Detailed, Step-by-Step NCERT Solutions for 11 Accountancy Chapter 16 Accounting for Not-for-Profit Organisation Questions and Answers were solved by Expert Teachers as per NCERT (CBSE) Book guidelines covering each topic in chapter to ensure complete preparation.

Accounting for Not-for-Profit Organisation NCERT Solutions for Class 11 Accountancy Chapter 16

Accounting for Not-for-Profit Organisation System Questions and Answers Class 11 Accountancy Chapter 16

Test Your Understanding-I (Page No. 20)

Question 1.

State with reasons whether the following statements are TRUE or FALSE –

(i) Receipt and Payment Account is a summary of all capital receipts and payments.

(ii) If there appears a sports fund, the expenses incurred on sports activities will be shown on the debit side of Income and Expenditure Account.

(iii) A credit balance of Income and Expenditure Account denotes excess of expenses over income.

(iv) Scholarships granted to students out of funds provided by Government will be debited to Income and Expenditure Account.

(v) Receipt and Payment Account records the receipts and payments of revenue nature only.

(vi) Donations for specific purposes are always capitalized.

(vii) Opening balance sheet is prepared when the opening balance of capital fund is not given.

(viii) Surplus of Income and Expenditure Account is deducted from the capital/general fund.

(ix) Receipt and Payment Account is equivalent to Profit and Loss Account.

(x) Receipt and Payment Account does not differ with capital and revenue receipts.

Answer:

1. (i) False-Because Receipt and Payment Account is a summary of all cash transactions whether they are capital receipts and payments or revenue receipts and payments.

(ii) False – Because Sports Fund is a special fund of capital nature, so the expenses incurred on sports activities will be deducted from Sports Fund in the Balance Sheet.

(iii) True – Because excess of income over expenditure denotes surplus.

(iv) False – Because Funds provided by the Government is a capital nature, therefore scholarships granted out of funds directly deducted from this fund in the Balance Sheet.

(v) False – Because Receipt and Payment Account is a summary of all cash transactions whether they are capital receipts and payments or revenue receipts and payments.

(vi) True – Because donations for specific purposes are non-recurring in nature so they are always capitalized.

(vii) True – Because opening capital fund is must to ascertain the actual financial position of the organisation.

(viii) False – Because surplus of Income and Expenditure Account increases the capital/general fund of the organisation, so it must be added to capital/general fund.

(ix) False – Because Receipt and Payment Account is merely summary of cash transactions, it does not disclose any information regarding the income/deficit of the organisation.

(x) True – Because Receipt and Payment Account is a summary of all cash transactions whether they are capital receipts and payments or revenue receipts and payments.

![]()

Test Your Understanding-II (Page No. 29)

Question 1.

How would you treat the following items in the case of a ‘not- for-profit’ organisation?

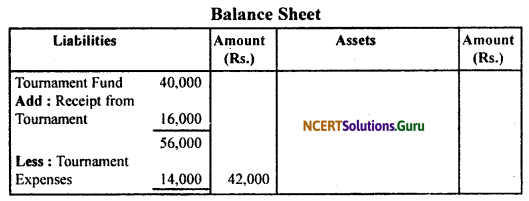

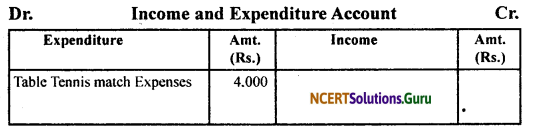

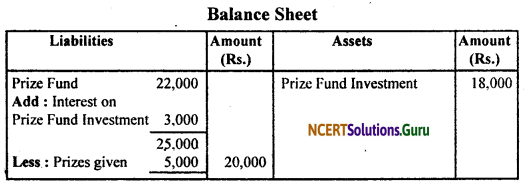

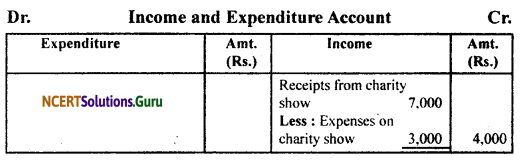

(i) Tournament Fund Rs. 40,000. Tournament Expenses Rs. 14,000. Receipts from Tournament Rs. 16,000.

(ii) Table Tennis match expenses Rs. 4,000.

(iii) Prize Fund Rs. 22,000. Interest on Prize Fund Investments Rs. 3,000. Prize given Rs. 5,000. Prize Fund Investments Rs. 18,000.

(iv) Receipts from Charity Show Rs. 7,000. Expenses on Charity Show Rs. 3,000.

Answer:

(i) Here Tournament Fund is a specific fund. The accounting treatment is as under –

(ii) Table Tennis match expenses is independent of any specific fund. The accounting treatment is as under –

(iii) There is a specific fund i.e. Prize Fund. The accounting treatment is as under –

(iv) There is no specific fund regarding Charity. The accounting treatment is as under –

Do It Yourself (Page No. 25)

Question 1.

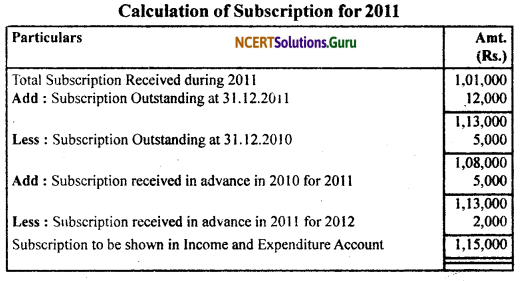

Subscriptions received by the health club during the year 2011 were as under-

Subscriptions Outstanding as on 31.12.2010 — 5,000

Subscriptions Outstanding as on 31.12.2011 — 12,000

Subscriptions received in advance in 2010 for 2011 — 5,000

Calculate the amount of subscriptions to be shown on the income side of Income and Expenditure Account.

Answer:

![]()

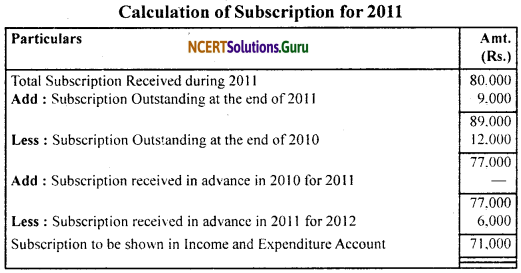

Question 2.

During the year 2011, subscriptions received by a sports club were Rs. 80,000. These included Rs. 3,000 for the year 2010 and Rs. 6,000 for the year 2012. On December 31,2010 the amount of subscriptions due but not received was Rs. 12,000. Calculate the amount of subscriptions to be shown in Income and Expenditure Account as income from subscription.

Answer:

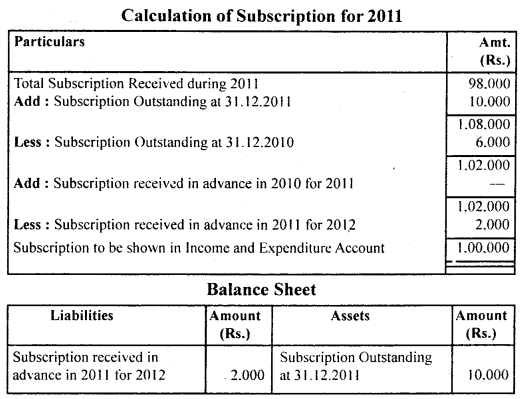

Question 3.

Subscriptions received during the year ended December 31,2011 by Royal Club were as under –

The Club has 500 members each paying @ Rs. 200 as annual subscriptions. Subscriptions outstanding as on December 31,2010 are Rs. 6,000. Calculate the amount of subscriptions to be shown as income in the Income and Expenditure Account for the year ended December 31,2011 and show the relevant data in the Balance Sheet as on that date.

Answer:

Do It Yourself (Page No. 30)

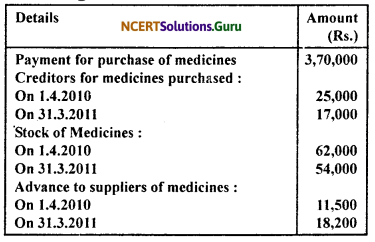

Question 1.

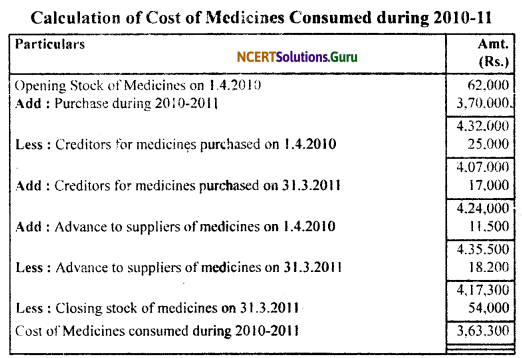

Find out the cost of medicines consumed during 2010-11 from the following information –

Answer:

![]()

Question 2.

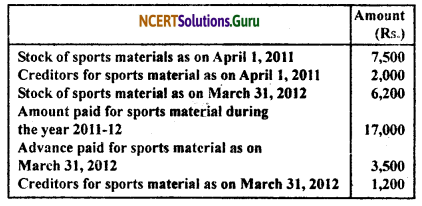

What amount of sports material will be posted to Income and Expenditure Account for the year ended March 31, 2012 as expenditure?

Answer:

Short Answer Type Questions

Question 1.

State the meaning of ‘Not-For-Profit’ Organisations.

Answer:

Meaning of‘Not-For-Profit’ Organisations – All trading and business organisations are profit organisations since their main objective is to earn profit. ‘Not-For-Profit’ Organisations are those organisations whose main aim objective is to provide services to their members or the society at large and not the earning of profits.

These organisations refer to the organisations that set-up for the welfare of the society, as a charitable institutions, which run without profit motive. Their main aim is to provide services to its members or the society at large. The funds raised by such organisations are represented as Capital Fund or General Fund. The main source of their income usually are subscription from their members, donations, grants, income from investment etc. These organisations keeps the accounting

records to meet the statutory requirements and controlling utilisation of their funds. They usually prepare them at the end of financial year to ascertain their income and expenditure and the financial position of the organisation and submit them to the statutory authority i.e. Registrar of Societies.

Question 2.

State the meaning of Receipt and Payment Account.

Answer:

Receipt and Payment Accounts – A receipt and payment account is a summary of cash transaction. It is prepared at the end of the accounting period from the cash receipts journals and cash payment journals. “Receipt and Payment Account is nothing more than a summary of the Cash Book (Cash and Bank transactions) over a certain period, analysed and classified under suitable heading. It is the form of account most commonly adopted by the treasures of societies, clubs, associations etc. when preparing the results of the year’s working.” – William Pickles

In other words, Receipt and Payment Account simply is a summary of cash and bank transactions under various heads. On the debit side, it begins with an opening balance of cash and bank and records all the items of receipts irrespective of whether they are of capital or revenue nature or whether they pertain to the current or past or future accounting period(s).

![]()

The payments are recorded on the credit side without making any distincition between items of revenue and capital nature and whether they belong to the current or past or future accounting period(s). It may be noted that this account does not show any non-cash item like depreciation. At the end of period, this account is balanced to ascertain the balance of cash in hand or cash at bank. The annual totals of various items of receipts and payments are found from their respective accounts in the ledger or from the Cash Book and are then entered in the Receipt and Payment Account.

Question 3.

State the meaning of Income and Expenditure Account.

Answer:

It is a nominal account of ‘Not-For-Profit’ Organisation equivalent to the profit and loss account of the trading concerns. The terms profit is substituted by the words excess of income over expenditure (surplus) and the loss is expressed as excess of expenditure over income (deficit). It reveals the surplus or deficit arising out of the organisation’s activities during an accounting period.

This account is prepared on accrual basis and includes only items of revenue nature. All the revenue items relating to the current period are shown in this account, the expenses and losses on the expenditure side (debit side) and incomes and gains on the income side (credit side) of the account. It shows the net operating result in the form of surplus or deficit, which is transferred to the capital fund shown in the balance sheet.

Question 4.

What are the features of Receipt and Payment Account?

Answer:

Features of Receipt and Payment Account –

(1) Real Account – It is a real account, so the rule of real account i.e. ‘Debit what comes in and credit what goes out’ is followed. Thus receipts are recorded in Debit side and the payments are recorded in Credit side.

(2) Summary of the Cash Book – It is a summary of the cash book. Its form is similar to cash book (without discount and bank column) with debit and credit sides.

(3) Shows amount irrespective of period – It shows the total amount of all receipts and payments irrespective of the period to which they pertain.

(4) No distinction between the nature (Capital or Revenue nature) – It includes all receipts and payments whether they are of capital nature or of revenue nature.

(5) No distinction between mode of transaction (Cash or Bank) – No distinction is made in receipts/payments made in cash or through bank. With the exception of the opening and closing balances, the total amount of each receipts and payment is shown in this account.

(6) Do not show non-cash items – Non-cash items like depreciation, outstanding expenses, accrued income etc. are not shown in this account.

(7) Opening and Closing Balances – The opening and closing balance in it respectively mean Cash in hand or Cash at bank in the beginning and at the end. The balance of Receipts and Payment Account must be debit being Cash in hand or Cash at bank, unless there is a bank overdraft.

(8) Does not reflect net income or net loss – This account does not tell us whether the current incomes exceeds the current expenditure or vice versa or in other words it does not give any information of net income or net loss.

Question 5.

What steps are taken to prepare Income and Expenditure Account from Receipt and Payment Account?

Answer:

The following steps are taken to prepare Income and Expenditure Account from Receipt and Payment Account –

(1) From the Receipt and Payment Account exclude the opening and closing balance of cash and bank as they are not an income.

(2) Exclude the items of capital nature as these are to be shown in balance sheet.

(3) Take out the revenue receipts only for the current year to be shown on the income side of Income and Expenditure Account. These are adjusted by excluding the amounts relating to the preceding and the succeeding

periods and including the amounts relating to the current year not yet received.

(4) Take out the revenue payments only the current year to be shown, on the expenditure side of Income and Expenditure Account. These are adjusted by excluding the amounts relating to the preceding and the succeeding periods and including the amounts relating to the current year not yet paid.

(5) Make the adjustments of non-cash items like –

(a) Depreciation on fixed assets.

(b) Provision for doubtful debts, if required.

(c) Profit or loss on sale of fixed assets etc.

For determining the surplus/deficit for the current year.

Question 6.

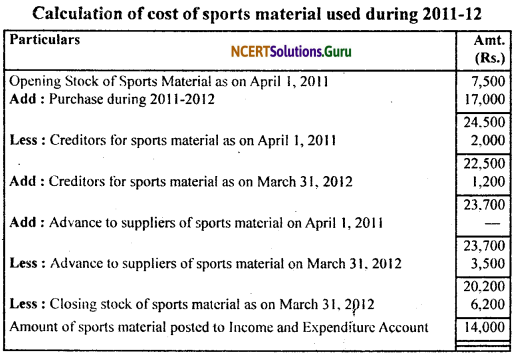

What is Subscription? How is it calculated?

Answer:

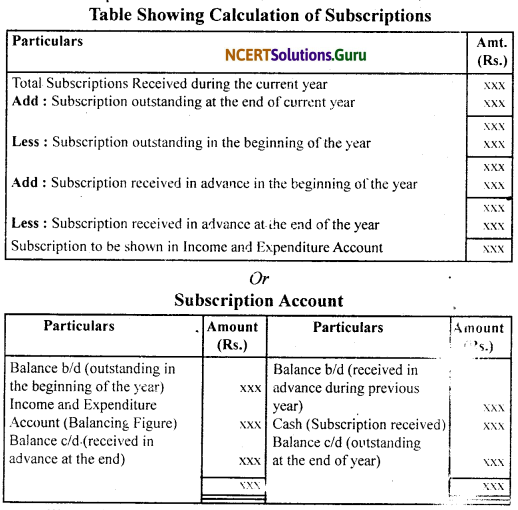

Subscription – It is the amount paid by the members of the organisation periodically so that their membership is not cancelled. This is the main source of income of ‘Not-For-Profit’ Organisations. Treatment –

(i) The total amount of subscription received during the accounting period is shown in the receipt side (Dr. side) of Receipt and Payment Account.

![]()

(ii) Subscription related to the current period shown in the income side (Cr. side) of Income and Expenditure Account. Amount of subscription to be shown in Income and Expenditure Account is calculated as follows :

(iii) Subscription Outstanding at the end of year is shown on the assets side of Balance Sheet and subscription received in advance in current year for the next year is shown on the liabilities side of the Balance Sheet.

Question 7.

What is Capital Fund? How is it calculated?

Answer:

It is the Capital of the non-profit organisation. It is the excess of assets over liabilities of the organisation. It may be made up in part by capitalising entrance fees, or by capitalising life membership fees etc. Excess of income over expenditure or surplus is added to the capital fund and excess of expenditure over income or deficit is deducted from etc. Excess of income over expenditure or surplus is added to the capital fund and excess of expenditure over income or deficit is deducted from the Capital Fund. It is also called ‘Accumulated Fund’ or ‘General Fund .

Long Answer Type Questions

Question 1.

Explain the statement – “Receipt and Payment Account is a summarised version of Cash Book”.

Answer:

According to William Pickles “Receipt and Payment Account is nothing more than a summary of the Cash Book (Cash and Bank transactions) over a certain period, analysed and classified under suitable heading. It is the form of account most commonly adopted by the treasurers of societies, clubs, associations etc.

when preparing the results of the year’s working”. The main difference between the Cash Book and Receipts and Payments Account is that in a cash book all cash transactions are recorded date-wise in detail but in Receipts and Payments Account, from chronological record of cash transaction in the cash book, summary of cash transactions is prepared at the end of the period under consideration.

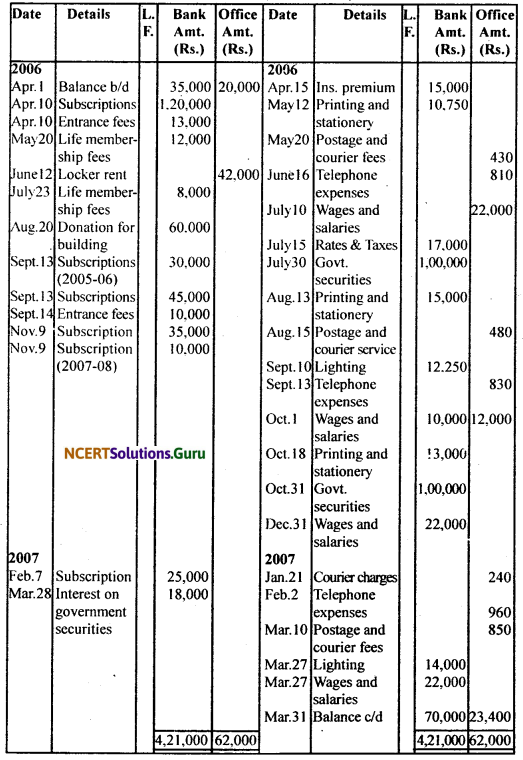

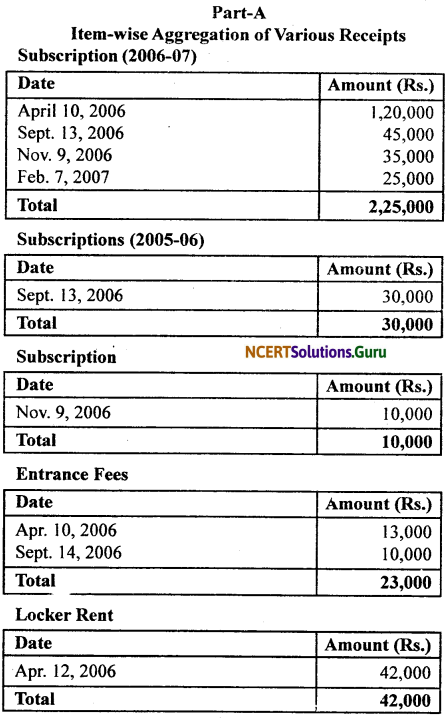

![]()

It does not give the date of the transactions. Thus, both ‘Cash Book’ and ‘Receipt and Payment Account’ provide the same information but in a different manner. For example, salary, rent, electricity charges paid from time to time as recorded on the credit side of the Cash Book but the total salary paid, total rent paid, total electricity charges paid during the year appear on the payment side of Receipts and Payments Account.

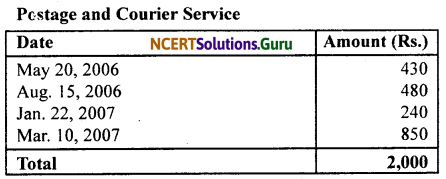

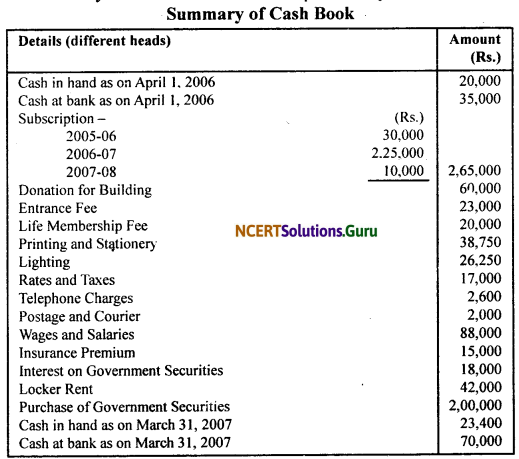

Thus, Receipt and Payment Account gives summarised picture of various receipts and payments, irrespective of whether they pertain to the current period, previous period or succeeding period or whether they are of capital or revenue nature. Let us take an example to show how cash book is summarised to show transactions in Receipts and Payments Account.

![]()

From the above aggregation of various receipts and payments, we can now prepare the summary of Cash Book and then represent this summary of Cash Book in the Receipts and Payments Account.

Therefore, it is clear from the above example that “Receipt and Payment Account is a summarised version of Cash Book”.

![]()

Question 2.

“Income and Expenditure Account of a ‘Not-For-Profit’ Organisation is akin to Profit and Loss Account of a business concern.” Explain the statement.

Answer:

“Income and Expenditure Account of a Not-For-Profit’ Organisation is akin to Profit and Loss Account of a business concern.” This statement is perfectly true because the set of rules or principles followed for preparing ‘Profit and Loss Account’ of a business concern and ‘Income and Expenditure Account’ of Not-For-Profit Organisation are same. As a result, there is no need for a separate conceptual framework for the preparation of both the accounts. As we know that business organisation prepare Profit and Loss Account to know the results of working of the business i.e. to know the Net Profit earned or Net Loss incurred during particular period.

‘Not-For-Profit’ Organisation do not prepare Profit and Loss Account because their primary objective is not to earn profit but to serve its members or society in general. However, these organisations compare incomes and expenses to check whether the organisation have sufficient resources to carry out its objectives. To achieve this, ‘Income and Expenditure Account’ is prepared by ‘Not-For-Profit’ Organisation.

Therefore, we can say that ‘Income and Expenditure’Account of Not-For-Profit Organisation is like ‘Profit and Loss Account’ of business concerns or profit-making organisations. ‘Not-For-Profit’ Organisation follow the same rule or principles for preparing Income and Expenditure Account which are followed by business organisations for preparing ‘Profit and Loss Account’.

Above statement can became more clear from the following points —

(i) ‘Income and Expenditure Account’ of ‘Not-For-Profit’ Organisation and ‘Profit and Loss Account’ of business organisation or trading organisation, both accounts are nominal accounts. Hence follow the same principle “Debit all expenses and losses and Credit all income and gains”.

(ii) Both accounts records all expenses and losses on the Debit side and all income and gains on the Credit side.

(iii) Both accounts records only revenue items and ignores capital items.

(iv) Both accounts are prepared on accrual basis i.e. both accounts records all the revenue items relating to the current period.

(v) Both accounts have not any opening and closing balances.

(vi) Both accounts prepared at the end of period after considering, all adjustments relating to current period.

(vii) Both accounts excludes all the items of income and expenses which do not pertain to the current period.

(viii) Both accounts shows the net result of working of the organisations during the current period in the form of profit or loss (for Business Organisation) and surplus/deficit (for ‘Not-For-Profit’ Organisation).

Hence, it is clear from the above discussion that “Income and Expenditure Account of a ‘Not-Fot-Profit’ Organisation is akin to Profit and Loss Account of a business concern”.

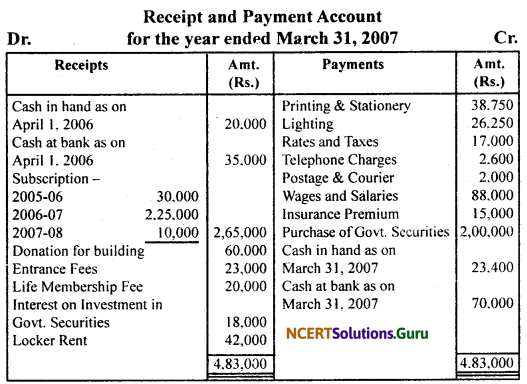

![]()

Question 3.

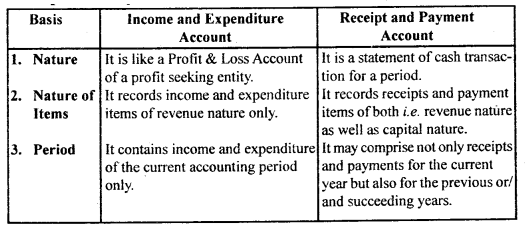

Distinguish between Receipts and Payment Account and Income and Expenditure Account.

Answer:

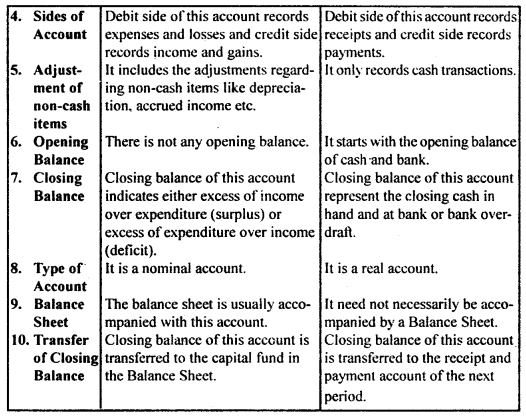

Distinction between Income and Expenditure Account and Receipt

Question 4.

Explain the basic features of Income and Expenditure Account and of Receipt and Payment Account.

Answer:

Basic Features of Income and Expenditure Account –

1. Nominal Account – It is a nominal account, therefore the rule of nominal account i.e. “Debit all expenses and losses and Credit all incomes and gains” is followed.

2. Ignore Items of Capital Nature – In this account only items of revenue nature are to be considered and all the items of capital nature should be ignored.

3. Prepare from Receipt and Payment Account – It is generally prepared from a given Receipts and Payments Account and other information after making necessary adjustments.

4. No Opening and Closing Balances – In this account no opening and closing balances of cash and bank are recorded.

5. Same as Profit & Loss Account – This account is prepared in the same manner in which a Profit & Loss Account is prepared, considering, all adjustment relating to current year.

![]()

6. Exclude Past and Future Items – It exclude all the items of income and expenditure which do not pertain to the current period.

7. End-balance of this Account – The end balance of the Income and Expenditure Account, which may be either ‘excess of income over expenditures’ or ‘excess of expenditure over income’ would be added to or deducted from, as the case may be, the capital fund, on the liabilities side of the Balance Sheet.

Basic Features of Receipt and Payment Account –

1. Real Account – It is a real account, so the rule of real account i.e. ‘Debit what comes in and Credit what goes out’ is followed. Thus receipts are recorded in Debit side and the payments are recorded in Credit side.

2. Summary of the Cash Book – It is a summary of the cash book. Its form is similar to cash book (without discount and bank column) with debit and credit sides.

3. Shows amount irrespective of period – It shows the total amount of all receipts and payments irrespective of the period to which they pertain,

4. No distinction between the nature (Capital or Revenue nature) – It includes ail receipts and payments whether they are of capita! nature or of revenue nature.

5. No distinction between mode of transaction (Cash or Bank) – No distinction is made in receipts/payments made in cash or through bank. With the exception of the opening and closing balances, the total amount of each receipts and payment is show’n in this account.

6. Do not show non-cash items – Non-cash items like depreciation, outstanding expenses, accrued income etc. are not shown it. this account.

7. Opening and closing balances – The opening and closing balance in it respectively mean cash in hand or cash at bank in the beginning and at the end. The balance of receipts and payment account must be debit being cash in hand or cash at bank, unless there is a bank overdraft.

8. Does not reflect net income or net loss – This account does not tell us whether the current incomes exceeds the current expenditure or vice versa or in other words it does not give any information of net income or net loss.

Question 5.

Show the treatment of the following items by a Not-For- Profit Organisation :

(i) Annual Subscription

(ii) Specific Donation

(iii) Sale of Fixed Assets

(iv) Sale of Old Periodicals

(v) Sale of Sports Materials

(vi) Life Membership Fee.

Answer:

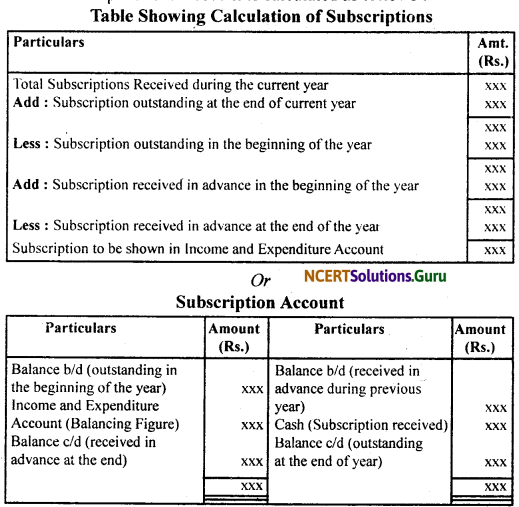

(i) Annual Subscription – It is the amount paid by the members of the organisation periodically so that their membership is not cancelled. This is the main source of income of Not-For-Profit Organisations.

Treatment-

(i) The total amount of subscription received during the accounting period is shown in the receipt side (Dr. side) of Receipt and Payment Account.

(ii) Subscription related to the current period shown in the income side (Cr. side) of Income and Expenditure Account. Amount of subscription to be shown in Income and X Expenditure Account is calculated as follows :

![]()

(iii) Subscription outstanding at the end of year is shown on the assets side of Balance Sheet and subscription received in advance in current year for the next year is shown m the liabilities side of the Balance Sheet.

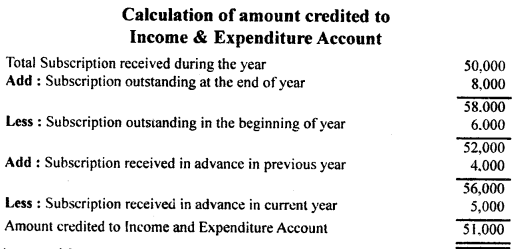

Example :

Subscription received during the current year — 50,000

Subscription outstanding at the end of year — 8,000

Subscription outstanding in the beginning of year — 6,000

Subscription received in advance during the year — 5,000

Subscription received in advance in last year — 4,000

Assets side of Balance Sheet:

Subscription outstanding at the end of year = Rs. 8,000 Liabilities side of Balance Sheet:

Subscription received in advance in current year = Rs. 5,000

(ii) Specific Donation – Donation is a type of gift in cash or in property received from person, firm or company. If the amount received as donation is for a specific purpose such as donations for extension of the existing building, donation for library, for construction of new computer laboratory etc., it is capitalised and is shown in the liabilities side of the Balance Sheet.

(iii) Sale of Fixed Assets – Receipt from the sale proceeds of fixed assets appear in the receipt side of Receipt and Payment Account. Only the profit or loss on the sale of a fixed asset is credited or debited, as the case may be, to the Income and Expenditure Account. In the Balance Sheet, the book value of the asset sold should be deducted from the relevant assets.

For example, if an item furniture with a book value of Rs. 5,000 is sold for Rs. 3,700, then amount of Rs. 3,700 will be shown in receipt side of Receipt and Payment Account and the loss of Rs. 1,300(5,000- 3,700) on sale of furniture will appear on the expenditure side of Income and Expenditure Account as a loss on sale of old asset and while showing furniture in the Balance Sheet Rs. 5,000 will be deducted from its total book value.

(iv) Sale of Old Periodicals – Receipts from the sale of old periodicals shown in the receipt side of Receipt and Payment Account. It is an item of recurring nature and shown in the income side of Income and Expenditure Account.

(v) Sale of Sports Materials – Sale of sports materials like old bat, old nets etc. is the regular feature with any sports club. It is treated as revenue income on the assumption that their book value is zero. It is therefore shown in the income side of Income and Expenditure Account. It also shown on the receipt side of Receipt and Payment Account.

(vi) Life Membership Fee – In order to become the member of an organisation for the whole of the life, some members pay the fee in lump sum i.e. once in their lifetime. It is a receipt of non-recurring nature since the members will not be required to pay the fees regularly. It is shown on the receipt side of Receipt and Payment Account and added to the capital fund in the Balance Sheet. It should not credited to the Income and Expenditure Account.

![]()

Question 6.

Show the treatment of items of Income and Expenditure Account when their is a specific fund for those items?

Answer:

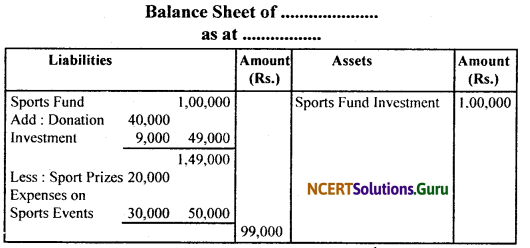

‘Not-For-Profit’ Organisation creates some specific funds for a specific purpose such as ‘Prize Funds’, ‘Match Funds’ and ‘Sports Fund’ etc. It may be created by setting aside a part of the excess of income over expenditure or when amount is received for a specific purpose. The amount may be invested outside the organisation in securities fora particular period. This fund is shown on the liabilities side of the Balance Sheet and investment out of special fund is shown on the assets side of the Balance Sheet. Any receipt relating to that fund is added to the specific fund and expenses incurred relating to the fund are deducted from it These funds do not affect the Income and Expenditure Account.

Donations received for Sports Fund during the year — 40,000

Interest received on Sports Fund Investment — 9,000

Sports Prizes awarded — 20,000

Expenses on Sports Events — 30,000

Sports Fund in beginning of year — 1,00,000

Sports Fund Investment in beginning of year –1,00,000

Treatment:

Question 7.

What is Receipt and Payment Account? How is it different from Income and Expenditure Account?

Answer:

Receipt and Payment Account – A Receipt and Payment Account is a summary of cash transactions. It is prepared at the end of the accounting period from the cash receipts journals and cash payment journals.

“Receipt and Payment is nothing more than a summary of the cash book (Cash and Bank transactions) over a certain period, analysed and classified under suitable heading. It is the form of account most commonly adopted by the treasures of societies, clubs, associations etc. when preparing the results of the year’s working.” – William Pickles In other words, Receipts and Payment Account, simply is a summary of cash and bank transactions under various heads.

On the debit side, it begins with an opening balance of cash and bank and records all the items of receipts irrespective of whether they are of capital or revenue nature or whether they pertain to the current or past or future accounting period(s). The payments are recorded on the credit side without making any distinction between items of revenue and capital nature and whether they belong to the current or past or future accounting period(s).

It may be noted that this account does not show any non-cash item like depreciation. At the end of period, this account is balanced to ascertain the balance of cash in hand or cash at bank. The annual totals of various items of receipts and payments are found from their respective accounts in the ledger or from the cash book and are then entered in the Receipts and Payment Account.

Income and Expenditure Account – It is a nominal account of ‘Not-For-Profit’ Organisation equivalent to the Profit and Loss A/c of the trading concerns. The term profit is substitute by the words excess of income over expenditure (surplus) and the loss is expressed as excess of expenditure over income (deficit). It reveals the surplus or deficit arising out of the organisation’s activities during a accounting period. This account is prepared on accrual basis and includes only items of revenue nature.

All the revenue items relating to the current period are shown in this account. The expenses and losses on the expenditure side (debit side) and income and gains on the income side (credit side) of the account.It shows the net operating result in the form of surplus or deficit, which is transferred to the Capital Fund shown in the balance sheet.

![]()

The distinction between Income and Expenditure Account and Receipt and Payment Account

Numerical Questions

Question 1.

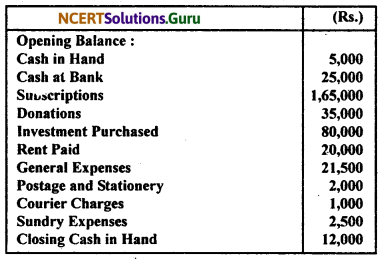

From the following particulars taken from the Cash Book of a health club, prepare a Receipts and Payments Account.

Answer:

Question 2.

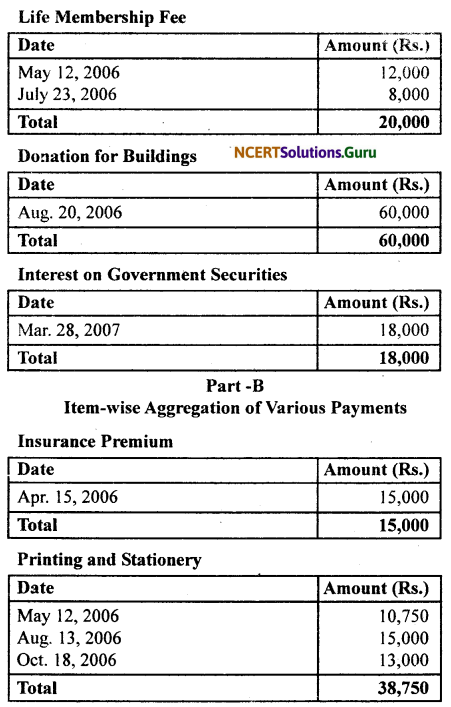

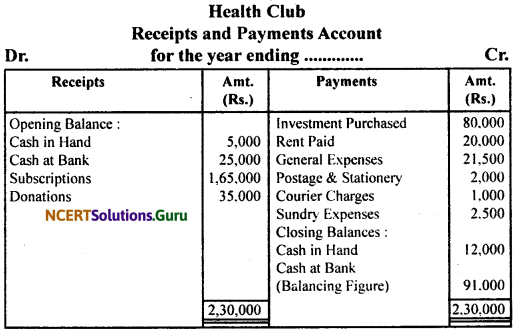

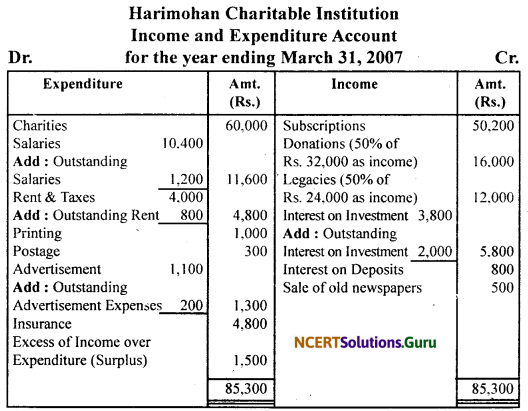

The Receipt and Payment Account of Harimohan Charitable Institution is given :

Prepare the Income and Expenditure Account for the year ended on March 31, 2007 after considering the following :

(i) It was decided to treat fifty percent of the amount received on account of Legacies and Donations as income.

(ii) Liabilities to be provided for are: Rent Rs. 800; Salaries Rs. 1,200; Advertisement Rs. 200.

(iii) Rs. 2,000 due for interest on investment was not actually received.

Answer:

![]()

Question 3.

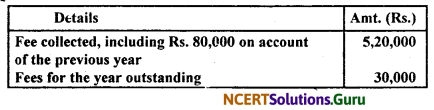

From the following particulars, prepare Income and Expenditure Account:

Answer:

Question 4.

Following is the information given in respect of certain items of a Sports Club. Show these items in the Income and Expenditure Account and the Balance Sheet of the Club :

Question 5.

Give reasons for your answers.

Answer:

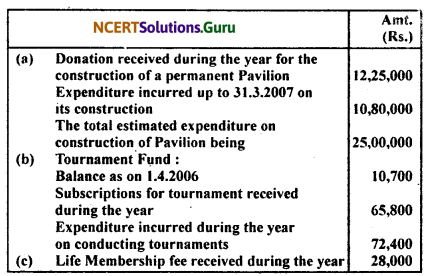

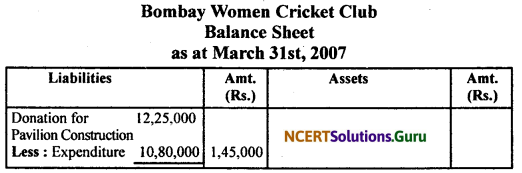

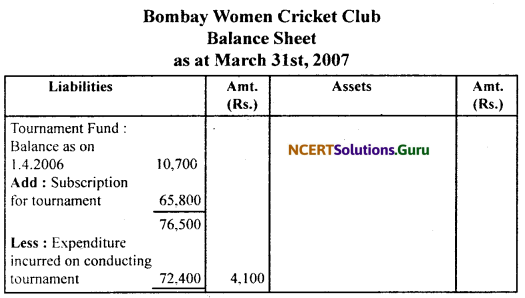

(a) Donation received Rs. 12,25,000 for the construction of a permanent Pavilion is a specific donation. Therefore, it will be capitalised and shown on the liability side of Balance Sheet at the end. Amount spent on the construction of Pavilion till the end of year Rs. 10,80,000 will be deducted from the Donation received. Estimated cost of construction will not be shown in Income and Expenditure Account and in Balance Sheet of the club. It should be noted that after the completion of the purpose of a specific fund, the balance lying in that fund is transferred to the Capital Fund.

(b) Tournament Fund is a special fund. Therefore, it is shown on the liability side of the Balance Sheet. Any receipt relating to the fund (subscription for tournament) is added to the fund and expenses (Expenditure incurred on conducting tournaments) are deducted from the fund.

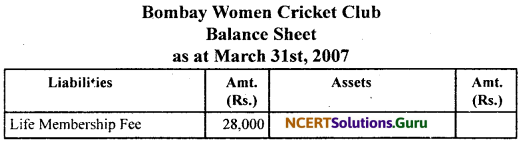

(c) Unless otherwise stated in the question, whole of the Life Membership Fee is capitalised. Therefore Rs. 28,000 received as Life Membership Fee will be shown on the liability side of the Balance Sheet at the end.

![]()

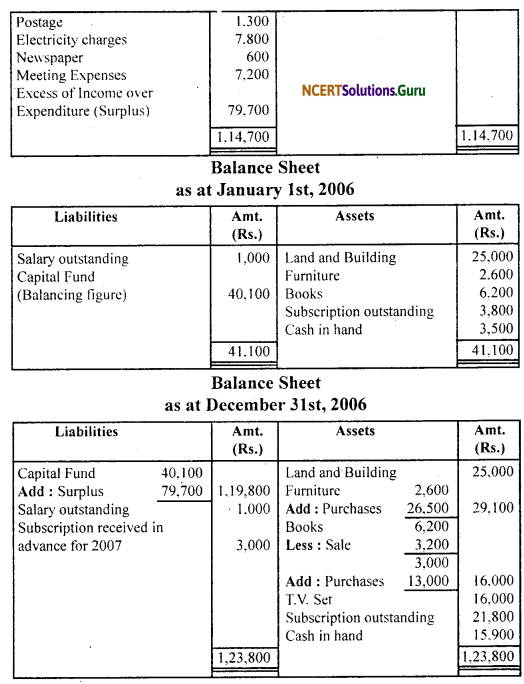

Question 6.

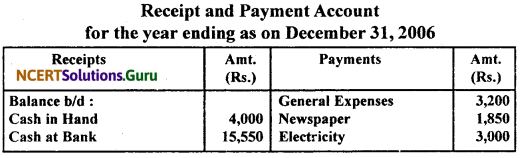

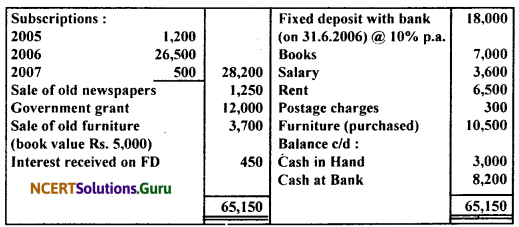

From the following receipts and payments and information given below, prepare Income and Expenditure Account and opening Balance Sheet of Adult Literacy Organisation as on December 31,2006 :

Information :

(i) Subscription outstanding as on 31.12.2005, Rs. 2000 and on December 31, 2006, Rs. 1,500.

(ii) On December 31,2006 Salary outstanding Rs. 600, and one month Rent paid in advance.

(iii) On January 1, 2005 organisation owned Furniture Rs. 12,000, Books Rs. 5,000.

Answer:

Question 7.

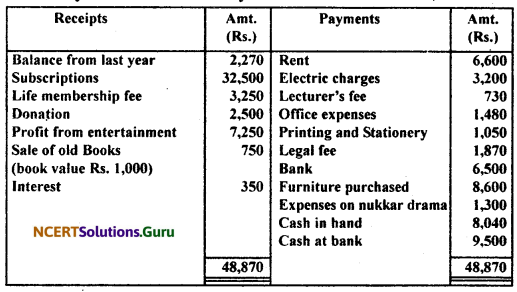

The following is the account of cash transactions of the Nari Kalyan Samittee for the year ended Dec ember 31,2006.

You are required to prepare an Income and Expenditure Account after the following adjustments :

(a) Subscription still to be received are Rs. 750, but subscription include Rs. 500 for the year 2007.

(b) In the beginning of the year the Sangh owned building Rs. 20,000 and furniture Rs. 3,000 and Books Rs. 2,000.

(c) Provide depreciation on furniture @ 5% (including purchase), books @ 10% and building @ 5%

Answer:

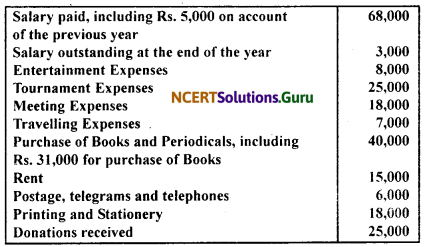

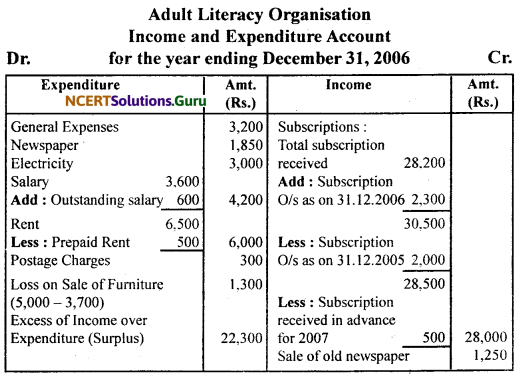

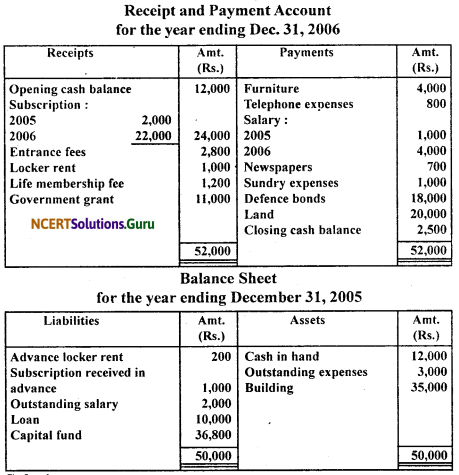

Question 8.

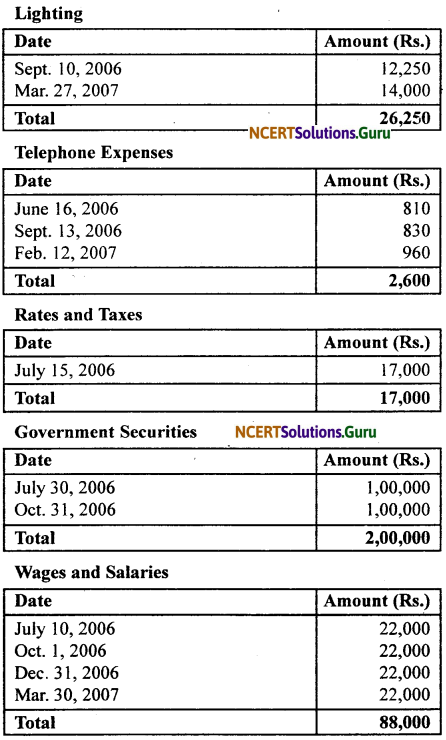

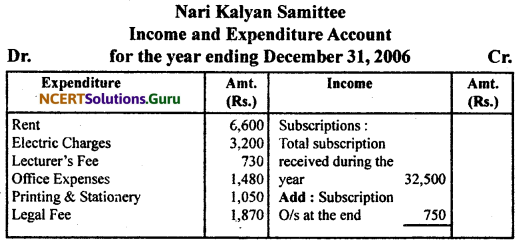

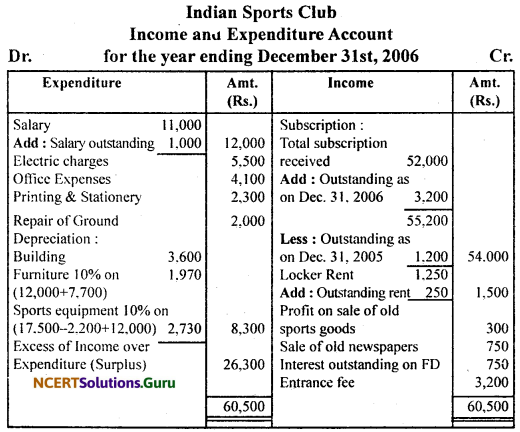

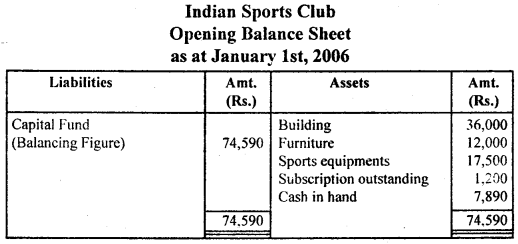

Following is the Receipt and Payment Account of Indian Sports Club, prepared Income and Expenditure Account, Balance Sheet as on December 31, 2006 :

![]()

Other Information :

Subscription outstanding was on December 31,2005 Rs. 1,200 and Rs. 3,200 on December 31, 2006. Locker rent outstanding on December 31, 2006 Rs. 250. Salary outstanding on December 31, 2006 Rs. 1,000.

On January 1, 2006, club has building Rs. 36,000, furniture Rs. 12,000. Sports equipments Rs. 17,500. Depreciation charged on these items @ 10% (including purchase).

Answer:

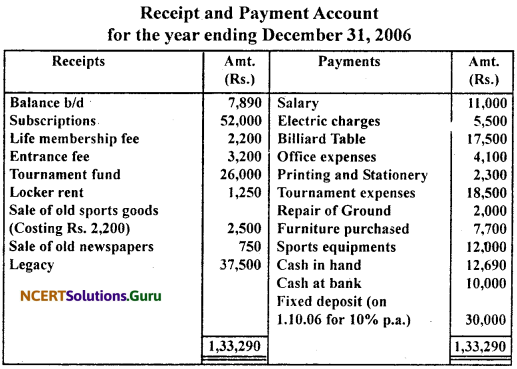

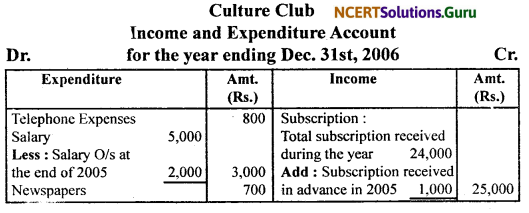

Question 9.

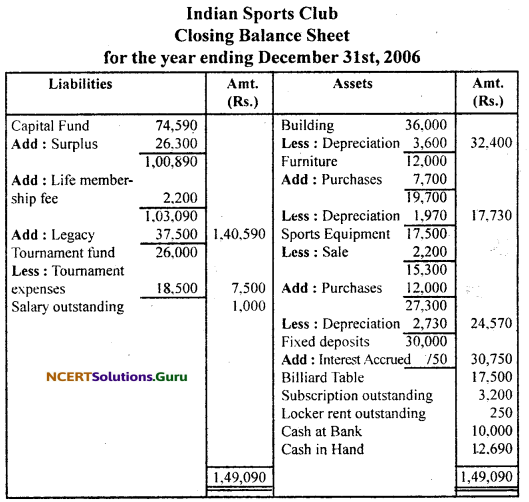

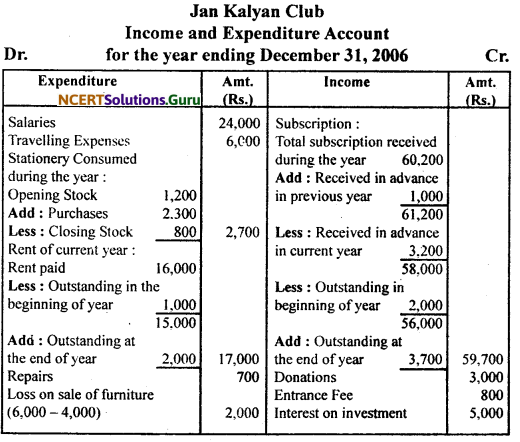

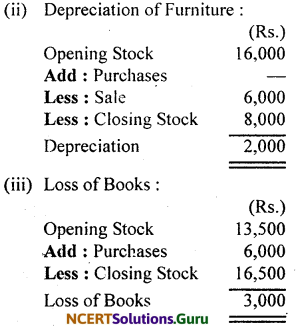

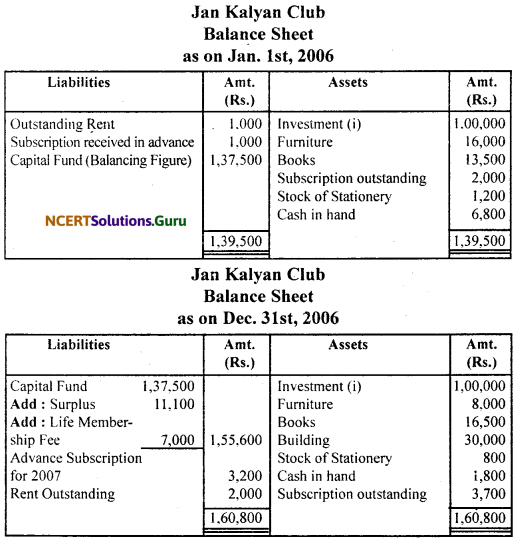

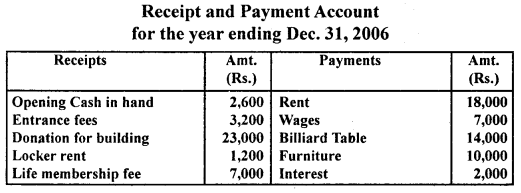

From the following Receipt and Payment Account of Jan Kalyan Club, prepare Income and Expenditure Account and Balance Sheet for the year ending December 31, 2006 :

Answer:

![]()

Question 10.

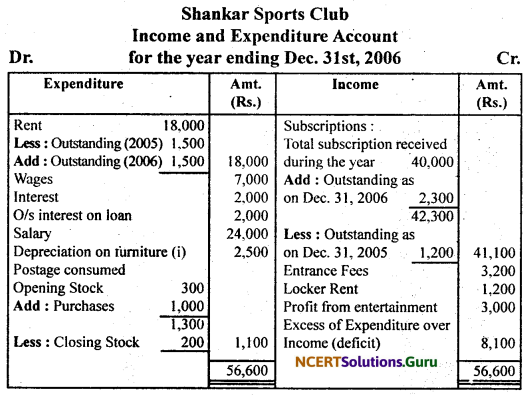

Receipt and Payment Account of Shankar Sports Club is given below, for the year ended December 31,2006 :

Prepare Income and Expenditure Account and Balance Sheet with help of following information :

Subscription outstanding on 31st December, 2005 is Rs. 1,200 and Rs. 2,300 on 31.12.2006, opening stock of postage stamps is Rs. 300 and closing stock is Rs. 200, Rent Rs. 1,500 related to 2005 and Rs. 1,500 is still unpaid.

On January 1, 2006 the club owned furniture Rs. 15,000, Furniture valued at Rs. 22,500 on 31.12.2006. The club tooka loan of Rs. 20,000 (@ 10% p.a.) in 2005.

Answer:

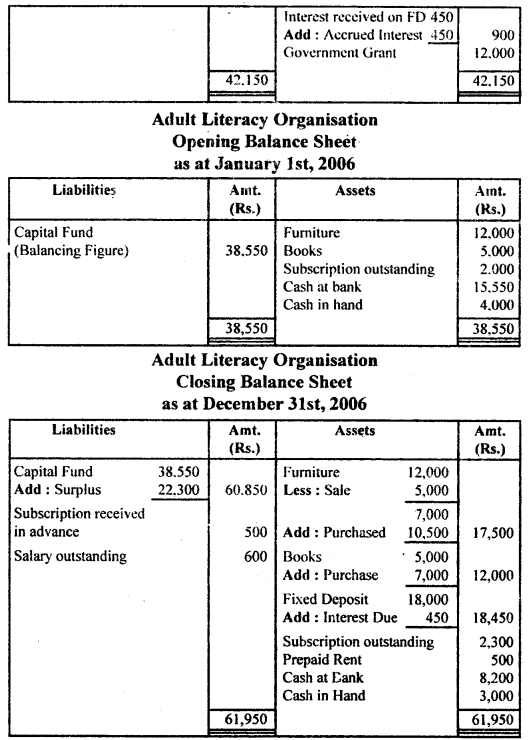

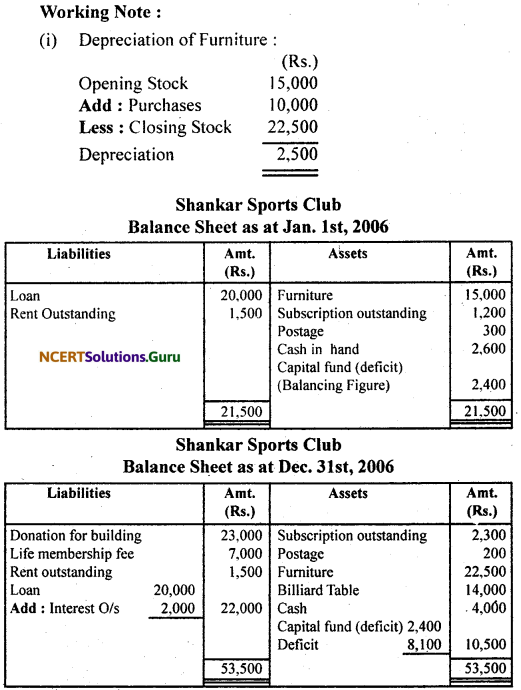

Question 11.

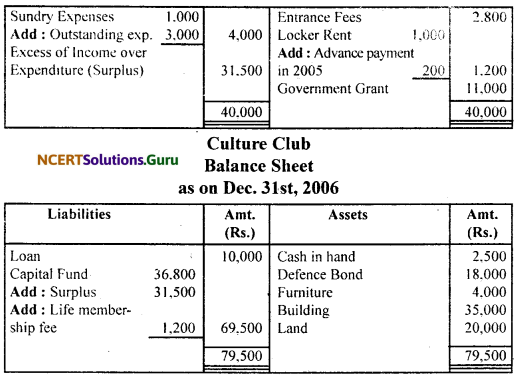

Prepare Income and Expenditure Account and Balance Sheet for the year ended December 31, 2006 from the following Receipt and Payment Account and Balance Sheet of Culture Club :

Answer:

![]()

Question 12.

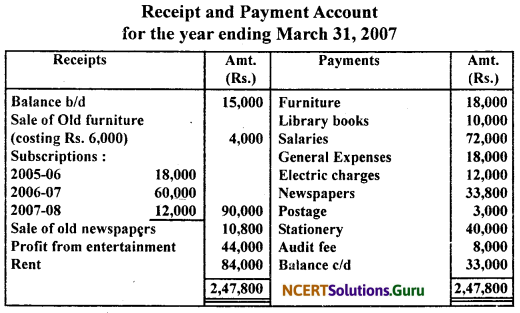

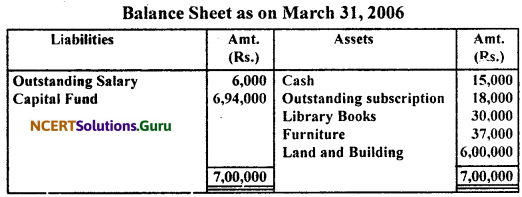

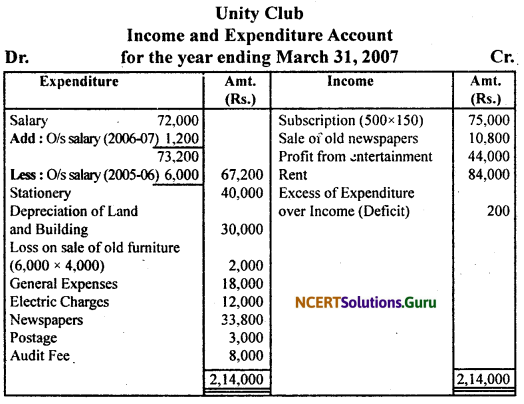

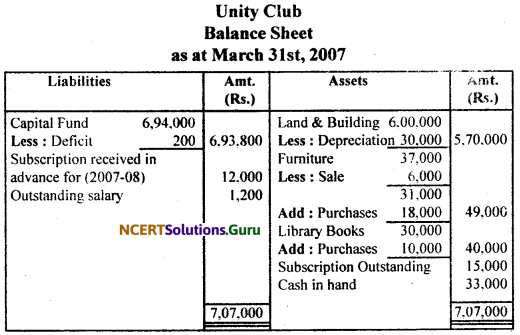

From the following Receipt and Payment Account prepare final accounts of a Unity Club for the year ended March 31, 2007 :

Additional Information :

(1) The club had 500 members each paying an annual subscription of Rs. 150.

(2) On 31.3.2007 salaries outstanding amounting to Rs. 1,200 and salaries paid included Rs. 6,000 for the year 2005-06.

(3) Provide 5% depreciation on Land and Building.

Answer:

![]()

Question 13.

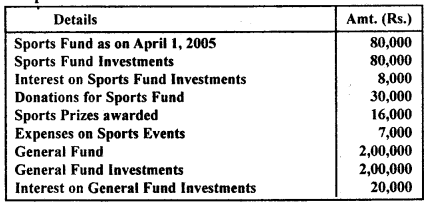

Following is the information in respect of certain items of a Sports Club. You are required to show them in the Income and Expenditure Account and the Balance Sheet.

Answer:

(These items does not affect the Income and Expenditure Account.)

Question 14.

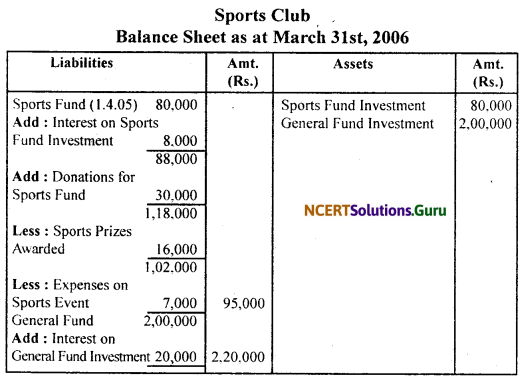

Receipt and Payment Account of Maitrey Sports Club showed that Rs. 68,500 were received by way of subscription for the year ended on March 31,2006.

The additional information was as under :

(1) Subscription outstanding as on March 31, 2005 were Rs. 6,500.

(2) Subscription received in advance as on March 31,2005 were Rs. 4,100.

(3) Subscription outstanding as on March 31, 2006 were Rs. 5,400.

(4) Subscription received in advance as on March 31,2006 were Rs. 2,500.

Show how that above information would appear in the final accounts for the year ended on March 31,2006 of Maitrey Sports Club.

Answer:

Subscription credited to Income and Expenditure Account for the year ended on March 31,2006 is Rs. 69,000. Subscription outstanding as on 31.3.2006 is Rs. 5,400 and should be shown on the assets side of the Balance Sheet as on March 31,2006 and subscriptions of Rs. 2,500 received in advance as on March 31,2006 on the liabilities side of the balance sheet as on March 31, 2006.

![]()

Question 15.

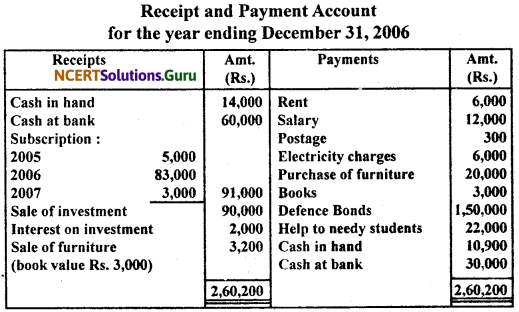

Following is the Receipt and Payment Account of Rohatgi Trust:

Prepare Income and Expenditure Account for the year ended December 31, 2006 and a Balance Sheet as on that date after the following adjustments :

Subscription for 2606, still owing were Rs. 7,000. Interest due on defence bonds was Rs. 7,000, Rent still owing was Rs. 1,000. The book value of investment sold was Rs. 80,000, Rs. 30,000 of the investment were still in hand. Subscription received in 2006 included Rs. 400 from a life member. The total furniture on January 1, 2006 was worth Rs. 12,000. Salary paid for the year 2007 is Rs. 2,000.

Solution :

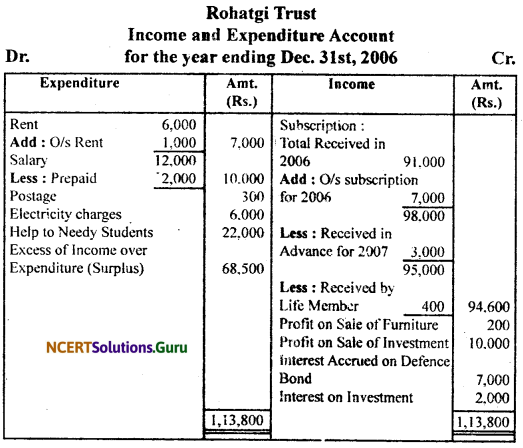

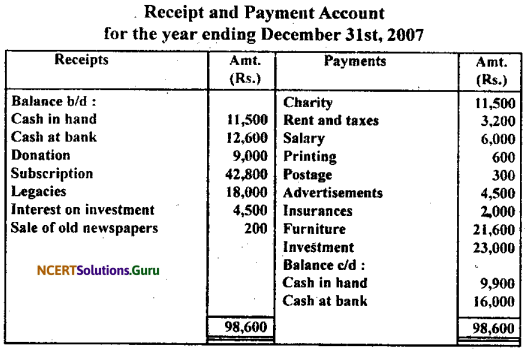

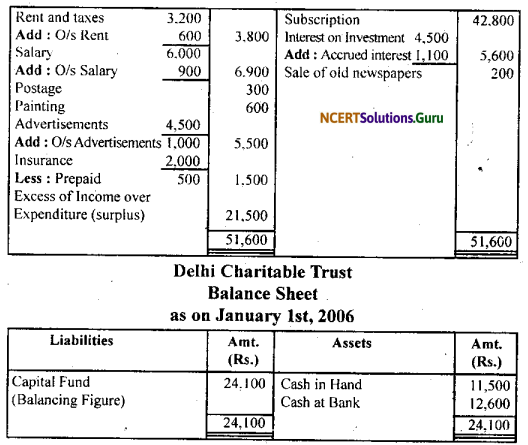

Question 16.

Following Receipt and Payment Account was prepared from the cash book of Delhi Charitable Trust for the year ending December 31,2007:

Prepare Income and Expenditure Account for the year ended December 31,2006, and a Balance Sheet as on that date after the following adjustments :

(a) It was decided to treat one-third of the amount received on account of donation as income.

(b) Insurance premium was paid in advance for three months.

(c) Interest on investment Rs. 1,100 accrued was pot received.

(d) Rent Rs. 600; salary Rs. 900 and advertisement expenses Rs. 1,000 outstanding as on December 31,2007.

Solution:

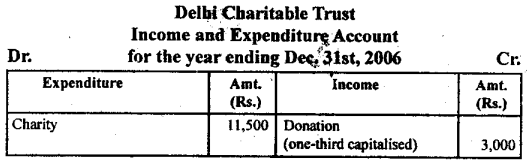

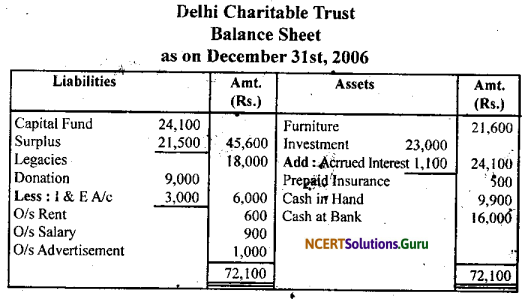

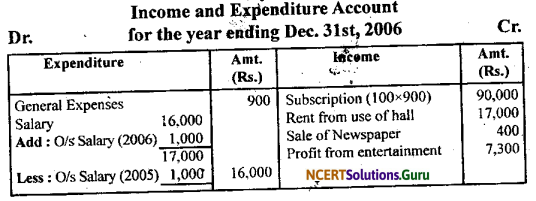

Question 17.

From the following Receipt and Payment Account of a club, prepare Income and Expenditure Account for the year ended December 31,2006 and the Balance Sheet as on that date : Receipt and Payment Account for the year ending December 31,2006

Additional Information :

(a) The club has 100 members each paying an annual subscription of Rs. 900. Subscriptions outstanding on December 31,2005 were Rs. 3,600.

(b) On December 31,2006, the salary outstanding amounted to Rs. 1,000. Salary paid included Rs. 1,000 for the year 2005

(c) On January 1, 2006 the club owned land and building Rs. 25,000, furniture Rs. 2,600 and books Rs. 6,200.

Solution:

![]()

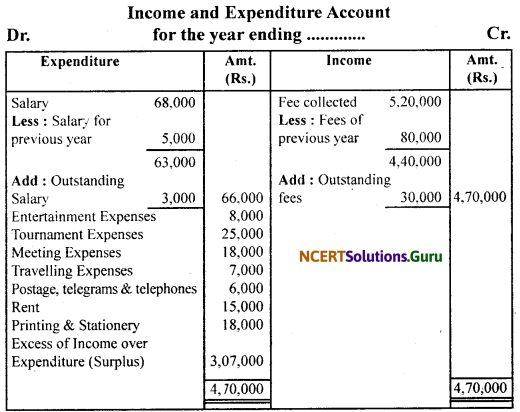

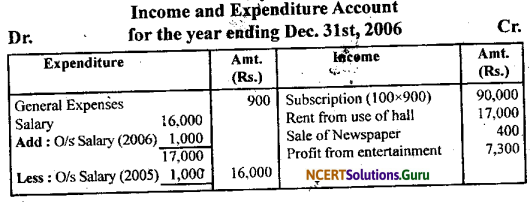

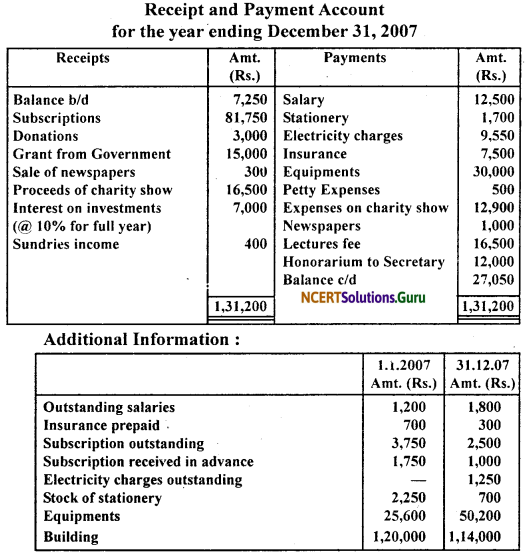

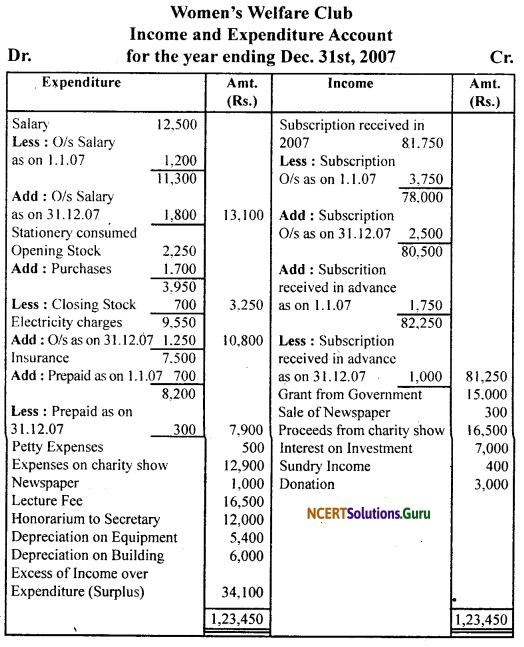

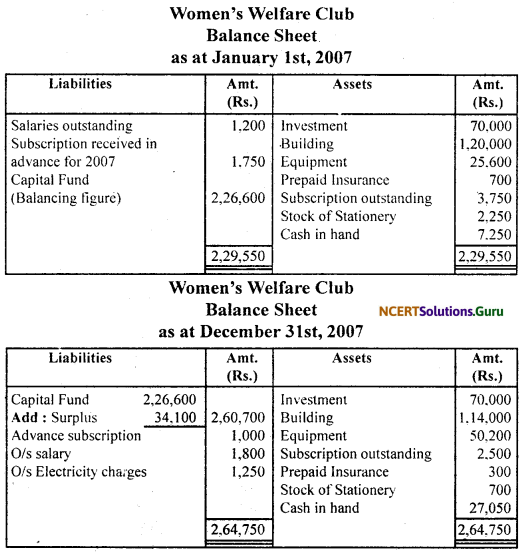

Question 18.

Following is the Receipt and Payment Account of Women’s Welfare Club for the year ended December 31, 2007 :

Prepare Income and Expenditure Account for the year ended December 31,2007 and Balance Sheet as on that date.

Answer:

![]()