Detailed, Step-by-Step NCERT Solutions for 12 Accountancy Chapter 6 Accounting for Share Capital Questions and Answers were solved by Expert Teachers as per NCERT (CBSE) Book guidelines covering each topic in chapter to ensure complete preparation.

Accounting for Share Capital NCERT Solutions for Class 12 Accountancy Chapter 6

Accounting for Share Capital Questions and Answers Class 12 Accountancy Chapter 6

Test your Understanding-I (Page No. 7)

State which of the following statements are true:

(a) A Company is formed according to the provisions of Indian Companies Act-1932.

Answer:

False

(b) A company is an artificial person.

Answer:

True

(c) Shareholders of a company are liable for the acts of the company.

Answer:

False

![]()

(d) Every member of a company is entitled to take part in its management.

Answer:

True

(e) Company’s shares are generally transferable.

Answer:

True

(f) Share application account is a personal account.

Answer:

True

(g) The director of a company must be a shareholder.

Answer:

True

(h) Application money should not be less than 25% of the face value of shares.

Answer:

True

(i) Paid-up capital can exceed called-up capital.

Answer:

False

![]()

(j) Capital reserves are created from capital profits.

Answer:

True

(k) Securities premium account is shown on the assets side of the balance sheet.

Answer:

True

(l) Premium on issue of shares is a capital loss.

Answer:

True

(m) At the time of issue of shares, the maximum rate of securities premium is 10%.

Answer:

False

(n) The part of capital which is called-up only on winding up is called reserve capital.

Answer:

True

(o) Forfeited shares can not be issued at a discount.

Answer:

False

![]()

(p) The shares originally issued at discount may be re-issued at a premium.

Answer:

True

Test your Understanding-II (Page No. 36)

Choose the Correct Answer.

(a) Equity share holders are :

(i) creditors

(ii) owners

(iii) customers of the company.

Answer:

(ii) Owners

(b) Nominal share capital is :

(i) that Part of the authorised capital which is issued by the company.

(ii) the amount of capital which is actually applied for by the prospective shareholders.

(iii) the maximum amount of share capital which a company is authorised to issue.

(iv) the amount actually paid by the shareholders.

Answer:

(iii) the maximum amount 01 share capital which a company is authorised to issue.

(c) Interest on calls-in-arrears is charged according to “Table A” at:

(i) 5%

(ii) 6%

(iii) 8%

(iv) 11%

Answer:

(ii) 5%

![]()

(d) Money received in advance from shareholders before it is actually called-up by the directors is :

(i) debited to calls-in-advance account

(ii) credited to calls-in-advance account

(iii) debited to calls account.

Answer:

(ii) Credited to calls-in-advance account

(e) Shares can be forfeited :

(i) for non-payment of call money

(ii) for failure to attend meetings

(iii) for failure to repay the loan to the bank

(iv) for which shares are pledged as a security.

Answer:

(i) for non-payment of call money

(f) The balance of share forfeited account after the reissue of forfeited shares is transferred to :

(i) general reserve

(ii) capital redemption reserve

(iii) capital reserve

(iv) reveneue reserve

Answer:

(iii) capital reserve

(g) Balance of share forfeiture account is shown in the balance sheet under the item :

(i) current liabilities and provisions

(ii) reserves and surpluses

(iii) share capital account

(iv) unsecured loans

Answer:

(iii) share capital account

Test your Understanding – III (Page No. 59)

(a) If a Share of Rs. 10 on which Rs. 8 is called-up and Rs. 6 is paid is forfeited. State with what amount the Share Capital account will be debited.

(b) If a Share of Rs. 10 on which Rs. 6 has been paid is forfeited, at what minimum price it can be reissued.

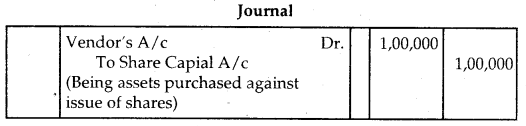

(c) Allhuwalia Ltd. issued 1,000 equity shares of Rs. 100 each as fully paid-up in consideration of the purchase of plant and machinery worth Rs. 1,00,000. What entry will be recorded in company’s journal.

Answer:

(a) Rs. 8

(b) Rs. 4

(c) …….

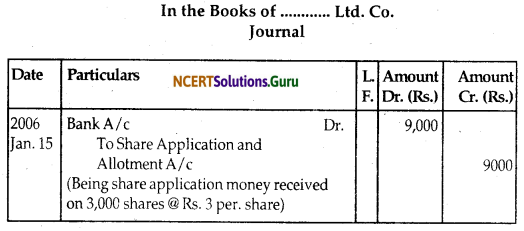

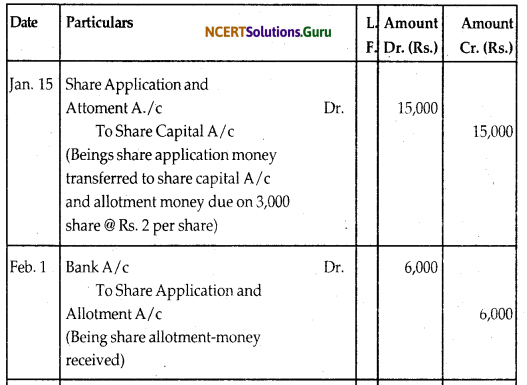

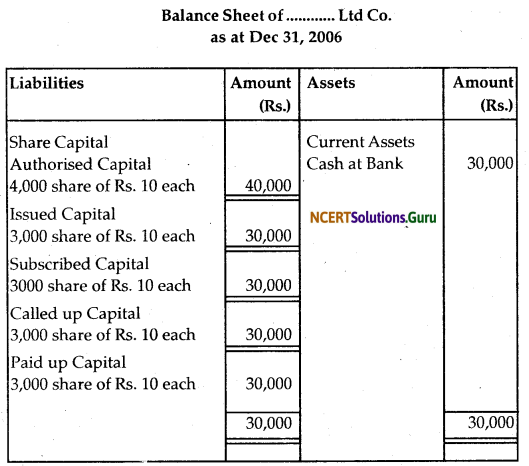

On January 1,2006, a Limited Company was incorporated with an authorised capital of Rs. 40,000 divided into shares of Rs. 10 each.

![]()

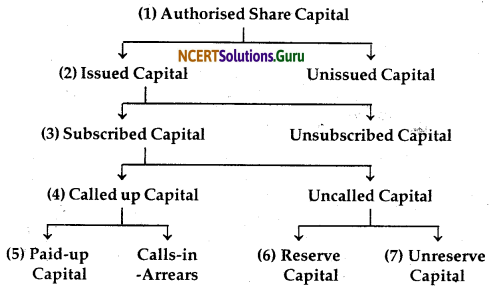

It offered to the public for subscription of 3,000 shares payable as follows :

On Application – Rs. 3 per share

On Allotment – Rs. 2 per share

On First Call (One month after allotment) – Rs. 2.50 per share

On Second and Final Call – Rs. 2.50 per share

The shares were fully subscribed for by the public and application money duly received on January 15, 2006, The directors made the allotment on February 1,2006.

How will you record the share capital transactions in the books of a company if :

(i) The amount due has been duly received.

(ii) The company maintains the combined account for application and allotment.

Answer:

Do It Yourself (Page No. 22)

Question 1.

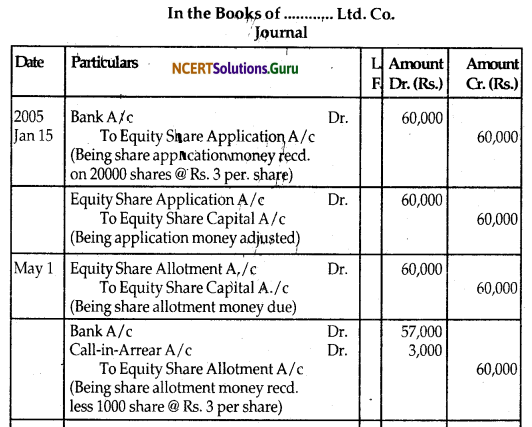

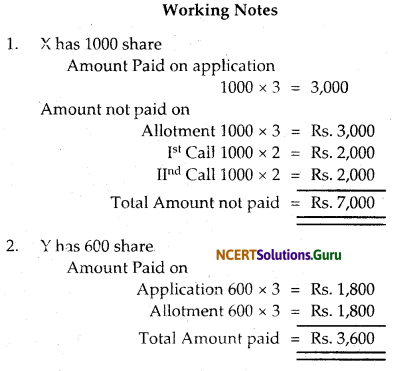

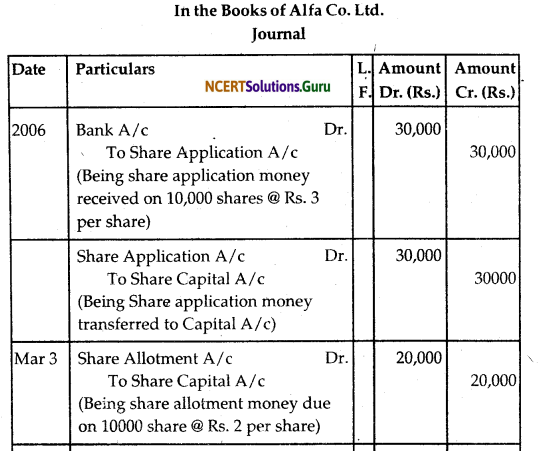

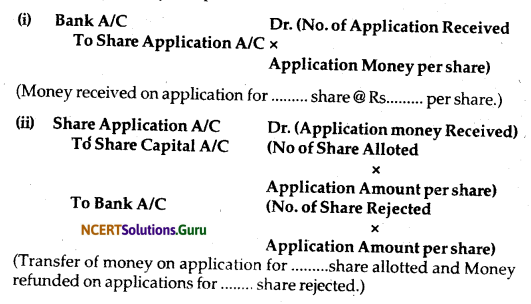

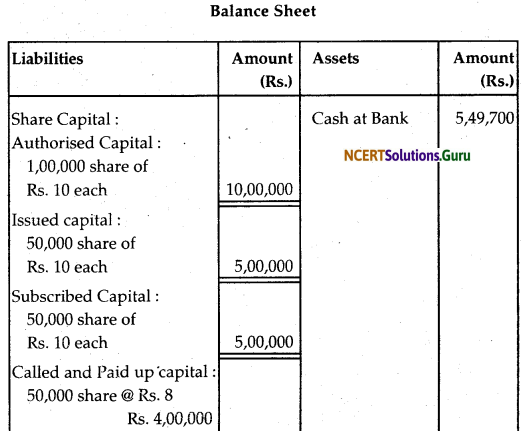

A company issued 20,000 equity shares of Rs. 10/- each payable at Rs. 3 on application, Rs. 3 on allotment, Rs. 2 on first call and Rs. 2 on second and the final call. The allotment money was payable on or before May 1st, 2005; first call money on or before August 1st, 2005; and the second and final call on or before October 1st, 2005; ‘X’, whom 1,000 shares were allotted, did not pay the allotment and call money; ‘Y’ on allottee of 600 shares did not pay the two calls; and ‘Z’, whom 400 shares were allotted, did not pay the final call. Pass journal entries and prepare the Balance Sheet of the company as on December 31st, 2005.

Answer:

![]()

Question 2.

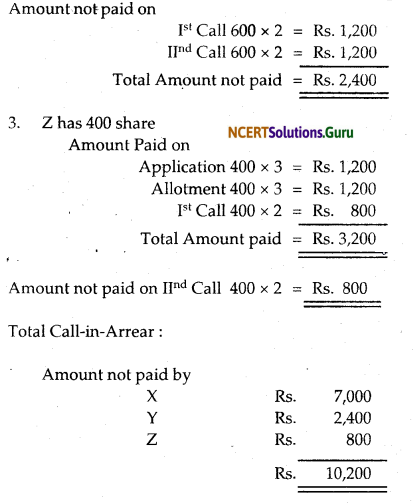

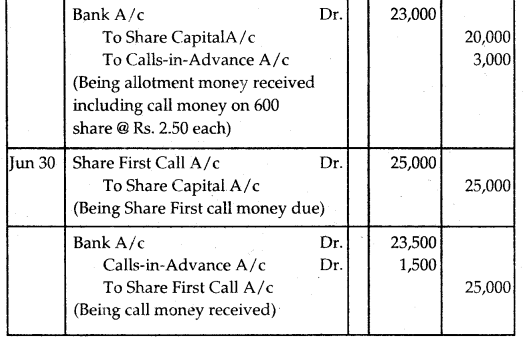

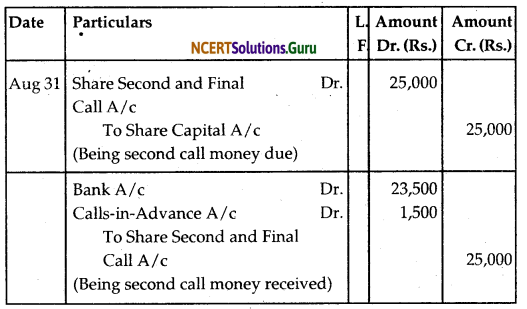

Alfa company Ltd. issued 10,000 shares of Rs. 10 each for cash payable at Rs. 3 on application, Rs. 2 on allotment and the balance in two equal installments. The allotment money was payable on or before March 3rd, 2006; the first call money on or before 30th June, 2006; and the final call money on or before 31st August, 2006. Mr. ‘A’, whom 600 shares were allotted, paid the entire remaining face value of shares alloted to him on allotment. Record journal entries in companies’ books and also prepare their Balance Sheet on the date.

Answer:

![]()

Do It yourself (Page No. 46)

Question 1.

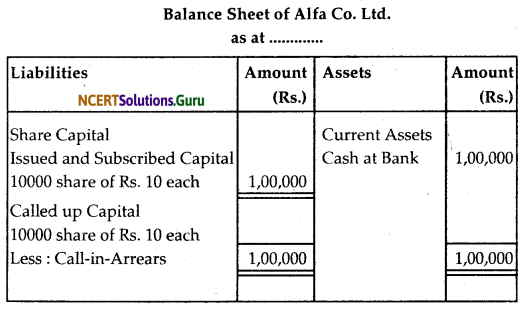

A company forfeited 100 equity shares of Rs. 10 each issued at a premium of 20% for non-payment of final call of Rs. 5 including the premium. Show the journal entry to be passed for forfeiture of Shares.

Answer:

Question 2.

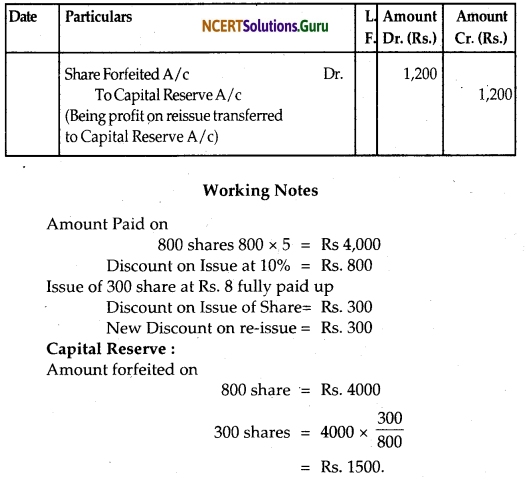

A company forfeited 800 equity shares of Rs. 10 each issued at a discount of 10% for non-payment of two calls of Rs. 2 each. Calculate the amount forfeited by the company. Also calculate the amount of capital profit if 300 shares were reissued out of the forfeited shares at Rs. 8 per share. Also show how to pass the journal entries.

Answer:

![]()

Do it Yourself (Page No. 59)

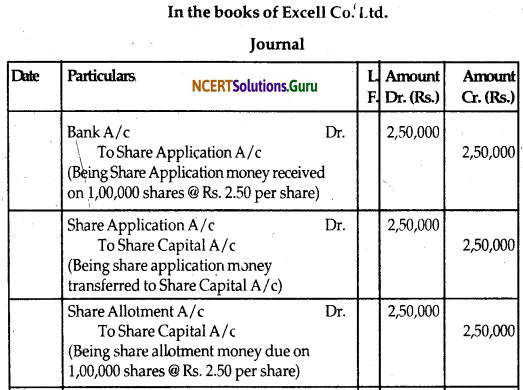

Excell Company Limited made an issue of 1,00,000 Equity Shares of Rs. 10 each, payable as follows:

On Application – Rs. 2.50 per share

On Allotment – Rs. 2.50 per share

On 1st and Final call – Rs. 5.00 per share

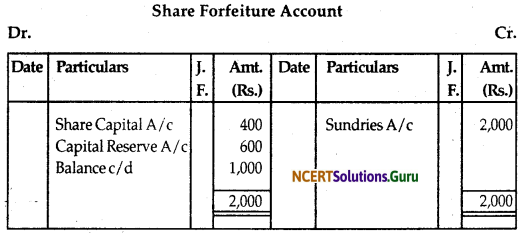

X, the holder of 400 shares did not pay the call money and his shares were forfeited. Two hundred of the forfeited shares were reissued as fully paid at Rs. 8 per share. Draft necessary journal entries and prepare Share Capital and Share Forfeited’ accounts in the books of the company.

Answer:

Do it Yourself (Page No. 62)

Journalise the following:

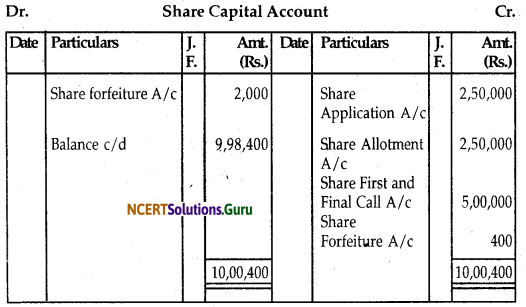

(a) The directors of a company forfeited 200 equity shares of Rs. 10 each on which Rs. 800 had been paid. The Shares were reissued upon payment of Rs. 1,500.

(b) A holds 100 shares of Rs. 10 each on which he has paid Re. 1 per share on application. B holds 200 Shares of Rs. 10 each on which he has paid Re. 1 on application Rs. 2 on allotment. C holds 300 shares of Rs. 10 each who has paid Re. 1 on applications. Rs. 2 on allotment and Rs. 3 on first call. They all failed to pay their arrears and second call of Rs. 4 per share as well. All the shares of A, B and C were forfieted and subsequently reissued at Rs. 11 per share as fully Paid- up.

Answer :

![]()

Short Answer Type Questions

Question 1.

What is Public Company?

Answer:

Public Company—According to Section 3(i) (iv) of the Companies Act 1956 “Public Company means a company

(a) which is not a private company and

(b) has a minimum paid up capital of Rs. 5 lakhs or such higher paid-up capital and

(c) is a private company which is a subsidiary of a company which is not a private company.” Companies Amendment Act 2000 states that a public company cannot be registered with a capital of less than Rs. 5 lakhs.

A public company may be a listed company or unlisted company. A listed company is a public company which has any of its securities listed in any recognised stock exchange. An unlisted company is one whose securities are not listed on any recognised stock exchange for trading.

![]()

Question 2.

What is Private Limited Company?

Answer:

Private Company—According to section (3)(i), (iii), a private company means a company which has a minimum paid up capital of Rs. One lakh or such higher paid-up capital as may be prescribed and by its articles—

(i) Restricts the rights of members to transfer its shares,

(ii) Limits the number of its members to 50 excluding :

- persons who are in employment of the company, and

- persons, who, having been formerly in the employment of the company, were members of the company while in that employment and have continued to be members after the employment ceased.

(iii) Prohibits any invitation to the public to subscribe to any shares or debentrues of the company.

(iv) Prohibits any invitation or acceptance of deposits from persons other than its members, directors and relatives.

Question 3.

Define Government Company.

Answer:

Government Company—According to section 617 of the Companies Act 1956, “a Government Company is a company in which not less than 51% of the paid-up capital is held by the Central Government, or by any State Government or Governments or partly by the Central Government and partly by one or more State Governments and includes a company which is a subsidiary of a Government Company.”

Question 4.

What do you mean by a listed company?

Answer:

A public company may be listed or unlisted company. A listed company is that public company which has any of its securities are listed in any recognised stock exchange in India for trading. Listing of securities in any recognised stock exchange gives a guarantee and impression in the minds of potential investors about the goodwill of the company.

Question 5.

What are the uses of securities premium?

Answer:

Security Premium and its Uses – When shares of a company are issued at a price more than the face value, it is said to be an issue of shares at premium. When shares are issued at premium, the premium amount is credited to a separate account called “Securities Premium

Account” because it is not a part of share capital. Rather, it represents, a capital gain and being a credit balance, is shown on the liabilities side of the company’s balance sheet under the heading “Reserves and Surplus”.

According to Section 78 of the Companies Act, Securities Premium Account may be used by the company :

- In paying up unissued capital of the company to be issued to the members of the company as fully paid bonus shares.

- To write off preliminary expenses of the company.

- To write off the expenses of, or commission paid, or discount allowed on any of the securities or debentures of the company.

- To pay premium on the redemption of preference shares or debentures of the company.

![]()

Question 6.

What is buy-back of shares?

Answer:

Buy-back of shares : The term buy-back of shares denotes the purchasing of its own shares by a company either from free reserves, securities premium or proceeds of any shares or debentures. According to Section 77 A of the Companies Act 1956, a company can buy its own shares in the following forms :

- Through existing equity shareholders on a proportionate basis; or

- Through open market; or

- By odd lot of shareholders; or

- Employees of the company pursuant to a scheme of stock option or sweat equity.

Following procedural rules are to be followed :

- The buy-back should be authorized by the Articles of Association.

- The special resolution is to be passed in the General Meeting of the shareholders.

- The buy-back of the shares cannot exceed 25% of paid-up capital and free reserves in a financial year.

- The debt-equity ratio should not be more than 2 :1 after such buy-back of shares.

- All the shares for buy-back should be fully paid up.

- The buy-back should be completed within 12 months from the date of passing of the special resolution.

- The company must file solvency declaration with the registrar and SEBI in the form of an affidavit signed by at least two directors of the company.

The affidavit must state that the board has made full inquiry into the affairs of the company is capable of meeting its liabilities and will not render insolvent within a period of one year from the date of declaration adopted by the board.

A company that buy-back of its own shares shall extinguish and physically destroy such shares within seven days of completion of buy-back in the presence of merchant bankers or Registrar or statutory auditor.

No Further Issue : When a company completes the buy-back of its shares, shall not make further issue of shares within a period of 24 month except by way of bonus shares or in the discharge of some obligations like conversion of share warrants, stock option schemes, sweat equity or conversion of preference shares and debentures into equity shares.

SEBI Guidelines: SEBI has made certain regulations in 1988 with regard to buy-back of shares. Following are the important guidelines given by the SEBI:

(i) Buy-back of shares cannot be made by a private person through negotiated deals with stock exchange or through spot transactions or any other private arrangement. A company is required to make public announcement in at least in one

National English Daily, and one in Hindi National Daily and one Regional Language Daily all with wide circulation where registered office of the company is situated. Public announcement should specify the following things :

(a) It should specify the date of the dispatch of the offer letter. The letter should specifically stated as “specific date” and it shall not be less than earlier than 30 days but not later than 42 days.

(b) The company shall file information to the SEBI within seven working days from the date of public announcement.

(c) The offer for buy-back shall remain open to the members for a period of not less than 15 days but not exceeding 30 days. However, the opening date for the offer shall not be earlier than 7 days or later than 30 days from the specified date.

(d) The company shall complete the verification of offers within 15 days from the date of closure and shares lodged shall be deemed to have been accepted unless communication of rejection is made within 15 days from the date of closure.

Proportionate Buy-Back of Shares : When the number.of shares tendered for buy-back are more than the number of shares to be bought back from each member of shareholder, the rule of proportionate buy-back shall be determined by using the following formula: Acceptance tendered by a member x Number of Securities to be bought back = Total acceptance tendered.

![]()

Question 7.

Write a brief note on “Minimum Subscription”.

Answer:

Minimum Subscription: It is the minimum amount which must be raised to meet the need of business operations of the company relating to the followings :

(a) The price of’ any property purchased, or to be purchased, which has to be met wholly or partly out of the proceeds of the issue.

(b) Preliminary expenses payable by the Company and any commission payable in connection with the issue of share.

(c) The repayment of any money borrowed by the company for the above two matters;

(d) Working capital; and

(e) Any other expenditure required for the usual conduct of business operations. It is to be noted that ‘minimum subscription’ of capital cannot be less than 90% of the issued amount according to SEBI

(Discolsure and Investor Protection) Guidelines, 2000. If the above condition is not satisfied, the company shall forthwith refund the entire subscription amount received. If a delay occurs beyond 8 days from the date of closure of subscription list, the company shall be liable to pay the amount with interest at the rate of 15%.

Long Answer Type Questions

Question 1.

What is meant by a word “Company”? Describe its charactertics.

Answer:

A company is an association of persons having a separate legal existence, perpetual succession’and common seal. Its capital is generally divided into shares, which are transferable, subject to certain condition.

Major definitions

“Company is an artificial person created by law having seprate entity with a perpetual succession and common seal.” —Prof. L.H. Haney

“Company means an associations of persons united for a common object.” —Justice James

“A Company means a company formed and registered under this Act (Companies Act, 1956) or any previous Act.”

—Indian Companies Act, 1956

“Company is an association of many persons who contribute money or money’s worth to a common stock and employ it for a common purpose.” —LordLindley

“As persons, artificial, invisible, intangible and existing only in the eyes of law. Being a creation of law, it possesses only those properties which the charter of its creations confers on it either, expressly or as incidental to its very existence, among the most important of which are immortality and individulaity.” —Chief Justice Marshal

Thus, that group of people which is incorporated under the Companies Act, whose creation is due to a special purpose, the liability of the members is generally limited, whose existence is separate from its members and is continuous or perpetual and which has a common seal, is called a company.

![]()

Characteristics of Company –

The definitations given above reveals the following features of a Company –

1. Voluntary Association—A Company is a voluntary association of certain persons formed to carry out a particular purpose in common. Members of a company can join it and leave it at their own free will.

2. Separate Legal Entity—The existence of company is separate and free from its members. Company can keep property in its name and enter into agreements. It can file suit against anybody and it can also be sued. All the liabilities and assets belong to the company itself and not to the owners.

3. Limited Liability—As a company has a separate legal entity, its members cannot be held liable for the debts of the company. The liability of every member is limited to the nominal value of the shares bought by him or to the amount of guarantee given by him.

4. Perpetual Succession— “Members may come, members may go. But the company goes on forever.”

A company has a continuous existence and its life is not affected by the death, lunacy, insolvency or retirement of its members or director. Members may come and go, but the company continous its operations so long as it fulfills the requirements of the law under which it has been formed. Since it is a legal person (created by law), it can go out of existence only through the legal process.

5. Common Seal—Being an artificial person, a company cannot put its signature. The law has, therefore, provided for the use of a common seal, with the name of the company engraved on it and which remains in the possession of its Secretary. It acts as an official signature of the company. Any document which does not carry the common seal of the company is not binding on the company.

6. Transferability of Shares—The shares of the company are generally transferable. A shareholder is free to withdraw his membership from the company by transferring his shares. But the Articles of the company can prescribe the manner in which the transfer of shares will be made.

7. May sue or be sued—A Company dan enter into contracts and can enforce the contractual rights against other. Similarly, the company can be sued by the others if there is a breach of contract by the company.

8. Right of Access to Information—The shareholders of a company have the right to inspect the books of accounts except the books not inspected under the statute. The shareholders have a right to seek information from the directors by participating in the meeting of the company and through the periodic reports.

9. Company is not a citizen—Although company is a legally created person yet under Article 19 of the Indian Constitution it has not been recognised as a citizen. Hence, like all other citizens, the company has no right to exercise the fundamental rights.

10. Maintenance of Books—A company is required by law to keep a prescribed set of account books and any failure in this regard attracts penalties.

![]()

Question 2.

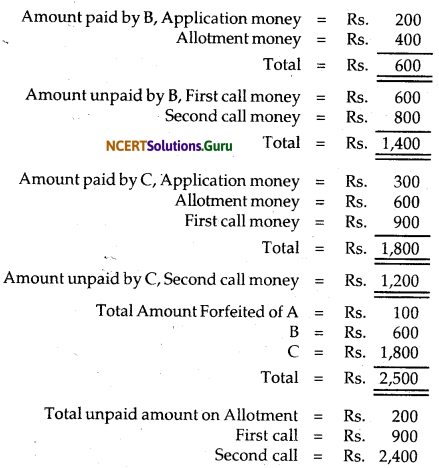

Explain in brief the main categories in which the share capital of a company is divided.

Answer:

Meaning of Share Capital—Every company should have capital in order to finance its activities. The company raises this capital by issue of share because it does not have capital of its own being an artificial person. Thus the total capital of the company is divided into shares, therefore, it is called share capital or the amount invested by the shareholders towards the face value of shares are collectively known as share capital

Categories of Share Capital – The Share capital of a company may be divided into the main six categories, which are presented here with the help of diagram.

(1) Authorised Share Capital or Nominal Capital or Registered Capital – Authorised share capital is the maximum amount of Share Capital, mentioned in the memorandum of association, which the company is entitled to issue. This is the maximum limit of the company which it is authorised to raise and beyond which the company cannot raise unless the capital clause in the Memorandum is alterted in accordance with the provisions of Sec. 94 of the Companies Act, 1956.

(2) Issued Capital – It is that portion of the authorised share capital for which offers have been invited for subscription. This includes any bonus share allotted by the corporate enterprise. It also includes share allotted to vendors of assets or promoters for considerations other than cash. That portion of authorised share capital for which offer have not been invited for subscription is called Unissued share capital. The issued capital cannot exceeds its authorised capital.

(3) Subscribed Capital—It means that portion of issued capital which has been subscribed for by the public and the balance of issued capital not subscribed for by the public is called the unsubscribed capital. When the share offered for public subscription were subscribed fully by the public, in such a case the issued capital and subscribed capital would be the same.

(4) Called up Capital – It is that part of the subscribed Share Capital which the company actually demands from the shareholders. The shareholders is generally required to pay it by instalments. The balance of subscribed capital which has not been called up represents uncalled Capital.

(5) Paid-up Capital – It is that portion of the called up capital which has been actually received from the shareholders. When the shareholder have paid all the call amount, the called up capital is the same to the paid-up capital. The amount yet due from the shareholders is called call in arrears.

(6) Reserve Capital – It is that portion of the subscribed capital which has not been called up and which, the company has resolved by special resolution can be called up only in the event of and for the purpose of the company being wound-up, that is capital which has been reserved for winding up.

![]()

Question 3.

What do you mean by the term ‘Share’. Discuss the type of shares, which can be issued under the Companies Act, 1956 as amended to date.

Answer:

Meaning of Share : The Capital of a company is divided into a number of equal units. Each unit is called a share. The word share implies a unit of share capital having property rights. The Companies Act, 1956 defines a share as “a share in the share Capital of the Company.”

A share is proportionate part of the share capital and forms the basis of ownership interest in a company. The persons who contribute money through shares are known as Shareholders’. A share is not a sum of money but is an interest measured by a sum of money.

Share is a bundle of rights and obligation contained in the contract, i.e. Articles of Associations. The company issues a certificate to every share holder stating the number of shares he holds. The certificate is called a share certificate.

Under the current corporate law a public limited company can issue two types of shares to the public for subscription of share capital:

(i) Preference Shares

(ii) Equity Shares (formerely known as ordinary shares.) (Section 86 of the Companies Act 1956.)

(i) Preference Shares: According to Sec. 85 of the Company Act, a preference share is one which carries the following two rights.

- a right to receives dividend at a stipulated rate or of a fixed amount before any dividend is paid on equity shares.

- a right to receives repayment of capital on winding up of the company, before the capital of equity shareholders is returned.

(ii) Equity Shares: Under Indian Companies Act 1956, “an equity share is a share which is not a preference share “Equity Share is one which is entitled to dividend and repayment of capital after the claim of preference shares is satisfied. Usually, the equity share holders controls the affairs of the company and hence get right to all the profits after the preference shareholders.

Question 4.

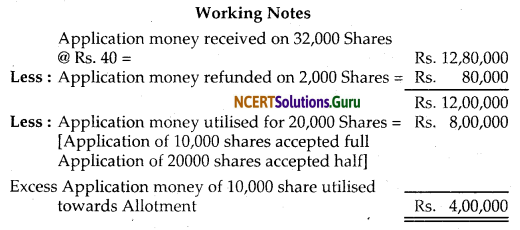

Discuss the process for the allotment of shares of a company in case of over subscription.

Answer:

Over subscription – When shares are issued to the public for subscription through the prospectus by well managed and financially strong companies, it may happen that applications for more share are received than the number of share offered to the public, such situation is said to be case of oversubscription.

Alternative:

1. They can accept some application in full and totally reject the others.

2. They can make a pro-rata distribution.

3. They can adopt combination of the above two alternatives.

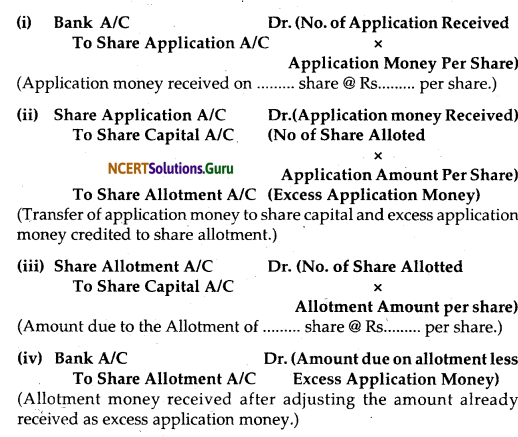

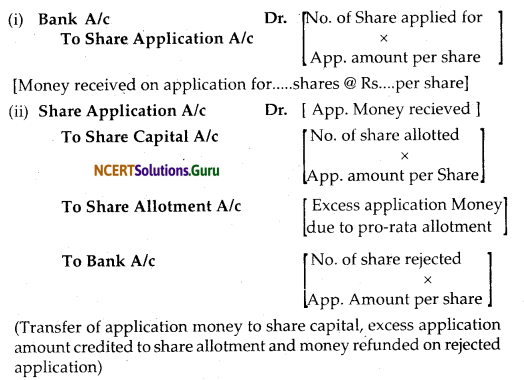

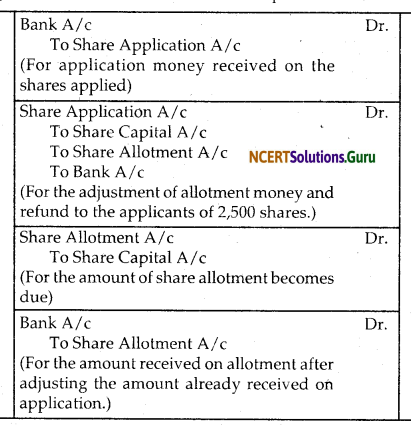

Accounting Treatment:

1. If the excess applicants are totally refused for allotment, the application money received on these shares is refunded. Following entry will pass:

2. If the applicants are made partial allotment (or pro-rata allotment):

The directors can as well opt to make a proportionate distribution of share available for allotment among the applicants of shares. The proportion is determined by the ratio which the number of shares to be allotted bear to the number of share applied for. This is called ‘pro¬rata-allotment.’ Generally excess application money received on these shares is adjusted towards the amount due on allotment or call.

![]()

3. This is a combination of two alternatives described above on thus:

(a) Application for some shares are rejected and

(b) Pro-rata allotment is made to the applicants of remaining number of shares.

Thus, money on rejected application is refunded and excess application money due to pro-rata distribution is adjusted towards the amount due on the allotment of shares alloted.

Question 5.

What is a ‘Preference Share’? Describe the different types ’ of Preference Shares.

Answer:

Meaning of Preference Shares – According to Sec. 85, of the Companies Act, a preference share is one which carries the following two rights.

(a) A right to receives dividend at a stipulated rate or of a fixed amount before any dividend is paid on equity shares.

(b) A right to receives repayment of capital on winding up of the company, before the capital of equity shareholders is returned. Thus, Shares which enjoy preferential right as to dividend and repayment of capital in the event of the winding up of a company, over its equity share, are called preference shares.

Types of Preference Shares—

1. Cumulative and Non-cumulative Preference Shares

2. Participating and Non-Participating Preference Share

3. Redeemable and Irredeemable Preference Share

4. Convertible and Non-convertible Preference Share.

1. (i) Cumulative Preference Shares—The dividend on these shares is accumulated until it is paid, that is, if the profits earned in a particular years or number of years are not sufficient to pay fixed annual dividend. The arrears of such dividends are carried forward and are paid in any subsequent year before any dividend is paid to equity shareholders. All preference shares are cumulative unless expressely stated to be non-cumulative.

(ii) Non-cumulative Preference Share—Dividend is payable only out of the profits of each year and if no profits are available for the payment of dividend then the right to dividend is gone. In other words it means arrears of dividend do not accumulate.

2. (i) Participating Preference Share—In addition to basic preferential rights, it also carries the right

- to participate in surplus profits left after payment of dividends to equity shareholder

- in winding up a right to participate in the surplus assets left after both the preference and equity shareholders have been paid in full.

(ii) Non-Participating Preference Share is one on which only a fixed rate of dividend is paid and nothing more. Preference share are always deemed to be non-parhcipating preference shares.

3. (i) Redeemable Preference Share – means which accordance with the terms of issue, will be repaid on or after a certain date, this type of share will be called redeemable preference share. The redemption is subject to certain legal restrictions enumerated in Section 80 of the Companies Act.

![]()

(ii) Irredeemable Preference Share are those shares for which the amount of capital is not paid back to the shareholders before the winding up of a company. After the commence of the Companies Amendment Act, 1988 no company limited by shares can issue any preference share which is irredeemable.

4. (i) Convertible Preference Share is that share which gets right of conversion into equity share.

(ii) Non-convertible Preference Share—When a preference share cannot be converted into equity share it is said to be a non-convertible preference share. Preference share are non-convertible unless otherwise stated.

Question 6.

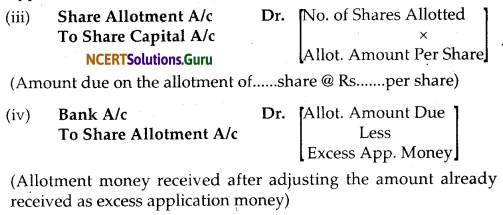

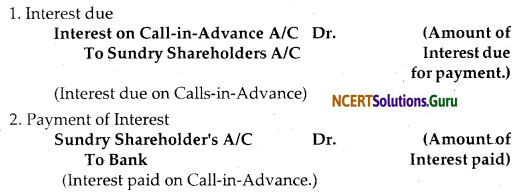

Describe the provisions of law relating to ‘Calls-in-Arrears’ and ‘Calls-in-Advance’.

Answer:

Calls-in-Arrears—When any shareholder fails to pay the amount due on allotment or on any of the calls, such amount is known as Calls-in-Arrears/Unpaid calls.

Calls-in-Arrears amounts shows the debit balance and the same is shown as a deduction from the paid-up capital on the liabilities side of Balance Sheet.

Accounting Treatment:

Calls-in-Arrears A/C – Dr.

To Share Allotment A/C .

To Share Call/Calls A/C

(Calls-in-Arrears brought into account)

The Articles of Association of a company usually empowers the director to charge interest at a stipulated rate on calls-in-arrears. In case the Articles are silent in this regard, the rule contained in Table A shall be applicable, which states that the interest at a rate not exceeding 5% p.a. shall have to be paid on all unpaid amounts on shares for the period intervening between the day fixed for payment and the time of actual payment there on. On receipt of the call amount together with interest, the following entry will passed

Bank A/C – Dr.

To Call-in-Arrears A/C

To Interest A/C

(For Call-in-Arrears received along with interest.)

Calls-in-Advance – Sometimes some shareholders pay a part or whole of the amount on the calls not yet made. Such amount received in advance from the shareholders is known as ‘Calls-in-Advance’. It may also happen in case of partial allotment of shares when the full amount of application money paid is not adjusted to allotment. The amount received will be adjusted towards the payment of calls as and when it becomes due.

Accounting treatment:

A separate Call-in-Advance A/c is opened for its accounting treatment and following entry will pass.

Bank A/C – Dr.

To Call-in-Advance A/c

(Amount received as Call-in-Advance)

When calls becomes actually due requiring adjustment of ‘Call-in-Advance’ A/C.

Call-in-Advance A/C – Dr.

To Particular Call A/C

(Calls-in-advance adjusted with the call money due.)

The credit balance of Calls-in-Advance A/C is shown separately on the liabilities side of balance sheet under heading ‘Share Capital’ but is not added to the amount of Paid-Up Capital.

As Calls-in-Advance is a liability to the company and it is under an obligation, if provided by the Articles of Association, to pay interest on such amount. In case the articles are silent then Table’A’ shall be applicable, according to which interest @ 6% p.a. may be paid.

Question 7.

Explain the terms ‘Over-subscription’ and ‘Under¬subscription’. How are they dealt with in accounting records?

Answer:

Meaning of Over subscription : Over subscription is a situation when applications received are for more shares than the number of shares offered to the public for subscription through the prospectus of a company.

Accounting treatment in case of over subscription : Three alternatives are available to the directors in such a situation. Firstly, on pro-rata basis and the excess amount received on application be adjusted towards allotment and subsequent calls. For example, applications received for 15,000 shares for 10,000 shares invited for subscription.

![]()

Directors decide to reject 2,500 applications out rightly and make a pro-rata allotment for the remaining 12,500 shares to 10,000 shares. Journal Entries in such a case will be passed as follows :

Under-Subscription : Under-subscription is the situation where applications received for number of shares are less than that have been invited for subscription. This, of course, is subject to the condition that minimum subscription has at least been received because without such subscription the procedure of share issue cannot – proceed further legally. The accounting procedure for under-subscription of shares is as usual as the issue of fresh shares.

Question 8.

Describe the purpose for which a company can use ‘Securities Premium Account’.

Answer:

Meaning – Shares are said to be issued at premium when they are issued at a price higher than the face value. The excess of issue price over the face value is called as the amount of ‘Share Premium’, at a premium of Rs. 5. The premium on issue of shares (whether received in cash or in kind) is a capital receipt and not a revenue receipt and must be credited to a separate account called ‘Securities Premium Account’.

Purposes – According to Sec. 78 of the Companies Act 1956, the Securities premium may be applied only for the following purposes –

- To issue fully paid bonus shares to the members.

- To write off preliminary expenses of the company.

- To write off the expenses of or the commission paid or discount allowed on any issue of shares or debentures of the company.

- To provide for the premium payable on the redemption of any redeemable preference shares or of any debentures of the company.

The use of Securities Premium for purposes other than those mentioned above requires the compliance of the provisions of the Act relating to reduction of share capital.

Question 9.

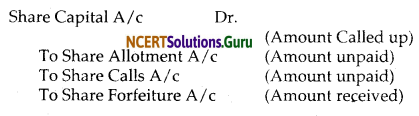

State clearly the conditions under which a company can issue shares at a discount.

Answer:

Issue of shares at discount: When the shares of a company are issued at an amount less than the nominal value of share, they are known as issue of shares at discount. According to section 79, a company is permitted to issue shares at a discount in the following conditions :

(i) Such issue must be authorized by passing an ordinary resolution in general meeting of the company and sanctioned by Company Law Board.

(ii) The maximum rate of discount at which shares are issued must not exceed 10 percent of the face value of shares. In special circumstances, if board convincted, the rate of discount can be more than 10%.

(iii) In order to issue such shares at least one year must have elapsed since the company was entitled to commence the business.

![]()

(iv) Such shares should of a class, which has already been issued.

(v) Such shares must be issued within two months from the date of received sanction for the same from the Central Government.

From the above, it is clear that restrictions placed on shares issued at discount are stated that:

- a new company cannot issue shares at discount and

- a new class, of shares cannot be issued at a discount.

Accounting treatment on such shares should be done by debiting the amount of discount denotes a loss to the company shown as capital nature loss under the head Miscellaneous expenditure in the asset side of Balance Sheet. It is written off by charging from Security Premium account or by Profit and Loss Account over a period of time.

Accounting Entry may be passed as follows:

Share Allotment A/c – Dr.

Discount on issue of shares A/c – Dr.

To Share Capital A/c

(For amount due on allotment and discount on issue brought into account)

Question 10.

Explain the term ‘Forfeitue of Shares’ and give the accounting treatment on forfeitue.

Answer:

When a shareholder fails to pay calls, the company, if empowered by its articles of association, may forfeit the shares of a defaulting shareholder. But before the directors forfeit the shares, the following procedures has to be followed :

(i) A notice is required to be sent to the defaulting shareholder requesting him to pay the calls in arrears along with interest within 14 days of the receipt of the notice.

(ii) If the notice also fails to get the money, the Company secretary issues a warning letter informing the defaulting shareholder that if money is not received by the company within next 14 days of the receipt of the warning letter, the shares may be forfeited by the company.

(iii) When the final notice also fails to realise the calls in arrears, a list of defaulting shareholders is prepared and placed before the Board of Directors who forfeit such shares by passing a resolution to that effect.

(iv) After the shares have been forfeited by the Board of Directors, Company secretary sends a copy of the resolution to the defaulting shareholders with a request to send back the share certificates to the company. Public notice to this effect is also given in the national daily newspapers.

Upon forfeiture, the original shareholders cases to be a member and his name is removed from the register of members.

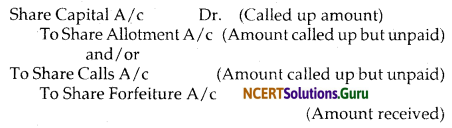

Accounting treatment: Entries regarding the forfeiture of shares may be passed in the following three conditions :

(i) Forfeiture of shares issued at Par: When the shares issued at par are forfeited, following journal entry required to be passed :

(ii) Forfeiture of shares issued at Premium:

(a) When premium is received: Where shares originally issued at a premium, on which premium amount has been fully realised, are later on forfeited due to non-payment of allotment/call money, the amount of premium is not to be debited at the time of forfeiture of shares. Following is the Journal Entry required to be passed :

(b) When premium is not received : If shares originally issued at a premium on which the premium amount has not been received either wholly or partially are subsequently forfeited, share premium account is debited with the amount of premium along with the share capital at the time of forfeiture of shares. The Journal Entry may be passed as follows :

(iii) Forfeiture of shares issued at Discount: When shares forfeited were originally issued at discount, the discount on such shares must be cancelled or written back. It should be credited at the time of forfeiture in order to balance on Discount on issue of Shares Account.

Following journal entry may be passed to record the forfeiture of shares issued at discount.

Numerical Questions

Question 1.

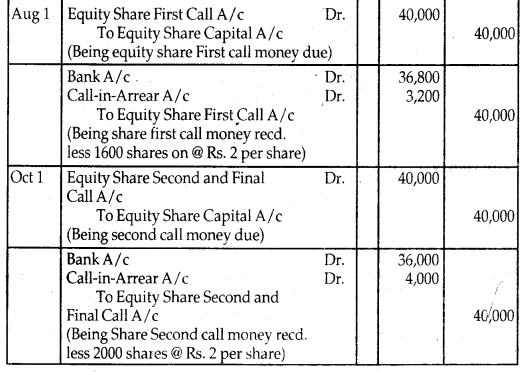

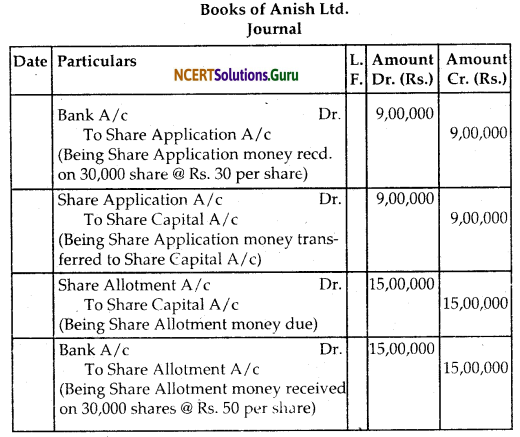

Anish Limited issued 30,000 equity shares of Rs. 100 each payable at Rs. 30 on application, Rs. 50 on allotment and Rs. 20 on 1st and final call. All money was duly received.

Record these transactions in the journal of the company.

Answer:

![]()

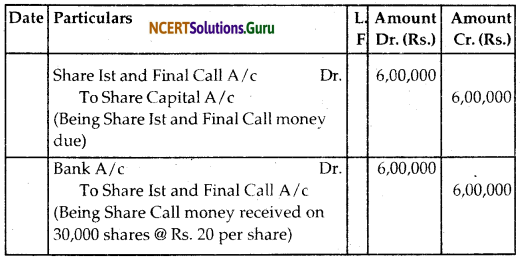

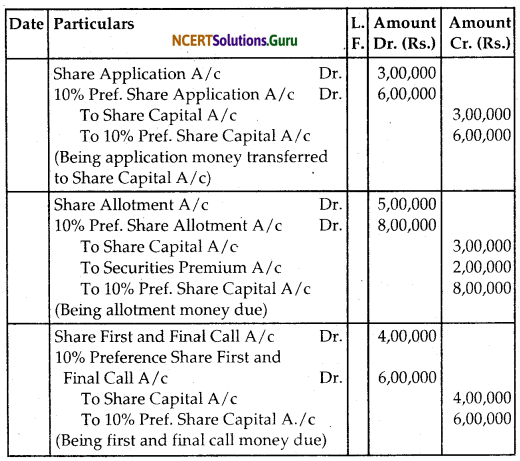

Question 2.

The Adersh Control Device Ltd. was registered with the authorised capital of Rs. 3,00,000 divided into 30,000 shares of Rs. 10 each, which were offered to the public. Amount payable as Rs. 3 per share on application, Rs. 4 per share on allotment and Rs. 3 per share on first and final call. These shares were fully subscribed and all money was duly received. Prepare Journal and Cash Book.

Answer:

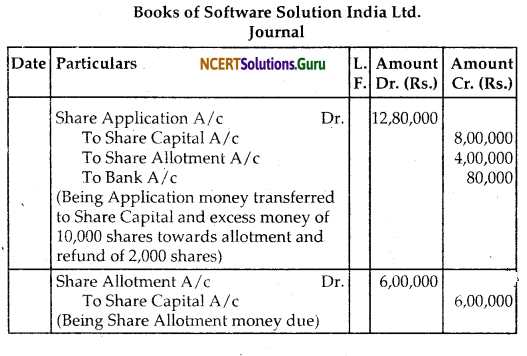

Question 3.

Software Solution India Ltd. inviting application for 20,000 equity share of Rs. 100 each, payable Rs. 40 on application, Rs. 30 on allotment and Rs. 30 on call. The company received applications for 32,0 00 shares. Application for 2,000 shares were rejected and money returned to Applicants. Applications for 10,000 shares were accepted in full and applicants for 20,000 share allotted half of the number of share applied and excess application money adjusted into allotment. All money received due on allotment and call.

Prepare journal and cash book.

Answer:

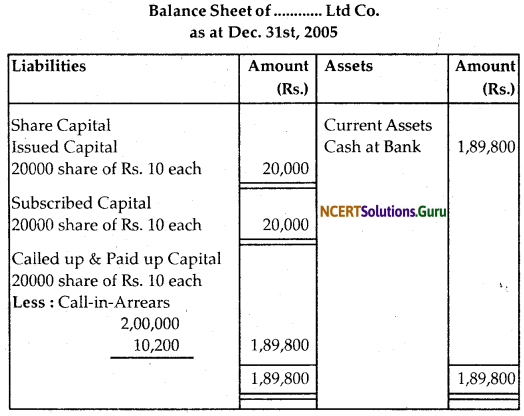

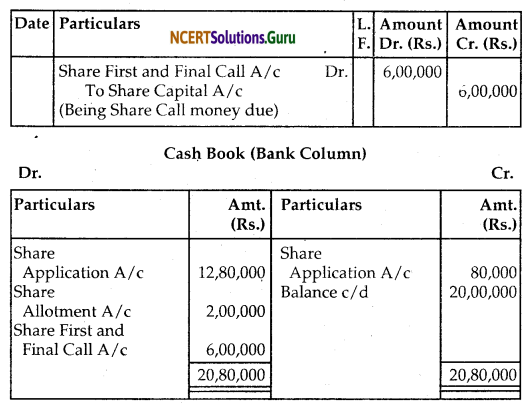

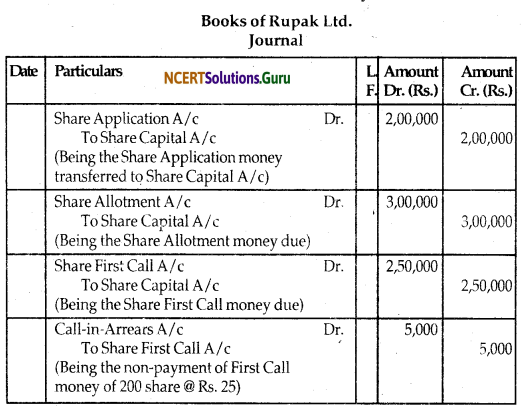

Question 4.

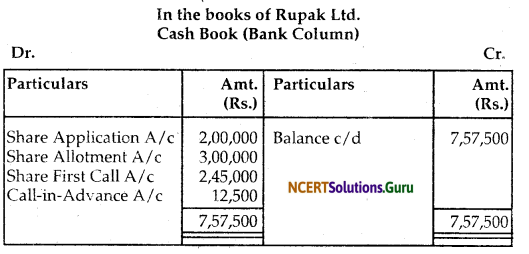

Rupak Ltd. issued 10,000 shares of Rs. 100 each payable at Rs. 20 per share on application, Rs. 30 per share on allotment and balance in two calls of Rs. 25 per share. The application and allotment money were duly received. On first call all member pays their dues except one member holding 200 shares, while another member holding 500 shares paid for the balance due in full. Final call was not made. Give journal entries and prepare cash book.

Answer:

![]()

Question 5.

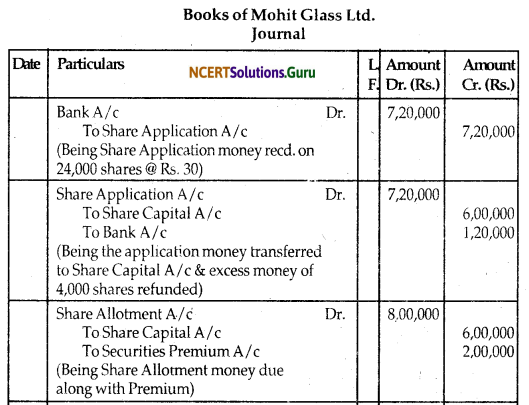

Mohit Glass Ltd. issued 20,000 shares of Rs. 100 each at Rs. 110 per share, payable Rs. 30 on application, Rs. 40 on allotment (including Premium), Rs. 20 on first call and Rs. 20 on final call. The applications were received for 24,000 shares and allotted 20,000 shares and reject 4,000 shares and amount returned thereon. The money was duly received. Give journal entries.

Answer:

Question 6.

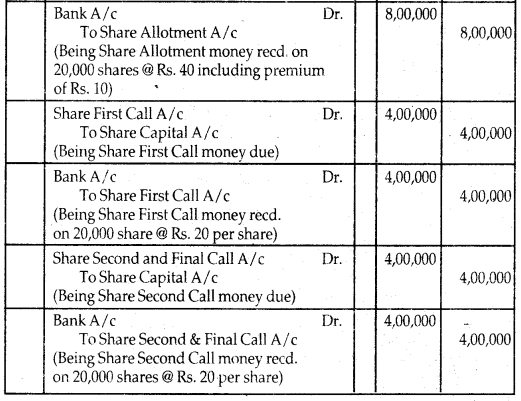

A limited company offered for subscription of 1,00,000 equity shares of Rs. 10 each at a premium of Rs. 2 per share. 2,00,000. 10% Preference shares of Rs. 10 each at par.

All the shares were fully subscribed, called-up and paid. Record these transactions in the journal and cash book of the company.

Answer:

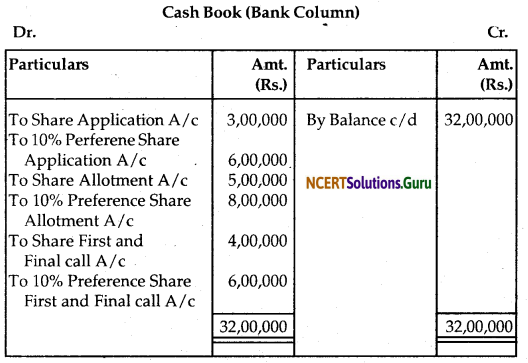

Question 7.

Eastern Company Limited, having an authorised capital of Rs. 10,00,000 in shares of Rs. 10 each, issued 50,000 shares at a premium of Rs. 3 per share payable as follows :

On Application – Rs. 3 per share

On Allotment (including premium) – Rs. 5 per share

On First call (due three months after – Rs. 3 per share allotment) and the balance as an when required.

Applications were received for 60,000 shares and the directors alloted the shares as follows :

(a) Applicants for 40,000 shares received shares, in full.

(b) Applications for 15,000 shares received an allotment of 8,000 shares.

(c) Applicants for 5000 shares received 2000 shares on allotment, excess money being returned.

All amounts due on allotment were received. The first call was duly made and the money was received with the exception of the call due on 100 shares. Give journal and cash book entries to record these transactions of the company. Also prepare the Balance Sheet of the company.

Answer:

![]()

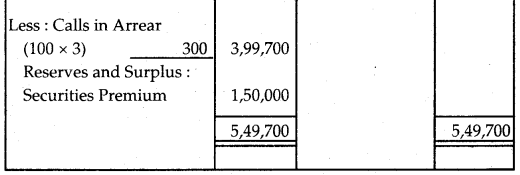

Question 8.

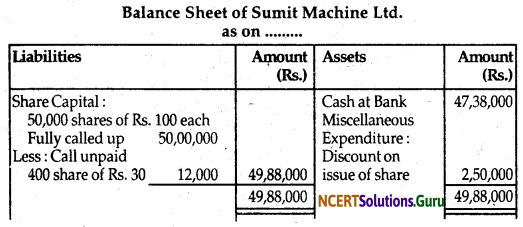

Sumit Machine Ltd. issued 50,000 shares of Rs. 100 each at discount of 5%. The shares were payable Rs. 25 on application. Rs. 40 on allotment and Rs. 30 of first and final call. The issue were fully subscribed and money were dully received except the final call on 400 shares. The discount was adjusted on allotment. Give journal entries and prepare balance sheet.

Answer:

Question 9.

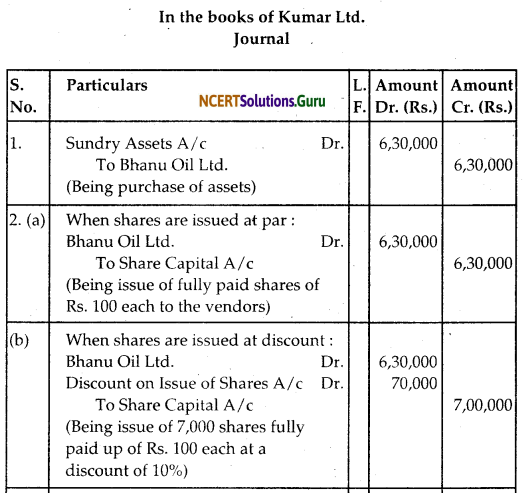

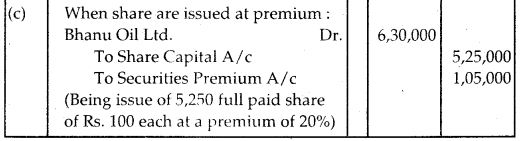

Kumar Ltd. purchase assets of Rs. 6,30,000 from Bhanu Oil Ltd. Kumar Ltd. issue equity share of Rs. 100 each fully paid in consideration. What journal entries will be made, if the share are issued, (a) at par, (b) at discount of 10 % and (c) at premium of 20%. [Ans : No. of shares issued (a) 6,300, (b) 7,000, (c) 5250]

Answer:

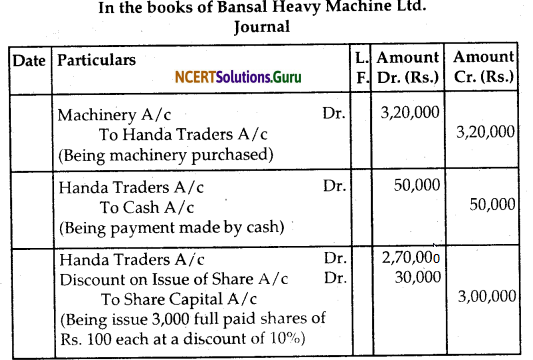

Question 10.

Bansal Heavy machine Ltd. purchased machine worth Rs. 3,20,000 from Handa Trader. Payment was made as Rs. 50,000 cash and remaining amount by issue of equity share of the face value of Rs. 100 each fully paid at an issue price of Rs. 90 each. Give journal entries to record the above transaction.

(Answer:: No of shares issued 3,000 shares)

Answer:

![]()

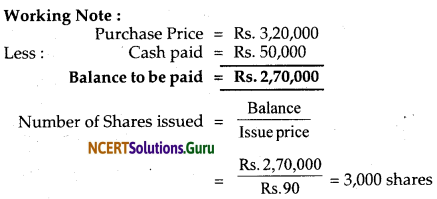

Question 11.

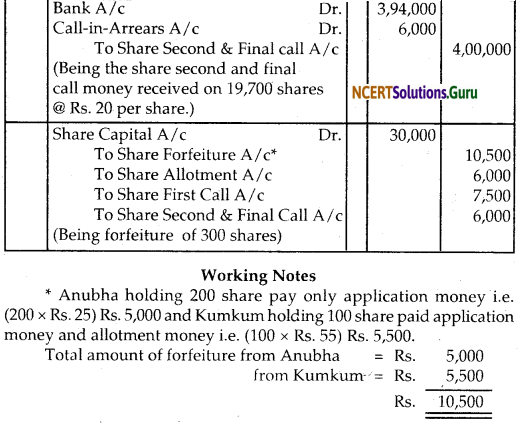

Naman Ltd. issued 20,000 shares of Rs. 100 each, payable Rs. 25 on application, Rs. 30 on allotment, Rs. 25 on first call and the balance on final call. All money dully received except Anubha, who holding 200 Shares did not pay allotment and calls money and Kumkum who holding 100 share did not pay both the calls. The directors forfeited shares of Anubha and Kumkum. Give journal entries.

Answer:

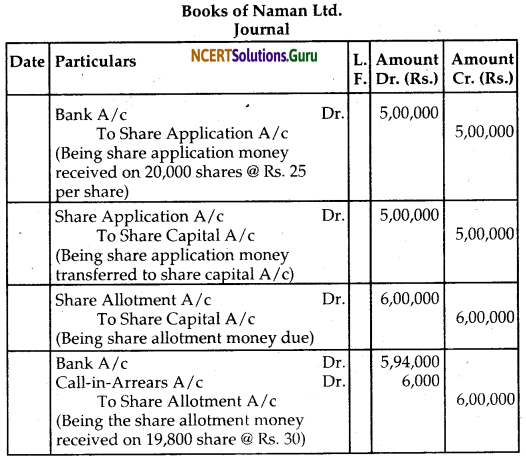

Question 12.

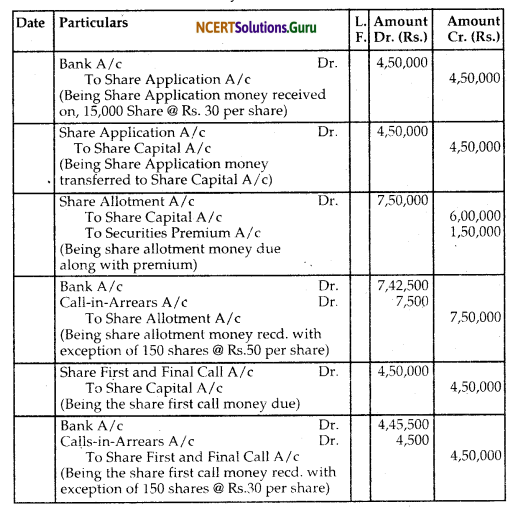

Kishna Ltd issued 15,000 shares of Rs. 100 each at a premium of Rs. 10 per share, payable as follows :

On Application – Rs. 30

On Allotment – Rs. 50 [inclding premium]

On first and final call – Rs. 30

All the shares subscribed and the company received all the money due, With the exception of the allotment and call money on 150 shares. These shares were forfeited and reissued to Neha as fully paid share of Rs. 120 each. Give Journal entries in the books of the company.

Answer:

![]()

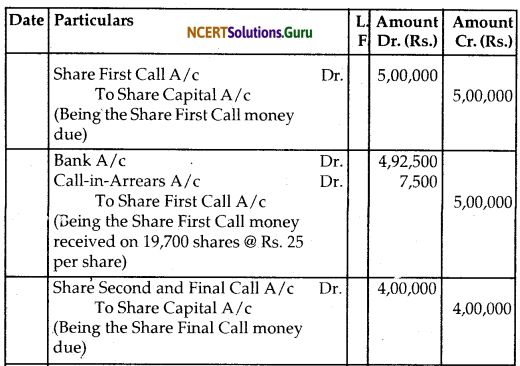

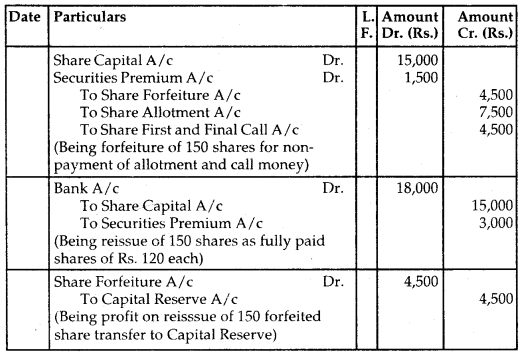

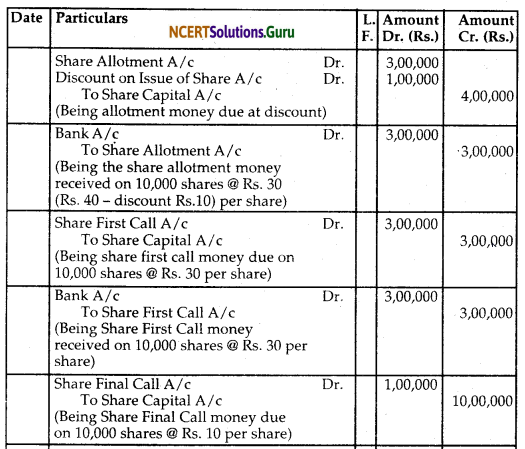

Question 13.

Arushi Computers Ltd issued 10,000 equity shares of Rs. 100. each at 10% discount. The net amount payable as follows :

On Application – Rs. 20

On Allotment – Rs. 30 [Rs. 40 – discount Rs. 10]

On first call – Rs. 30

On final call – Rs. 10

A Shareholder holding 200 shares did not pay final call. His shares were forfeited. Out of these 150 shares were reissued to Ms. Sonia at Rs. 75 per shares.

Give journal entries in the books of the company.

(Answer:: Capital Reserve Rs. 9,750)

Answer:

![]()

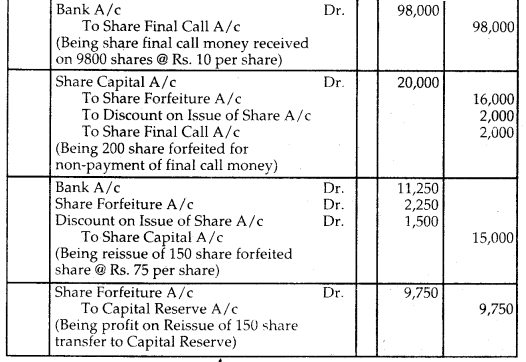

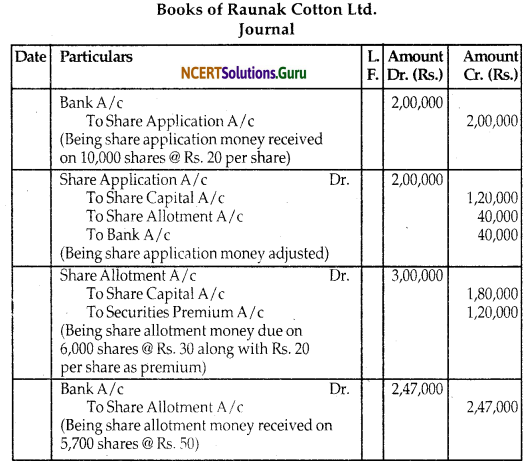

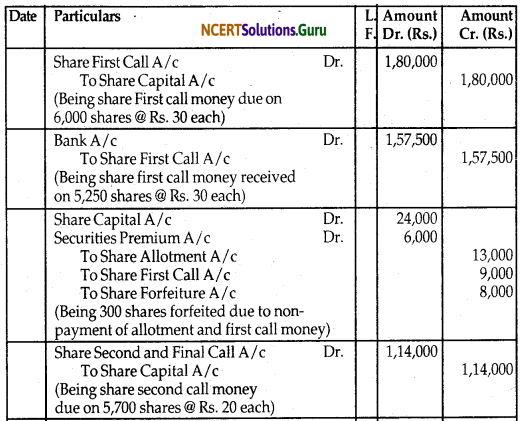

Question 14.

Raunak Cotton Ltd. issued a prospectus inviting application for 6,000 equity shares of Rs. 100 each at a premium of Rs. 20, per shares, payable as follows:

On Application – Rs. 20

On Allotment – Rs. 50 [including premium]

On first call – Rs. 30

On final call – Rs. 20

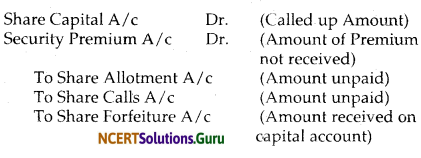

Application were received for 10,000 share and allotment was made Pro-rata to the application of 8,000 shares, the remaining application being refused. Money received in excess on the application was adjusted toward the amount due on allotment.

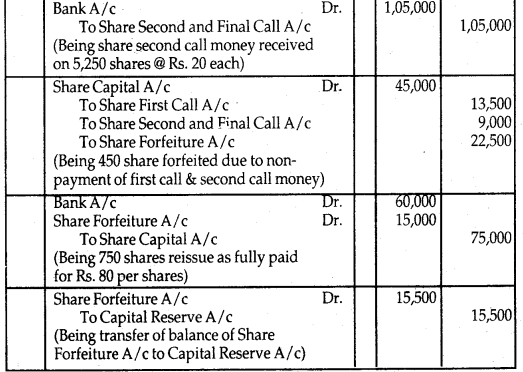

Rohit, to whom 300 shares were alloted failed to pay allotment and calls money, his shares were forfeited. Like, who applied for 600 shares, failed to pay the two calls and her share were also forfeited. All these shares were sold to Kartika as fully paid for Rs. 80 per shares. Give journal entries in the books of the company.

Answer:

![]()

Question 15.

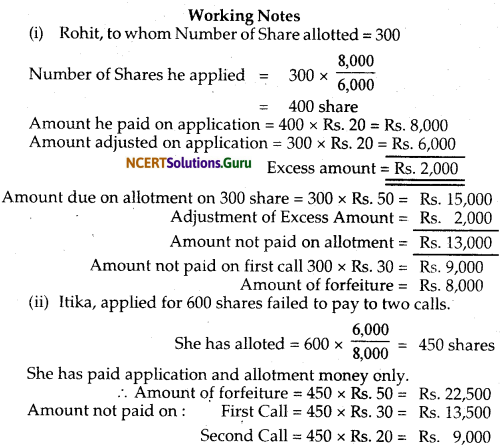

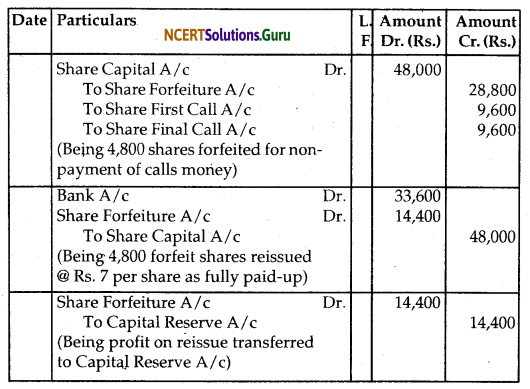

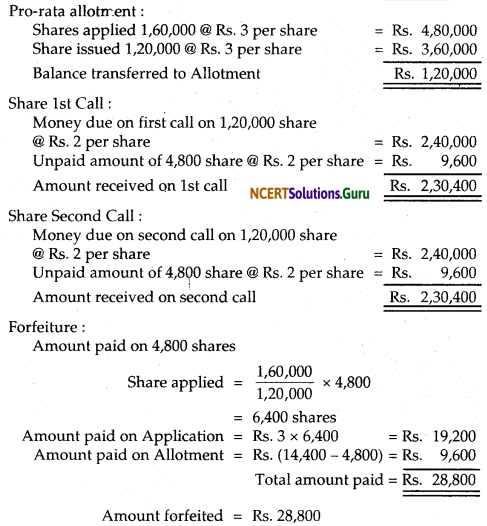

Himalaya Company Limited issued for public subscription of 1,20,000 equity shares of Rs. 10 each at a premium of Rs. 2 per share payable as under :

With Application – Rs. 3 per share

On allotment (including premium) – Rs. 5 per share

On First Call – Rs. 2 per share

On Second and Final Call – Rs. 2 per share

Applications were received for 1,60,000 shares. Allotment was made on pro-rata basis. Excess money on application was adjusted against the amount due on allotment.

Rohan, whom 4,800 shares were allotted, failed to pay for the two calls. These shares were subsequently forfeited after the second call was made. All the shares forfeited were reissued to Teena as fully paid at Rs. 7 per share.

Record journal entries in the books of the company to record these transactions relating to share capital. Also show the company’s balance sheet. (Answer: Capital Reserve Rs. 14,400)

Answer:

![]()

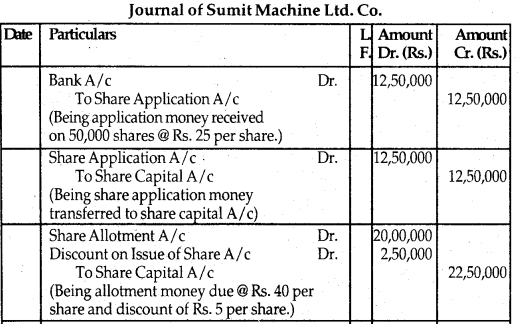

Question 16.

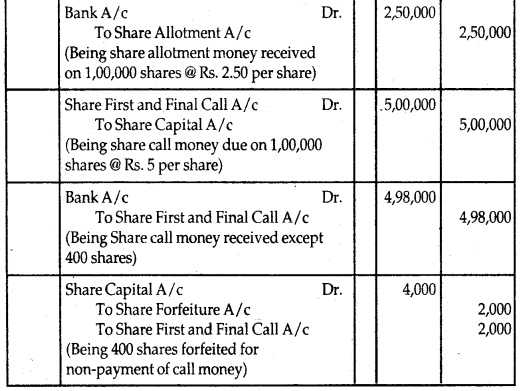

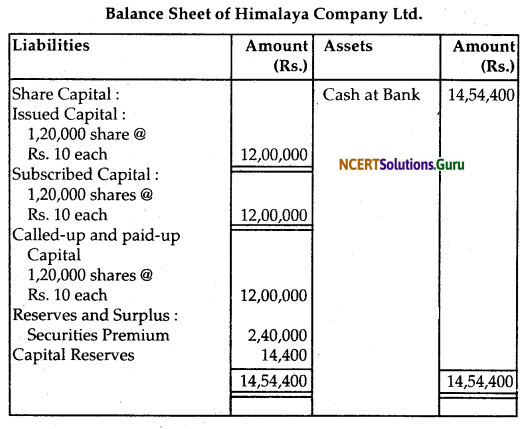

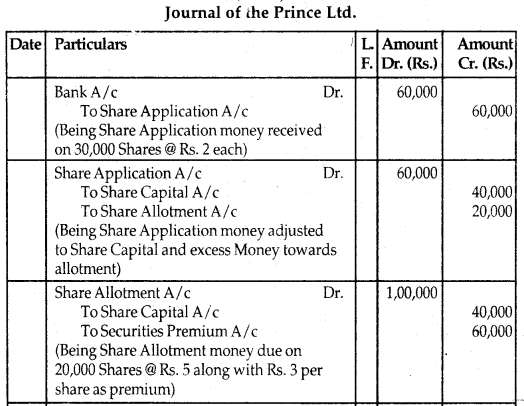

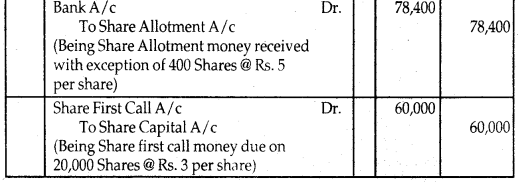

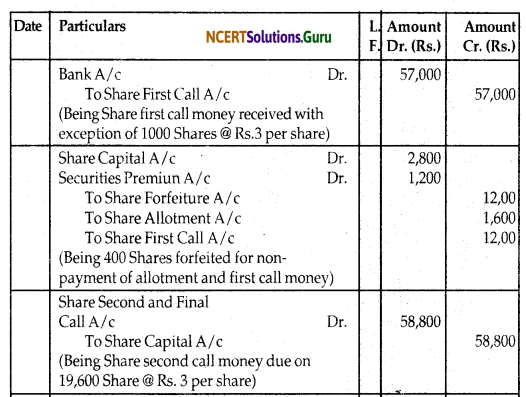

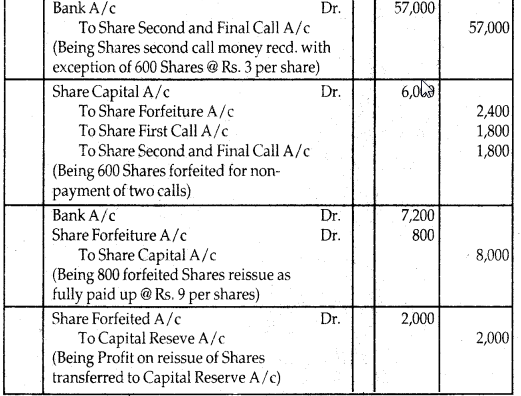

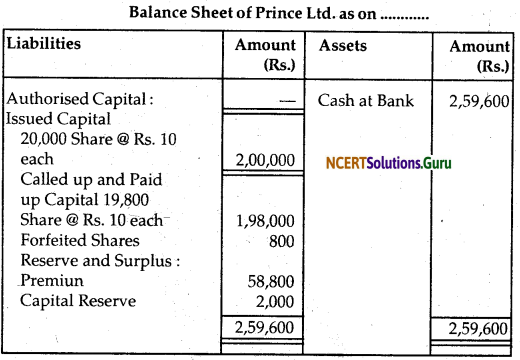

Prince Limited issued a prospectus inviting applications for 20,000 equity Shares of Rs. 10 each at a premium of Rs. 3 Per Share payable as follows:

With Application – Rs. 2

On Allotment (including premium) – Rs. 5

On First Call – Rs. 3

On Second Call – Rs. 3

Applications were received for 30,000 Shares and allotment was made on prorata basis. Money overpaid on to the amount due on allotment. applications was adjusted Mr. ‘Mohit’ whom 400 Shares were allotted, failed to pay the allotment money and the first call, and his Shares were forfeited after the first call. Mr. ‘Joly’, whom 600 Shares were allotted, failed to pay for the two calls and hence, his Shares were forfeited.

Of the Shares forfeited, 800 Shares were reissued to Supriya as fully paid for Rs. 9 per shares, the whole of Mr. Mohit’s shares being included.

Record journal entries in the books of the Company and prepare the Balance Sheet.

(Ans : Capital Reserve Rs., 2000)

Answer:

![]()

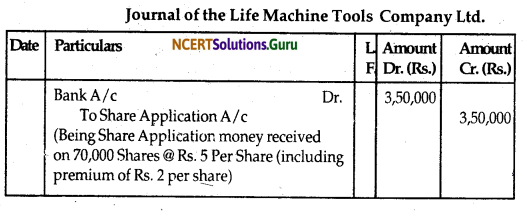

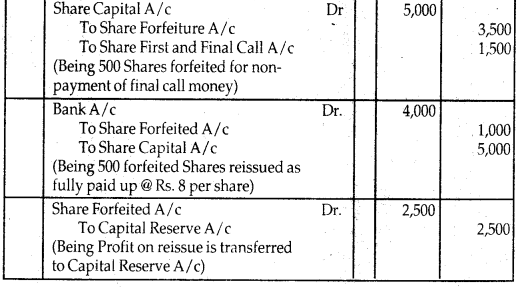

Question 17.

Life machine tools Limited, issued 50,000 equity Shares of Rs. 10 each at Rs. 12 per share, payable at to Rs. 5 on application (including premium), Rs. 4 on allotment and the balance on the first and final call. Application for 70,000 Shares had been received. Of the cash received, Rs. 40,000 was returned and Rs. 60,000 was applied to the amount due on allotment, the balance of which was paid. All Shareholders paid the call due, with the exception of one Shareholder of 500 Shares. These Shares were forfeited and reissued as fully paid at Rs. 8 Per Share. Journalise the transactions. (Answer: Capital Reserve Rs. 2,500)

Answer:

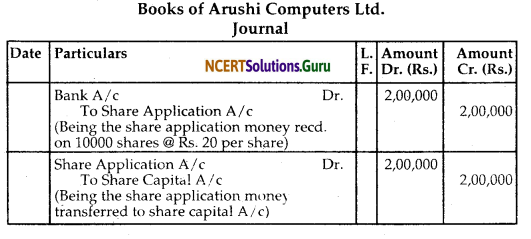

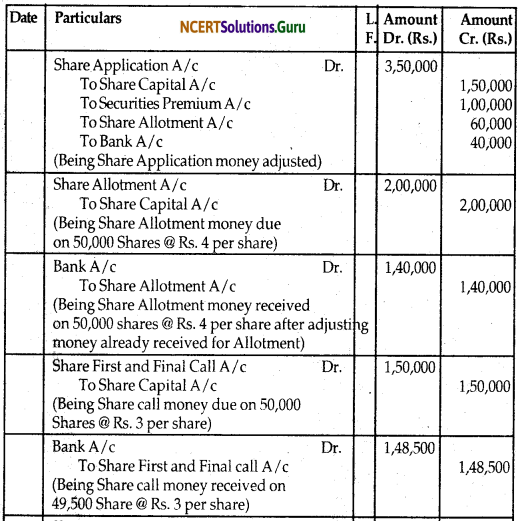

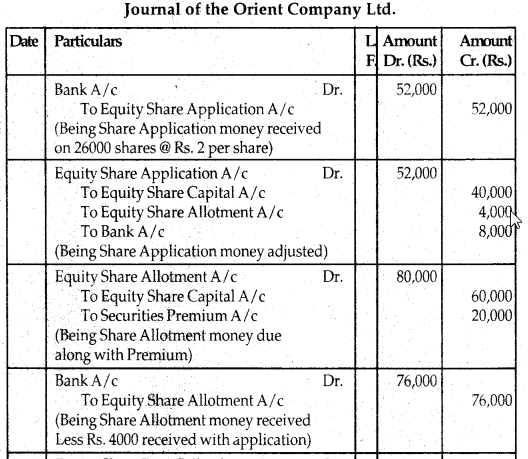

Question 18.

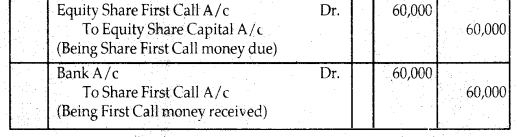

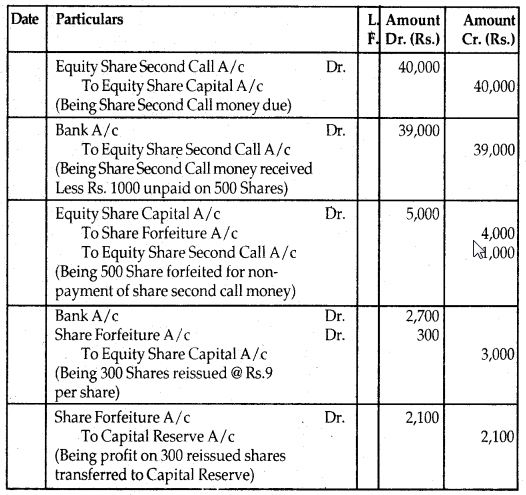

The Orient Company Limited offered for public subscription 20,000 equity shares of Rs. 10 each at a premium of 10% payable at Rs. 2 on application; Rs. 4 on allotment including premium; Rs. 3 on First Call and Rs. 2 on Second and Final Call. Applications for 26,000 shares were received. Applications for 4,000 shares were rejected. Pro-rata allotment was made to the remaining applicants. Both the calls were made and all the money were received except the final call on 500 shares which were forfeited. 300 of the forfeited shares were later on issued as fully paid at Rs. 9 per share. Give journal entries and prepare the balance sheet.

Answer:

![]()

Question 19.

Alfa Limited invited applications for 4,00,000 its equity shares of Rs. 10 each on the following terms:

Payable on application – Rs. 5 per share

Payable on allotment – Rs. 3 per share

Payable on first and final call – Rs. 2 per share

Applications for 5,00,000 shares were received. It was decided :

(a) to refuse allotment to the applicants for 20,000 shares;

(b) to allot in full to applicants for 80,000 shares;

(c) to allot the balance of the available shares’ pro-rata among the other applicants; and

(d) to utilise excess application money in part as payment of allotment money.

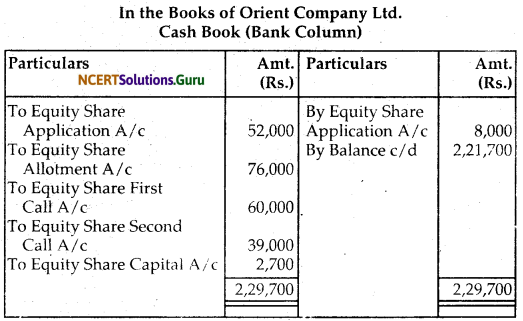

One applicant whom shares had been allotted on pro-rata basis, did not pay the amount due on allotment and on the call, and his 400 shares were forfeited. The shares were reissued @ Rs. 9 per share. Show the journal and prepare cash book to record the above.

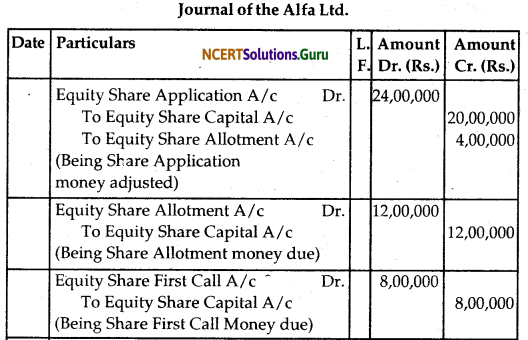

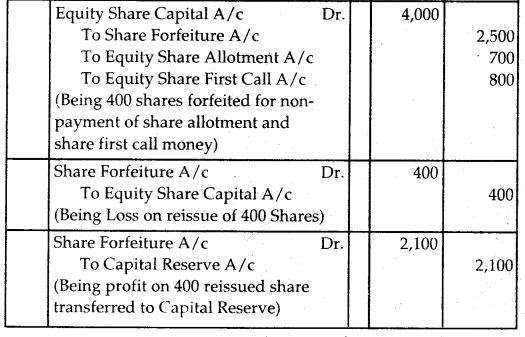

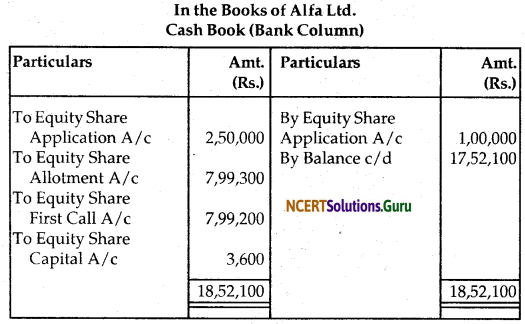

Answer:

![]()

Question 20.

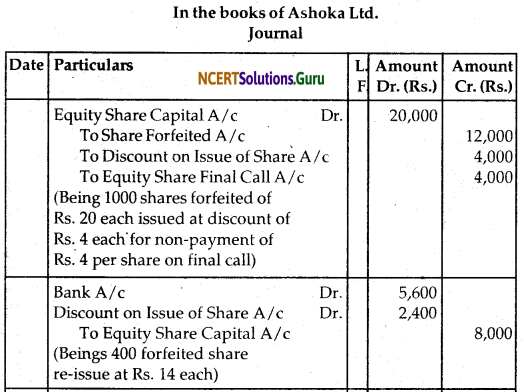

Ashoka Limited Company which had issued equity shares of Rs. 20 each at a discount of Rs. 4 per share forfeited 1,000 shares for non-payment of final call of Rs. 4 per share. 400 of the forfeited shares are reissued at Rs. 14 per share out of the remaining shares of 200 shares reissued at Rs. 20 per share. Give journal entries for the forfeiture and reissue of shares and show the amount transferred to Capital Reserve and the balance in Share Forfeiture Account.

Answer:

Question 21.

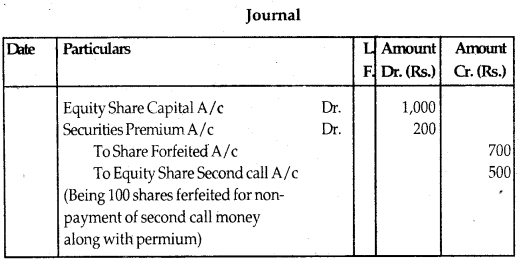

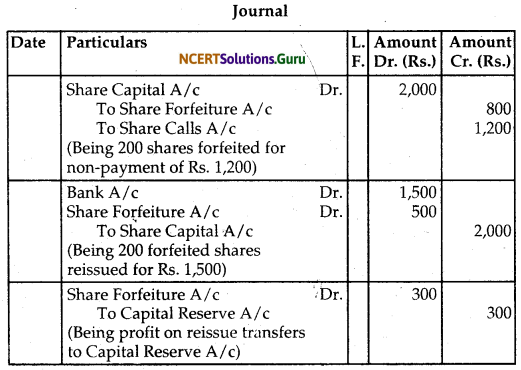

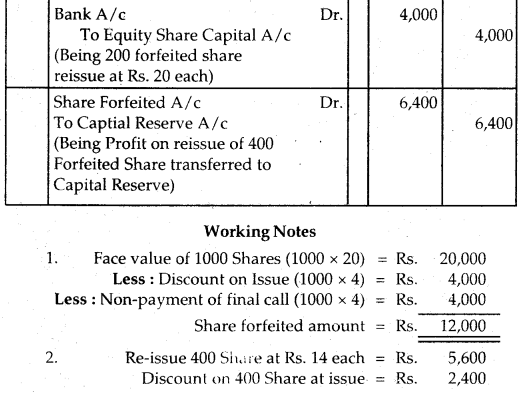

Amit holds 100 shares of Rs. 10 each on which he has paid Re. 1 per share as application money. Bimal holds 200 shares of Rs. 10 each on which he has paid Re. 1 and Rs. 2 per share as application and allotment money, respectively. Chetan holds 300 shares of Rs. 10 each and has paid Re. 1 on application, Rs. 2 on allotment and Rs. 3 for the first call. They all fail to pay their arrears and the second call of Rs. 2 per share and the directors, therefore, forfeited their shares. The shares are reissued subsequently for Rs. 11 per share as fully paid, Journalise the transactions.

Answer:

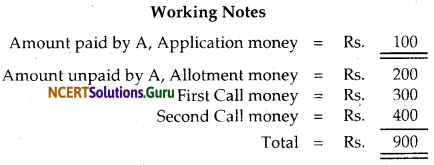

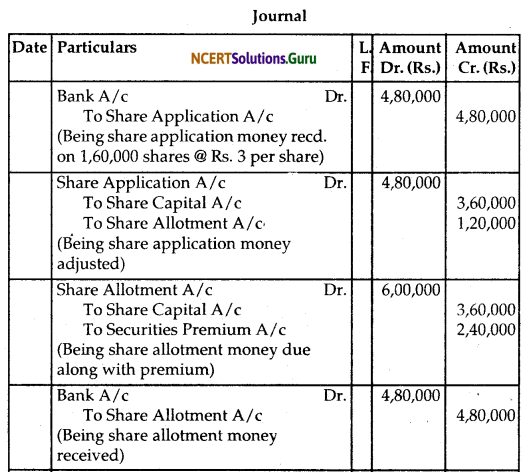

Working Notes

Total Amount paid = 100+200+400+300+600+ 900= 2,500

Total Amount not paid on Allotment = Rs. 200

Total Amount not paid on Ist call = Rs. 900

Total Amount not paid on IInd call = Rs. 1200

Forfeiture of Shares of Amit

Amit hold 100 Share of Rs. 10 each

Amount paid on Application = Rs. 100

Amount not paid on Allotment = Rs. 200

Amount not paid on Ist call = Rs. 300

Amount not paid on IInd call= Rs. 200

Forfeiture of Shares of Bimal

Bimal hold 200 Share of Rs. 10 each

Amount paid on Application = Rs. 200

Amount paid on Allotment = Rs. 400

Amount not paid on Ist call – Rs. 600

Amount not paid on IInd call= Rs. 400

Forfeiture of Shares of Chetan

Chetan hold 300 Share of Rs. 10 each

Amount paid on Application = Rs. 300

Amount paid on Allotment = Rs. 600

Amount paid on Ist call = Rs. 900

Amount not paid on IInd call = Rs. 600

Question 22.

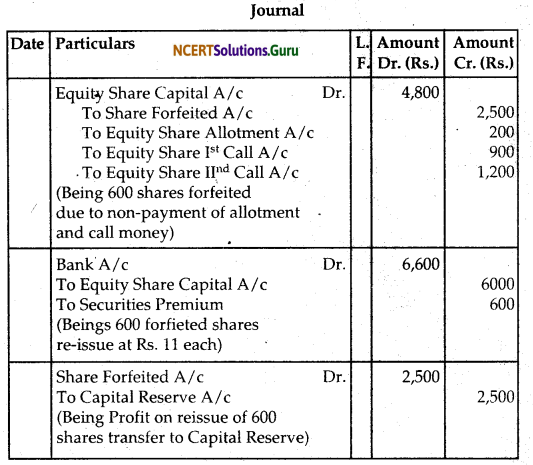

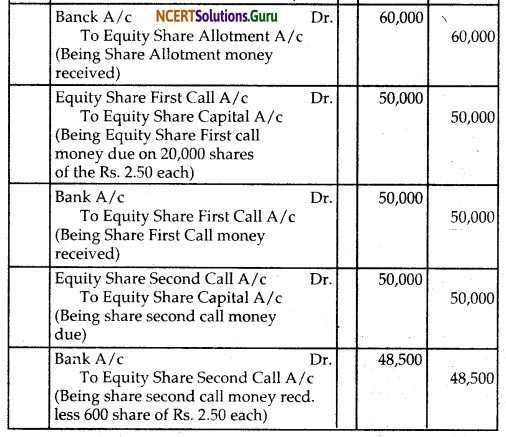

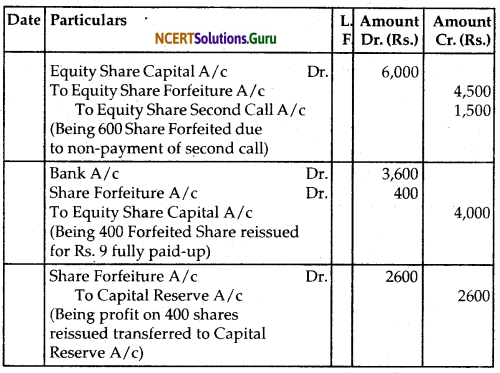

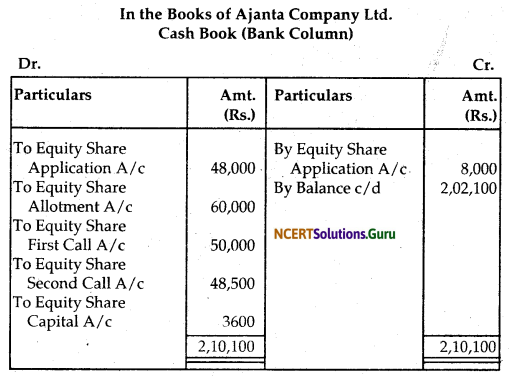

Ajanta Company Limited having a normal capital of Rs. 3,0, 000 divided into shares of Rs. 10 each offered for public subscription of 20,000 shares payable at Rs. 2 on application; Rs. 3 on allotment and the balance in two calls of Rs. 2,50 each. Applications were received by the company for 24,000 shares. Applications for 20,000 shares were accepted in full and the shares allotted. Applications for the remaining shares were rejected and the application money was refunded.

All money due were received with the exception of the final call on 600 shares which were forfeited after legal formalities were fulfilled. 400 shares of the forfeited shares were reissued at Rs. 9 per share. Record necesary journal entries and prepare the Balance Sheet showing the amont transferred to capital reserve and the balance in Share Forfeiture Account.

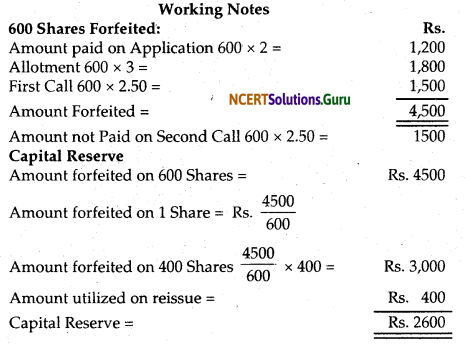

Answer:

![]()

Question 23.

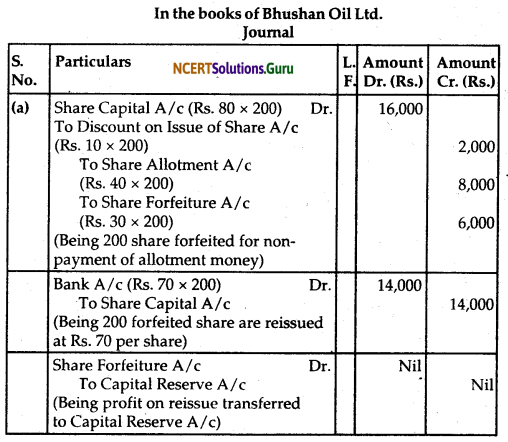

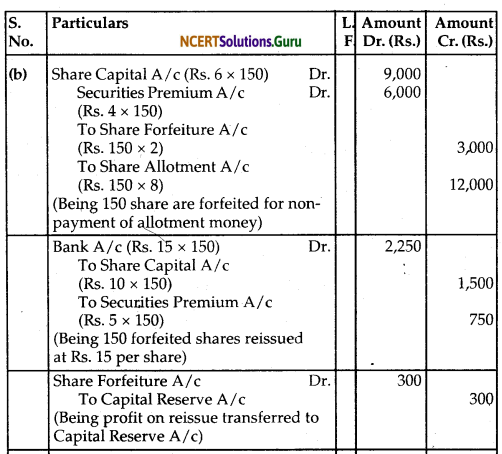

Journalise the following transactions in the books of Bhushan Oil Ltd:

(a) 200 shares of Rs. 100 each issued at a discount of Rs. 10 were forfeited for the non-payment of allotment money of Rs. 50 per share. The first and final call of Rs. 20 per share on these were not made. The foreited share were reissued at Rs. 70 per share as fully paid-up.

(b) 150 shares of Rs. 10 each issued at a premium of Rs. 4 per share payable with allotment were foreited for non-payment of allotment money of Rs. 8 per share including premium. The first and final call of Rs. 4 per share were not made. The forfeited share were reissued at Rs. 15 per share fully paid-up.

(c) 400 share of Rs. 50 each issued at par were forfeited for non-payment of final call of Rs. 10 per share. These share were reissued at Rs. 45 per share fully paid-up.

(Answer: Capital Reserve (a) Nil, (b) Rs. 300(c) Rs. 14,000)

Answer:

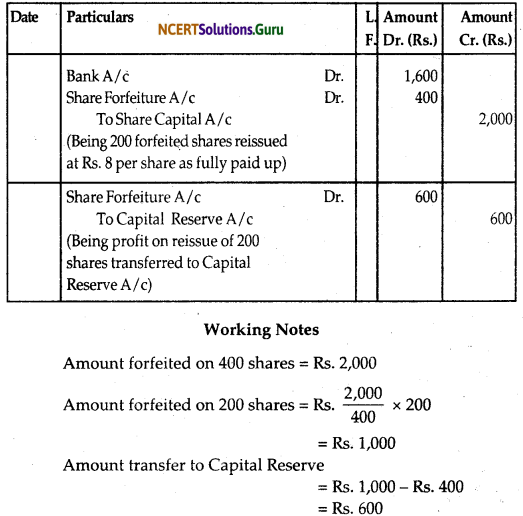

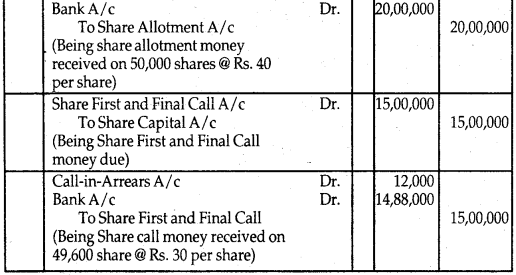

Question 24.

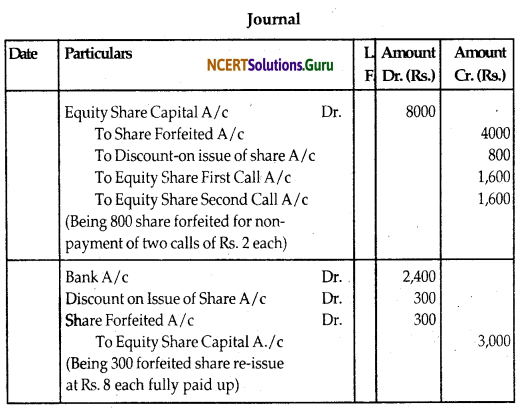

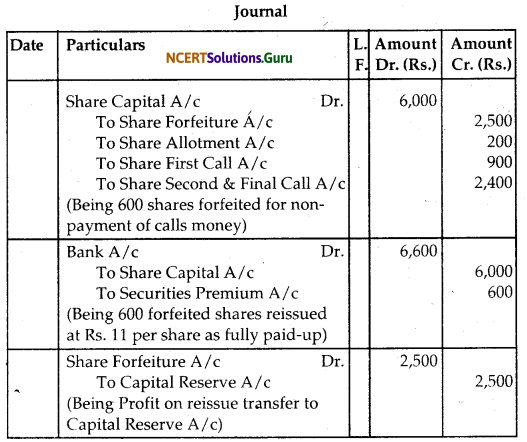

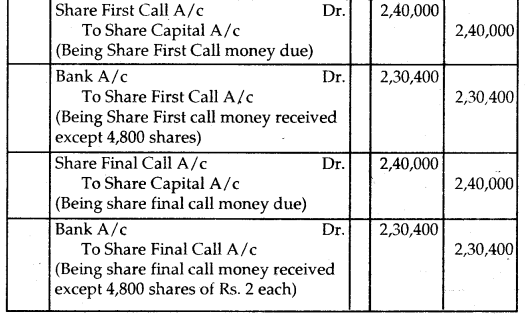

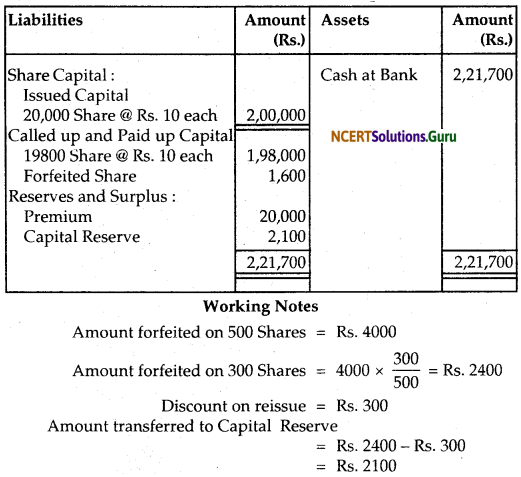

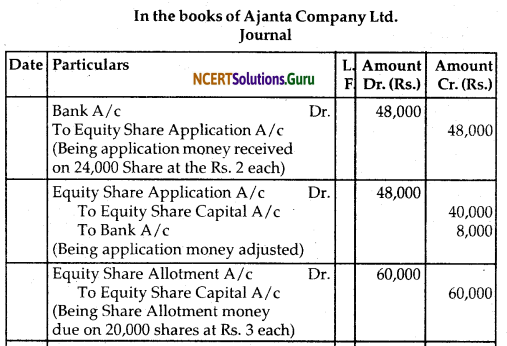

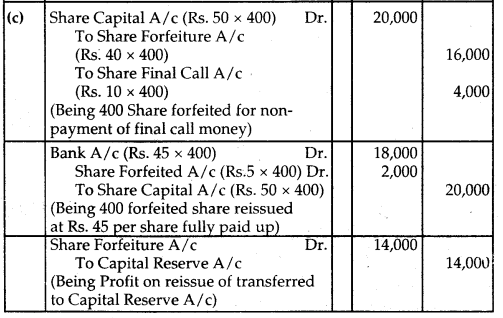

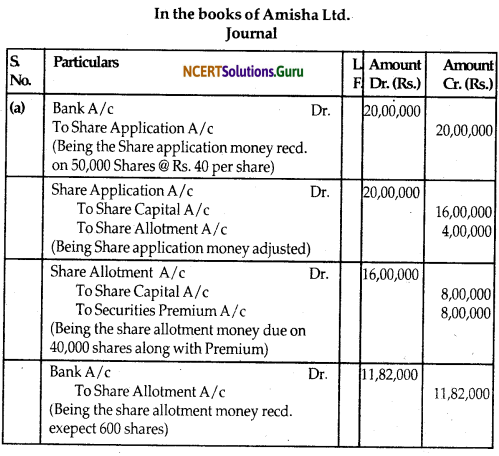

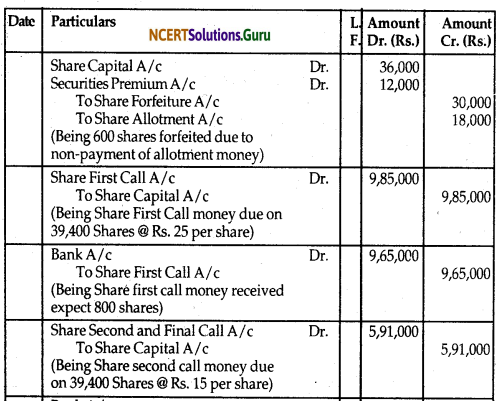

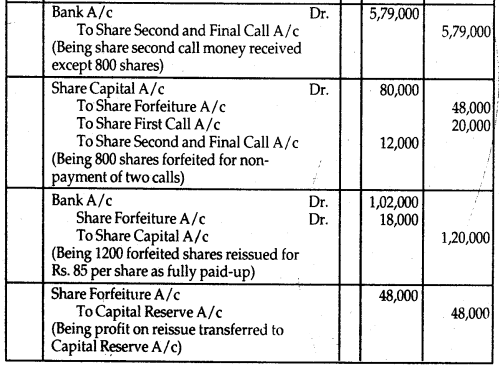

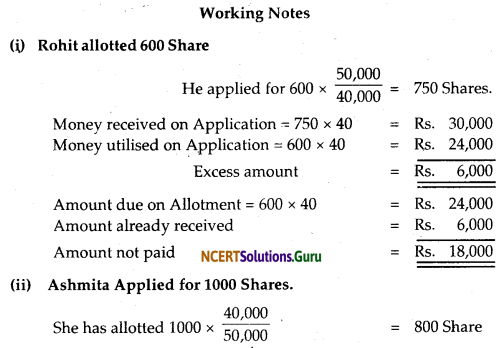

Amisha Ltd. inviting application for 40,000 shares of Rs. 100 each at a premium of Rs. 20 per share payable; on application Rs. 40; on allotment Rs. 40 (including premium): on first call Rs. 25 and Second and final call Rs. 15. –

Application were received for 50,000 shares and allotment was made on pro-rata basis. Excess money on application was adjusted on sums due on allotment.

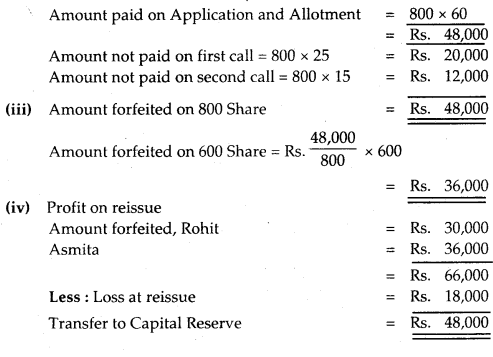

Rohit to whom 600 shares were allotted failed to pay the allotment money and his shares were forfeited after allotment. Ashmita, who applied for 1000 shares failed to pay the, two calls and her shares were forfeited after the second call. Of the shares forfeited, 1200 shares were sold to Kapil for Rs. 85 per share as fully paid, the whole of Rohit’s shares being included. Record neccessary journal entries.

(Answer: Capital Reserve Rs. 48,000; Balance in Share forfeited A/c Rs. 12,000.)

Answer:

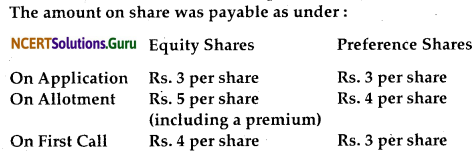

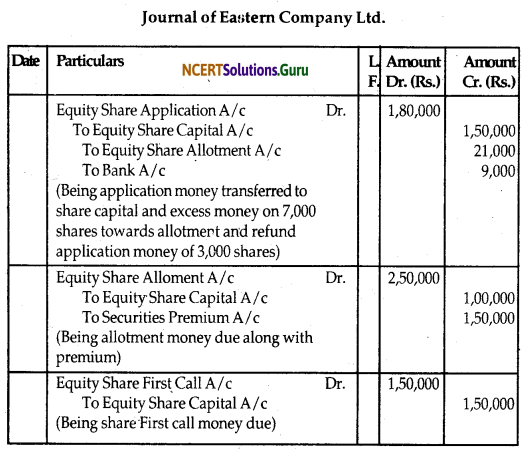

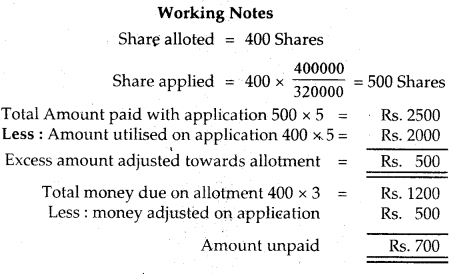

![]()

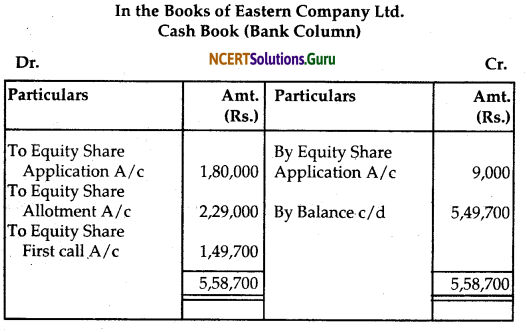

![]()