net profit after charging such commission.

Solution:

Question 14.

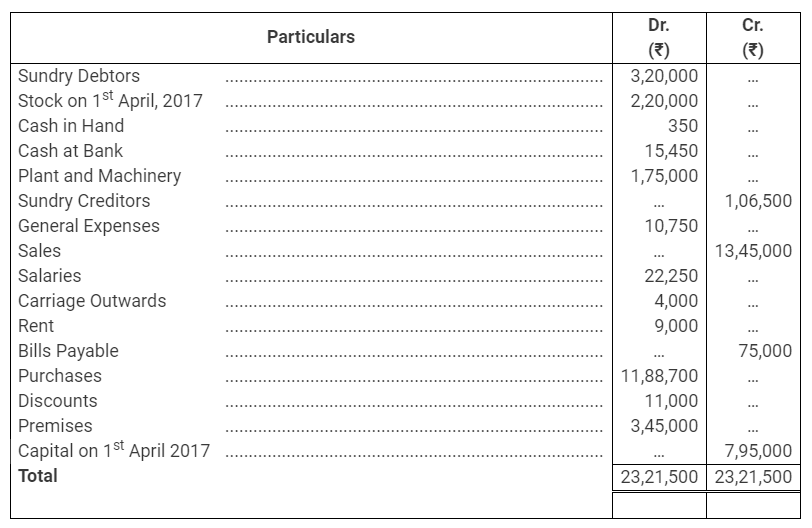

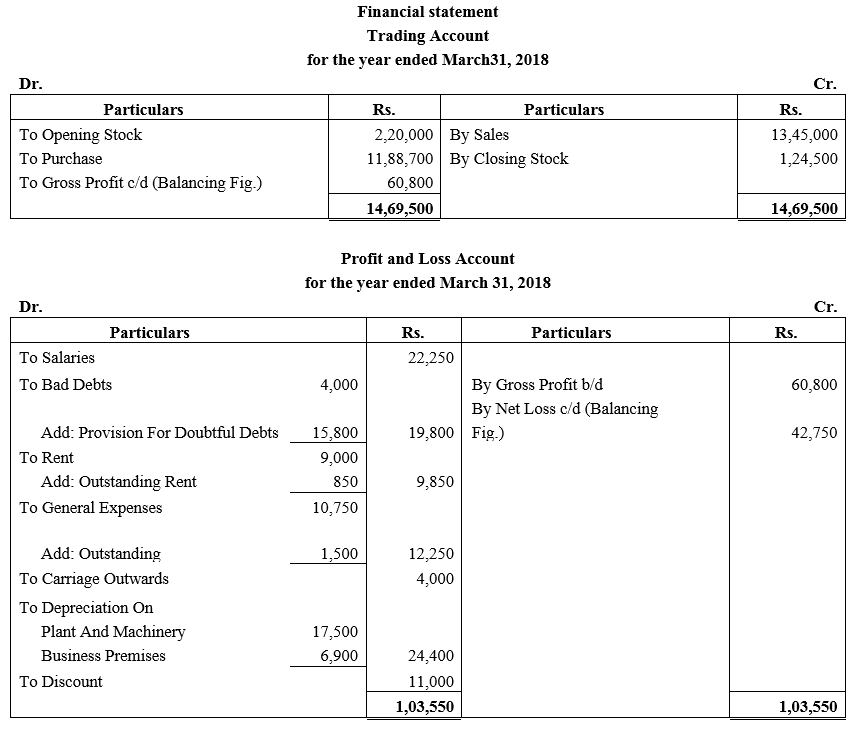

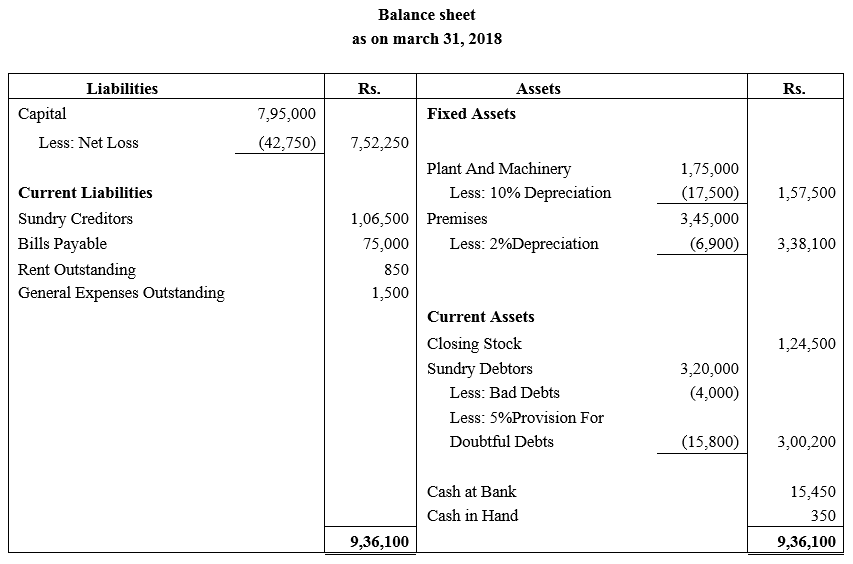

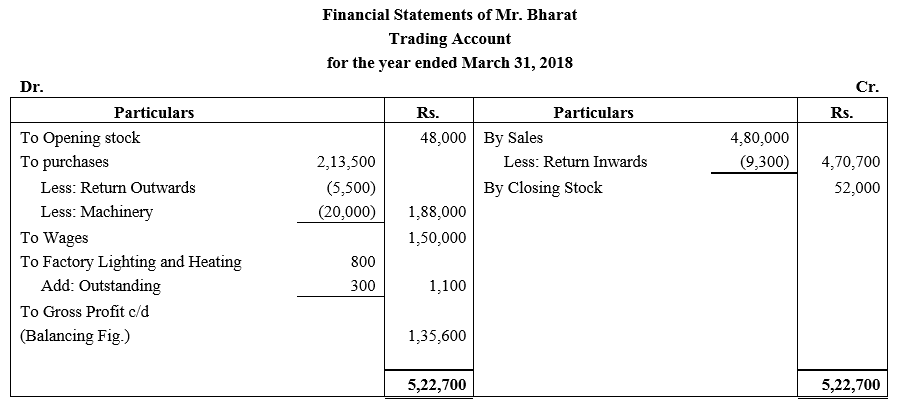

From the following Trial Balance and other information prepare Trading and Profit and Loss Account for the year ended 31st March, 2018 and Balance Sheet as at that date:

Stock on 31st March, 2018 was ₹ 1,24,500. Rent was unpaid to the extent of ₹ 850 and ₹ 1,500 were outstanding for General Expenses; ₹ 4,000 are to be written off as bad debts out of the above debtors; and 5% is to be provided for doubtful debts. Depreciate Plant and Machinery by 10% and Business Premises by 2%.

Manager is entitled to a commission of 5% on net profit after charging his commission.

Solution:

Note: During the year firm has incurred a loss of Rs. 42,750. Therefore, manager commission given in the question as 5% on Net profit after charging commission is not payable.

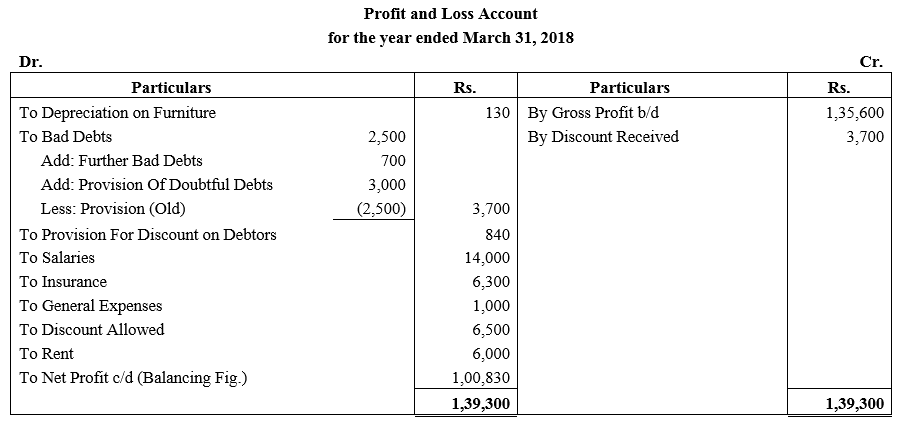

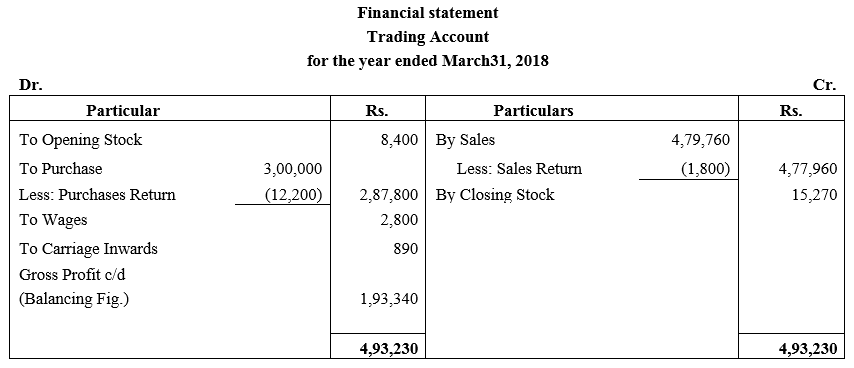

Question 15.

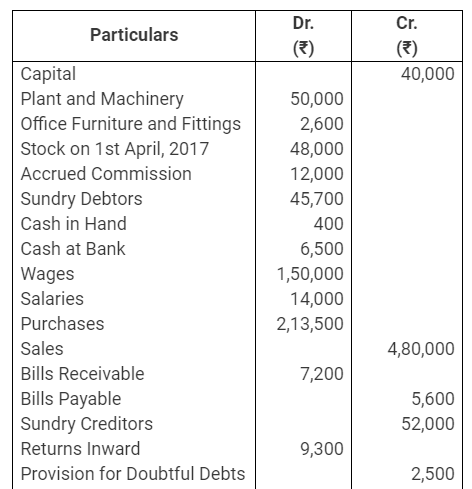

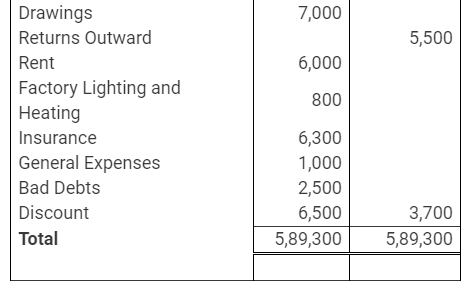

Following is the Trial Balance of Mr. Bharat on 31st March, 2018.

Following adjustments are to be made:

(a) Stock on 31st March, 2018 – ₹ 52,000.

(b) Three months factory lighting and heating due but not paid – ₹ 300.

(c) 5% depreciation to be written off on furniture.

(d) Write off further Bad Debts – ₹ 700.

(e) Provision for Doubtful Debts to be increased to ₹ 3,000 and Provision of Discount on Debtors @ 2% to be made.

(f) During the year, machinery was purchased for ₹ 20,000 but it was debtied to the Purchases Account.

You are required to prepare Trading Account, Profit and Loss Account and Balance Sheet.

Solution:

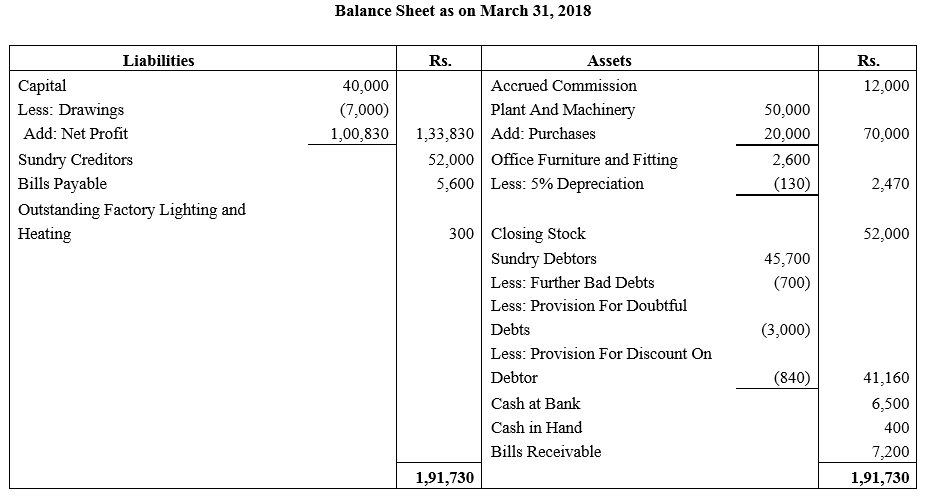

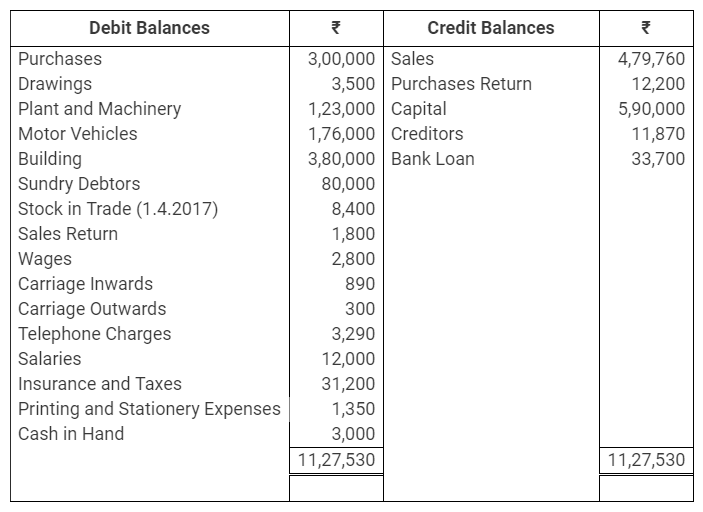

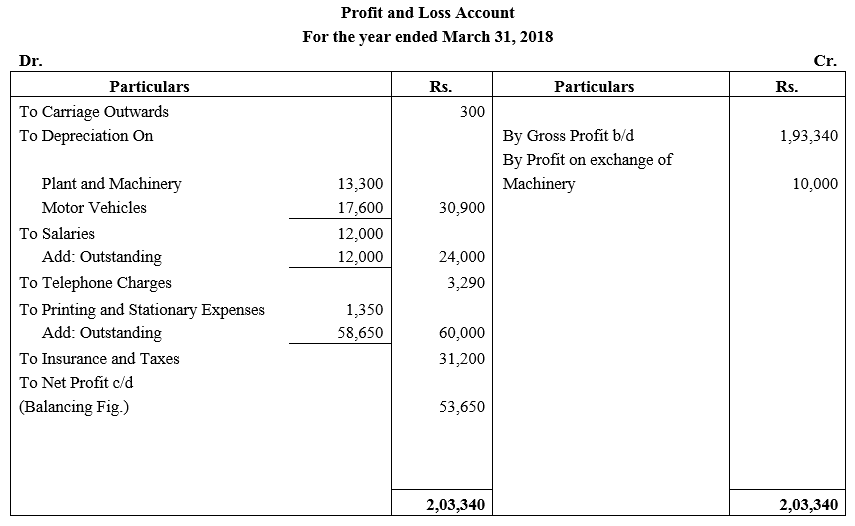

Question 16.

From the following Trial Balance, prepare Trading Account, Profit and Loss Account for the year ended 31st March, 2018 and Balance Sheet as at the date:

Following adjustments are to be considered:

(i) Closing Stock ₹ 15,270.

(ii) Printing and Stationery expenses due ₹ 58,650.

(iii) Outstanding liabilities for salaries ₹ 12,000.

(iv) An old machine value at ₹ 12,000 (Book Value of which was ₹ 2,000) was given in exchange for a new machine purchased on 1st April, 2017. The machine given in exchange was not recorded in the books. Cheque issued for new machine purchased was accounted in the books of account.

(v) Depreciation @ 10% p.a. is to be provided on all fixed assets except building.

Solution:

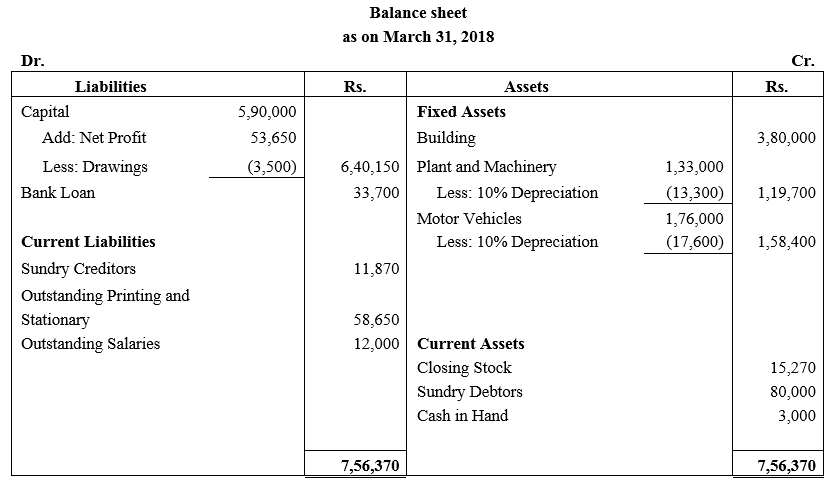

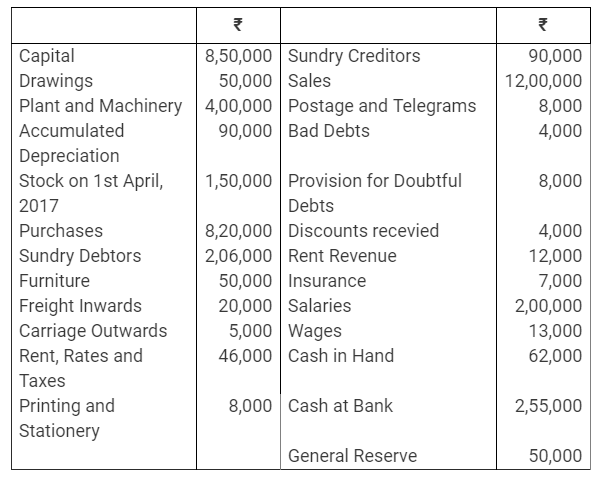

Question 17.

Following balances were extracted from the books of Modern Traders on 31st March, 2018:

Prepare Final Accounts for the year ended 31st March, 2018 after taking into account the following:

(a) Stock on 31st March, 2018 was valued at ₹ 1,50,000.

(b) Outstanding Wages ₹ 5,000.

(c) Provision for Doubtful Debts is to be maintaind at 5% of the Sundry Debtors.

(d) Prepaid Insurance was ₹ 1,000.

(e) An advance paid by the proprietor from his personal bank account of ₹ 50,000 for purchase of a machine on 1st April, 2017 was not recorded in the books. Plant and Machinery was not debited in the books by the amount paid from firm.

(f) Provide Depreciation on Plant and Machinery @ 10% on cost and on Furniture @ 5%.

Solution:

Note: Advance paid by proprietor for Purchased of Plant and Machinery 1st April 2016 out of his personal bank account but not recorded in the books. Therefore, will increase the Plant and Machinery Account and Capital Account balance by Rs.50,000. And also increase in the amount of depreciation by Rs.5,000.

Question 18.

From the following Trial Balance of Shubdo Banerjee, prepare final accounts for the year ended in 31st March, 2018 and Balance Sheet as at that date:

The following adjustments be taken care of:

(i) Depreciate Land and Building @ 6%, Plant and Machinery @ 10%, Office equipments @ 20% and Furniture and Fixtures @ 15%.

(ii) Calculate Provision for Doubtful Debts at 2% on Debtors.

(iii) Insurance premium includes ₹ 250 paid in advance.

(iv) Provide salary to Banerjee ₹ 15,000 p.a.

(v) Outstanding Salaries ₹ 11,500.

(vi) 10% of the final profit is to be transferred to General Reserve.

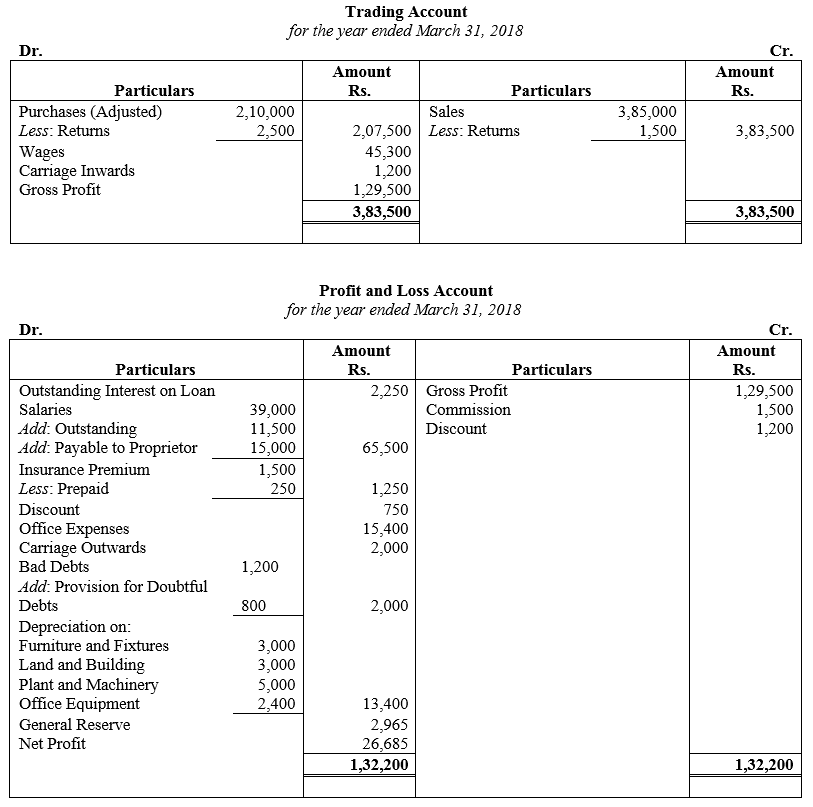

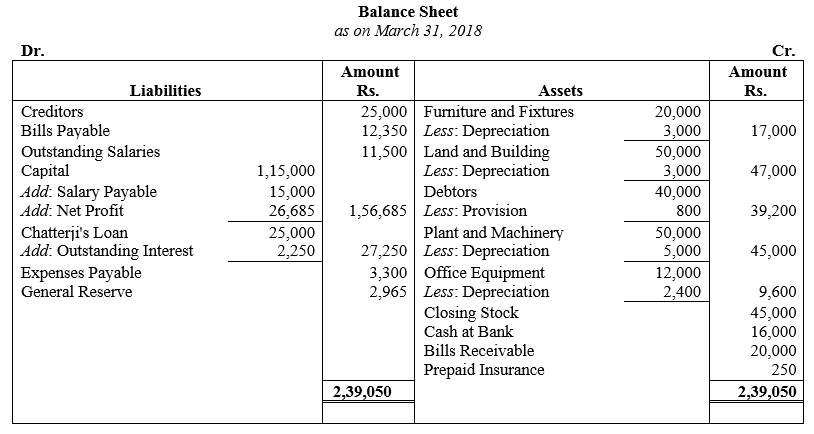

Solution:

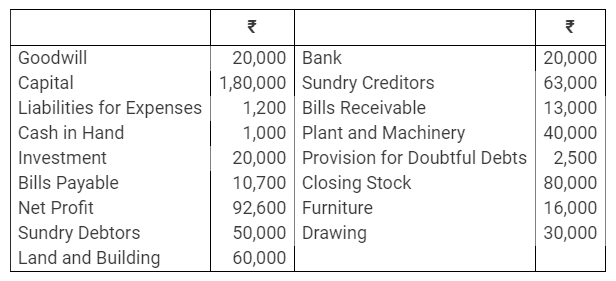

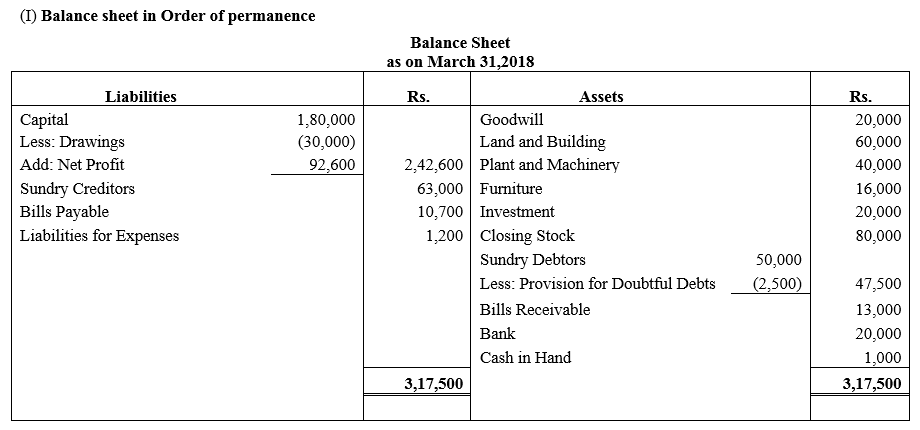

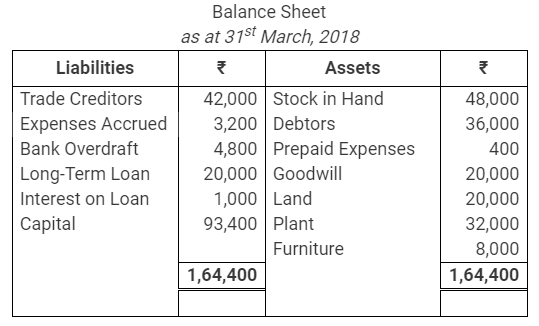

Question 19.

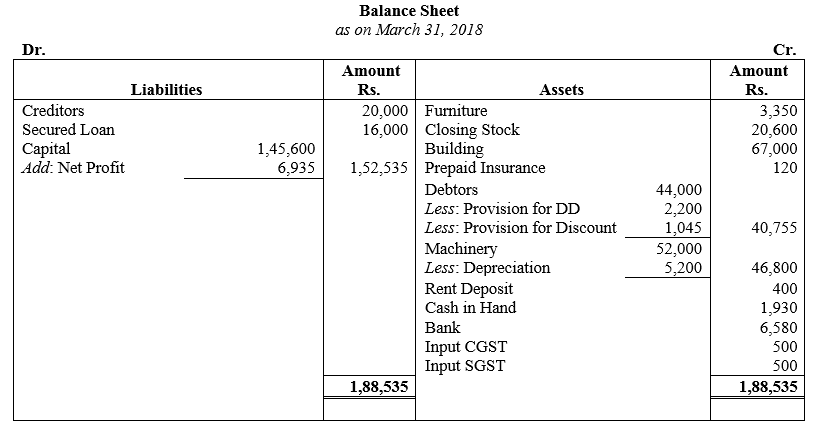

Following is the Trial Balance as on 31st March, 2018. Prepare Trading and Profit and Loss Account and Balance Sheet:

You are to make adjustments in respect of the following:

(a) Depreciate Machinery at 10% p.a.

(b) Make a provision @ 5% for Doubtful Debts.

(c) Provide discount on debtors @ 2\(\frac { 1 }{ 2 }\) %.

(d) Rent includes Rent deposit of ₹ 400.

(e) Insurance Prepaid ₹ 120.

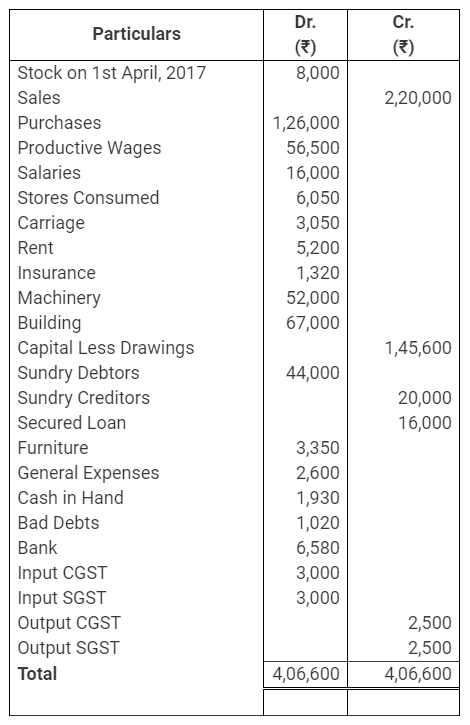

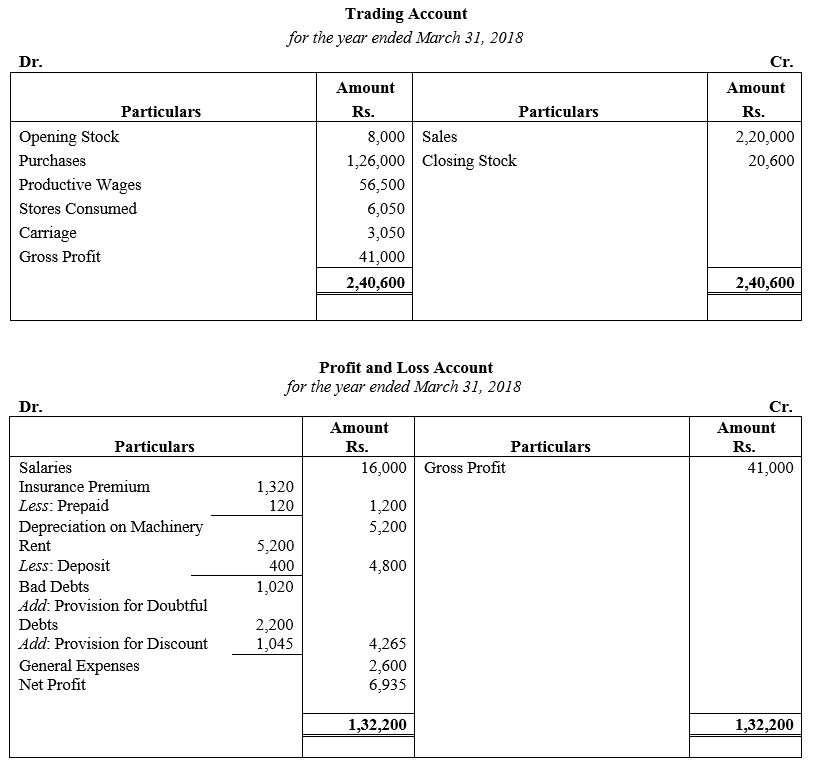

Solution:

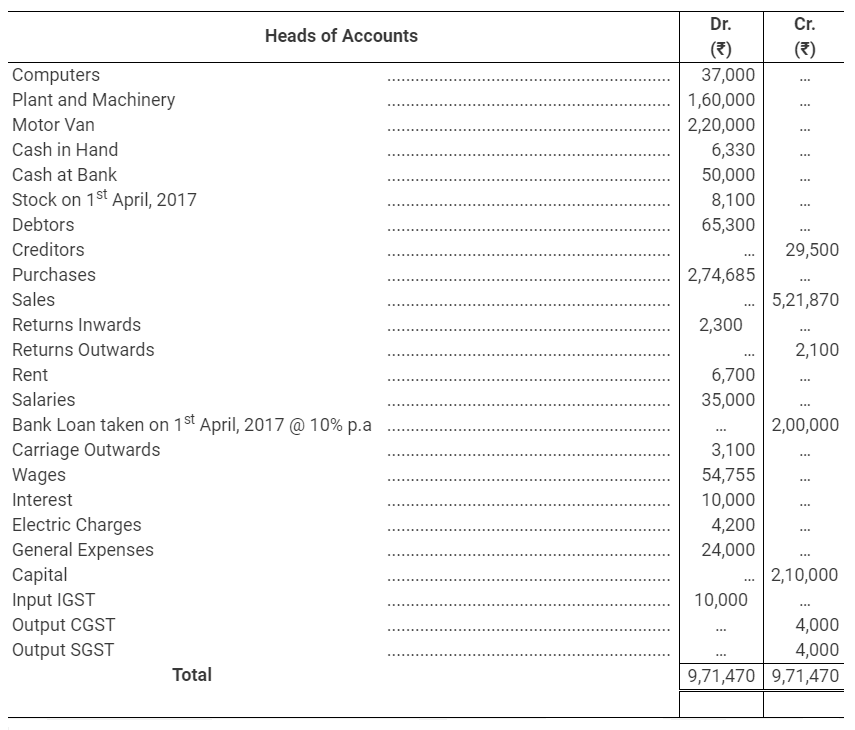

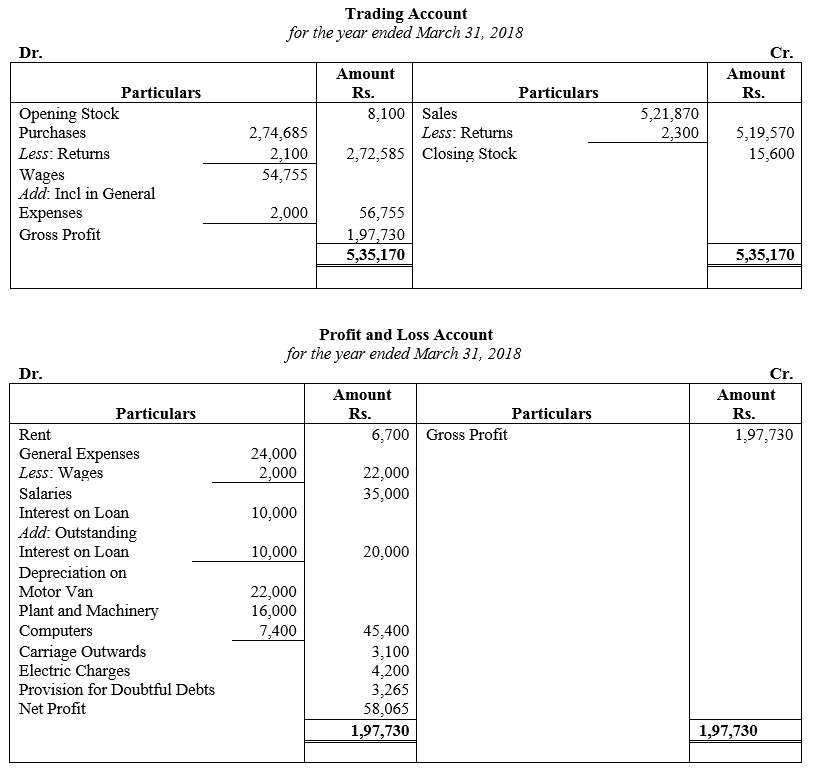

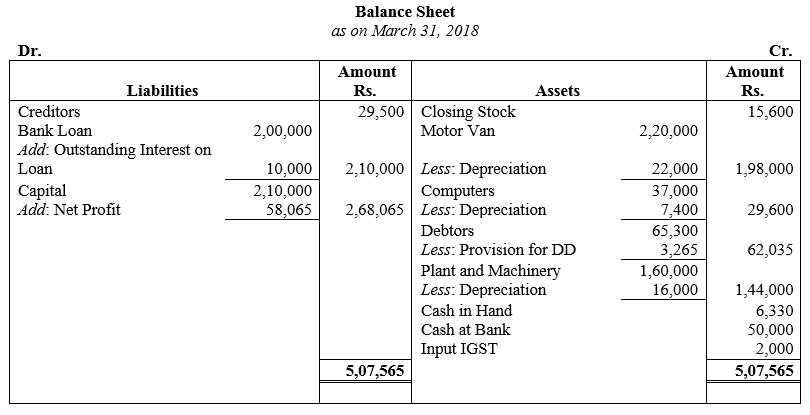

Question 20.

Following is the Trial Balance obtained from the books of Mr. Vishwanath on 31st March, 2018:

You are required to prepare Mr. Vishwanath’s Trading and Profit and Loss Account for the year ended 31st March, 2018 and his Balance Sheet as at that date after taking into account the following adjustments:

(a) Stock on 31st March, 2018 was ₹ 15,600.

(b) Depreciate Motor Van and Plant and Machinery by 10% p.a. and Computers @ 20% p.a.

(c) Create Provision for Doubtful Debts @ 5%.

(d) General Expenses include ₹ 2,000 paid of wages.

Solution:

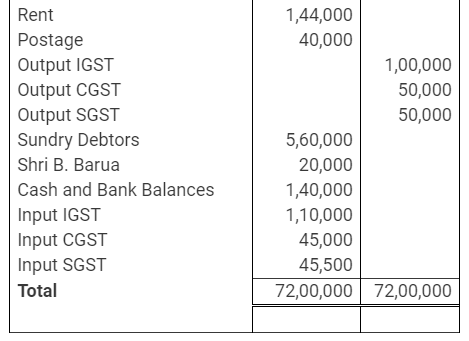

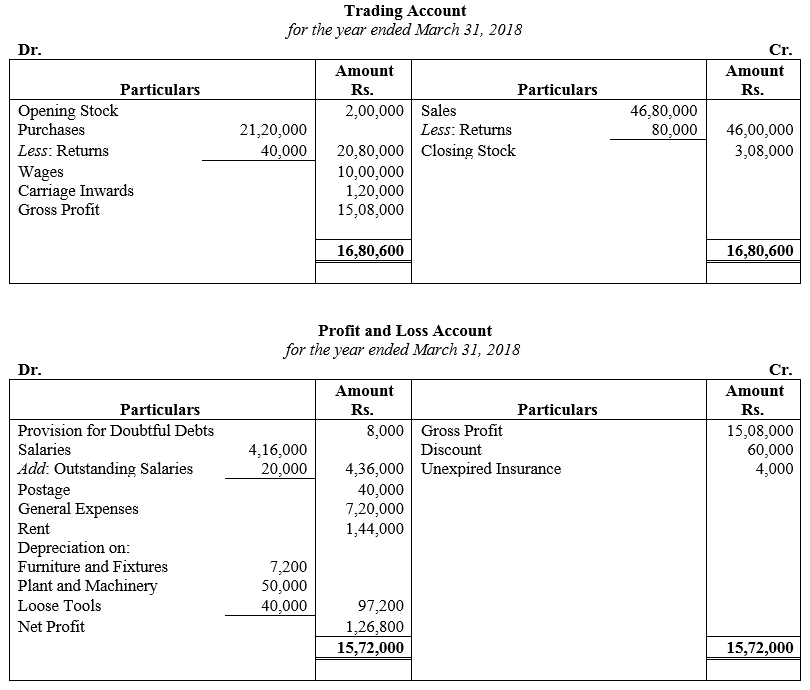

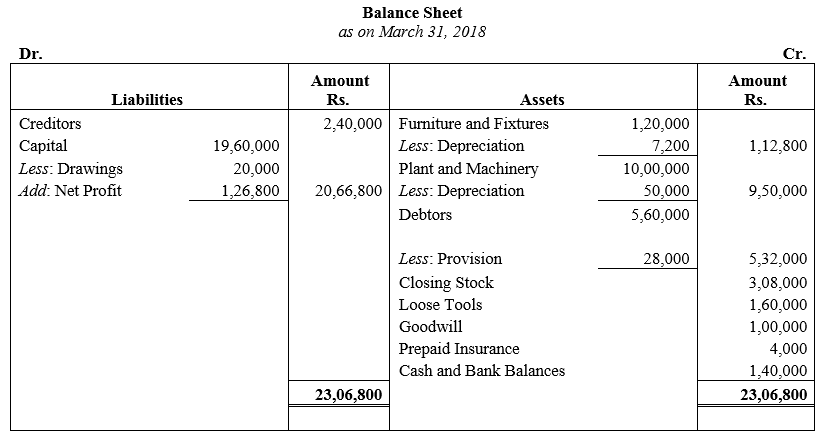

Question 21.

Followingt Trial Balance has been extracted from the books of Santosh on 31st March, 2018:

Following additional information is available:

(a) Stock on 31st March, 2018 was ₹ 3,08,000.

(b) Depreciation is to be charged on Plant and Machinery at 5% and Furniture and Fixtures at 6%. Loose Tools are revalued at ₹ 1,60,000.

(c) Provision for Doubtful Debts is to be maintained at 5% on Sundry Debtors.

(d) Remuneration of ₹ 20,000 paid to Shri B. Barua, a temporary employee, stands debited to his personal account and it is to be corrected.

(e) Unexpired insurance was ₹ 4,000.

You are to prepare Trading and Profit and Loss Account for the year ended 31st March, 2018 and Balance Sheet as at that date.

Solution:

Question 22.

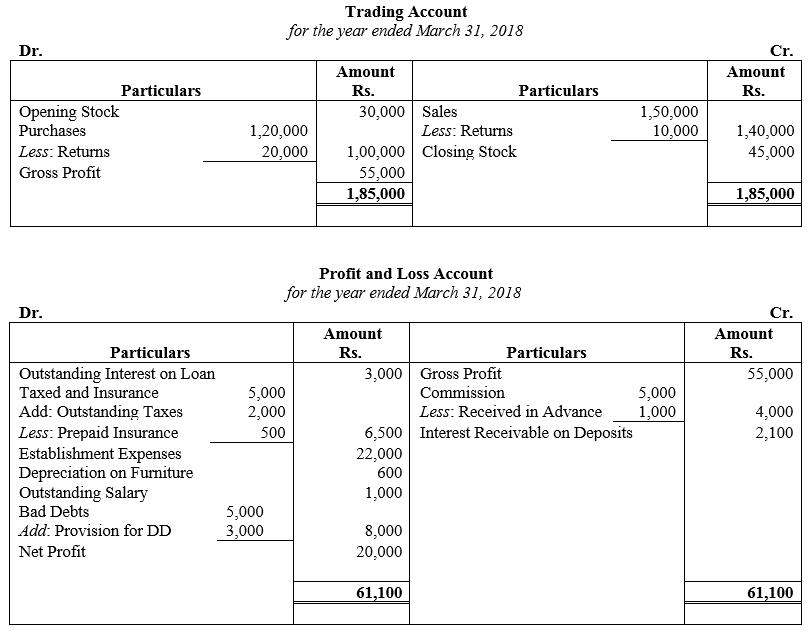

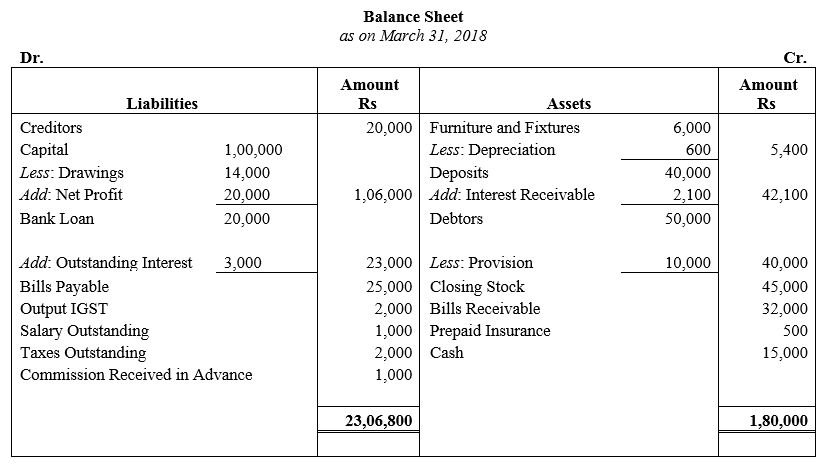

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2018 and Balance Sheet as at that date from the following Traial Balance:

Adjustments:

(i) Salaries ₹ 1,000 and Taxes ₹ 2,000 are outstanding but Insurance ₹ 500 is prepaid.

(ii) Commission ₹ 1,000 received in advance for the next year.

(iii) Interest ₹ 2,100 is to be received on Deposits and Interest and Bank Loan ₹ 3,000 is to be paid.

(iv) Provision for Doubtful Debts to be maintained at ₹ 10,000.

(v) Depreciate Furniture by 10%.

(vi) Stock on 31st March, 2018 is ₹ 45,000.

(vii) A fire occurred on 1st April, 2018 destroying goods costing ₹ 10,000. These goods were purchased paying CGST and SGST @ 6% each.

Solution:

Question 23.

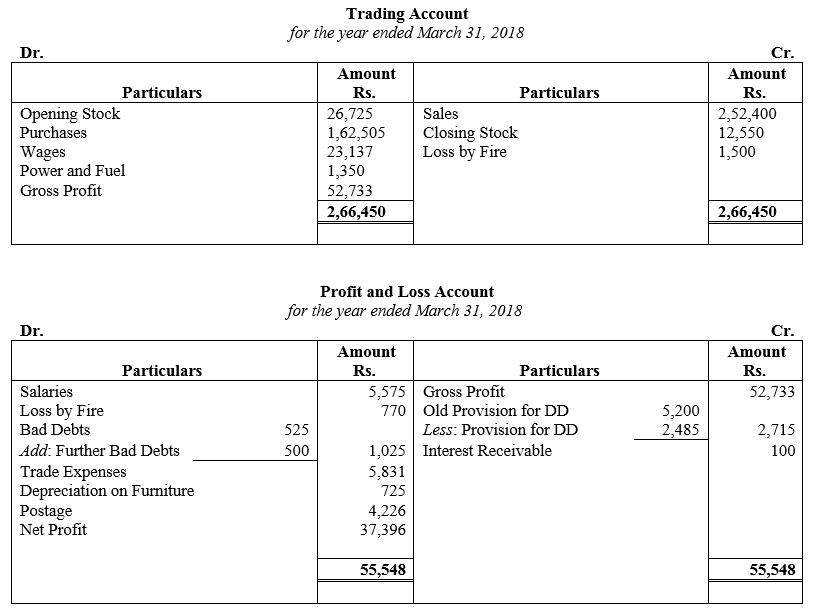

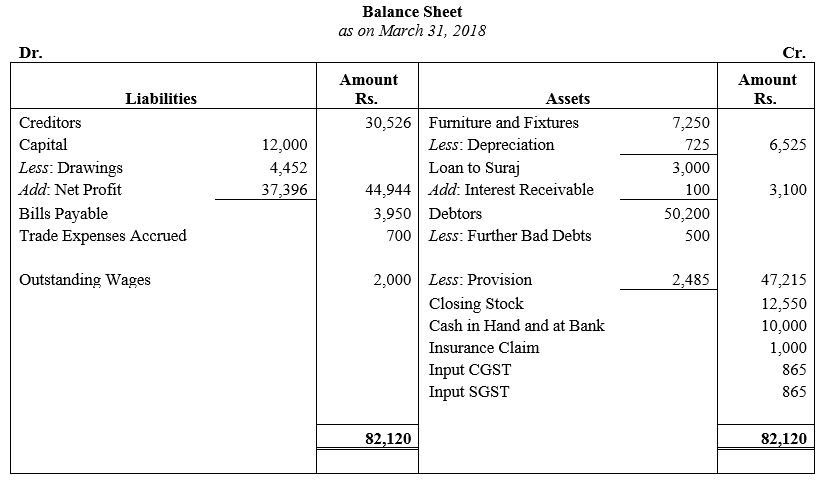

The Trial Balance of M/s. Taj & Co. as on 31st March, 2018 was as follows:

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2018 and Balance Sheet after considering the following information:

(i) Depreciation on Furniture @ 10% to be charged.

(ii) Sundry Debtors include ₹ 500 due from a customer who has become insolvent.

(iii) Provision for Doubtful Debts @ 5% on Sundry Debtors is to be maintained.

(iv) Goods costing ₹ 1,500, purchased paying CGST and SGST @ 9% each, were destroyed by fire and insurance company admitted a claim for ₹ 1,000.

(v) Stock on 31st March, 2018 was ₹ 12,550.

Solution:

Question 24.

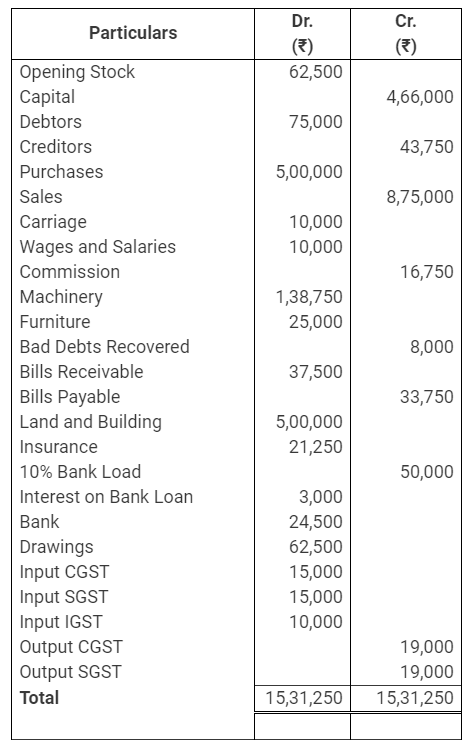

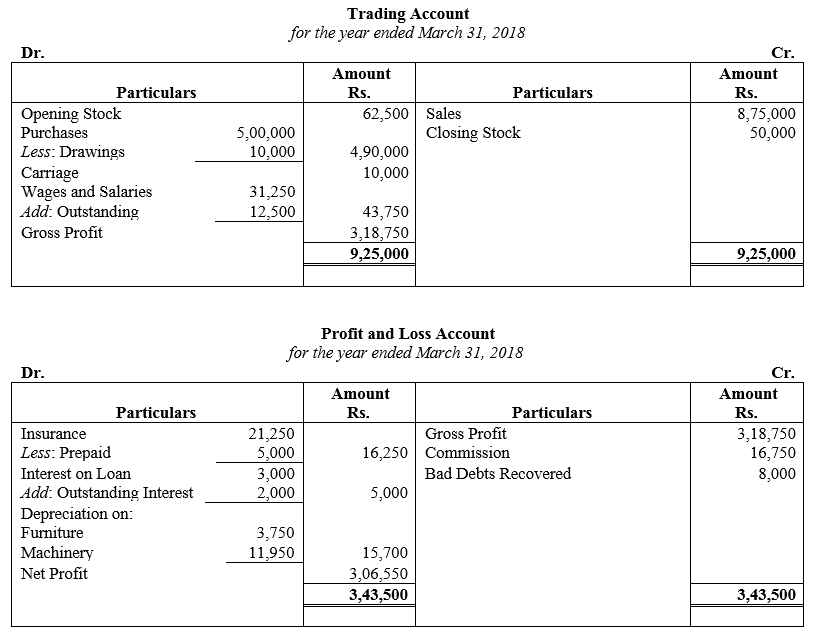

From the following Trial Balance of Mr. Gaurav and additional information given, prepare Trading and Profit and Loss Account for the year ended 31st March,2018 and Balance Sheet as at 31st March, 2018:

Adjustments:

(i) Value of the Closing Stock as on 31st March, 2018 is ₹ 50,000.

(ii) Wages and Salaries outstanding are ₹ 12,500 and Insurance prepaid is ₹ 5,000.

(iii) Depreciate Machinery and Furniture @ 10% and 15% p.a. respectively. Machinery included a machine which was purchased for ₹ 38,500 on 30th September, 2017.

(iv) Goods costing ₹ 10,000 were taken by the proprietor for his personal use but no entry has been made in the books of account. These goods were purchased paying IGST @ 18%.

Solution:

Question 25.

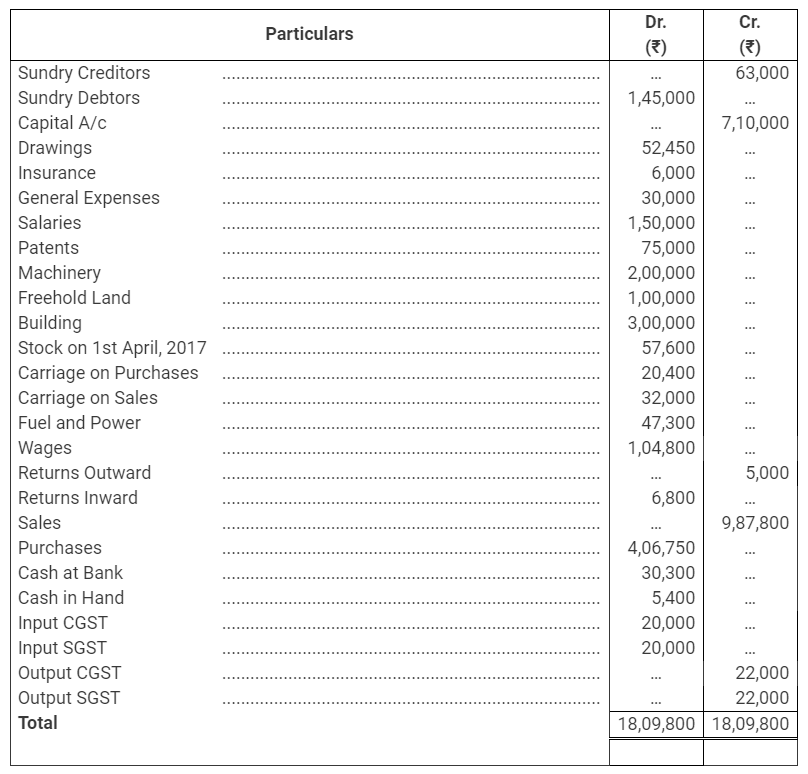

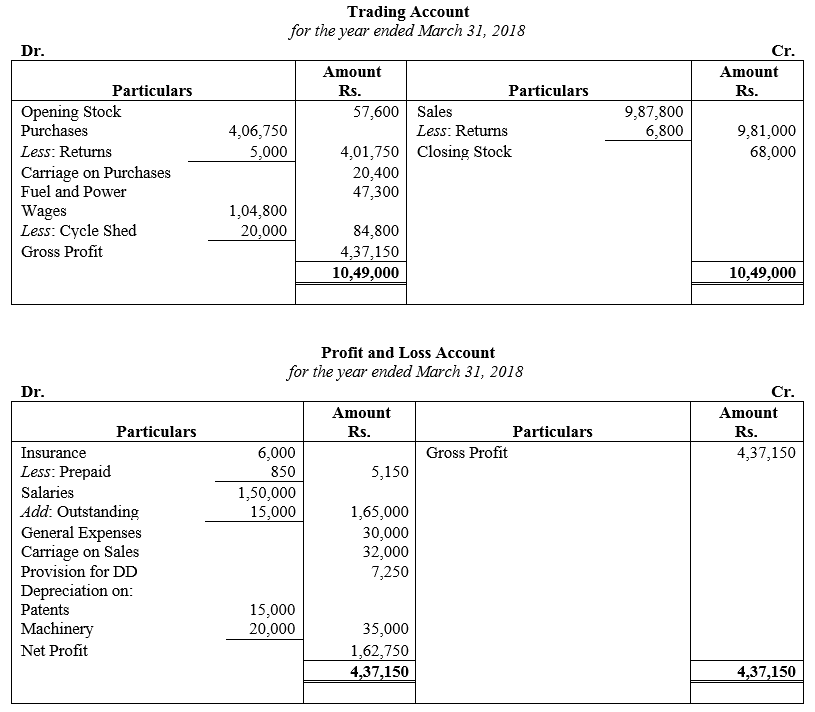

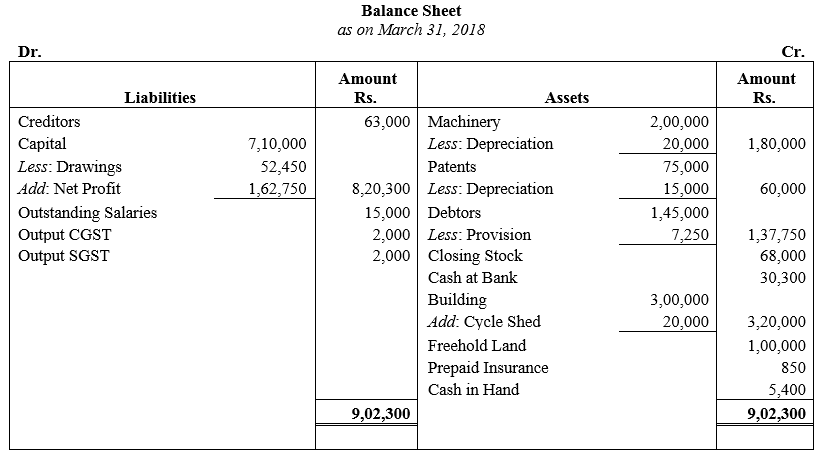

Following is the Trial Balance of Shri Bansi Lal as on 31st March, 2018. You are required to prepare Final Accounts:

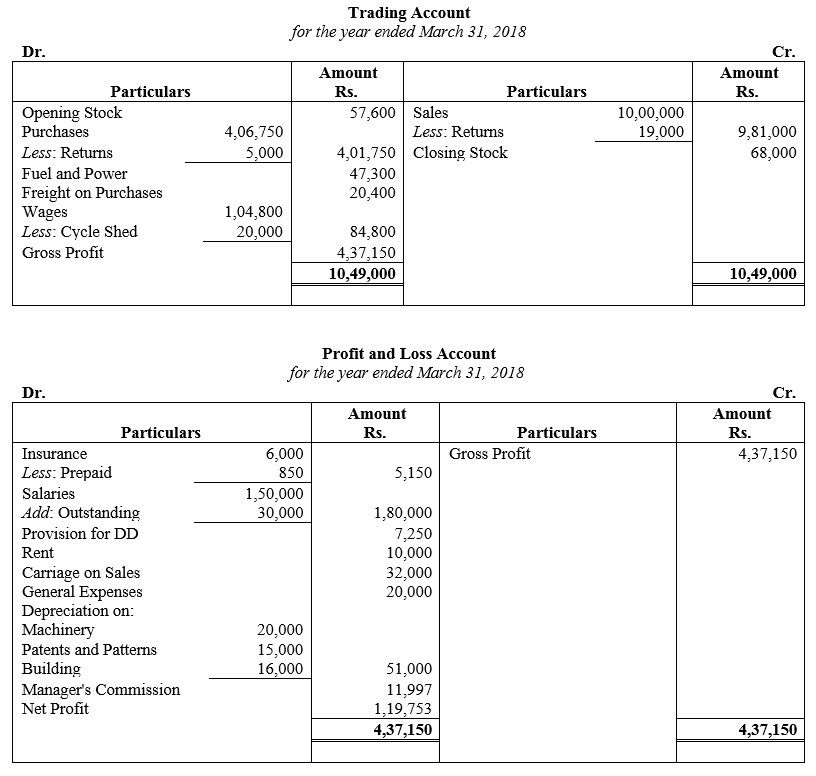

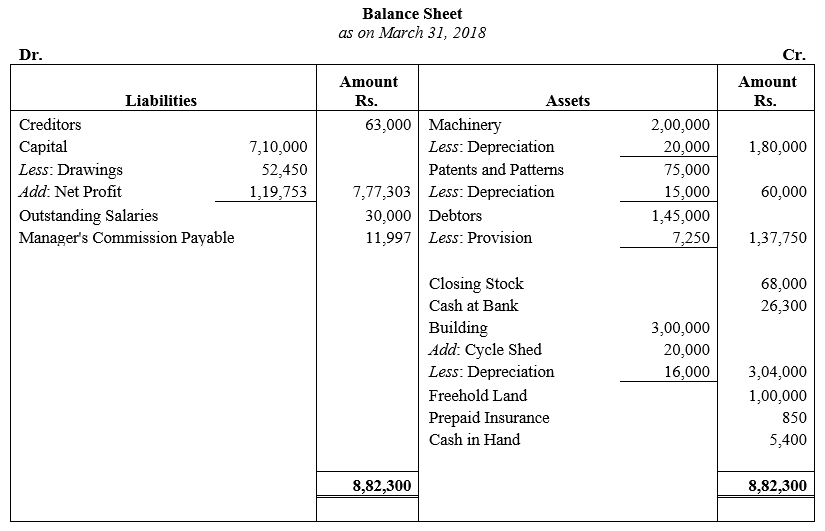

Following adjustments are to be made:

(a) Stock on 31st March, 2018 was valued at ₹ 68,000.

(b) Provision for Doubtful Debts is to be created to the extent of 5% on Debtors.

(c) Depreciate Machinery by 10% and Patents by 20%.

(d) Wages include a sum of ₹ 20,000 spent on the erection of a cycle shed for employees and customers.

(e) Salaries for the month of March, 2018 amounted to ₹ 15,000 were unpaid.

(f) Insurance includes a premium of ₹ 1,700 on a policy expiring on 30th September, 2018.

Solution:

Question 26.

From the following Trial Balance of M/s. Ram Lal and Sons, prepare Trading, Profit and Loss Account for the year ending 31st March, 2018 and a Balance Sheet as on that date:

Adjustments:

(i) The cost of stock on 31st March, 2018 was ₹ 37,000. However, its market value was ₹ 35,000.

(ii) Wages outstanding were ₹ 6,000 and salaries outstanding were ₹ 5,000 on 31st March, 2018.

(iii) Depreciate Land and Building @ 2\(\frac { 1 }{ 2 }\) %, Plant and Machinery @ 10% p.a. and Furniture @ 15 p.a.

(iv) Purchase includes purchase of machinery for ₹ 10,000 on 1st October, 2017.

(v) Debtors include bad debts of ₹ 2,000. Maintain a provision for doubtful debts @ 10% on Debtors.

Solution:

Question 27.

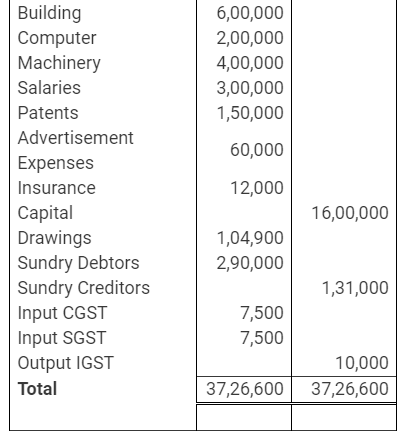

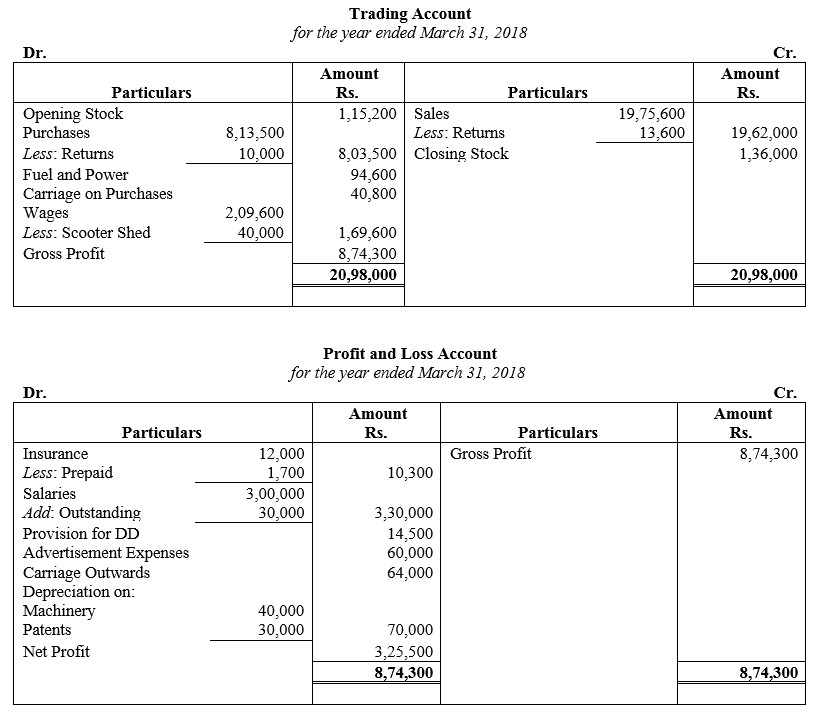

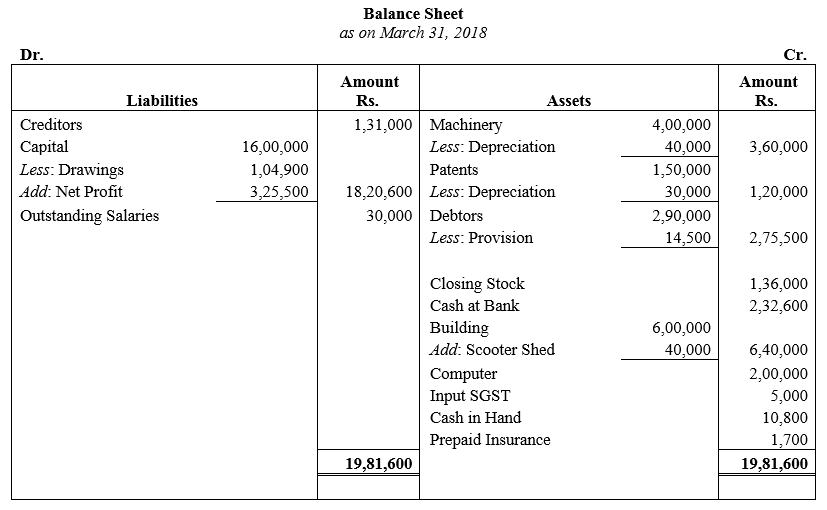

Following is the Trial Balance of Mr. S. Kapur on 31st March, 2018:

Taking into account the following adjustments, prepare Trading and Profit and Loss Account and Balance Sheet:

(a) Stock in Hand on 31st March, 2018 is ₹ 1,36,000.

(b) Machinery is to be depreciated @ 10% and patents @ 20%.

(c) Salaries for the month of March, 2018 amounting to ₹ 30,000 were unpaid.

(d) Insurance includes a premium of ₹ 1,700 for the year ending 31st March, 2019.

(e) Wages include a sum of ₹ 40,000 spent on constructing a scooter shed for employees and customers.

(f) Provision for Doubtful Debts is to be created to the extent of 5% on Sundry Debtors.

Solution:

Question 28.

Following is the Trial Balance of Shri Paras on 31st March, 2018:

Following adjustments are made:

(a) Stock on 31st March, 2018 was valued at ₹ 68,000.

(b) Provision for Doubtful Debts is to be made to the extent of 5% on Sundry Debtors.

(c) Depreciate Machinery by 10%, Patents 20% and Building 5%.

(d) Wages include a sum of ₹ 20,000 spent on constructiion of a cycle shed.

(e) Salaries for the months of February and March, 2018 were not paid.

(f) Insurance includes a premium of ₹ 1,700 on a policy expiring on 30th September, 2018.

(g) General Manager is entitled to a commission of 10% on the net profit after charging his commission.

You are required to prepare Final Accounts after giving effects to the adjustments.

Solution:

Note: There’s a misprint in the book. The correct Net Profit should be Rs.1,19,753 and not Rs.1,19,773 as given.

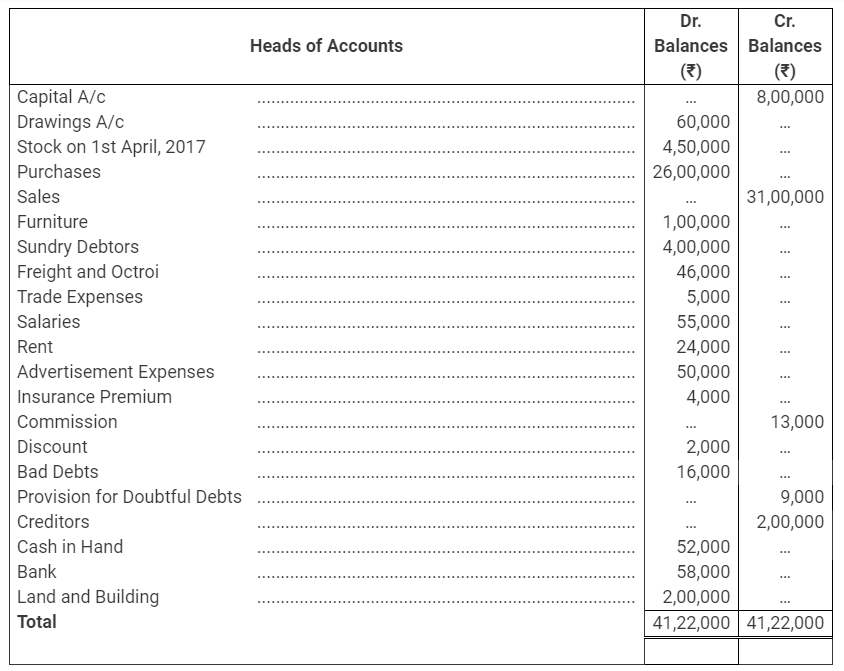

Question 29.

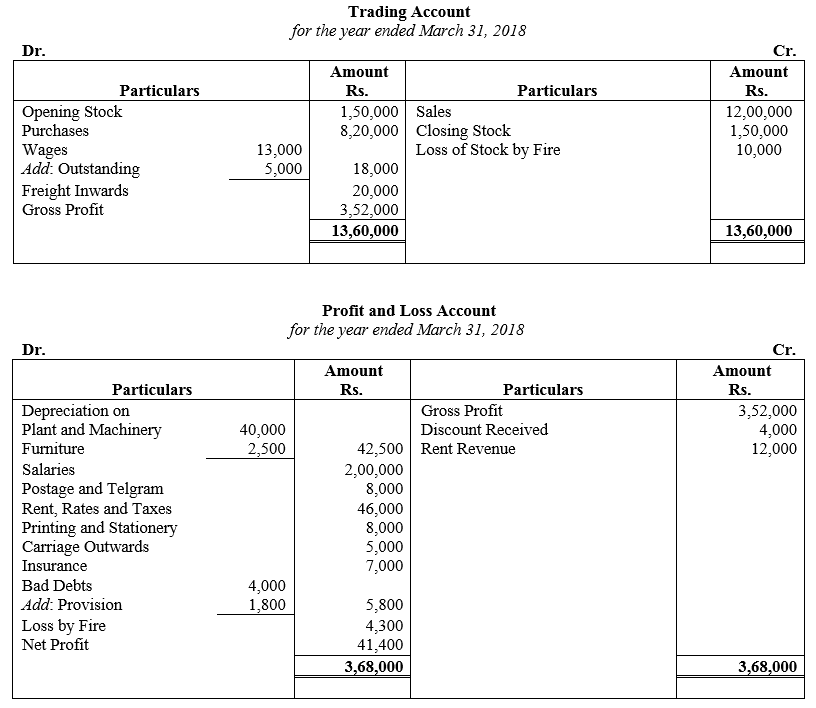

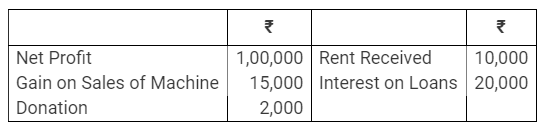

Following is the Trial Balance of Atam Prakash as on 31st March, 2018:

Adjustments:

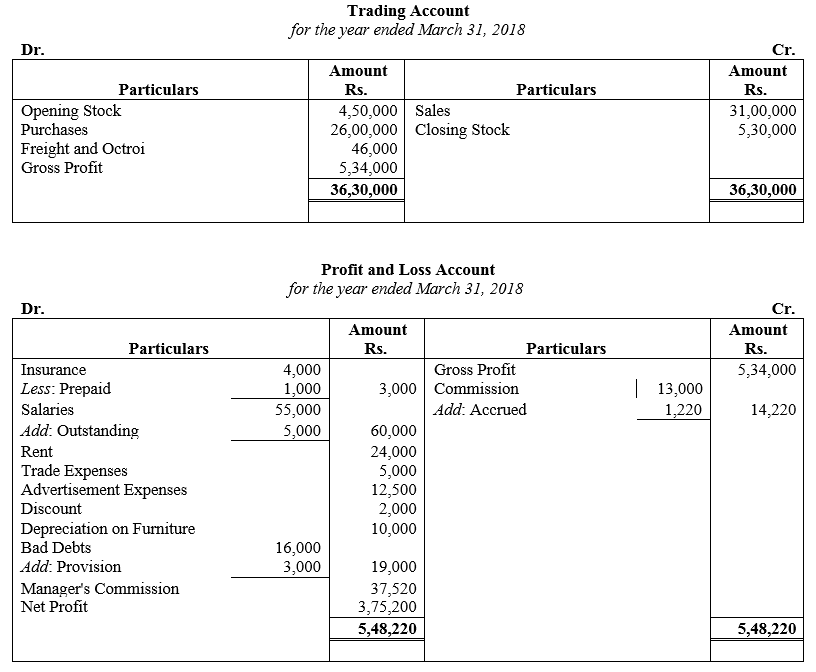

(i) Stock on 31st March, 2018 was valued at ₹ 5,30,000.

(ii) Salaries have been paid so far for 11 months only.

(iii) Unexpired insurance is ₹ 1,000.

(iv) Commission earned but not yet received amounting to ₹ 1,220 plus IGST @ 12% is to be recorded in books of account.

(v) Provision for Doubtful Debts is to be bought up 3% of Sundry Debtors.

(vi) Manager is to be allowed a commission of 10% on net profits after charging such commission.

(vii) Furniture is depreciated @ 10% p.a.

(viii) Only one-fourth of advertisement expenses are to be written off.

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2018 and Balance Sheet as on that date.

Solution:

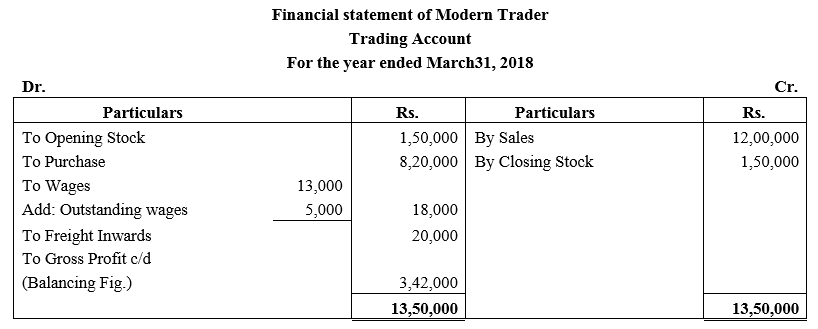

Question 30.

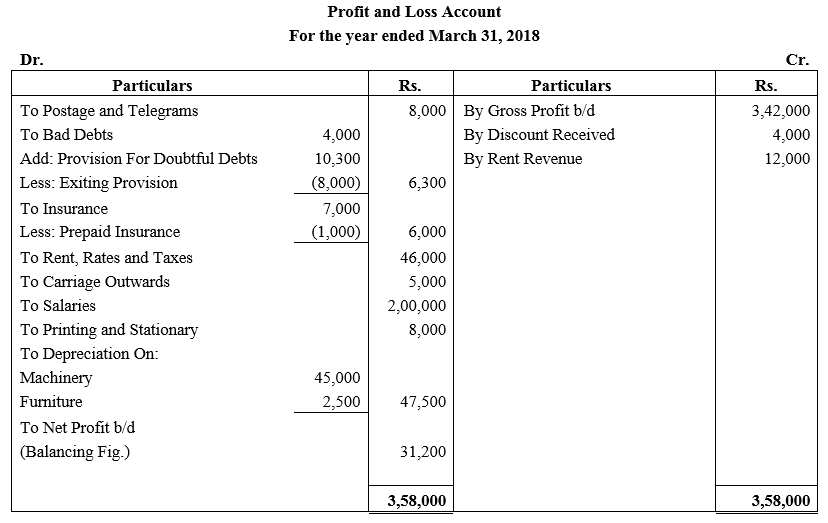

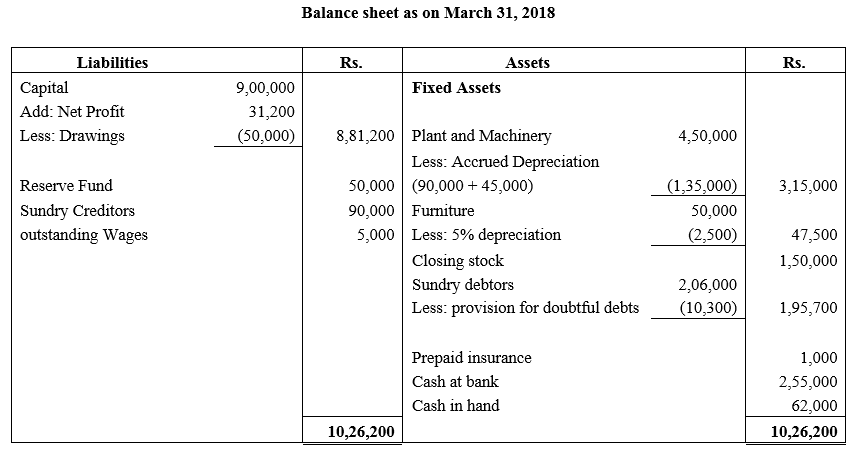

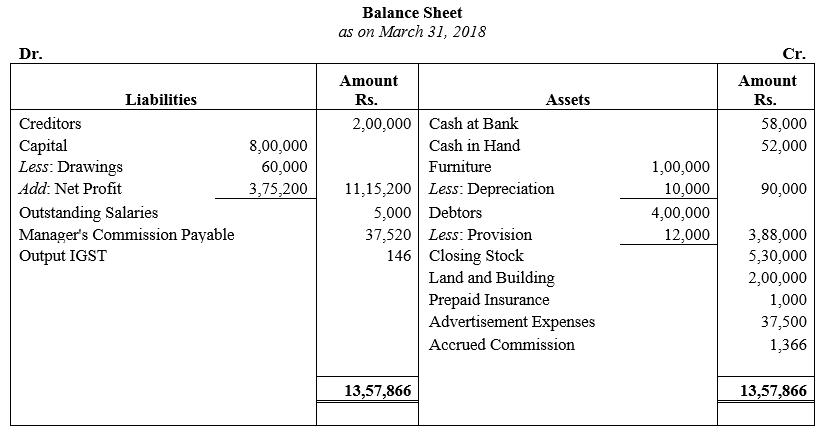

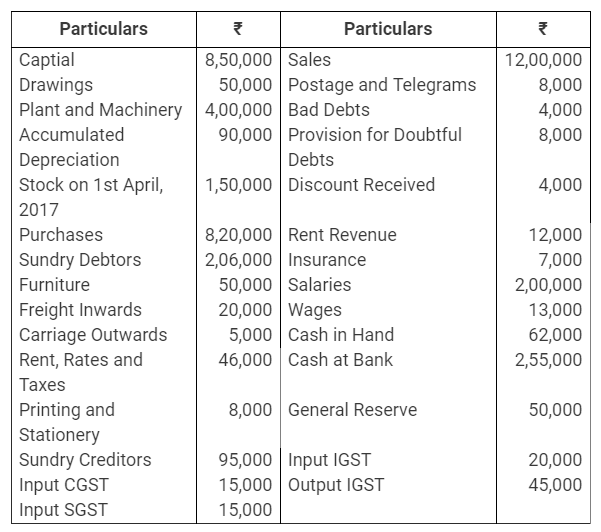

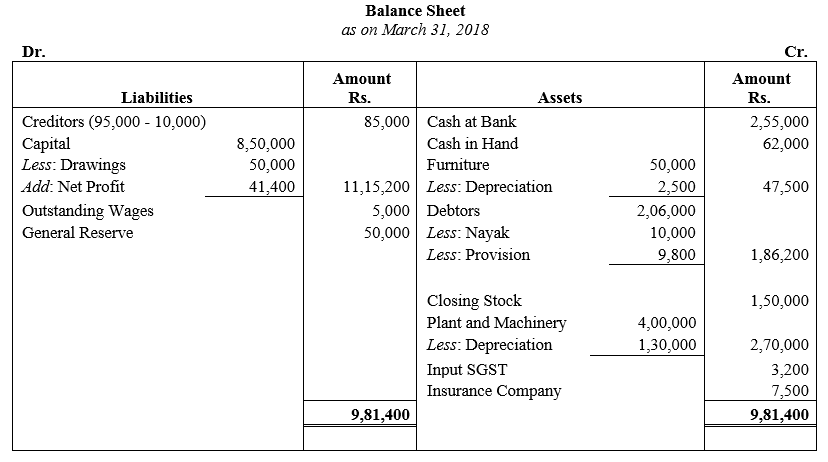

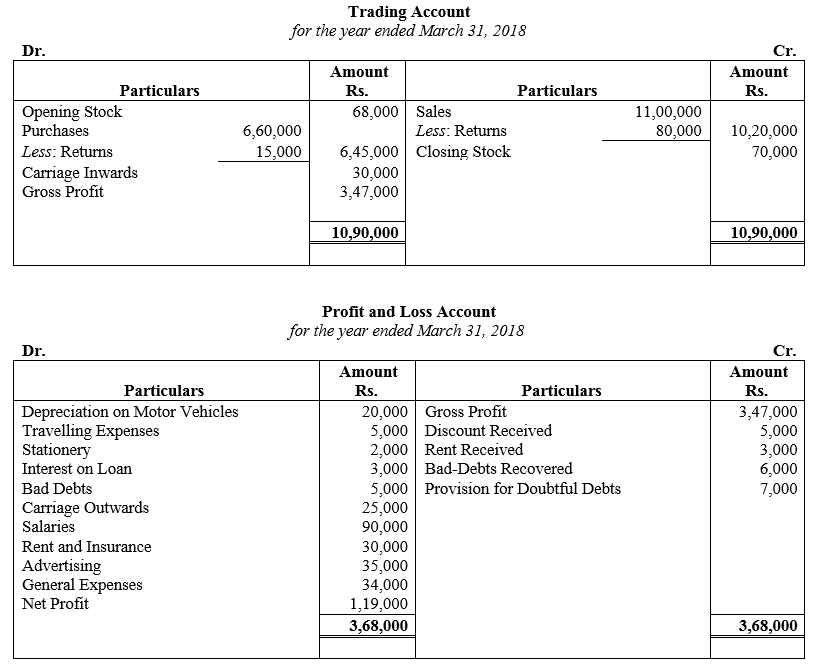

Following balances were extracted from the books of Modern Traders on 31st March, 2018:

Prepare Profit and Loss Account for the year ended 31st March, 2018 and the Balance Sheet as at that date giving effect to the following:

(a) Closing Stock was ₹ 1,50,000.

(b) Wages Outstanding were ₹ 5,000.

(c) Provision for Doubtful Debts is to be maintained at 5% of Sundry Debtors.

(d) Depreciate Plant and Machinery by 10% and Furniture by 5% on Straight Line Method.

(e) Sundry Creditors include ₹ 10,000 due to Nayak who is also included in Sundry Debtors at ₹ 15,000.

(f) New furniture for ₹ 12,000 was purchased on 1st April, 2017. Old furniture valued at ₹ 2,000 was exchanged and balance was paid by cheque. Purchase of furniture was recorded at the net value of furniture, i.e., ₹ 10,000. The firm had purchased this furniture paying IGST @ 18%.

(g) A fire occurred on 27th March, 2018 destroying stock costing ₹ 10,000, which were purchased paying CGST and SGST @ 9% each. Insurance company conveyed acceptance of claim of ₹ 7,500 on 10th April, 2018. Final accounts were prepared on 1st July, 2018.

Solution:

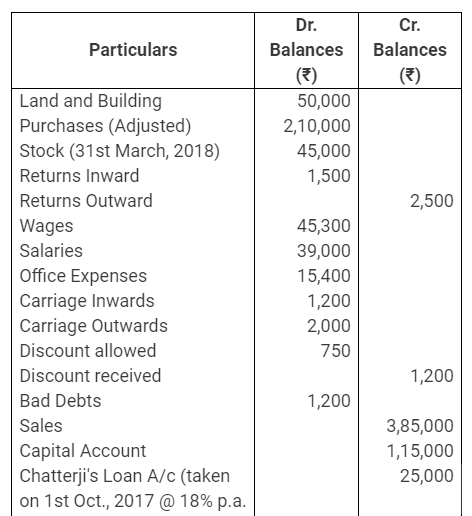

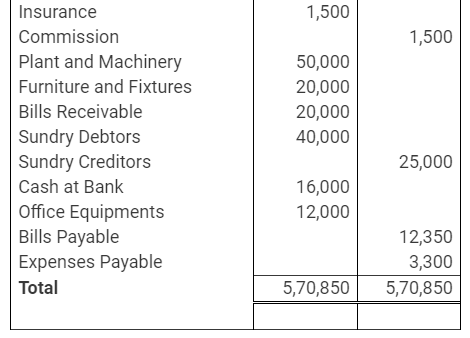

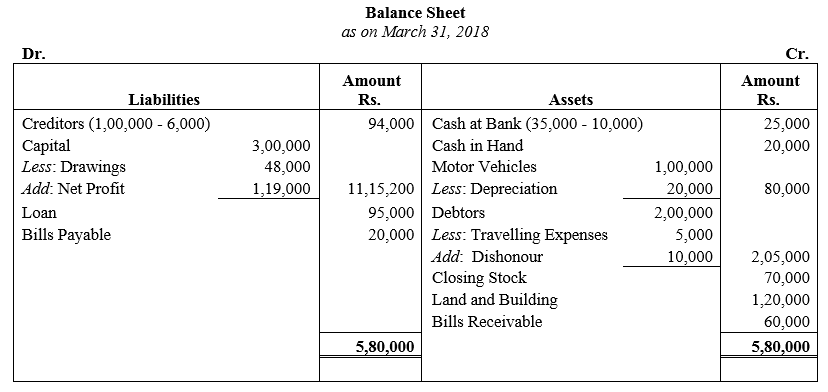

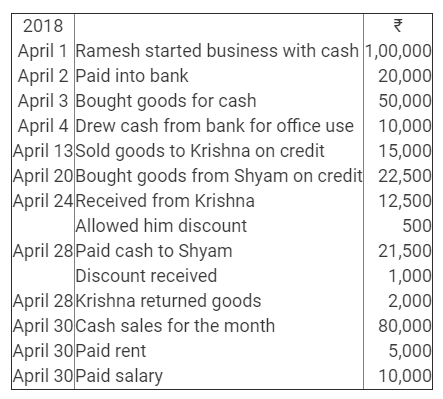

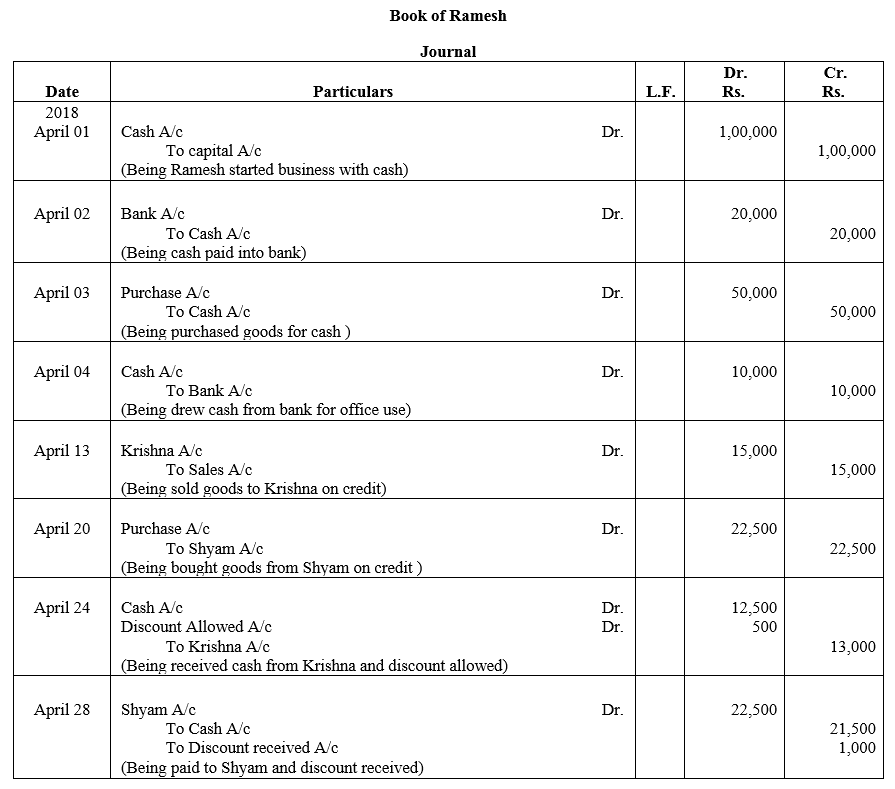

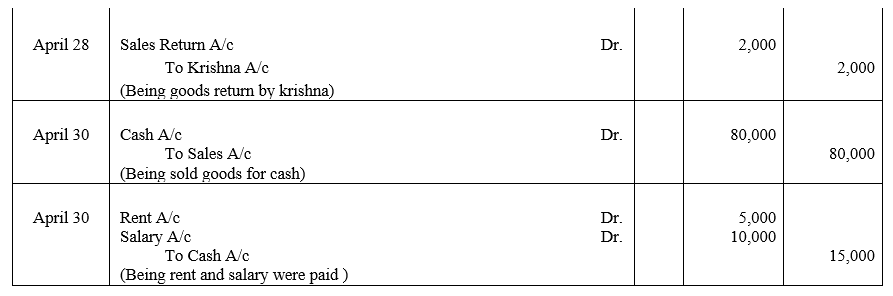

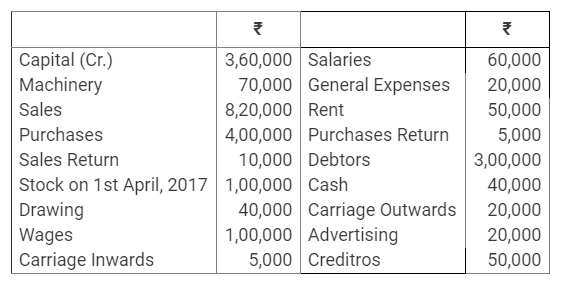

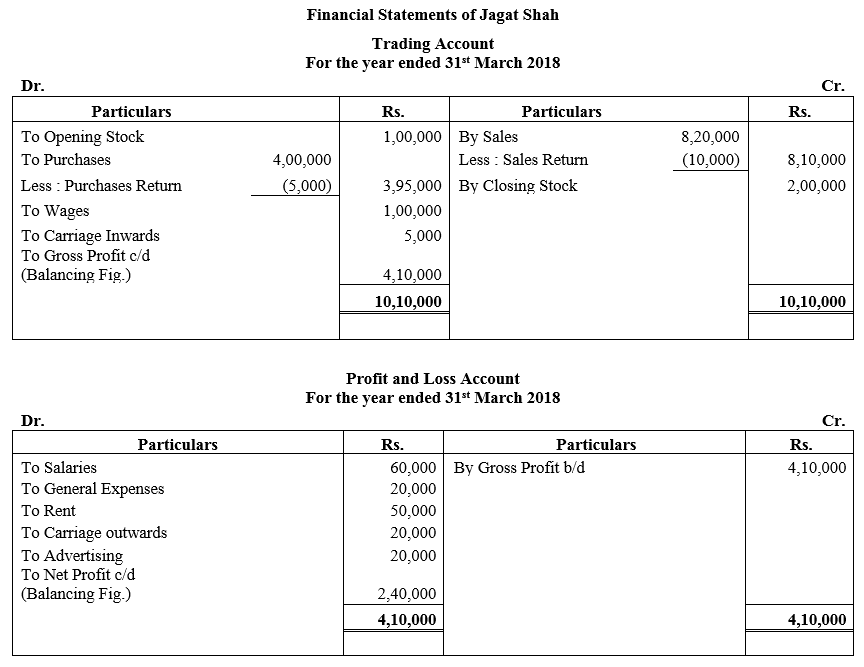

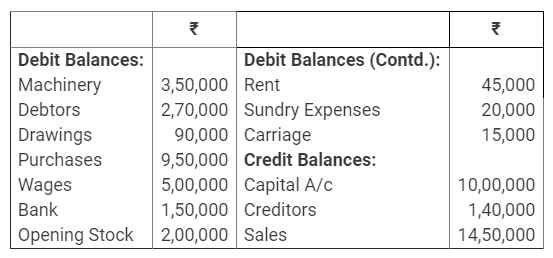

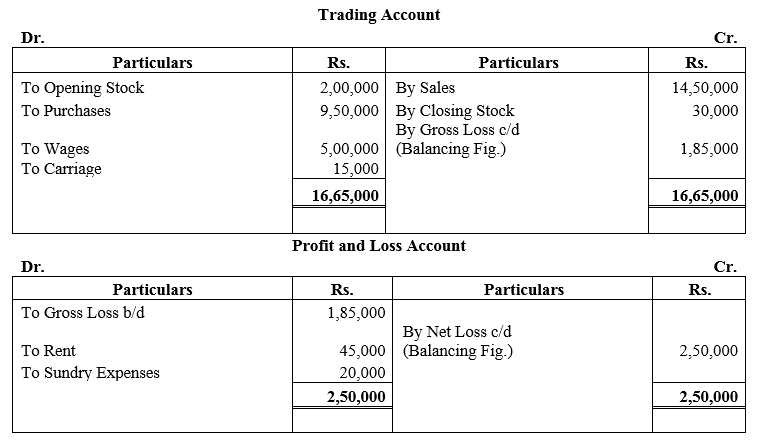

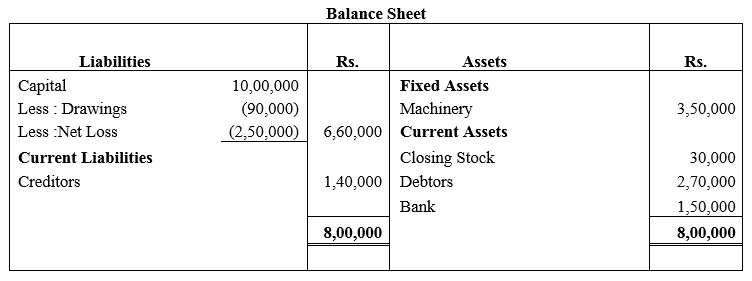

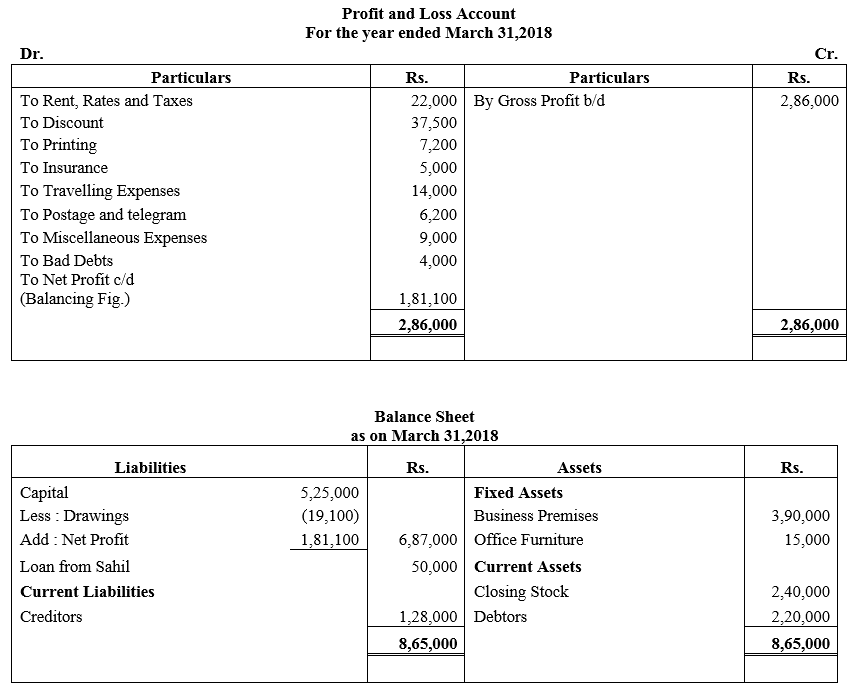

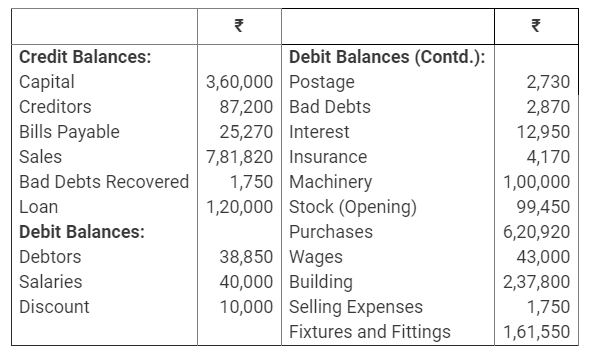

Question 31.

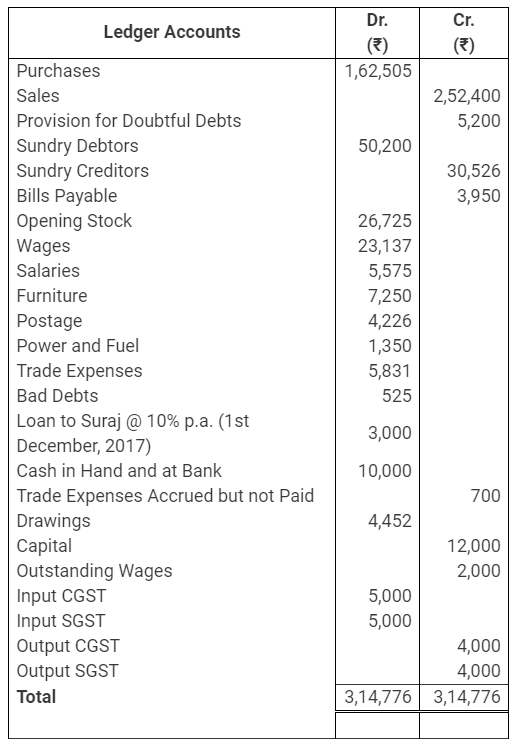

On 31st March, 2018 the following Trial Balance was extracted from the books of Mohan:

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2018 and Balance Sheet as at that date after taking into account the following:

(a) Stock as at 31st March, 2018 was valued at ₹ 70,000.

(b) All debtors are considered good for recovery.

(c) Depreciate Motor Vehicles by 20%.

(d) Bank intimation of customer’s cheque of ₹ 10,000 being dishonoured is not recorded in the books.

(e) Travelling expenses of ₹ 5,000 paid to sales person was wrongly debited to his Personal Account and was included in debtors.

(f) Amount of ₹ 6,000 received from Ronit was credited to his account and was included in creditors. This amount was written off as bad debt in earlier years.

(g) Drawings included an amount of ₹ 2,000 being amount drawn in cash. It was used by Mohan for Purchase of stationery used in business.

Solution:

We hope the TS Grewal Accountancy Class 11 Solutions Chapter 14 Adjustments in Preparation of Financial Statements help you. If you have any query regarding TS Grewal Accountancy Class 11 Solutions Chapter 14 Adjustments in Preparation of Financial Statements, drop a comment below and we will get back to you at the earliest.

b

b